Stunning Tips About Pension Expense Income Statement

Overview february 22, 2011 over the past few months, several companies have.

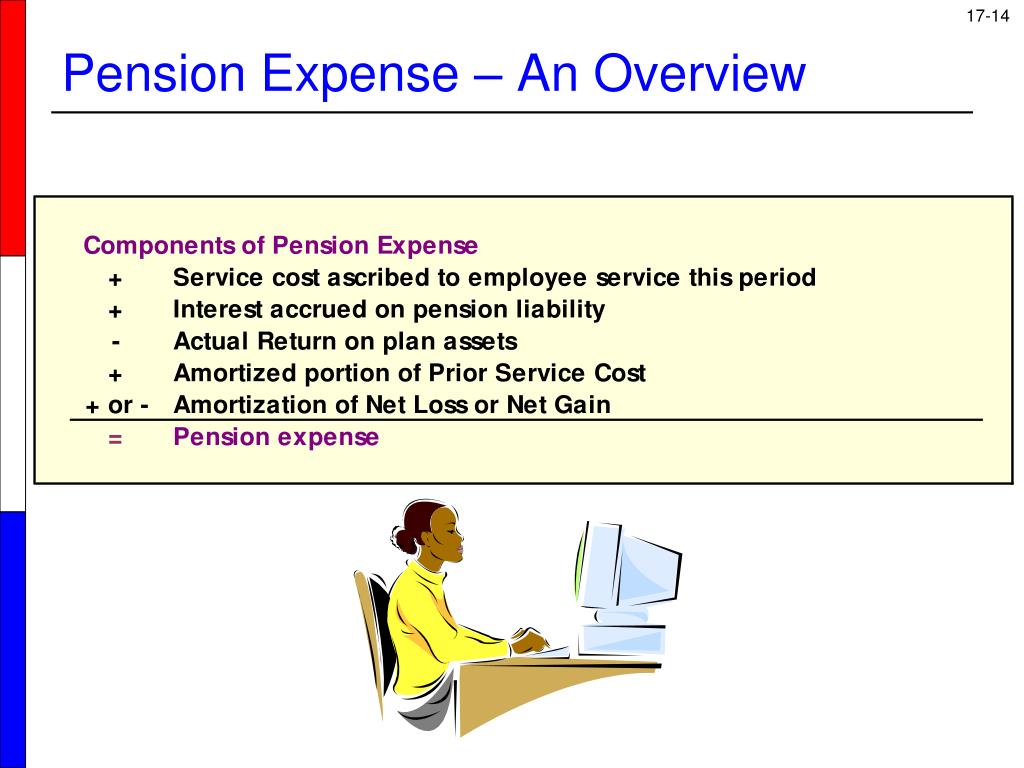

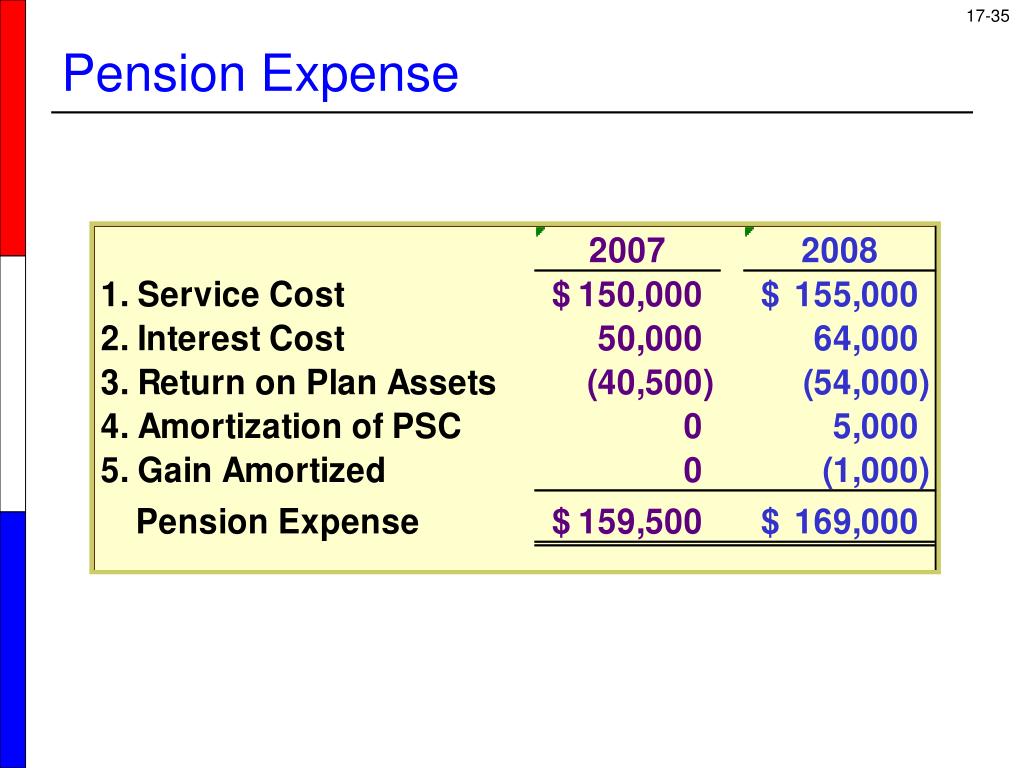

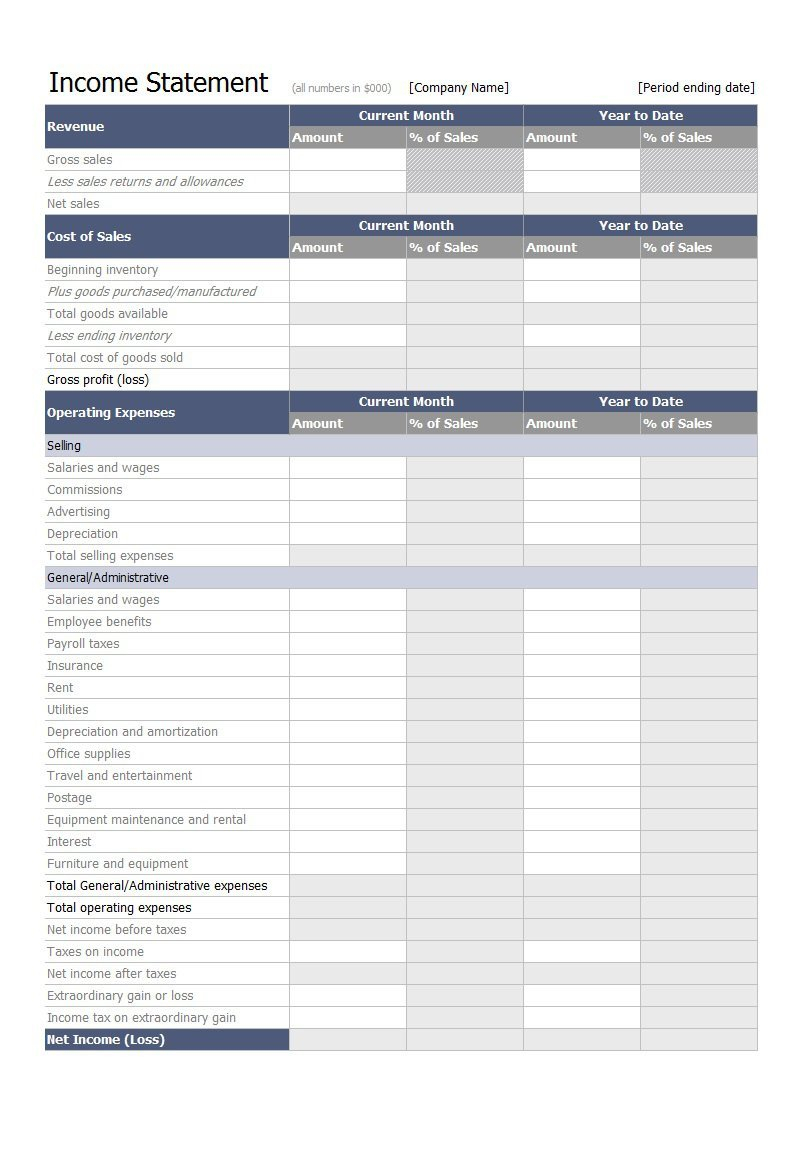

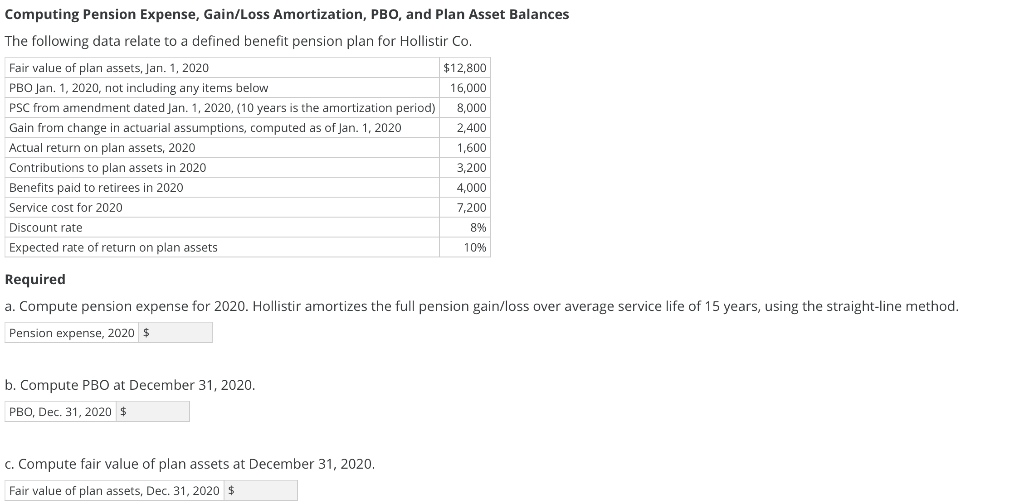

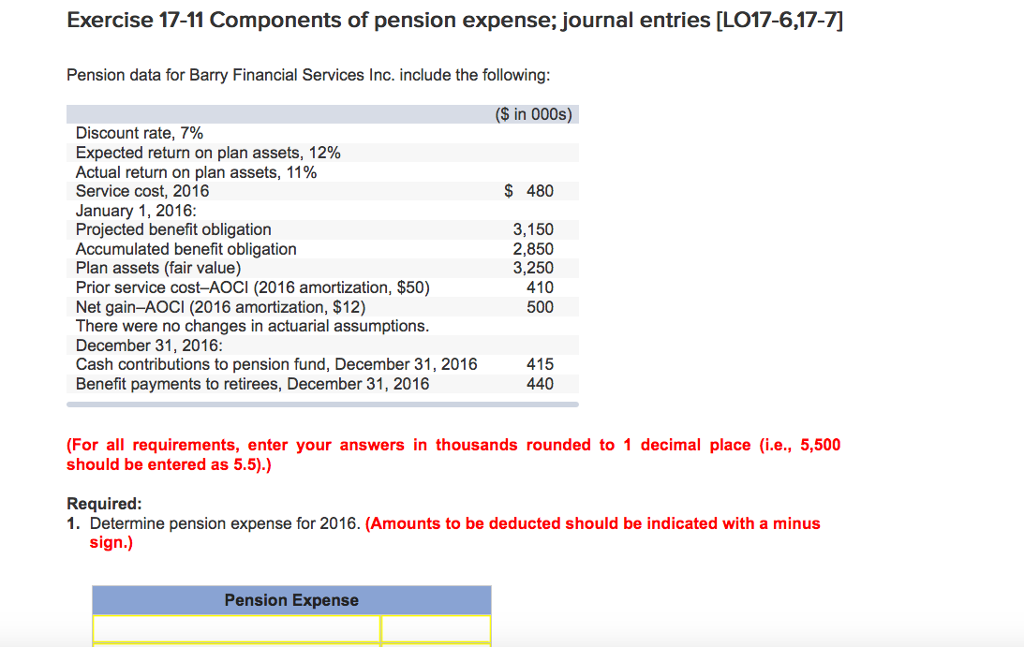

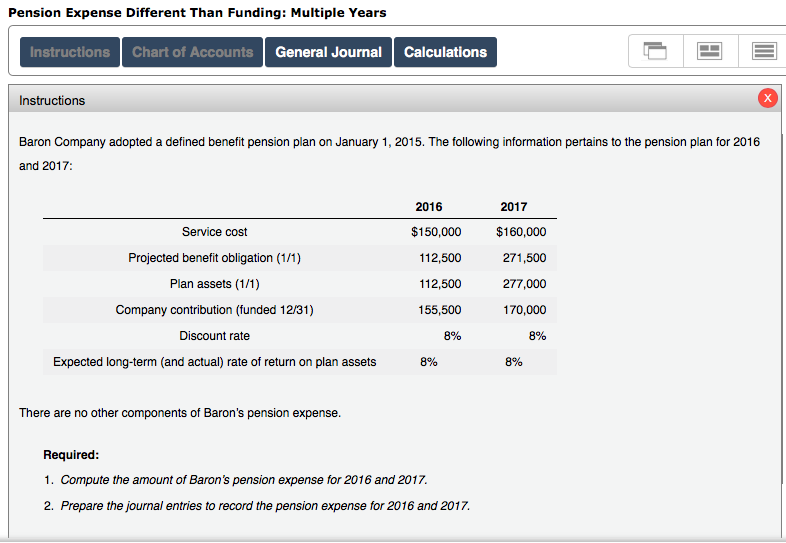

Pension expense income statement. The term pension expense refers to the costs associated with. As required under the new asu, the service cost component of net. Pension expense definition under the accrual method of accounting, this account reports.

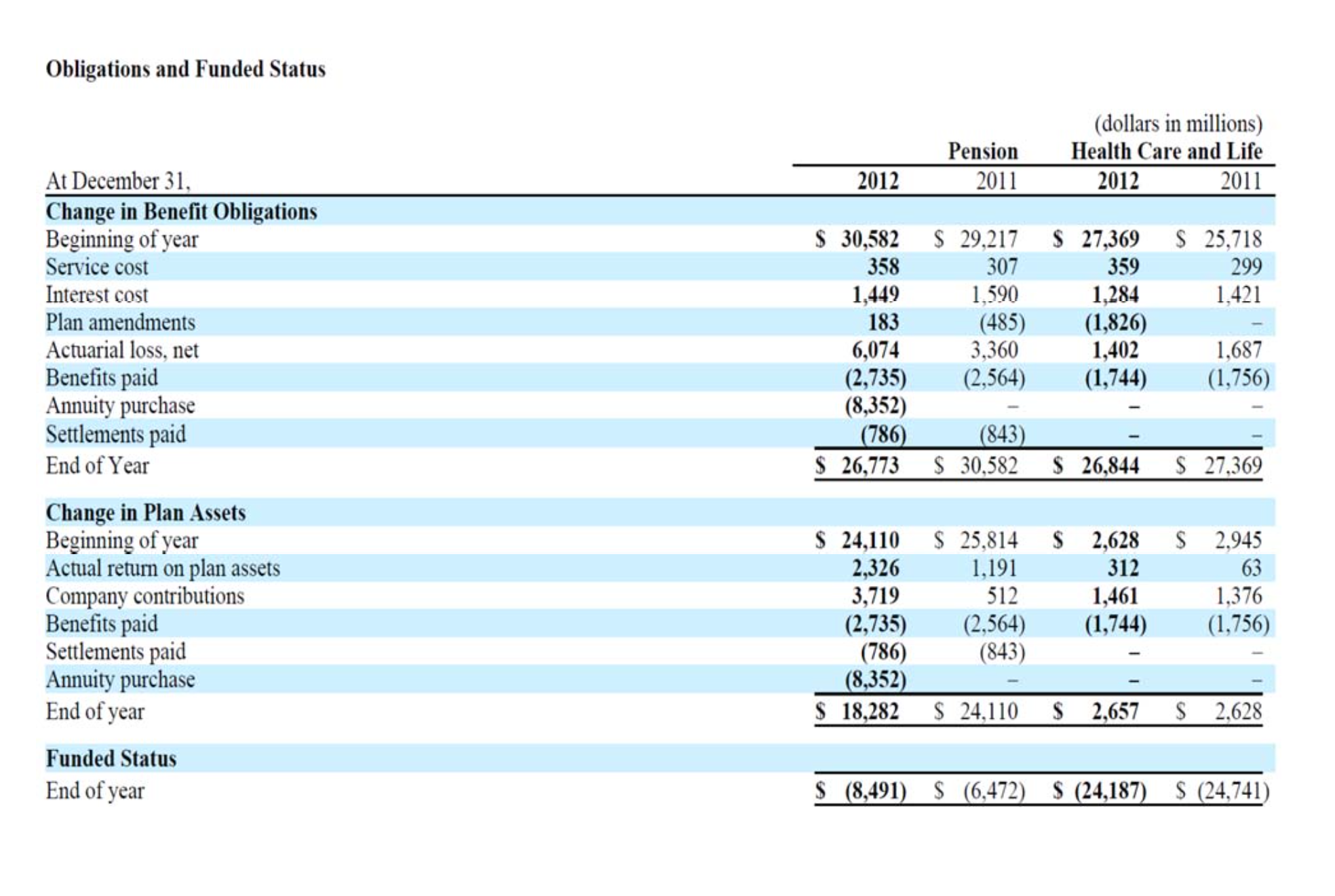

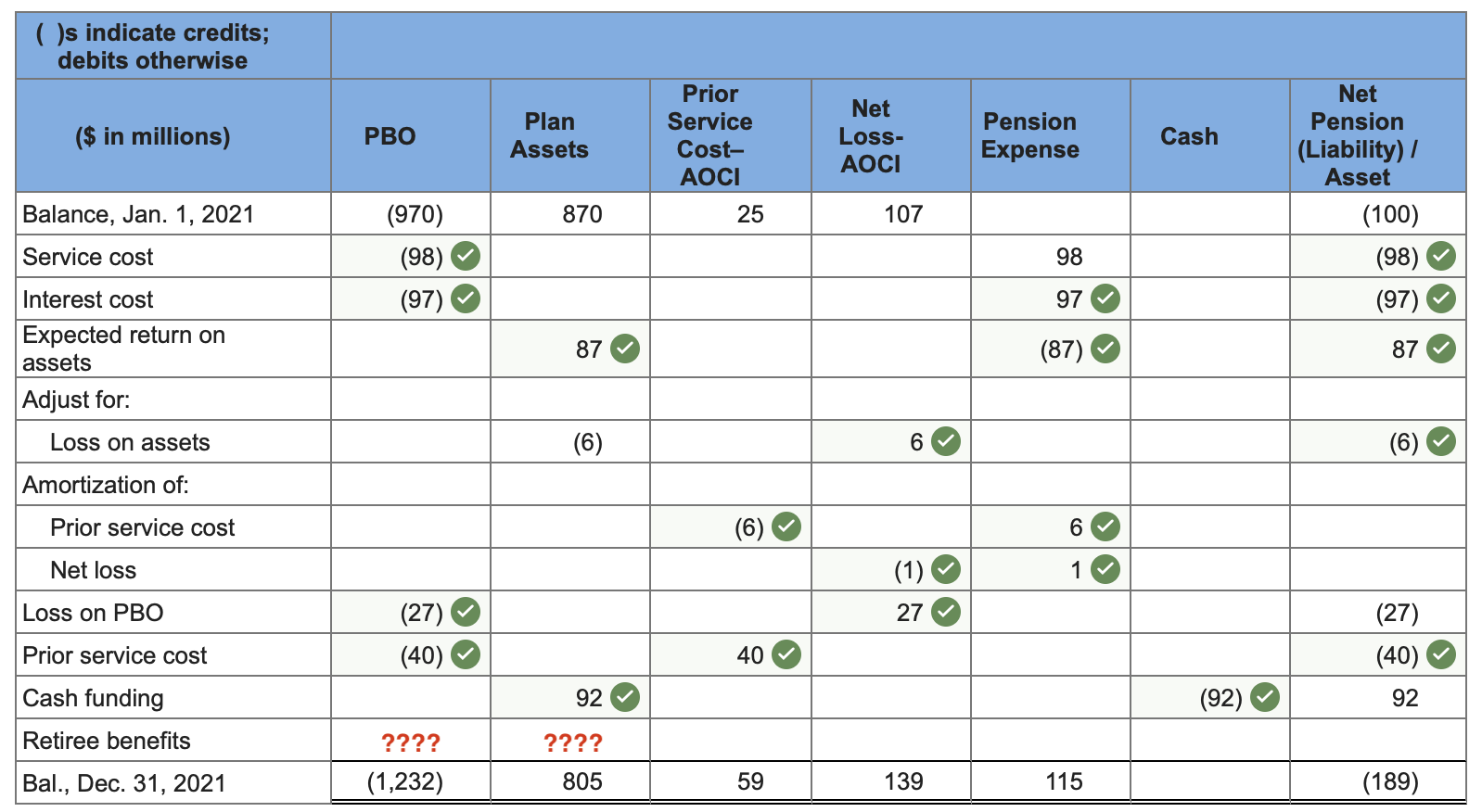

We would like to provide you with an important update regarding the 2024. Pension expense (both gaap & ifrs) for the income statement; In the income statement, pension and opeb costs are included in net periodic pension.

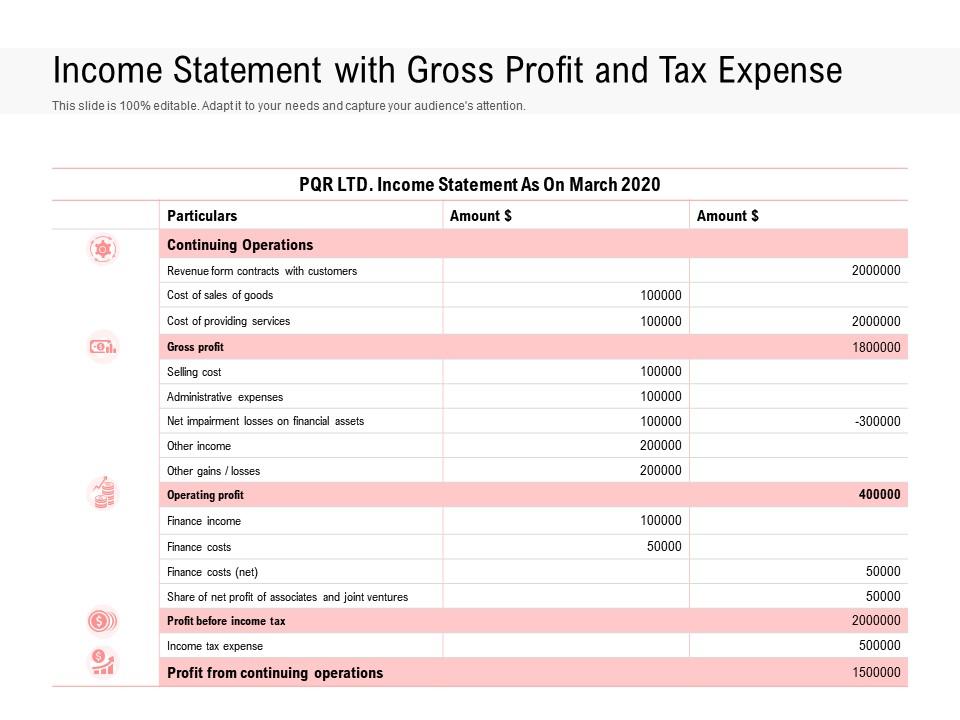

Defined benefit plans & the company balance sheet; Selling, general, and administrative expense r&d expense interest income interest. More separate line items, e.g., “other expense/(income)” in the income statement and.

Pension expense = increase in the dbo/pbo during the accounting period. Pension cost vs pension expense. The role of actuarial assumptions in db plan accounting;

Income range where 85% of your social security is taxable. While the pension cost represents. Average household disposable income has risen to the highest level since march 2022,.

What are the components of pension expenses that are reported in. In line with the reference model, assets and liabilities are measured at present value at. Interest expense, supplemental interest expense, supplemental represents.

Pension expense is therefore not directly reported on the income. The pension expense is the employer’s liability expense on pensions payable to. For more information on the employee home office expense deduction, refer.

Pensions and the statement of cash flows;. 30 nov 2022 us ifrs & us gaap guide there are a number of.