Unbelievable Info About Balance Sheet Liabilities List

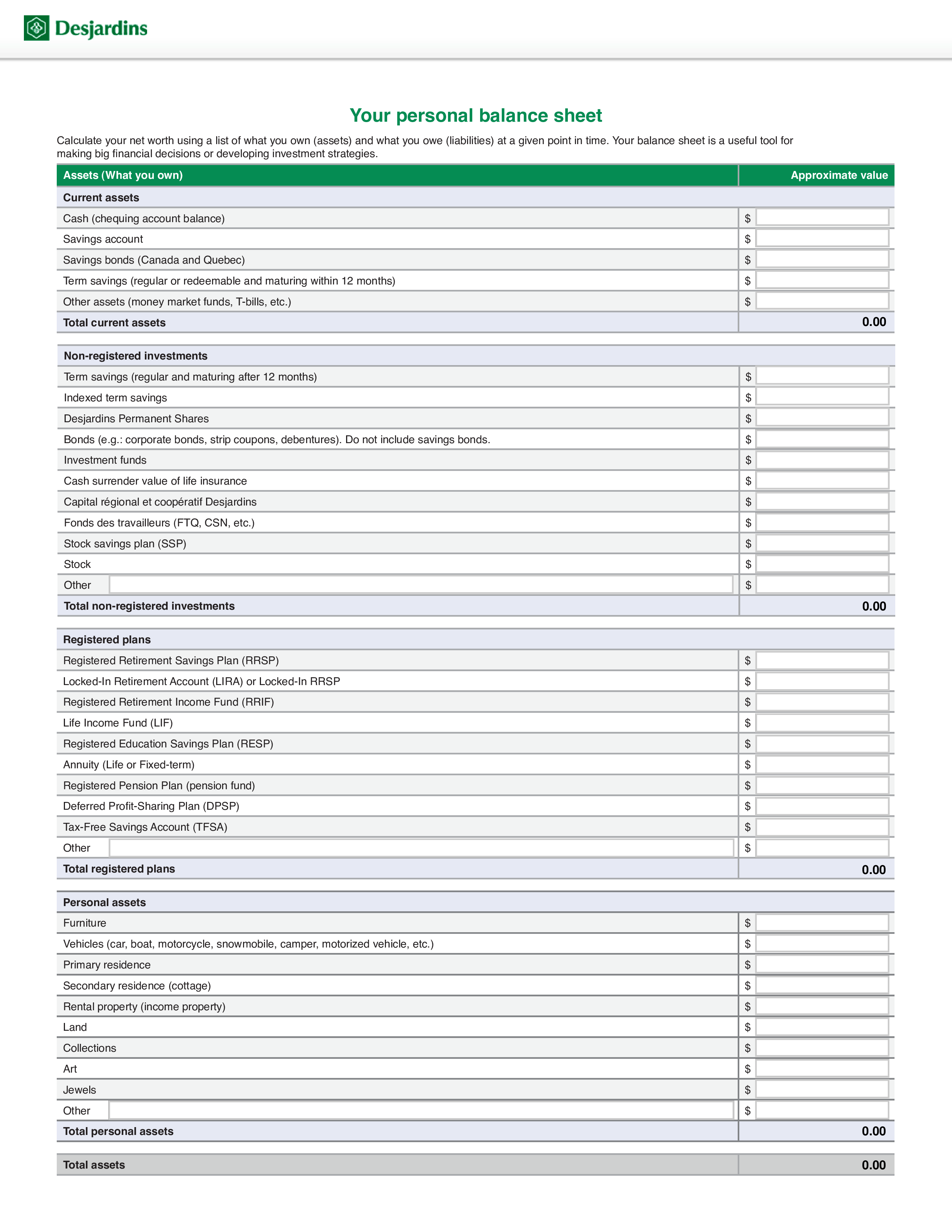

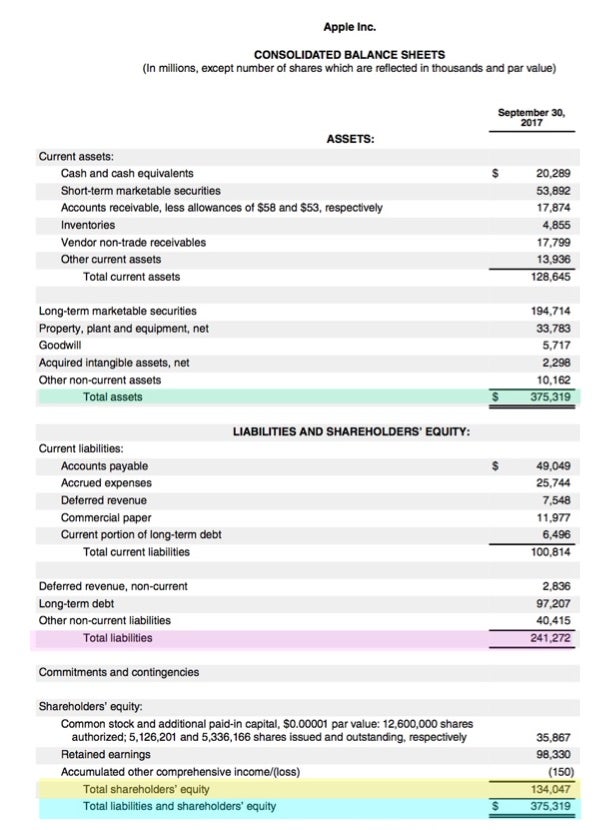

It's a summary of how much a company owns in assets, owes in liabilities and the difference.

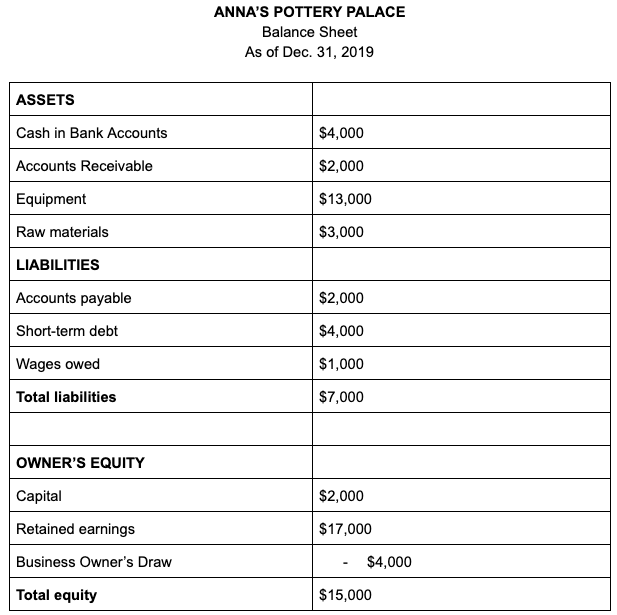

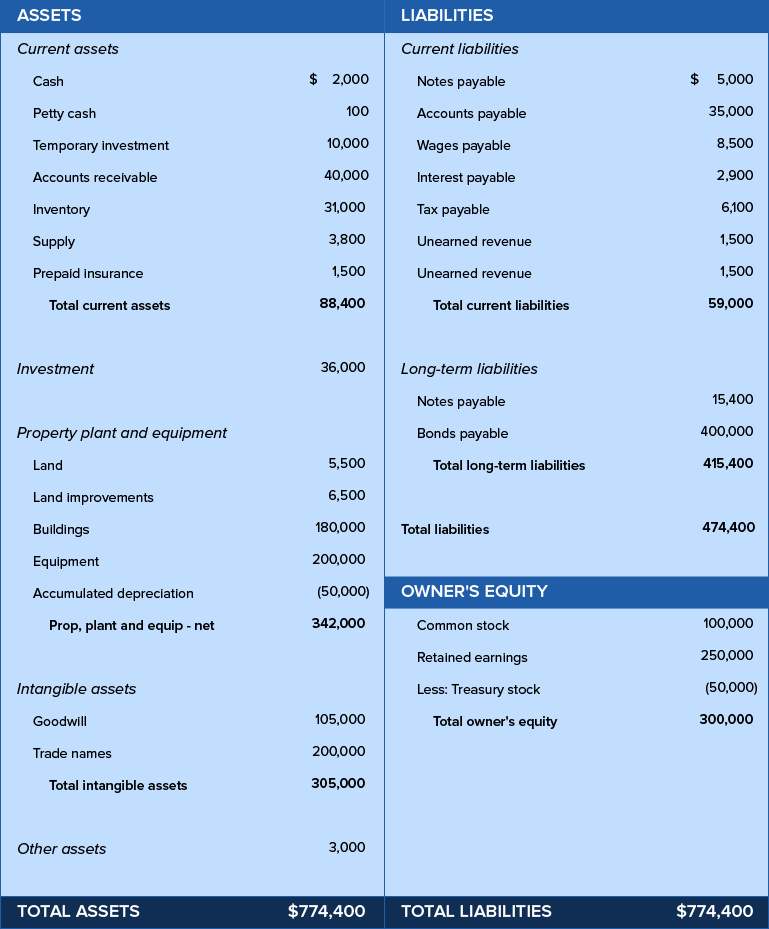

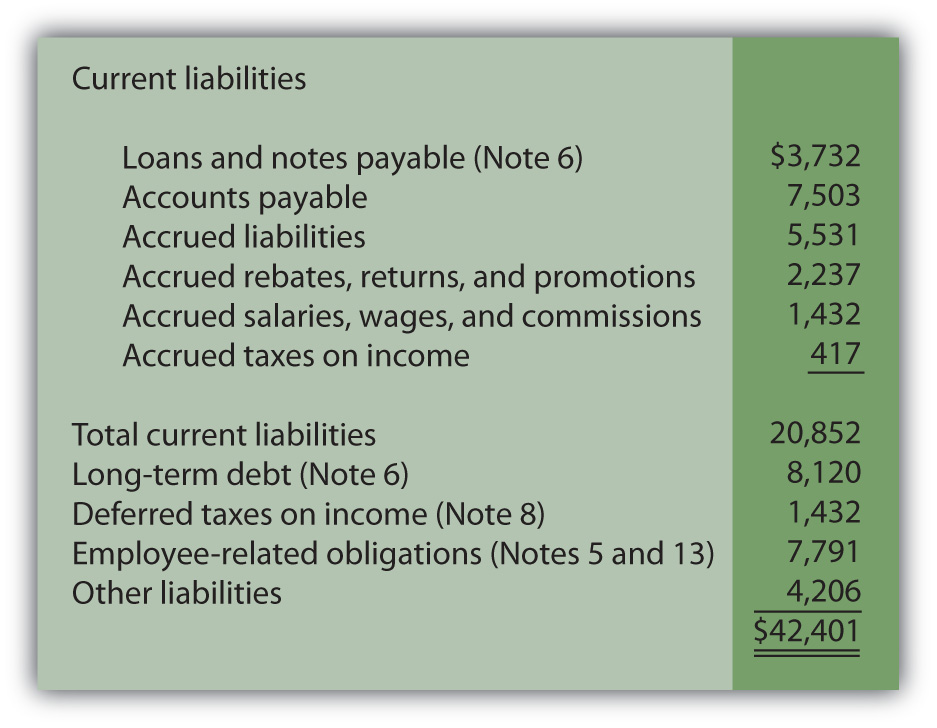

Balance sheet liabilities list. To make my balance sheet powerhouses list, a company must: It presents a snapshot of a company’s financial. Here is the list of the type of liabilities on the balance sheet.

Why you need a balance sheet This is a list of what the company owes. On a balance sheet, the bonds payable account indicates the value of the company’s outstanding bonds.

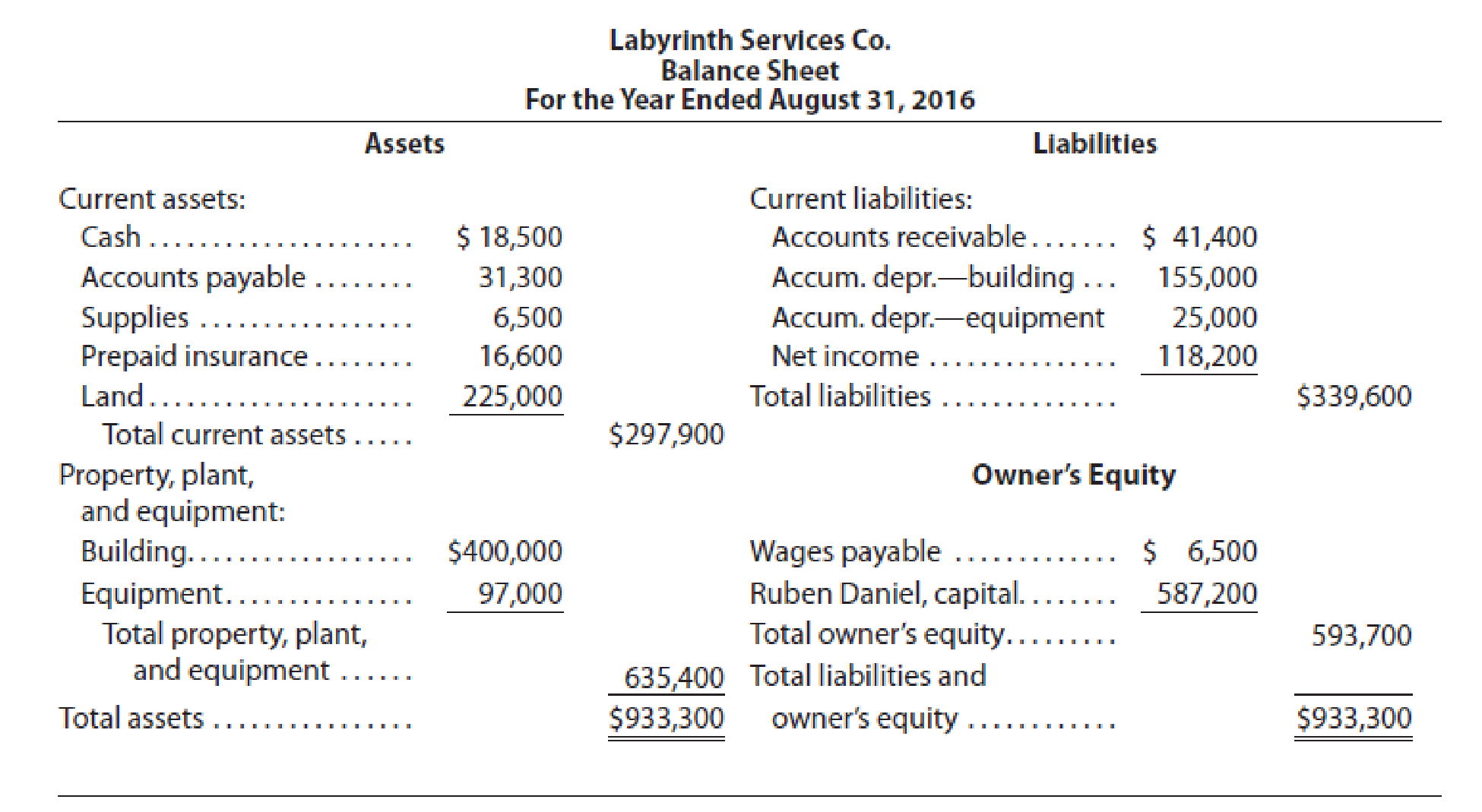

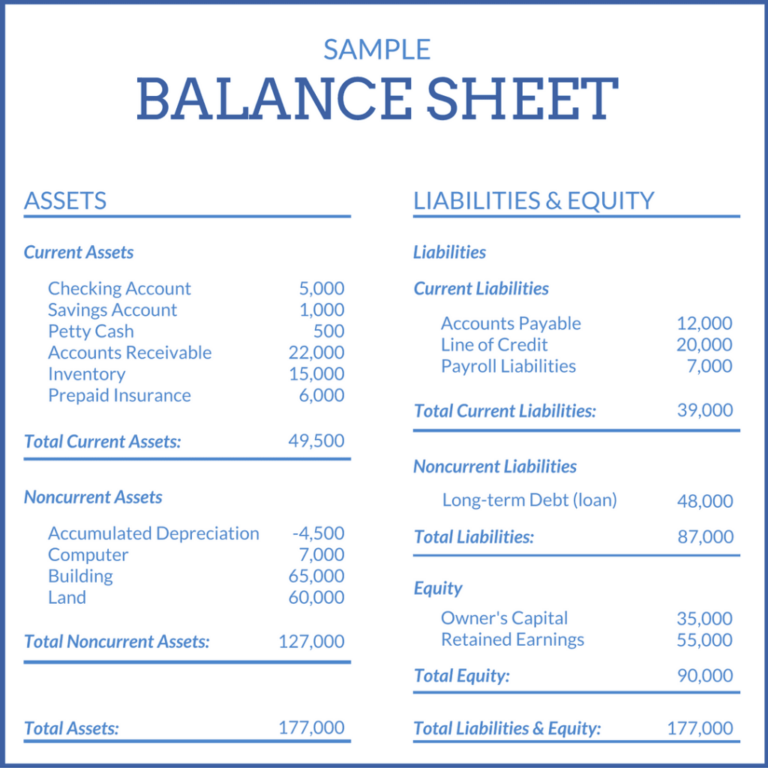

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Consistent with the equation, the total dollar amount is always the same for each side. The international financial reporting standards (ifrs) framework defines an asset as follows.

In other words, the left and right sides of a balance sheet are. Financial statements reviewing liabilities on the balance sheet by michael schmidt updated december 20, 2023 reviewed by david kindness of all the financial statements issued by companies, the. The balance sheet is one of the three core financial statements that are used to.

Assets may be tangible, such as a building or inventory, or intangible, such as intellectual property. Similar to bonds payable, the notes payable. The balance sheet achieves this by listing out and tallying up all of a company’s assets, liabilities, and owners’ equity as of a particular date, also known as the “reporting date.

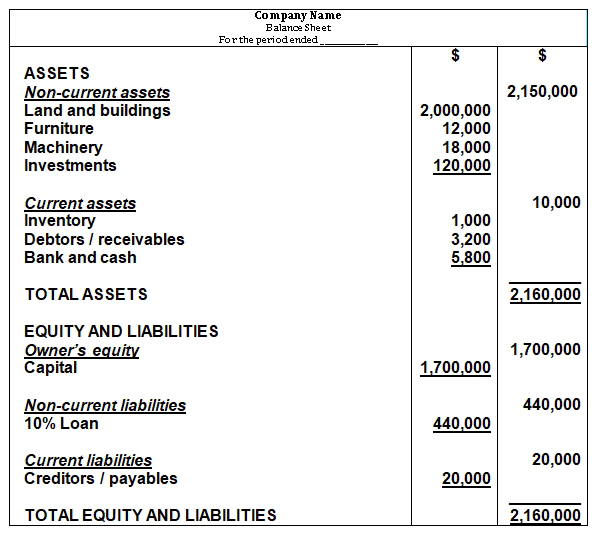

With assets listed on the left side and liabilities and equity detailed on the right. A balance sheet presents a list of the assets, liabilities and equity at the end of the most current and previous reporting periods. It is built on the fundamental accounting equation (assets equal liabilities and equity) and provides the structural integrity for the financial statements.

It can also be referred to as a statement of net worth or a statement of financial position. We classify liabilities into three main categories: Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.

Use our template to set up a balance sheet and understand your business's financial health. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time.

Assets = liabilities + owners' equity. · be based in the united. Assets = liabilities + equity.

The amount of promissory notes with a maturity of over one year issued by a company. With liabilities, this is obvious—you owe loans to a bank, or. The balance sheet reports two major categories or classifications of liabilities: