Here’s A Quick Way To Solve A Info About Trial Balance Credit Side Items

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

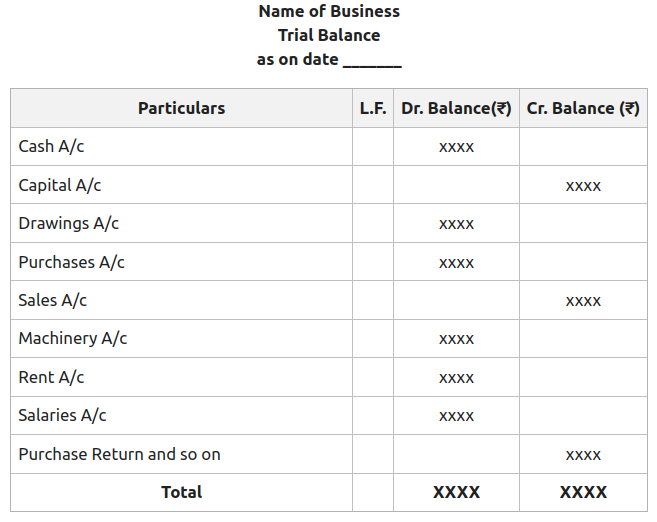

Trial balance credit side items. One, it is a summary of all ledger account balances at the end of the given period and two, it is used to assess whether there was erroneous accounting entries. All income and gain must be on the credit side. This statement comprises two columns:

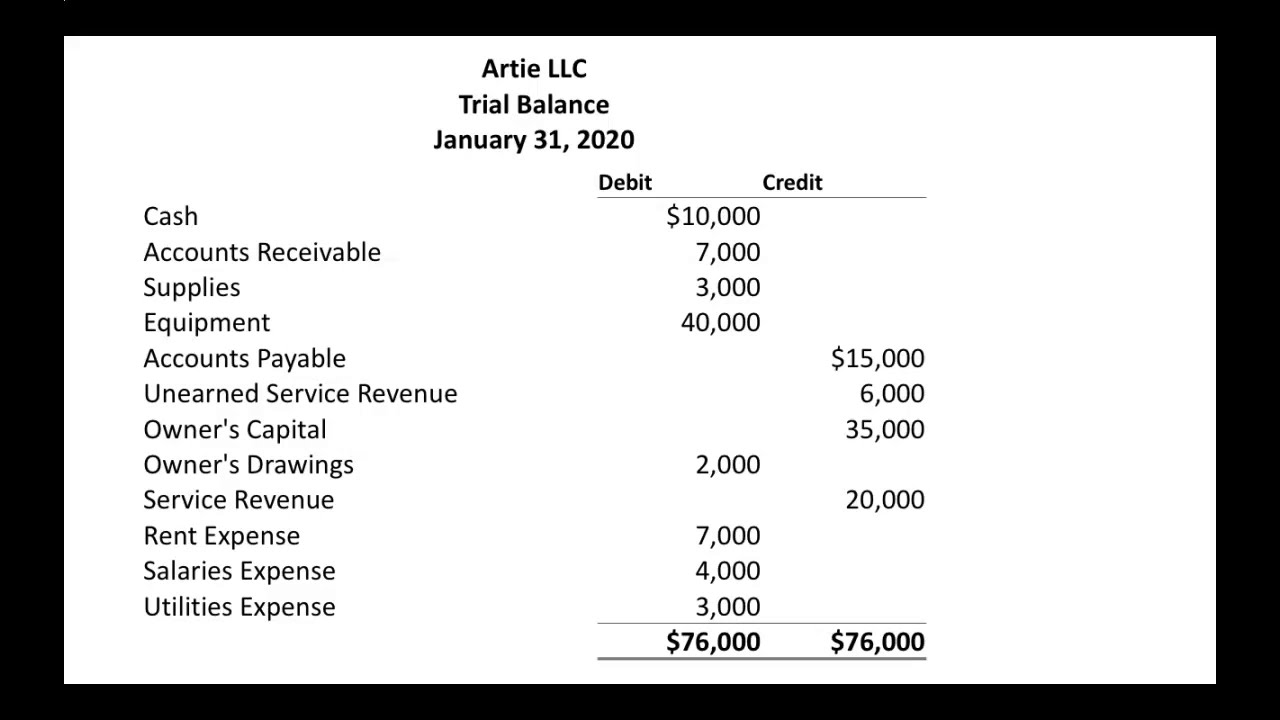

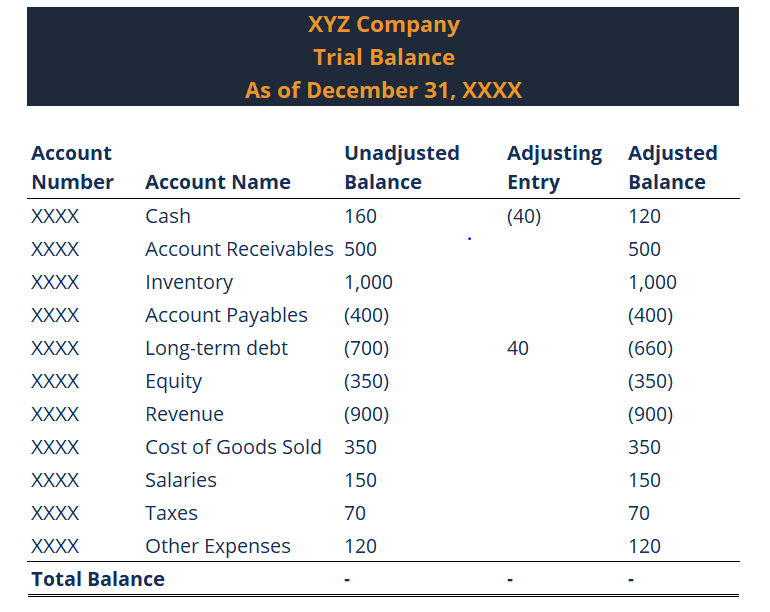

The total of the debit column and credit column should be the same. Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that. Preparing and adjusting trial balances aid in the preparation of accurate financial statements.

What is a trial balance? The total of the debit side is placed in the debit column and the total of the credit side in the credit column of the trial balance. Although a trial balance may equal the debits and credits, it does not mean the figures are correct.

A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. The total of both should be equal. The last is amount (credit), i.e., those ledgers with credit balances such as share capital share capitalshare capital refers to the funds raised by an organization by issuing the company's initial public offerings, common shares or preference stocks to the public.

Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side. All liabilities must be reflected on the credit side and assets reflected on the debit side. Expenses must be reflected on the debit side of the trial balance.

It is primarily used to identify the balance of debits and credits entries from the transactions recorded in the general ledger at a certain point in time. During the accounting close process, check that the trial balance line items are included in the general ledger. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

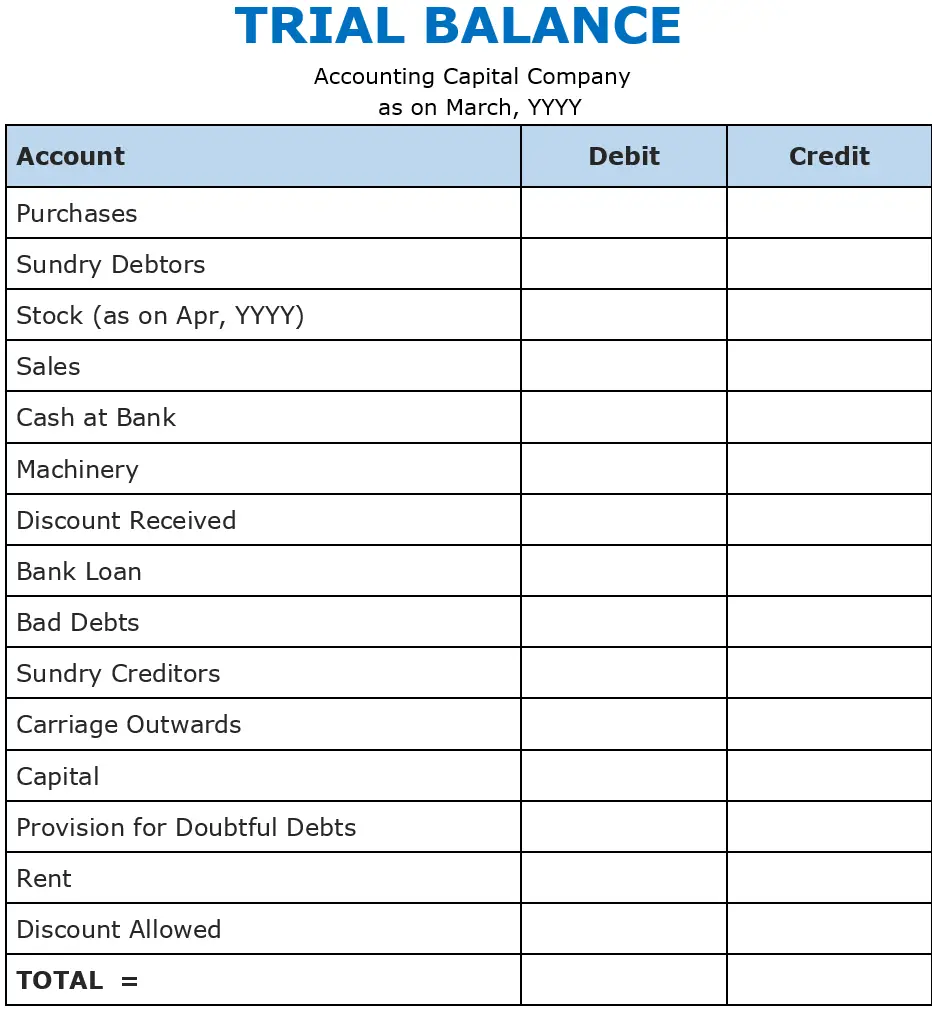

Scan and review the trial balance for reasonableness to detect errors. Errors in a trial balance: The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales.

If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell. The learner needs to understand that a trial balance is prepared for twofold reasons. Within the assets category, the most liquid (closest to becoming cash) asset appears first and the least liquid appears last.

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. A trial balance is a list of the balances of all of a business's general ledger accounts. Gains and income must be reflected on the credit side of a trial balance.

Resources technical skills accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating financial statements. Assets, liabilities, equity, dividends, revenues, and expenses. In this method the totals of the debit side of the account are entered in the debit side of the trial balance, and the totals of the credit side of the account are entered into the credit side of the trial balance.