Ace Tips About Income Tax On Cash Flow Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

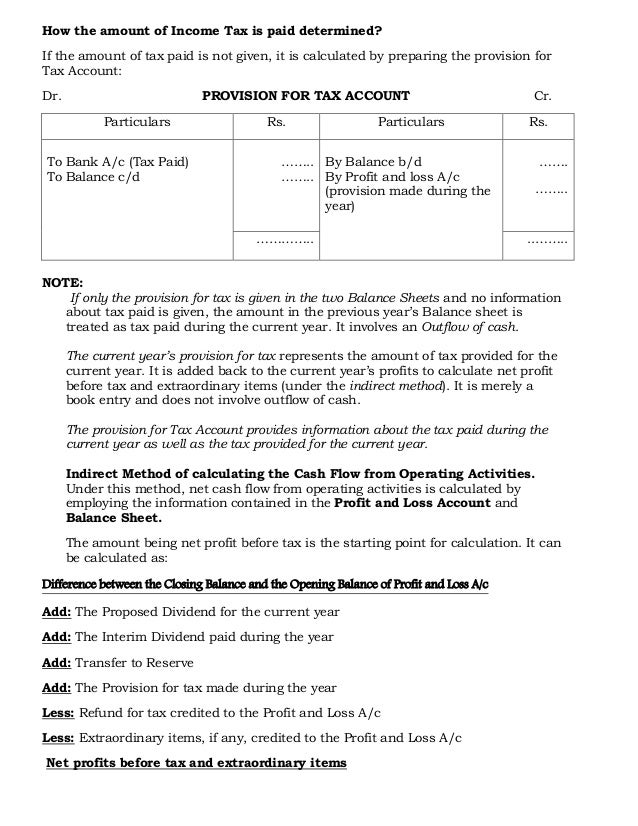

In 2018, a deductible difference of $1000 would arise because the carrying value ($5000) of the asset is less than its tax base ($6000).

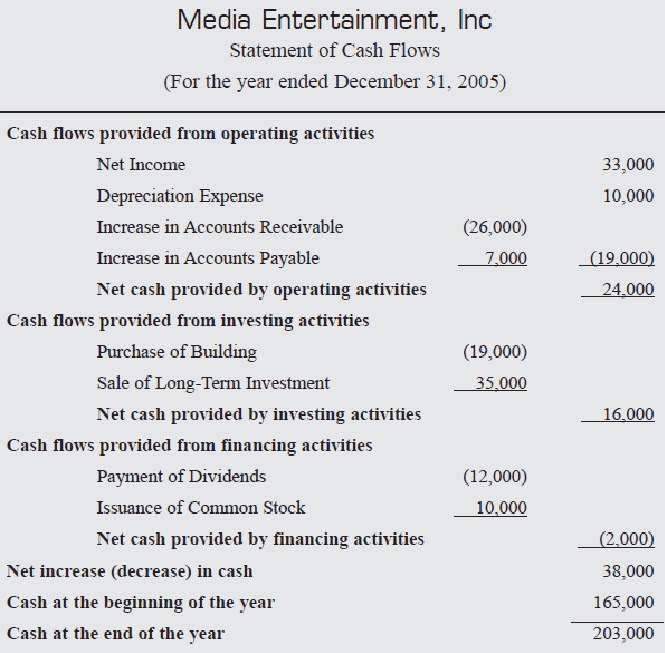

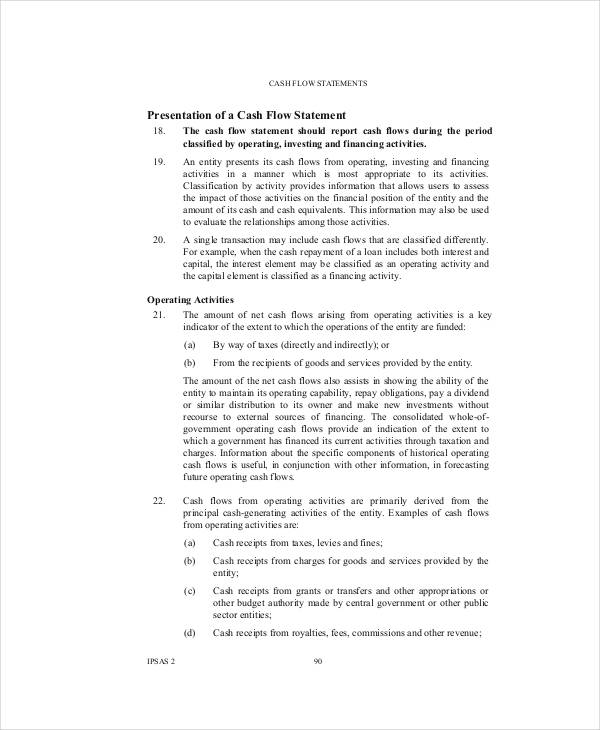

Income tax on cash flow statement. This article considers the statement of cash flows of which it assumes no prior knowledge. Taxes appear in some form in all three of the major financial statements: The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

How to create a cash flow statement. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

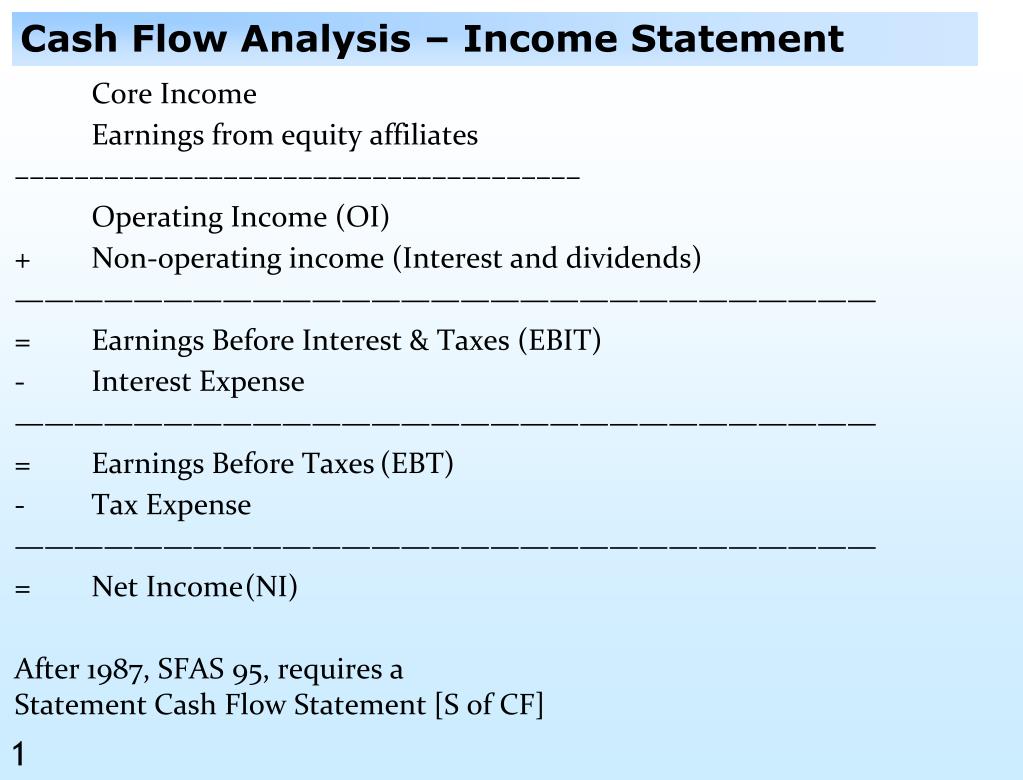

We can identify three different measures of profit or income: Key takeaways the cash flow statement and the income statement, along with the balance sheet, are the three main financial statements. This value can be found on the income statement of the same accounting period.

Add back noncash expenses, such as depreciation, amortization, and depletion. Did you get it ⬇️樂 question: The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. The statement of cash flows is prepared by following these steps: The operating profit margin is only 14.2% ($382.5 million) = operating profit/sales.

The last item is the tax paid. This item is found in the cash flow statement as it refers to the actual cash paid during the period. Did you get it ⬇️🤔 question:

The cash flow statement and income statement. What happens to income tax payable on a statement of cash flow? Cash flow from operating activities is calculated by adding depreciation to the earnings before income and taxes and then subtracting the taxes.

It can be assumed for many cases that the tax paid will be the tax payable from the prior accounting period. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. A company's ebit —also known as its earnings.

How do these items relate in the financial statements? Record adjusted ebitda margin fourth. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

This would result in a deferred tax asset of $300 i.e. The balance sheet, the income statement, and the cash flow statement. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)