Smart Info About Statement Of Cash Flows Investing Activities Examples

Updated may 22, 2021 reviewed by andy smith what is cash flow from investing activities?

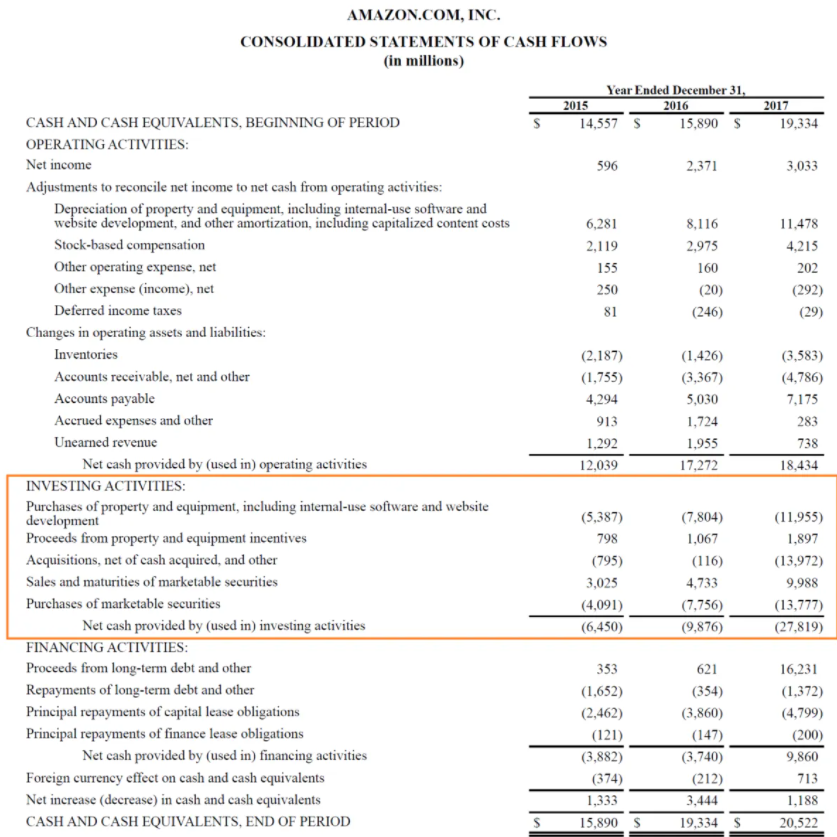

Statement of cash flows investing activities examples. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year. What are some examples of investing activities? Cash flow from financing activities cash flow from financing activities read more.

And these are cash flows from financing activities, cash flow from operational activities, and cash flow from investing activities. Every entity needs to present the cash flow statement as part of its annual accounts/reports. Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the change in cash reported on the balance sheet, supplemental information

In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting. Understand how these examples differentiate investing, financing, and operating activities. A cash flow statement is one of the three main types of financial statements, alongside a balance sheet and an income statement.

Cash paid for property, plant, and equipment (ppe), cash paid for investments in marketable securities, cash received from sale of ppe and cash received from sale or maturity of marketable securities. For example, a company might be investing heavily in plant and equipment to grow the business. Cash flow from investing activities cash flow from investing activities.

Receiving cash from issuing stock or spending cash to repurchase shares receiving cash from issuing. The economic decisions that are taken by users require an. There are four main components in this section of a cash flow statement:

For example, cash flow statements can reveal what phase a business is in: A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. It can also reveal whether a company is going through transition or in a state of decline.

Investing activities includes cash flows from the sale of fixed asset, purchase of a fixed asset, sale and purchase of investment of business in shares or properties, etc. On the other hand, a company’s balance sheet shows the assets, liabilities, and shareholders’ equity. The three sections of the cash flow statement are:

Let’s look at an example of what investing activities include. The cash flow statement is one of the most revealing documents of a firm’s financial. Operating activities, investing activities and financing activities.

As with any financial statement analysis, it's best to analyze the cash flow statement in tandem. Cash flow statement: Cash flow from investing activities refers to the cash inflow and outflow from investing and purchasing assets like property, plant, and equipment (pp&e) and from sale proceeds of assets or disposal of shares or redemption of investments like a collection from loans advanced or debt issued.

Learn about cash flow statements and cash flows from operating activities. Cash flow from operating activities cash flow from operating activities. The cfs highlights a company's cash management, including how well it generates.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)