Unique Info About Operating Cash Flow Indirect Method

It starts with a business’s net income.

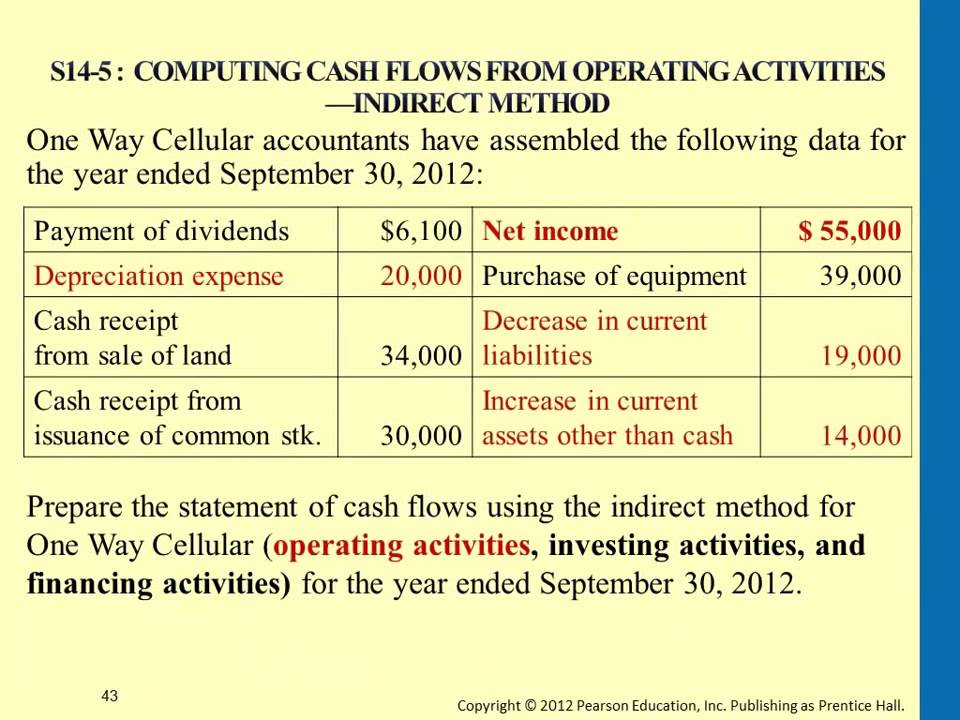

Operating cash flow indirect method. Cash flow from operating activities (cfo) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational. The cash flow statement indirect method is one way to present a company’s total cash flow. Begin with net income from the income statement.

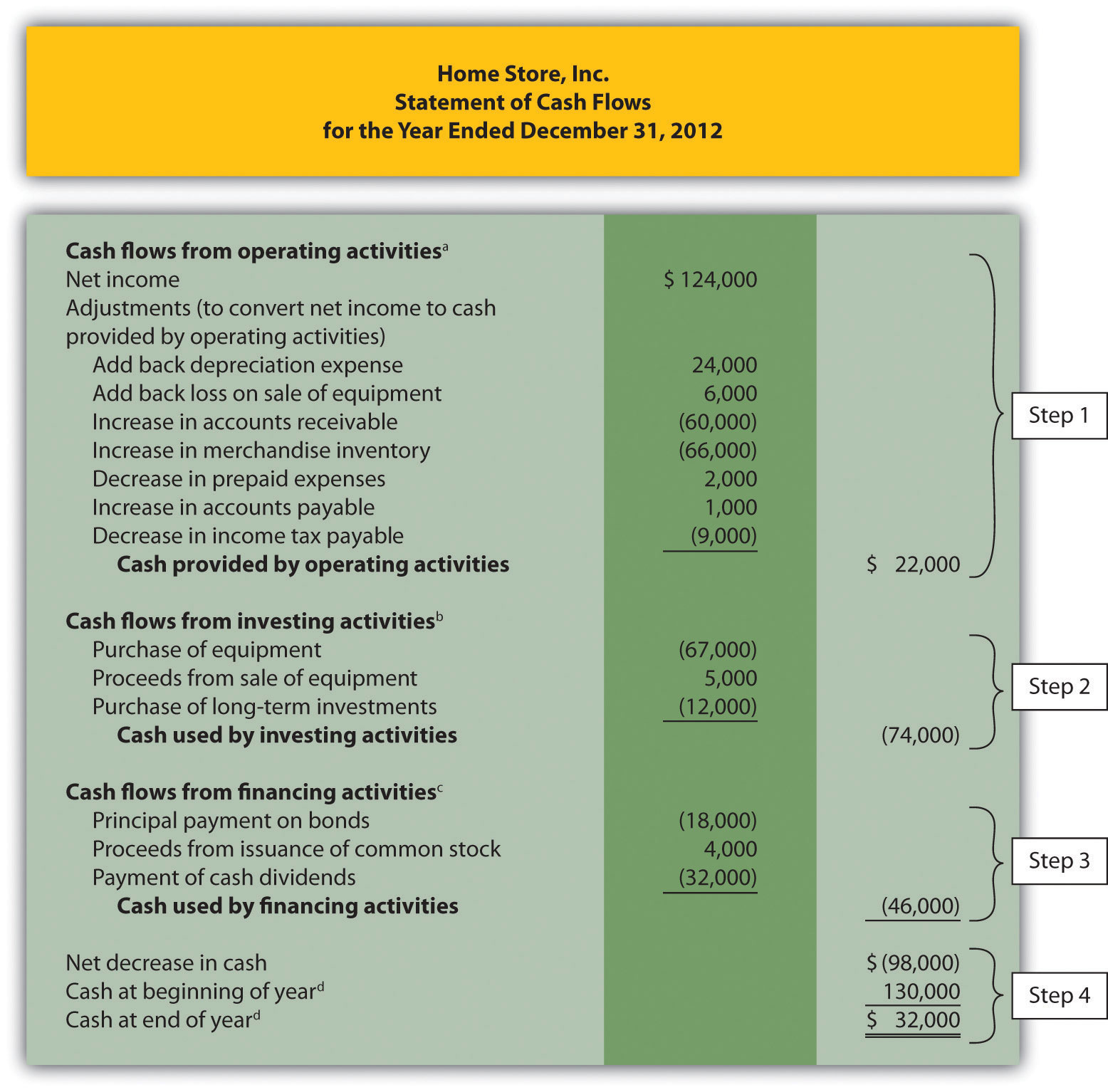

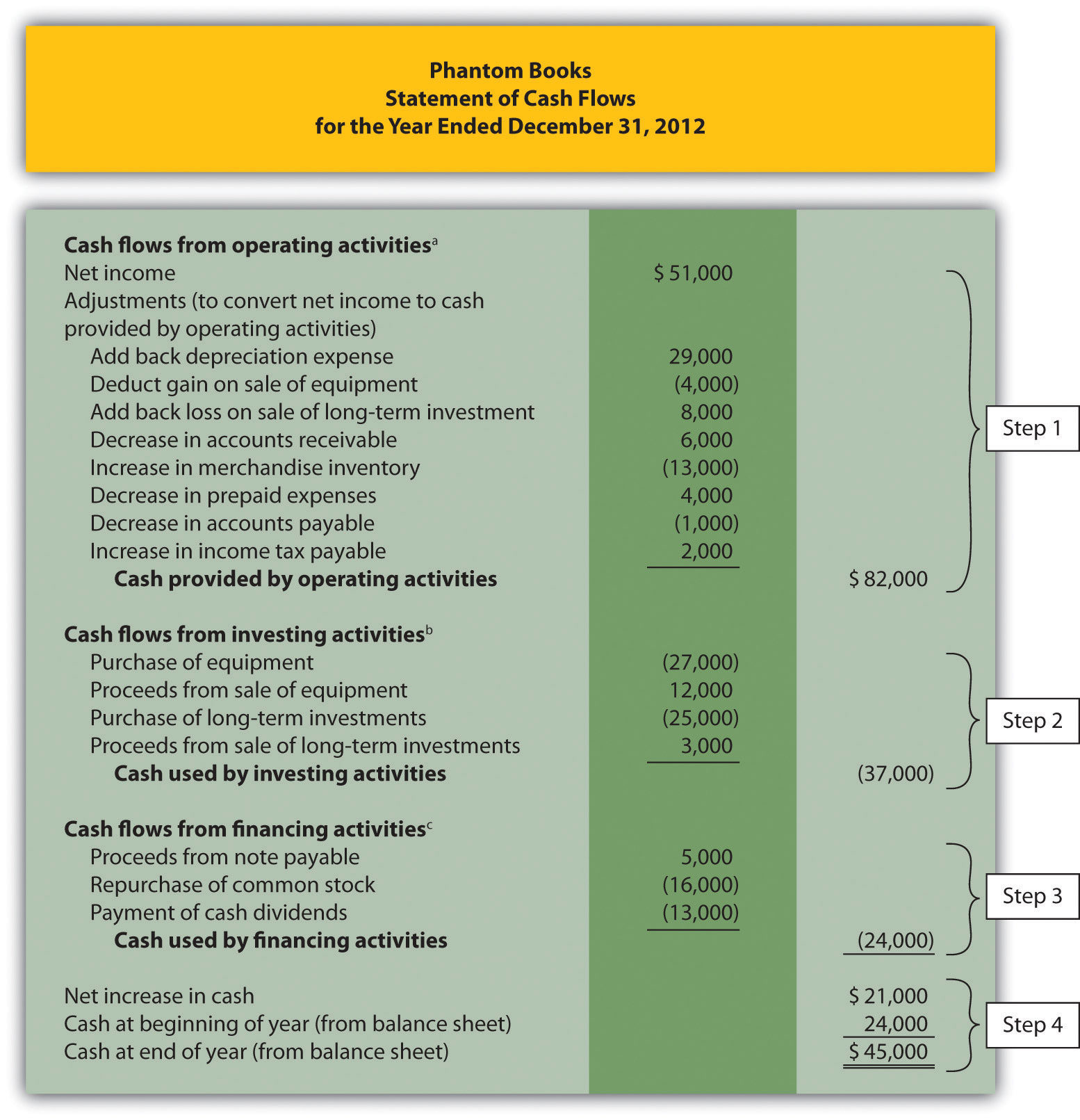

The following example shows the format of the cash flows from. The format of the indirect method appears in the following example. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

The ocf calculation will always include the. Indirect method → the beginning line item is net income,. Concepts teaching (and learning) accounting involves starting with simple transactions and gradually layering in.

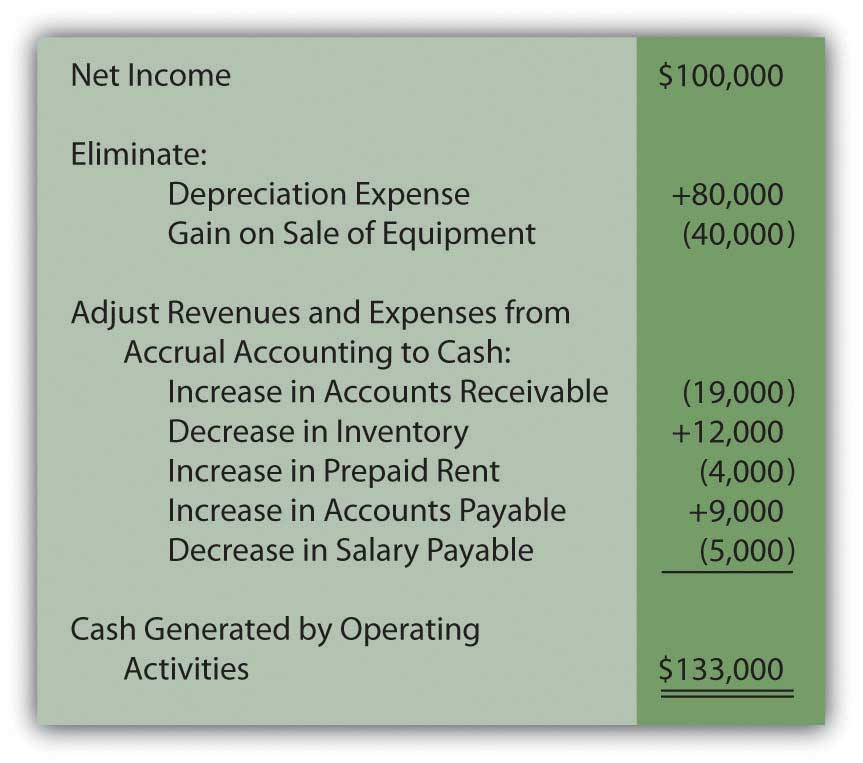

The following is the indirect method formula to calculate net cash flow from operating activities: The indirect method uses increases and decreases in balance sheet line items to modify the operating section of the cash flow statement from the accrual method to the cash methodof accounting. The calculation for ocf using the indirect method uses the following formula:

In the presentation format, cash flows are divided into the following general classifications:. Determine net cash flows from operating activities. Title your first section “cash flow from operating activities”.

In the first line, create a reference to net income from the income statement tab. Using the indirect method, operating net cash flow is calculated as follows: Add back noncash expenses, such as depreciation,.

Indirect method cash flow from operations: The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. The cash flow statement (cfs) can be presented under two methods — the indirect or the direct method:

In this method, you begin with the net income and adjust it to calculate. The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their bookkeeping. When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items:

Using the indirect method, operating net cash flow is calculated as follows: The indirect method is one of two accounting treatments used to generate a cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)