Matchless Info About Calculate Roce From Balance Sheet

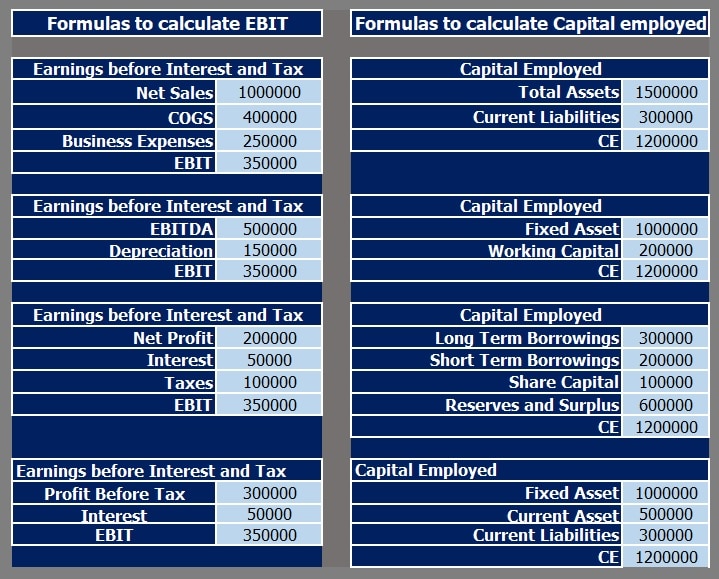

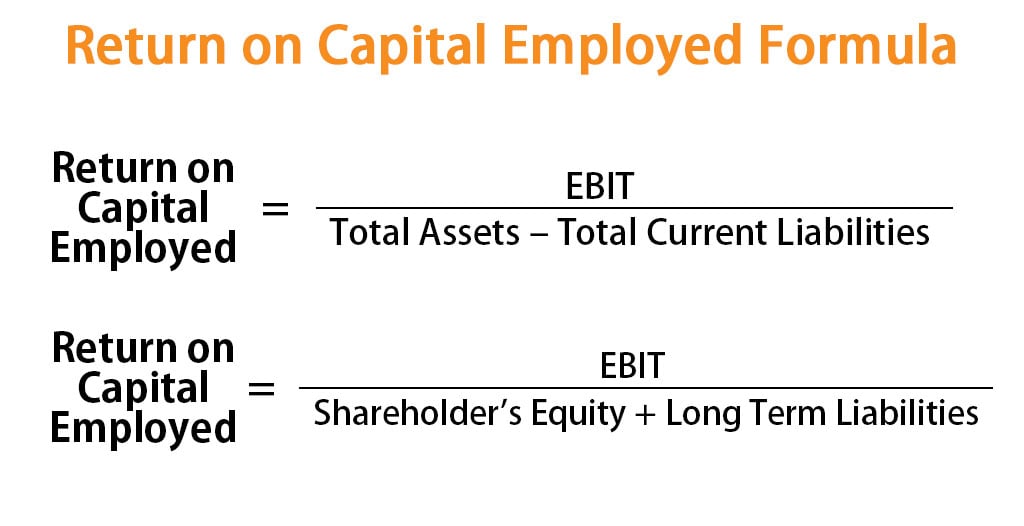

Return on capital employed formula is calculated by dividing net operating profit or ebit by the employed capital.

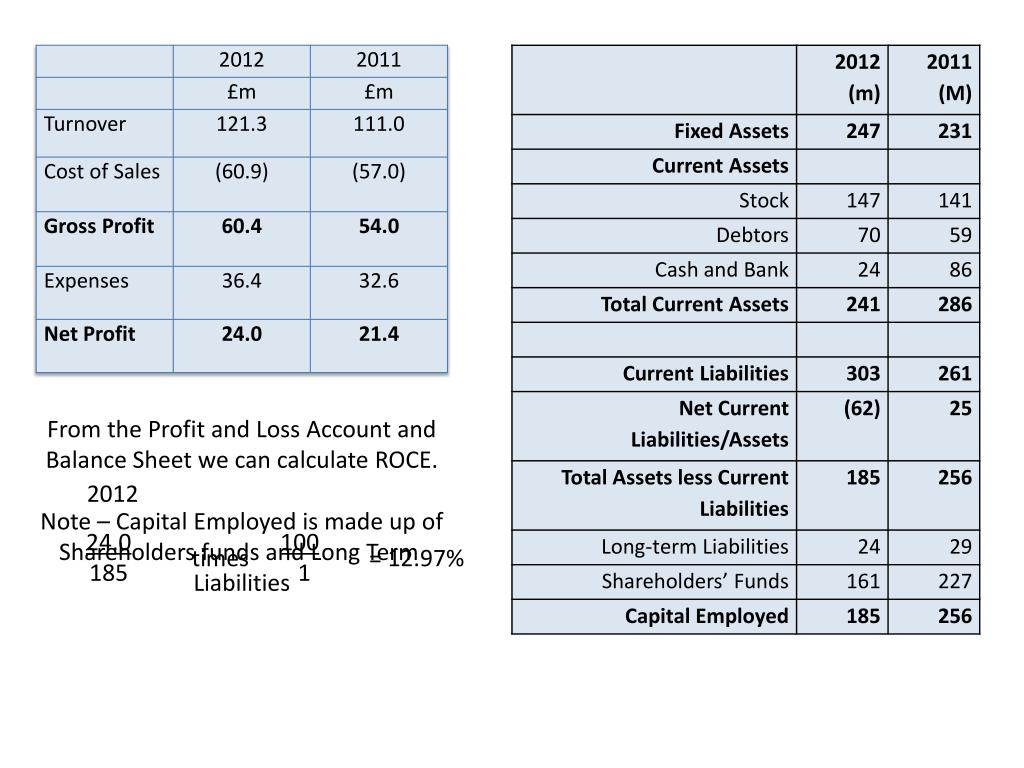

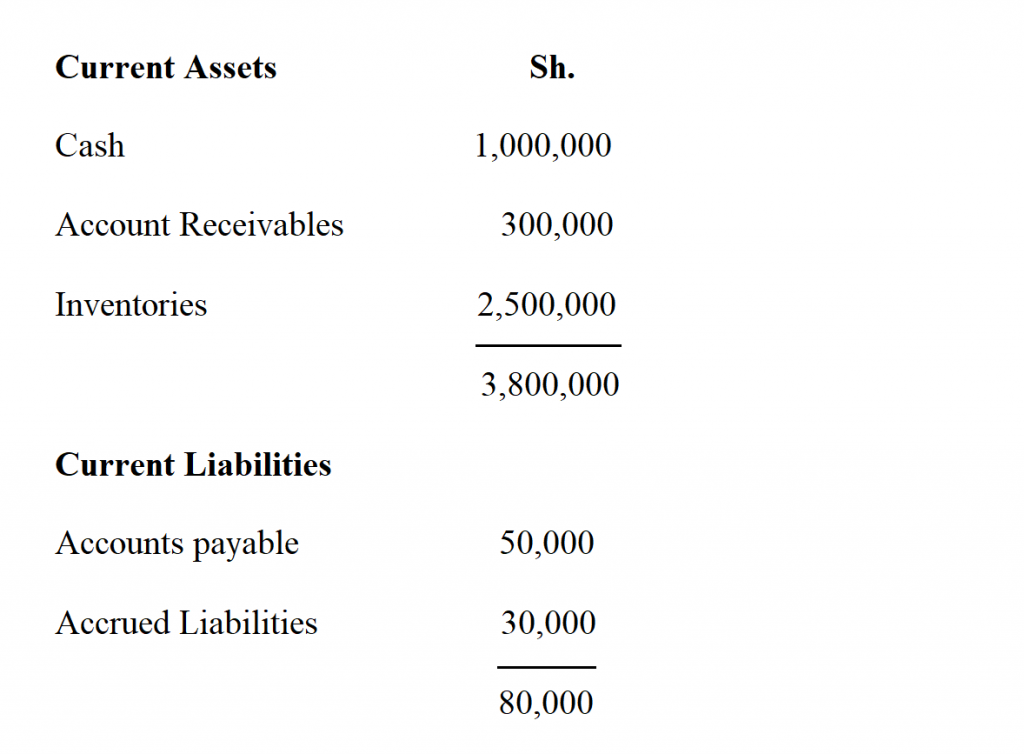

Calculate roce from balance sheet. Roce = ($40,000 / $80,000) x 100 roce = 0.5 x 100 roce = 50% related: The balance sheet of anand group private limited states that it has total assets of $40,000,000 and current liabilities of $15,000,000. Formula to calculate roce?

Roce = (net profit after tax / total assets) x 100 the formula is applied to the company’s income statement and balance sheet. Roc looks at profits using invested capital (or equity of shareholders) whereas roce looks at all capital employed to help generate additional profits. What roce can tell you roce is a useful measure of financial efficiency , viewed from.

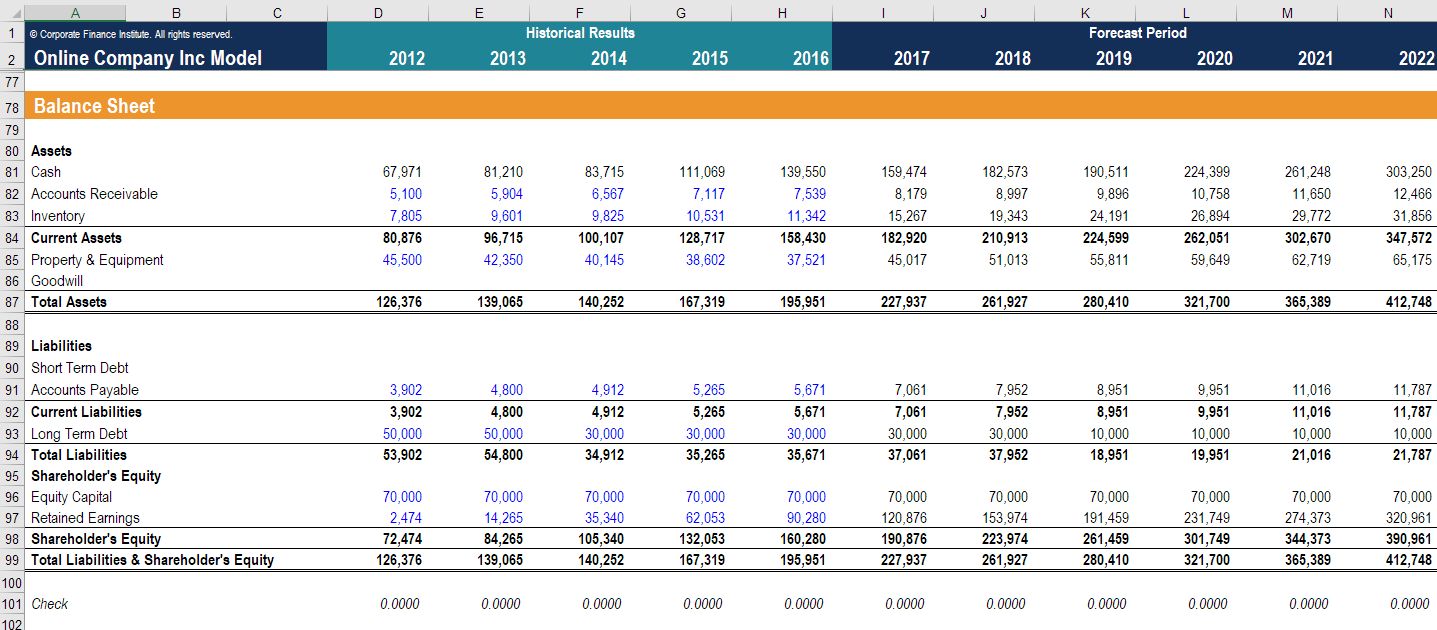

You can calculate capital employed from a company's balance sheet. Roace is one of the several methods to calculate the return on capital. Return on equity (roe) vs.

The company has average capital employed equal to. The return on capital employed (roce) is a financial metric that measures the profit a company makes in relation to its capital employed. The return on capital employed (roce) ratio is calculated by expressing profit before interest and tax as a percentage of total capital employed.

Return on capital employed (roce) is thought of as a profitability ratio. The higher the return on capital. You can calculate roce using the following formula:

Capital employed refers to the total. Operating profit of ( ebit) divided by capital employed. Let's calculate roce for apple inc.

It compares net operating profit to capital employed and informs investors how much each. When looking at the roce calculations of public companies, it is calculated as ebit as a percentage of total capital employed (debt and equity.) public companies. A higher roce is always more favorable, as it indicates that more profits are generated per dollar of capital employed.

The total assets figure comes from. The formula for return on capital employed (roce) is: Return\ on\ capital\ employed=\frac {ebit} {capital\ employed} where:

Return on capital employed (roce) formula return on capital employed (roce) = ebit / capital employed earnings before interest and tax or ebit is a. If employed capital is not given in a problem or in the financial. Here's the equation investors may use to determine this:

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)

![ROIC vs ROCE When to Use One Over the Other [Pros & Cons]](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2021/11/csco-balance-sheet-678x1024.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)