Wonderful Tips About Cash Flow From Continuing Operations

It excludes any profits or losses from discontinued operations, extraordinary items, and the impacts of changes in accounting principles.

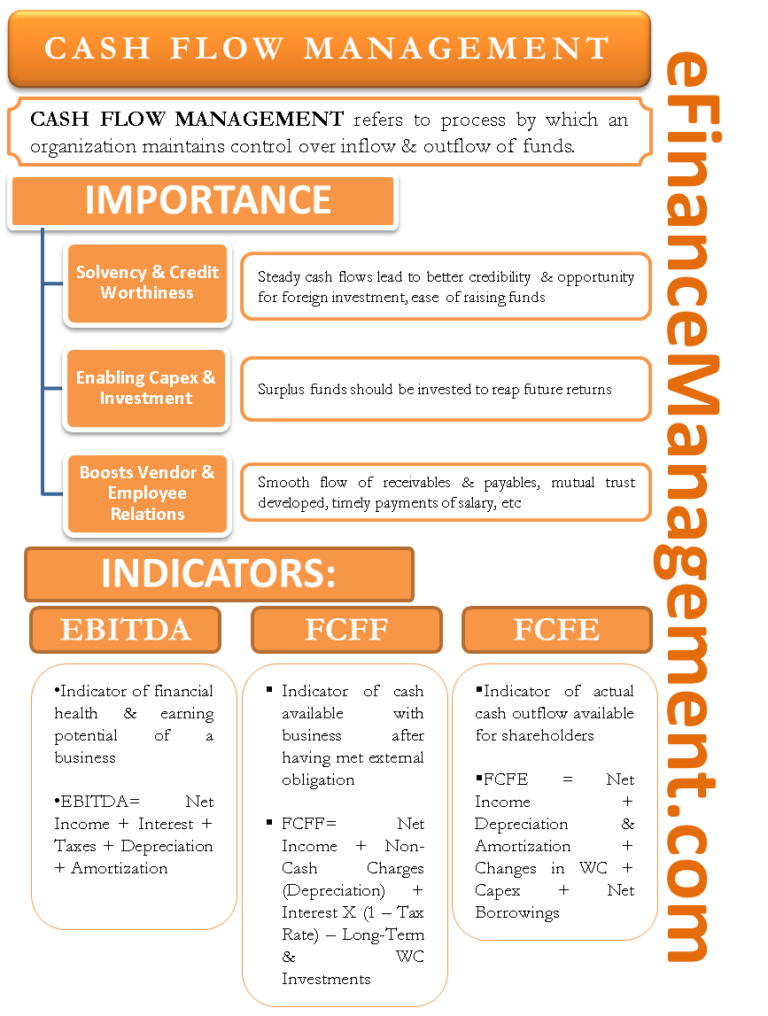

Cash flow from continuing operations. Focusing on these activities, investors and stakeholders can assess the company’s performance and make informed decisions about its value and potential for growth. Operating cash flow represents the amount of cash that a company generates from its regular operating activities during a defined period. A company’s operating cash flow shows whether it can regularly generate enough cash to continue and grow its operations.

Approximately $212 million of additional liquidity is available under two, undrawn committed financing facilities net loss. The net cash flows relating to each type of activity (operating, investing and financing) derived from discontinued operations are then disclosed separately in a note to the financial. Mooreast is in the process of finalising its unaudited consolidated financial results for 2hfy2023 and fy2023, which will be announced on or before feb 29.

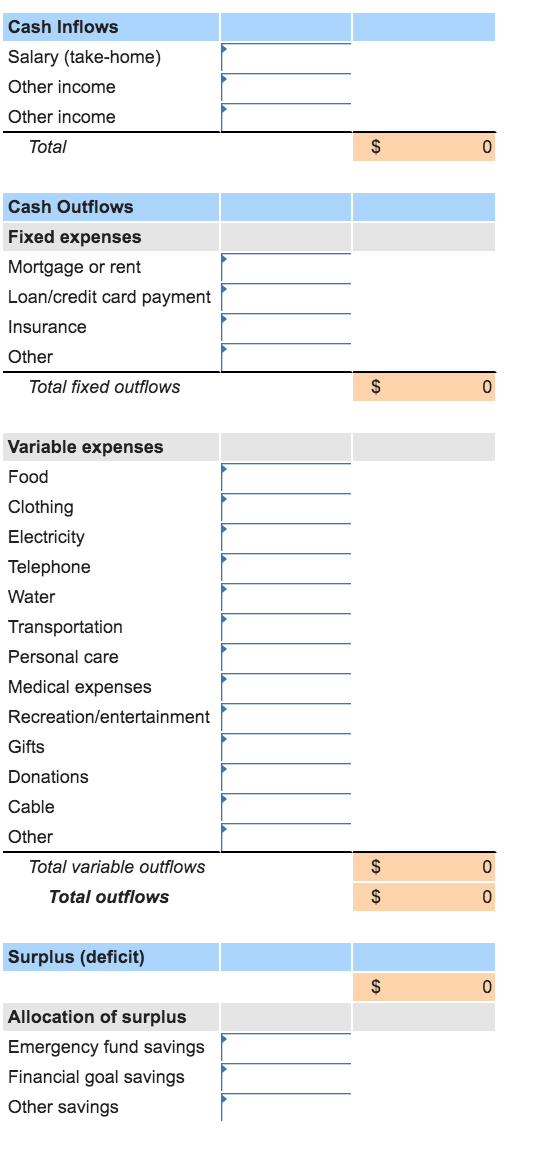

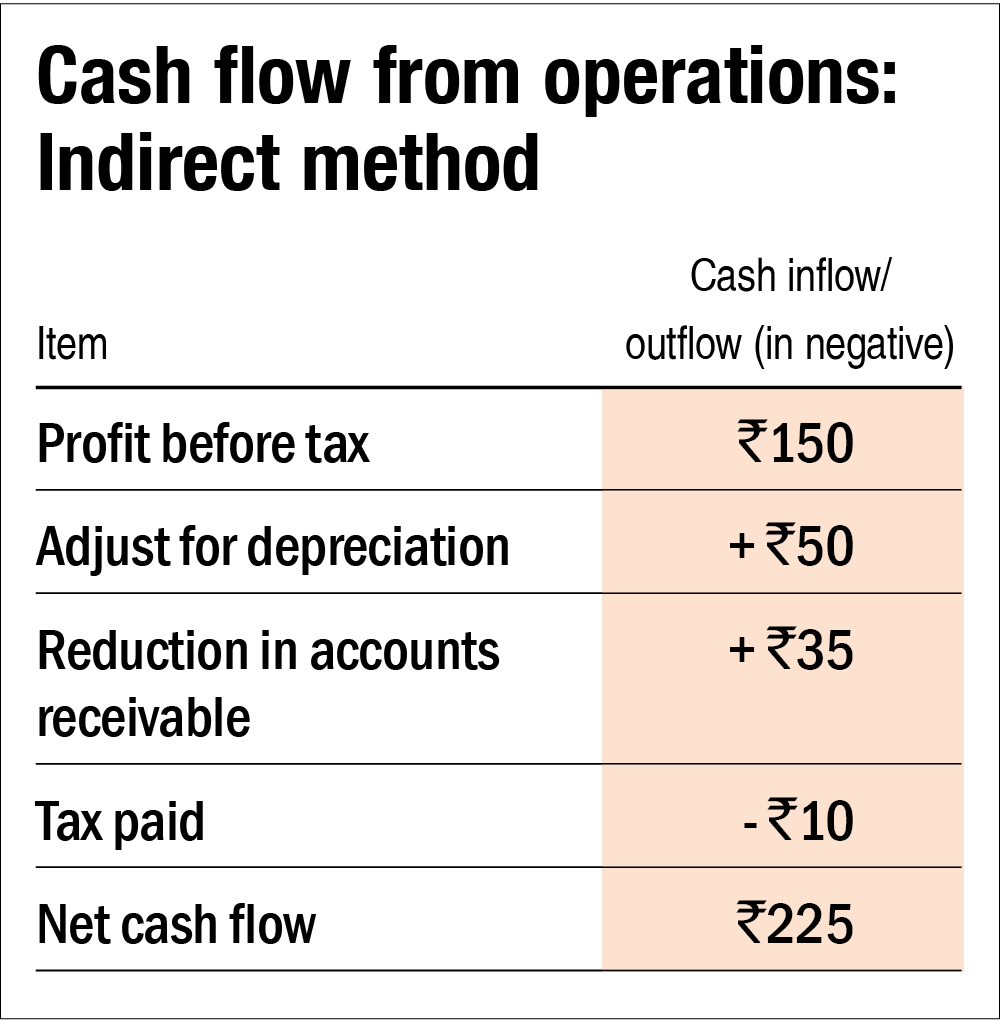

The cash flow from operations can be prepared in two ways: Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

Learn more with detailed examples in cfi’s financial analysis course. 50,721 48,524 187,027 175,063 net operating cash flows used by. The direct method, arguably the more intuitive way of recording cash flows, simply lists all inflows and outflows that have occurred in a company's operations.

Operating cash flow is cash generated from the normal operating processes of a business. Continuing operations is a term used in financial reporting to describe the activities of a business that have been ongoing or continuous since the financial statements were issued. Thomas brock what is operating cash flow?

October 19, 2020 what is cash flow from operations? Operating cash flow is a measure of the amount of cash generated by a company's normal business operations. For the full year, coeur reported revenue of $821 million, cash flow from operating activities of $67 million and gaap net loss from continuing operations of $104 million, or $0.30 per share.

Income from operations of $652 million; A company's ability to generate positive cash. Examples of direct costs that may be reported in discontinued operations include:

Generally, costs and expenses that are expected to continue in the ongoing reporting entity after the disposal date should not be allocated to discontinued operations and instead should be included in the results of continuing operations. Launching multiple products in revenue generating categories.streamlining operations. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two.

Continuing operations are the ongoing and regular activities that generate revenue consistently over time. Strong increase in revenue and recurring operating income which are expected to continue in 2024 paris, february 15, 2024 fy 2023 adjusted data revenue:

Define cash flow from continuing operations. Occidental petroleum corp. Record adjusted ebitda margin fourth.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)