Looking Good Info About Acc Depreciation On Balance Sheet Profit And Loss Examples

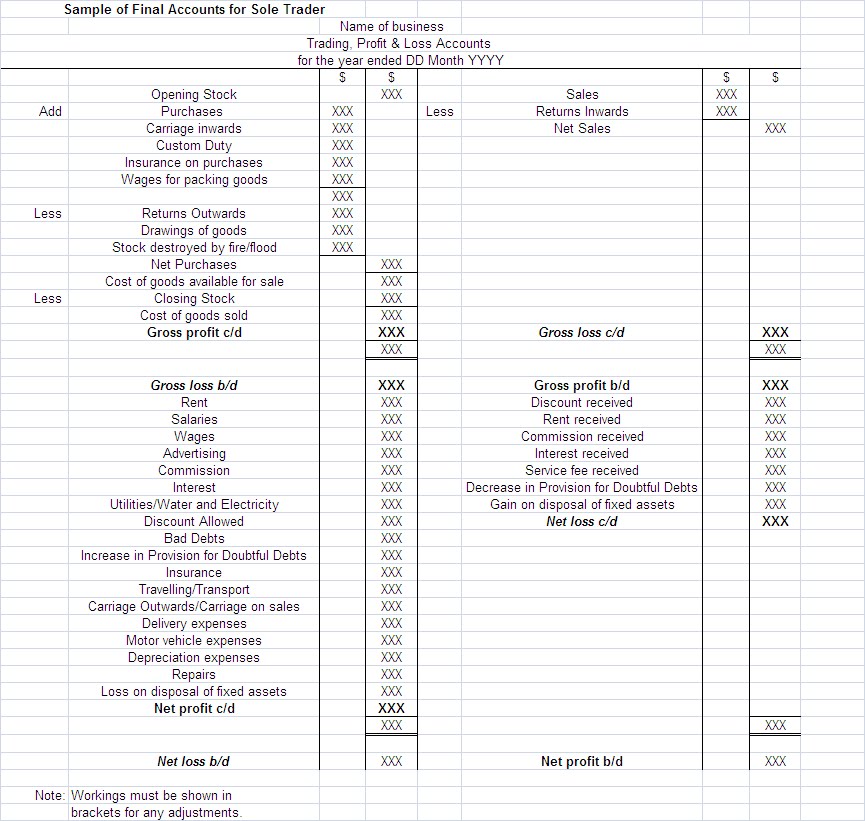

For income statements, depreciation is listed as an expense.

Acc depreciation on balance sheet profit and loss and balance sheet examples. Assets cash and cash equivalents. Fixed assets are to be depreciated by 10% of cost. You are required to calculate the depreciation and explain how they will be treated in trading, profit and loss account and balance sheet.

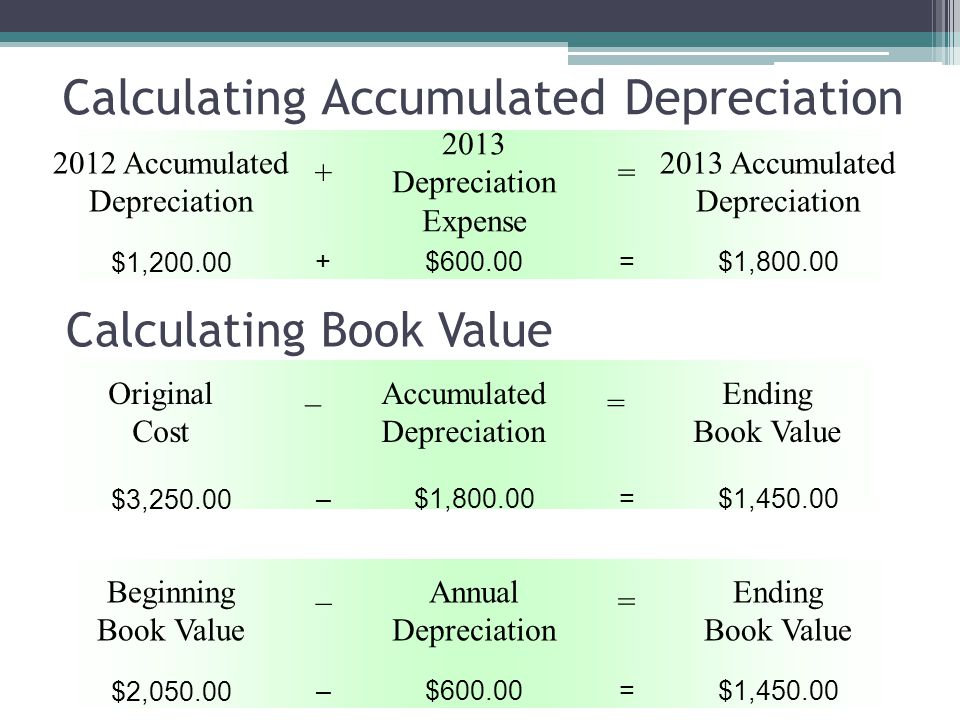

Depreciation is typically tracked one of two places: Accumulated depreciation formula after 3 rd year = acc depreciation at the start of year 3 + depreciation during year 3 = $40,000 + $20,000 = $60,000. The basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets).

Here's how to account for equipment depreciation on your p&l statement and balance sheet. So, investors should be wary of overstated life. Since the original cost of the asset is still shown on the balance sheet, it's easy to see what profit or loss has been recognized from the sale of that asset.

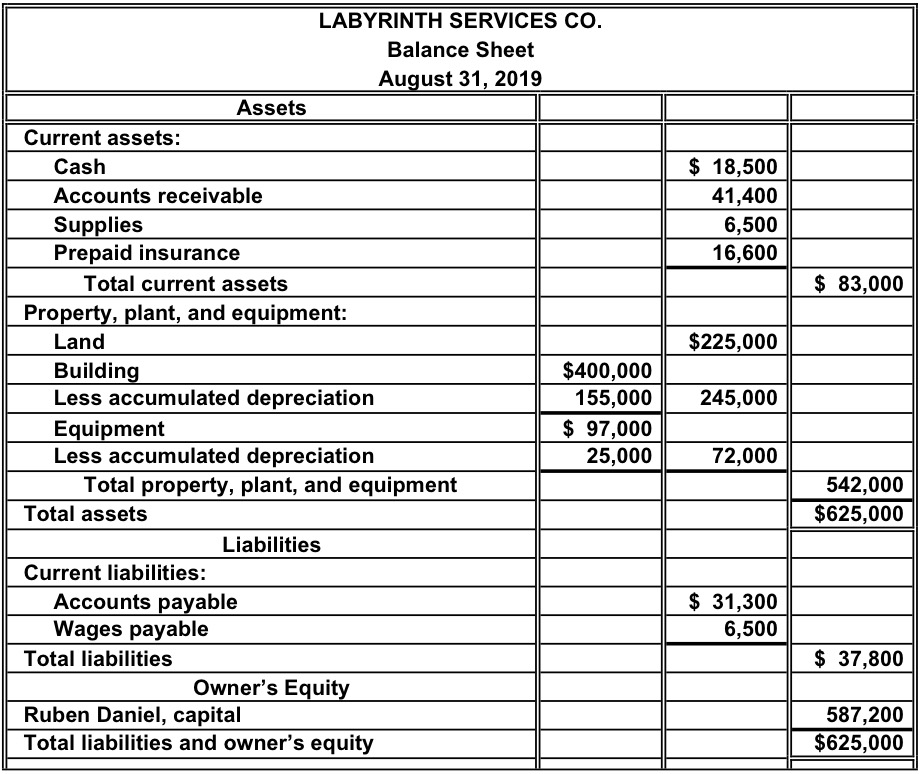

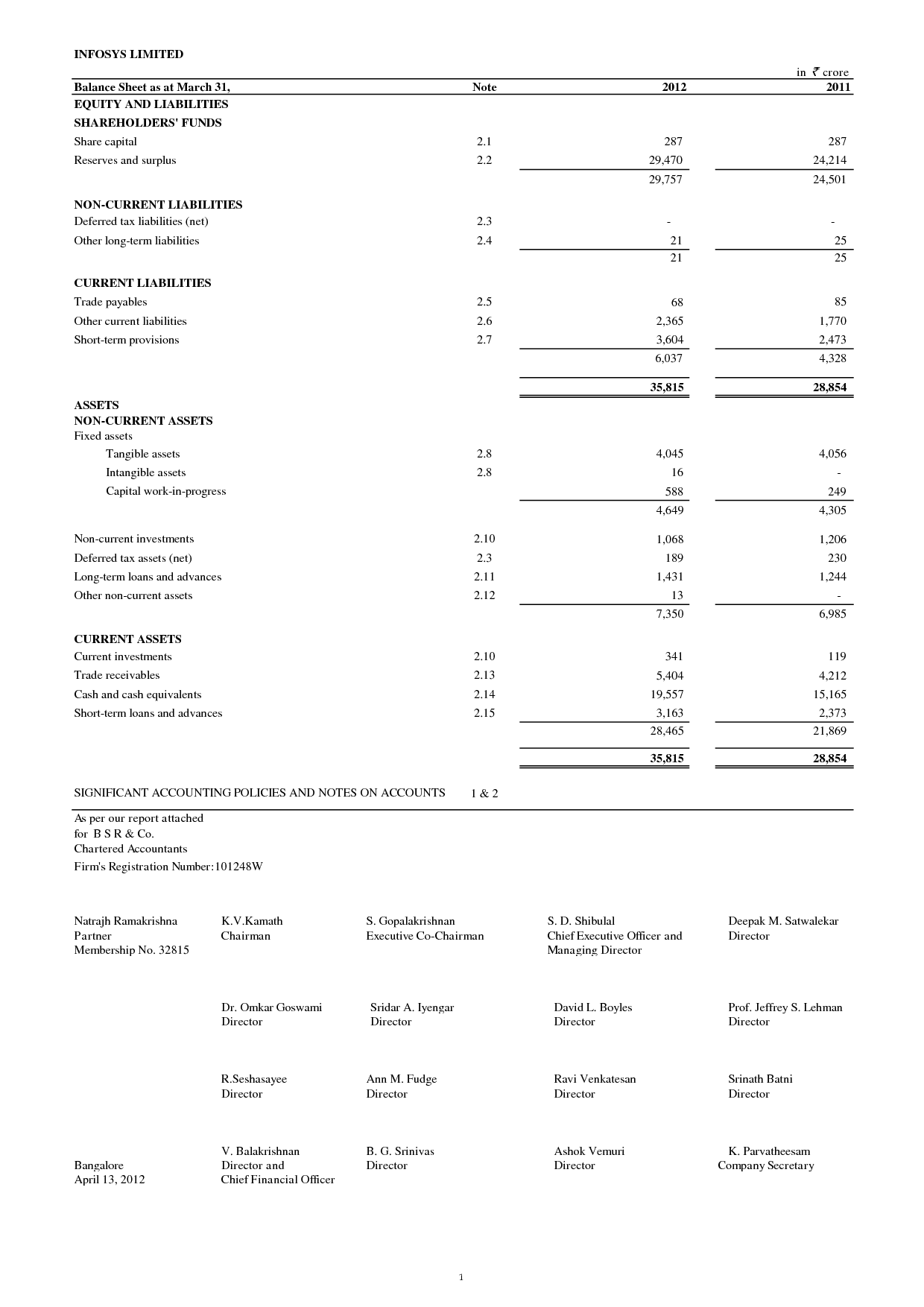

At the beginning of the accounting year 2018, the balance of the plant and machinery account was $7,000,000, and the balance of the accumulated depreciation account was $3,000,000. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and common stock. On the other hand, it reduces the assets side in the balance sheet.

Let us calculate the accumulated depreciation on the balance sheet at the end of the financial year ended december 31, 2018, based on the following information: This means that it must depreciate the machine at the rate of $1,000 per month. Solution verified by toppr depreciation is charged as expenditure in profit and loss account and the depreciation figure is deducted from the value of concerned assets in the assets side of the balance sheet.

Example of depreciation usage on the income statement and balance sheet a company acquires a machine that costs $60,000, and which has a useful life of five years. The equipment has a residual value of $20,000 and has an expected useful life of 8 years. Trading and profit and loss account a trading account is one that holds both stocks and cash.

It accounts for depreciation charged to expense for the income reporting period. Fua team together the profit and loss account and balance sheet describe the financial position of a business. You can find the net book value on the balance sheet by subtracting accumulated depreciation from the total asset cost.

The profit and loss account reports sales, expenditure and profit during a given period. The building is expected to be useful for 20 years with a. This figure appears on the balance sheet as a deduction from the total cost of the asset.

The balance sheet shows what the business has and what the business owes on a particular date. Accumulated depreciation is the total amount of depreciation applied to an asset throughout its existence. When you sell an asset, the book value of the asset and the accumulated depreciation for that asset are both removed from the balance sheet.

As fixed assets age, they begin to lose their value. On december 31, 2017, what is the balance of the accumulated depreciation account? Depreciation and accumulated depreciation example tracking the depreciation expense of an asset is important for reporting purposes because it spreads the cost of the asset over the time.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)