Fun Tips About Does Opening Stock Appear In Trial Balance

The closing stock is shown in the trial balance when it is adjusted against purchases.

Does opening stock appear in trial balance. Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance. So, it should be shown in. If the value of closing stock is not available (or is not recorded) by the time of making up the trial balance at the end of the accounting period, it would appear as a part of the.

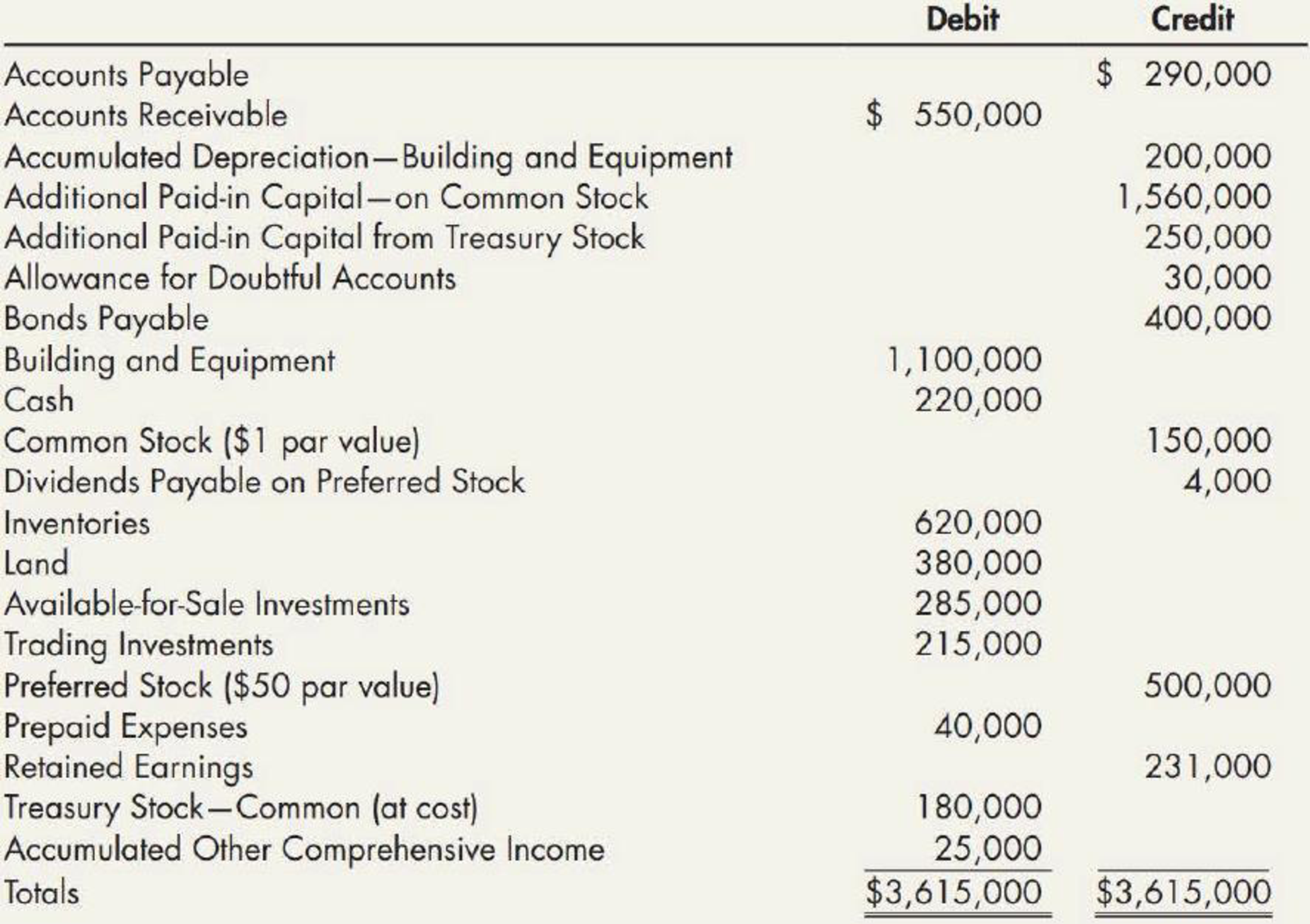

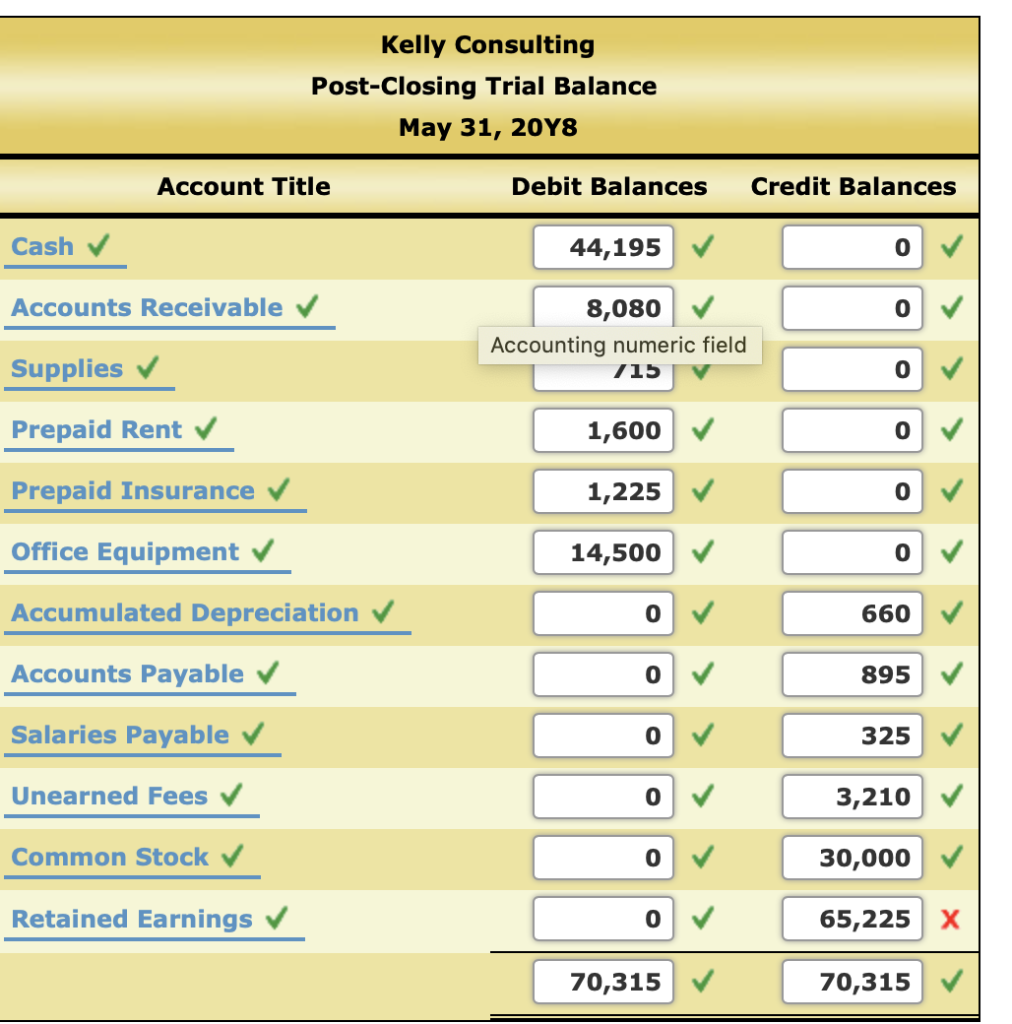

Trial balance has two stages: The accounts reflected on a trial balance are related. Opening stock would appear on the debit side of the trial balance.this opening stock is the previous years closing stock.

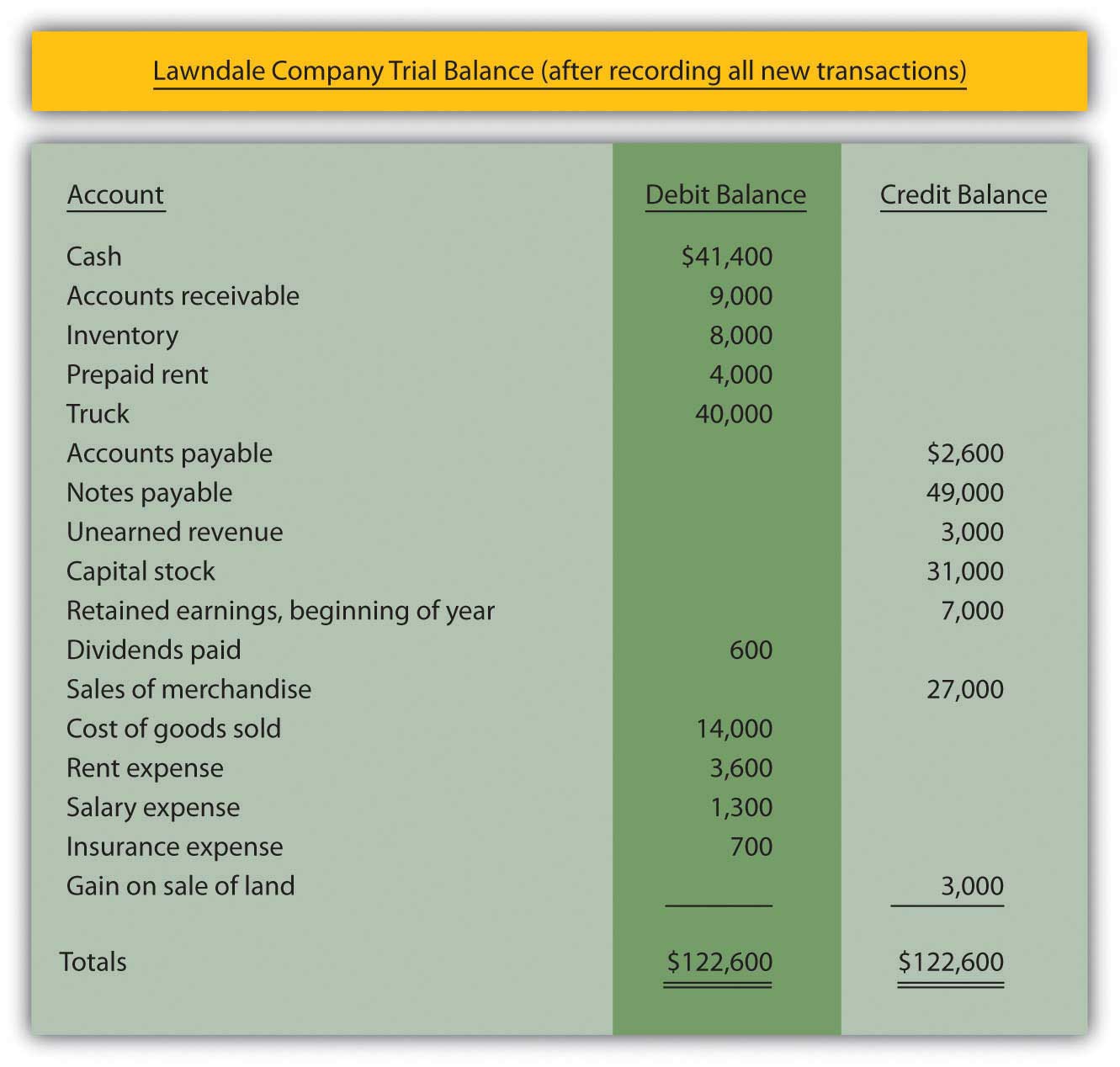

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Does opening stock appear on trial balance?

Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period. Yes opening stock appear inthe trial balacne trail balance is the blance of all the balance at the given point of time & the value of the opening stock is put in the. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

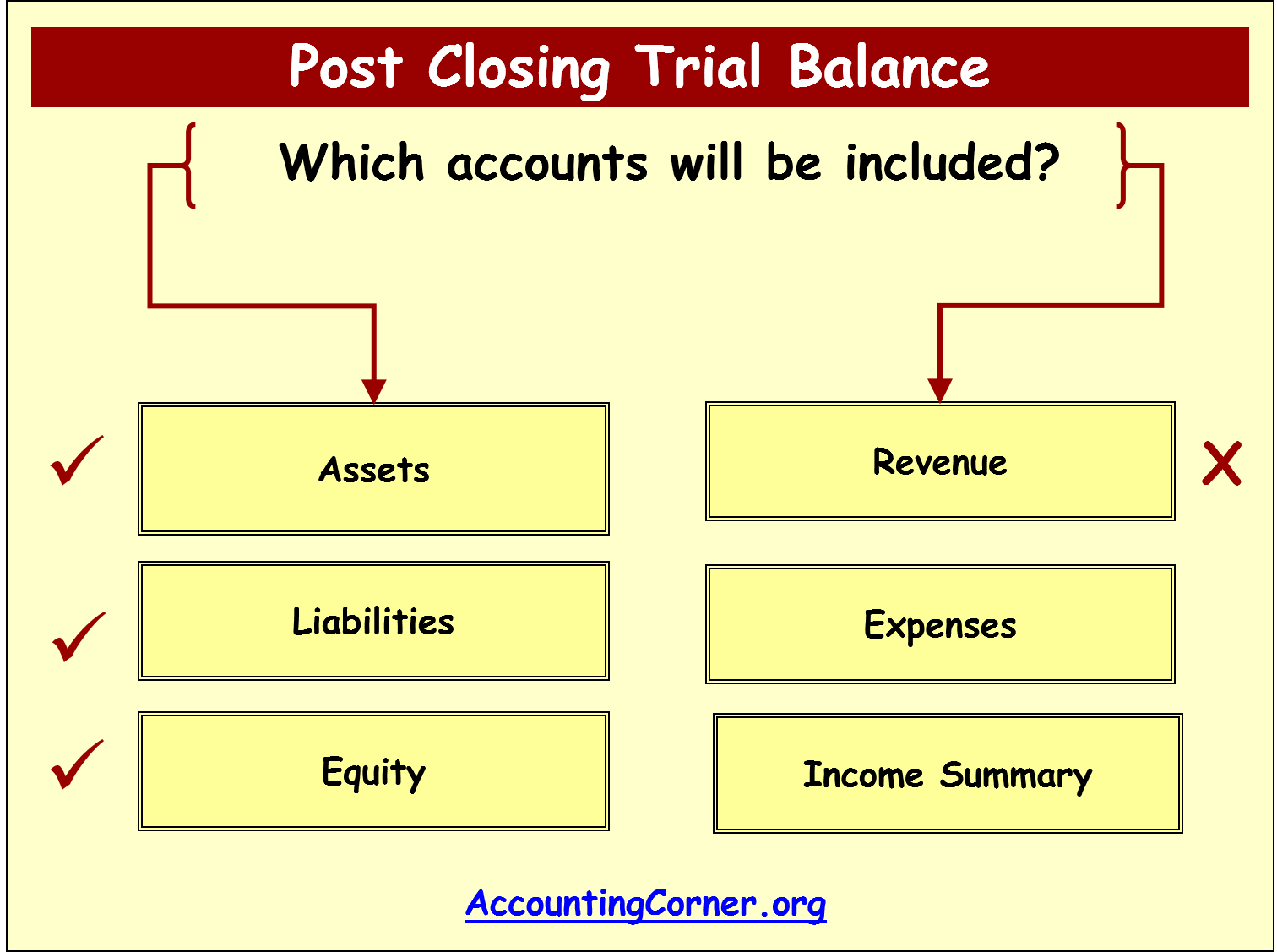

If it is included, the effect will be. Identify which financial statement each account will go on:. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Uncommon, but possible scenario where the closing stock is shown in the trial balance, it is only possible when the closing stock is already adjusted against purchases. Before closing entries, we make a trial summary of ledger. Closing stock is the leftover balance out of goods which were purchased during an accounting period.

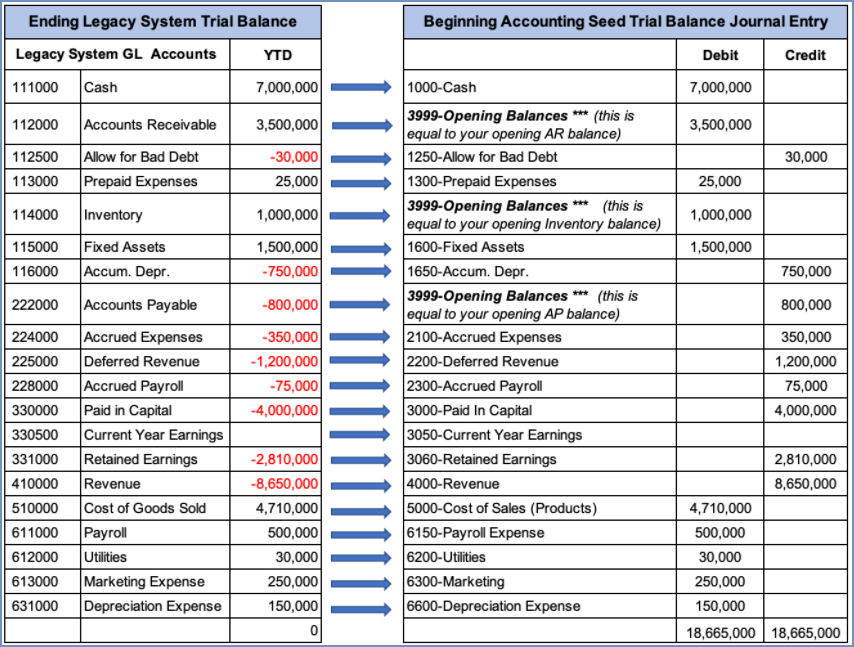

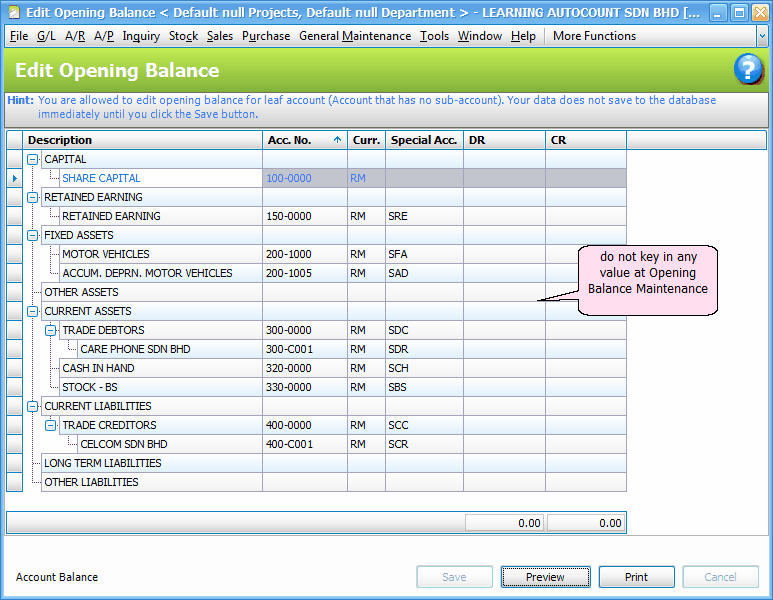

For instance, y ou might want the opening balance of this financial year to appear in the trial balance report, so that you can tally it with the c losing balance of the previous. This statement comprises two columns:. Total purchases are already included in the trial balance, hence closing stock should not be included in the trial balance again.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Ashish gupta ( student) (1922. Sometimes, adjusted purchases are given in the trial balance which indicates that the opening as well the closing stock have been adjusted through purchases.

If closing stock does appears in the trial balance, it means the purchases has been reduced to the extent of stock amount at the end of the period. The opening stock (last year’s unsold purchases) will appear on the opening trial balance on the debit side and will be classified as current assets.