Perfect Tips About Treatment Of Bad Debts In Profit And Loss Account

Bad debt expense is used to reflect receivables that a company will be unable to collect.

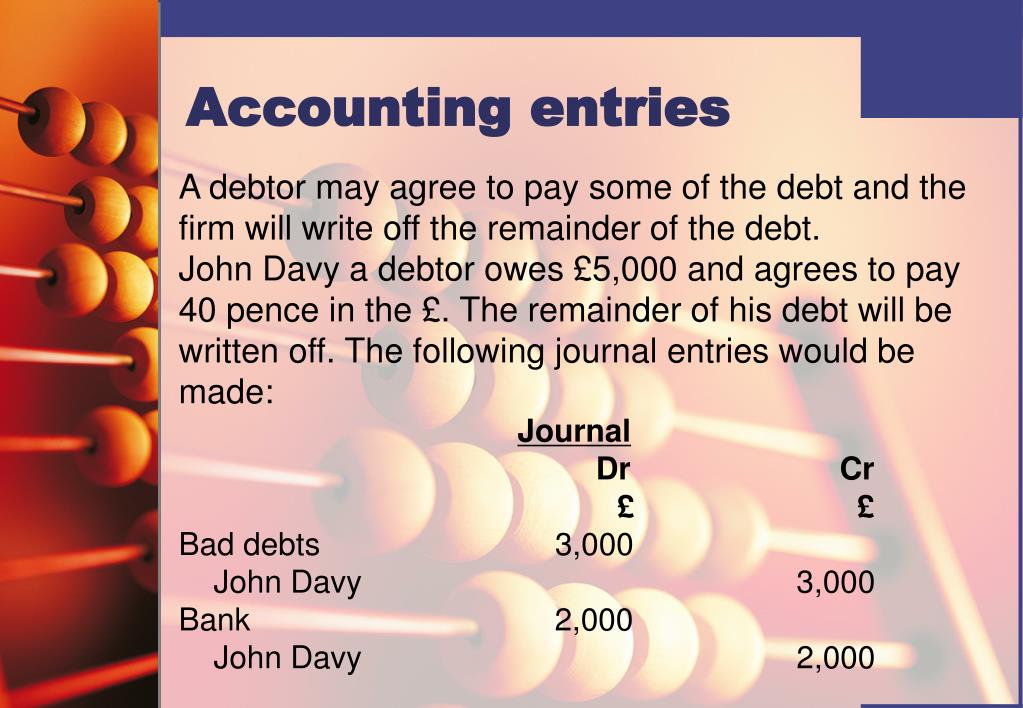

Treatment of bad debts in profit and loss account. To the debtor’s (by name) account. But in this case all assume according to past records of. At any rate, in balance sheets which they prepare some will show items as assets which.

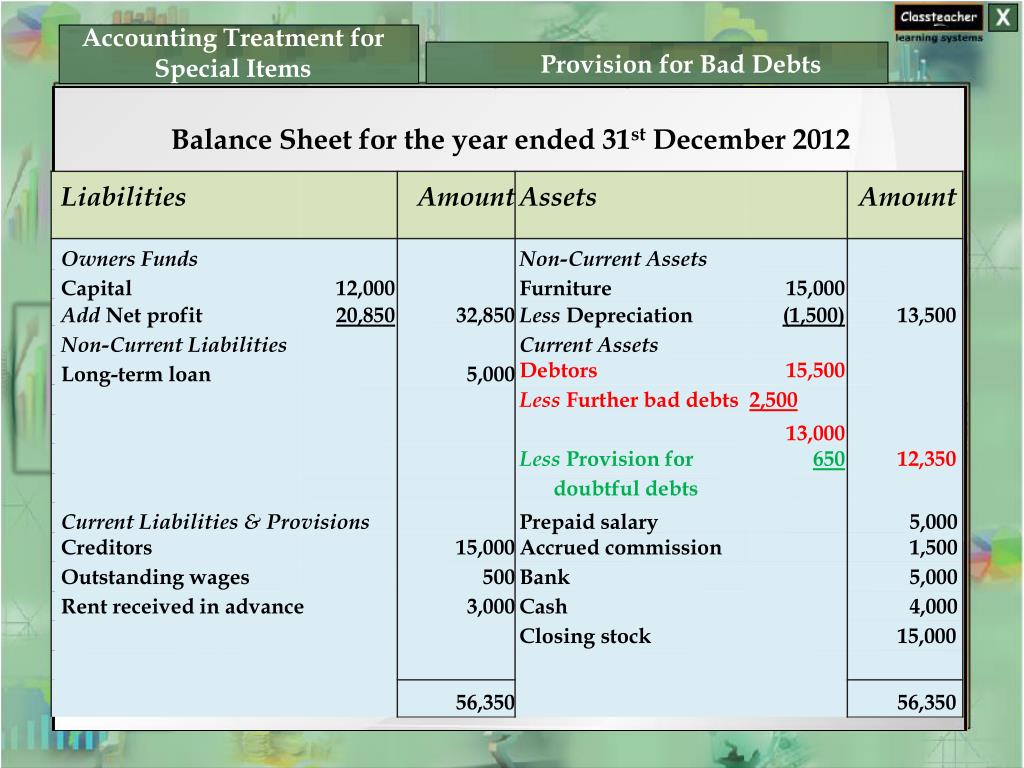

To reduce a provision, which is a credit, we enter a debit. However, david still wants to maintain a provision for. Death where a debtor dies and leaves no assets or insufficient assets to cover the debt, it is considered a bad debt.

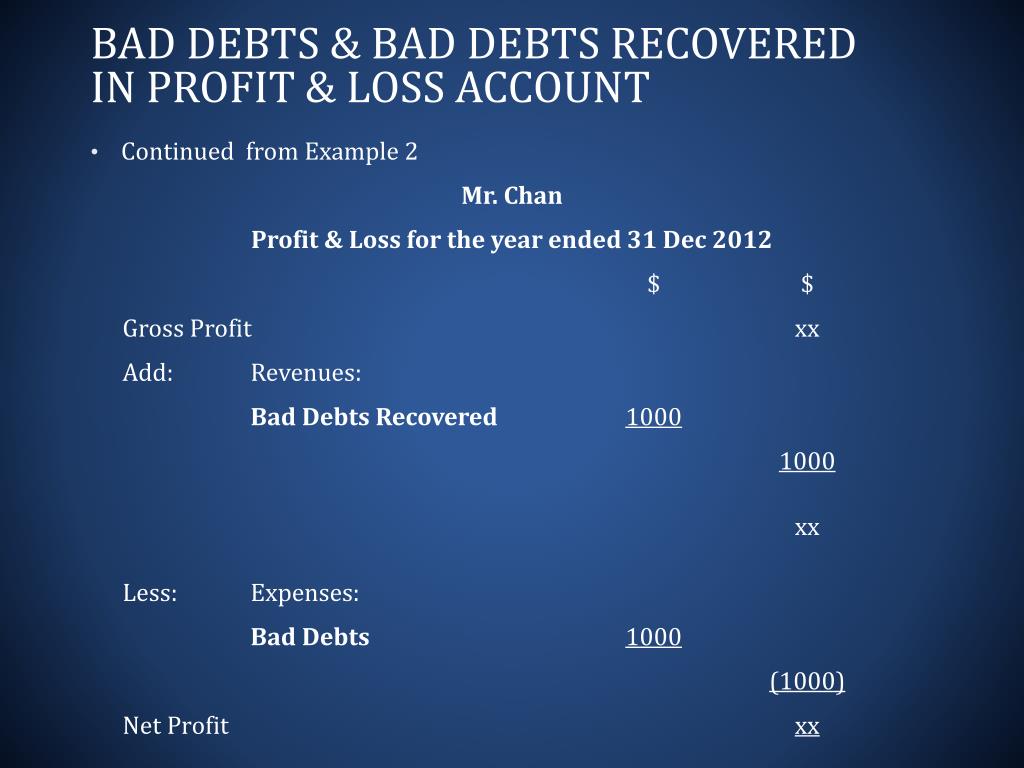

The credit balance on the account is then transferred to the statement of profit or loss (added to gross profit or included as a negative in the list of expenses). The other side would be a credit, which would go to the bad debt provision expense account. Disappearance in some cases, the debtor absconds and.

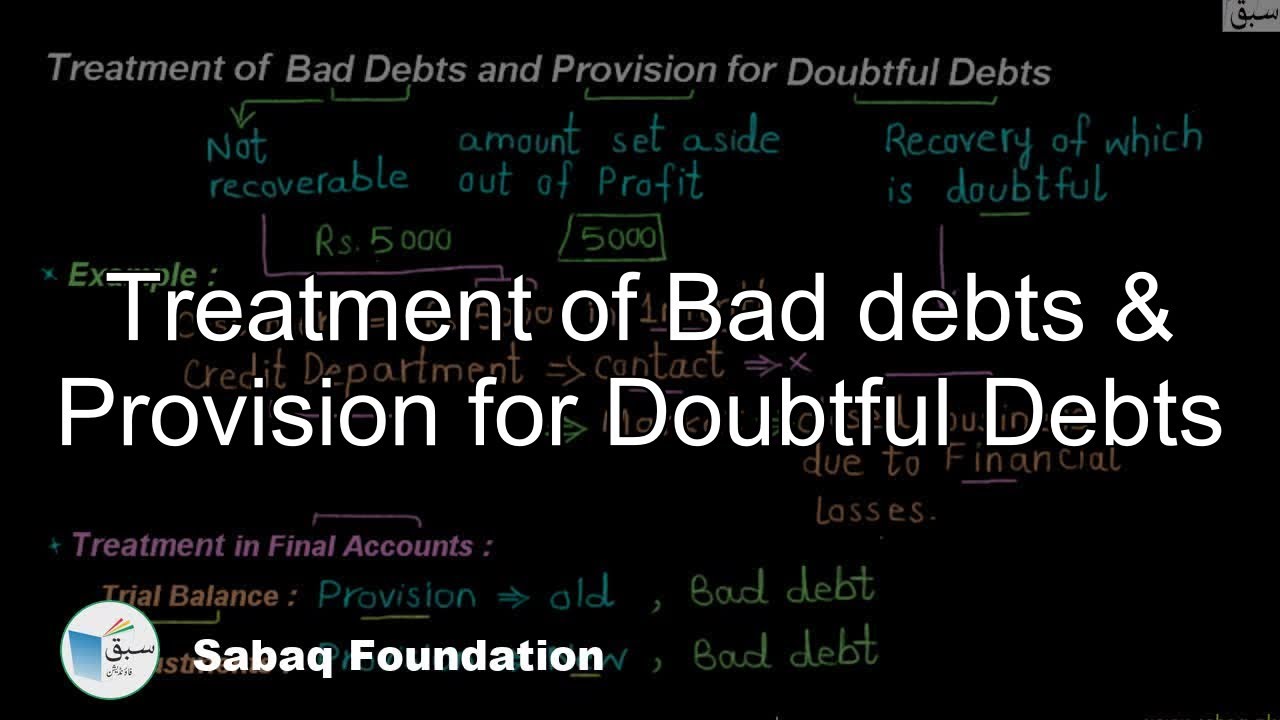

But the accountant is unsure when or how much the loss/expenses may occur. Bad debt expense. Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write.

It is also known as an. Prepare the bad debts account, provision for bad debts account, profit and loss account and balance sheet from the following information as on december 31,2011.rs. Provision for discount on debtors = 28,500 x 3/100 = $855;.

A provision for bad debts is the different from the bad debts where the loss or expenses is certain. Bad debts are the debts which are uncollectable or irrecoverable. At the end of each subsequent financial year, the.

If you started with zero allowance for bad debt on the balance sheet and you recorded $500. If provision for bad & doubtful debts is given outside the trial balance: And it will be shown.

Bad debt recovery refers to a payment received for a debt that had previously been written off and considered. Somer anderson fact checked by kirsten rohrs schmitt what is bad debt? In case if bad debts are recovered, so it is again.

An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be uncollectible. Thomas brock what is bad debt recovery? Now it is not credited to the party’s account but should be credited to bad debts recovered account.

The following treatment takes place for provision for bad and doubtful debts: Bad debt is an amount of money that a creditor must write off if a borrower defaults on. Provisions for bad debts account, with the amount of anticipated bad debts;

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)