Amazing Tips About Agoda Financial Statement Tax Deferred Income Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

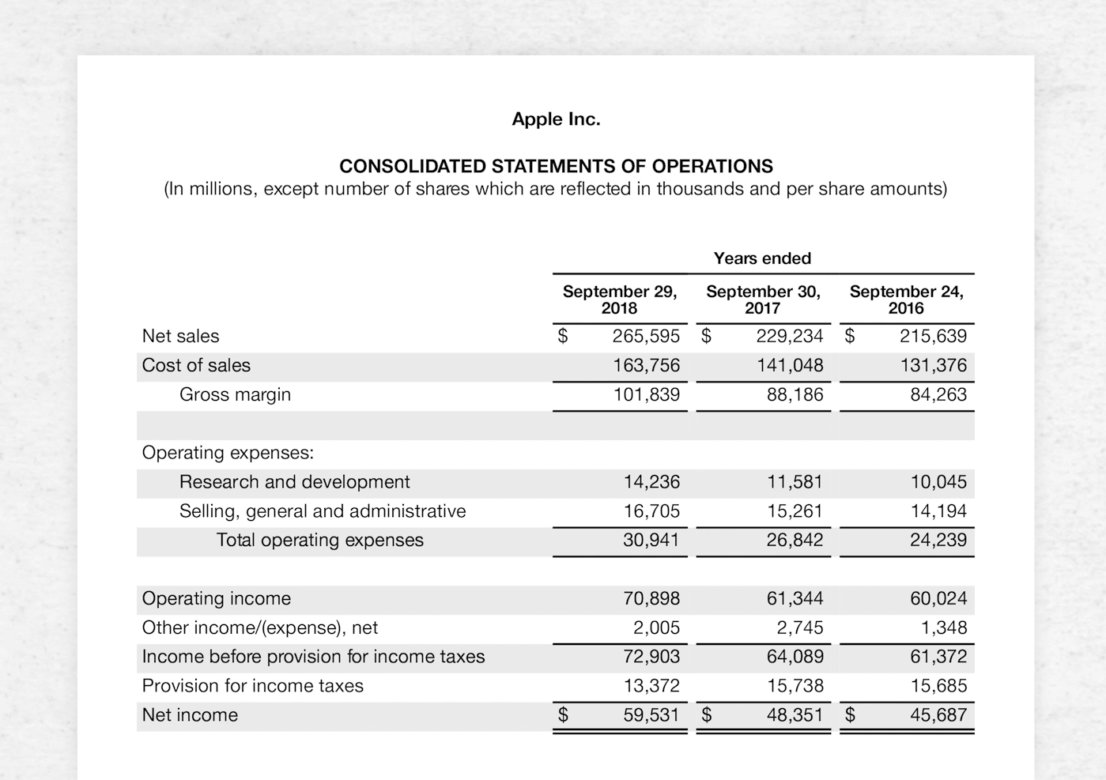

The closing figures are reported in the statement of financial.

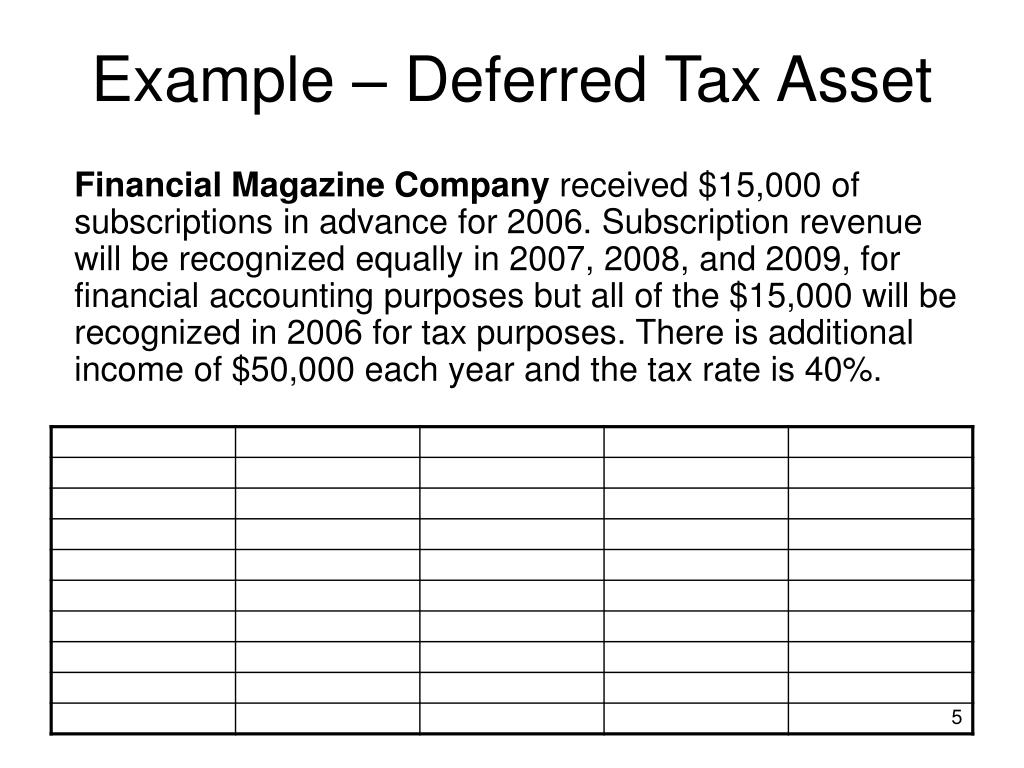

Agoda financial statement tax deferred income examples. You can check the tax settings of your property by: We explain and go through an example of. Examples include advance premiums received by the insurance companies for prepaid insurance policies, etc.

Depreciation the most notable creation of a deferred tax liability is due to differences between how depreciation is calculated by an appropriate. Learn more about agoda's vision, values, and performance by browsing its annual. Commission amount you can also refer to the sample statement below:

Depreciation on plants, properties and equipment 2. Deferred tax liability example: The movements in the liability are recorded in the statement of profit or loss as part of the income tax charge.

(i) the amount of the deferred tax assets and liabilities recognised in the statement of financial position for each period presented; Thus, the company reports it as deferred revenue, a liability. A deferred tax asset represents potential future tax benefits resulting from temporary differences that will likely lead to lower taxable income in the future.

What action is required from you upon receiving commercial statements from agoda? Amount exclusive of gst (good and services tax)/vat (value added tax) gst/vat. Top 4 examples of deferred revenue.

Illustration of the purpose of deferred tax. Elimination of unrealised losses from intragroup transactions in consolidated financial statements. Conceptually, deferred taxes are a result of differences in tax profit and accounting profit under the income statement approach, or of differences in the tax.

Go to settings then click tax. Below is an example scenario in which a deferred tax liability is created. Deferred taxes example.

In certain circumstances, however, the change in deferred tax balances is reflected in other accounts. Tax is automatically set up based on the location of your property. Company buys a $30 piece of equipment (pp&e).

Unabsorbed depreciation or carry forward losses as per tax laws 3. (a) deferred income tax assets the group recognises deferred income tax assets on carried forward tax losses to the extent there are sufficient estimated future taxable. Use of these sample disclosures management’s discussion and analysis — general md&a — results of operations md&a — critical accounting estimates md&a —.

(ii) the amount of the. An example of substantial positive evidence is an existing noncancelable sales contract that will generate future taxable capital gain income.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)