Brilliant Strategies Of Tips About Balance Sheet Ratios For Banks

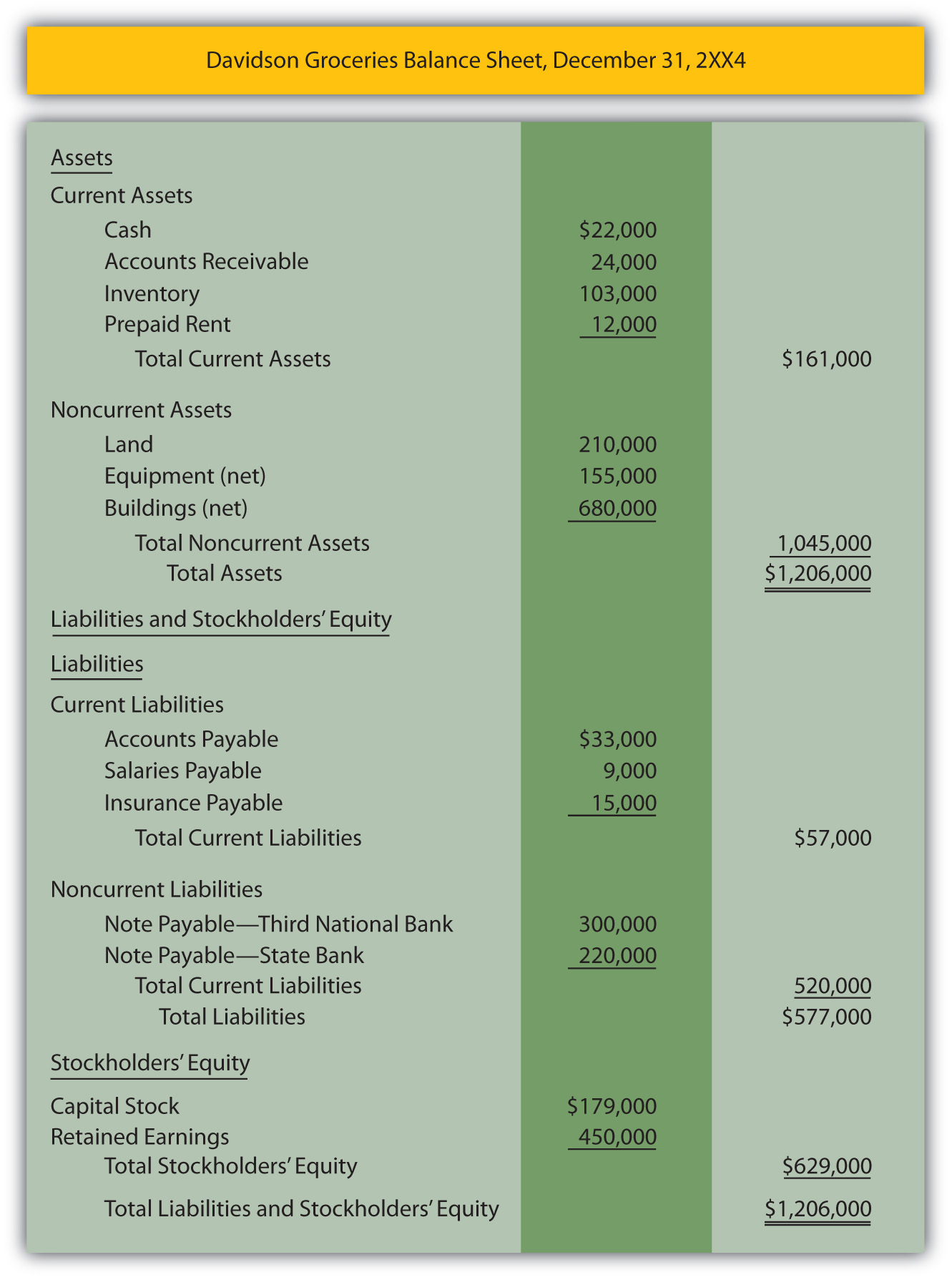

Quick assets = $140,000 + 250,000 + 300,000 =.

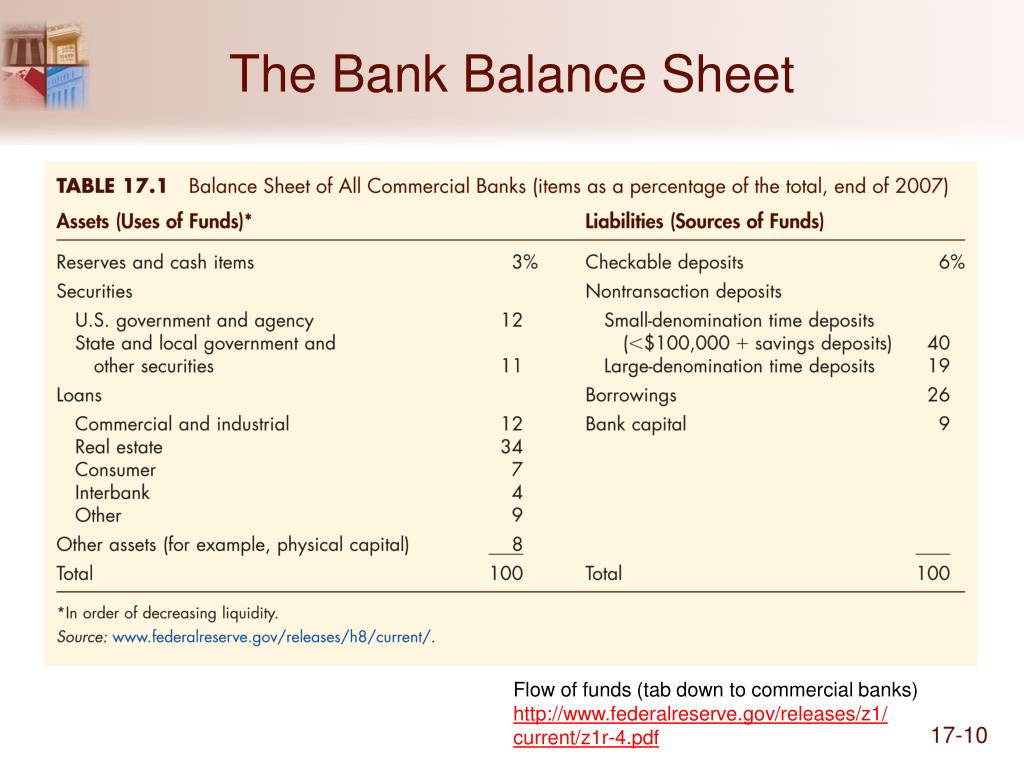

Balance sheet ratios for banks. Calculate the quick ratio from the balance sheet shown below. Financial ratios definitive guide. On the bank’s balance sheet, your money is a liability because the bank has to give it to you upon request.

The higher the ratio the better for most banking institutions. To calculate your debt to asset ratio, look at your balance sheet and divide your total liabilities by your total assets. However, banks still grapple with two issues in.

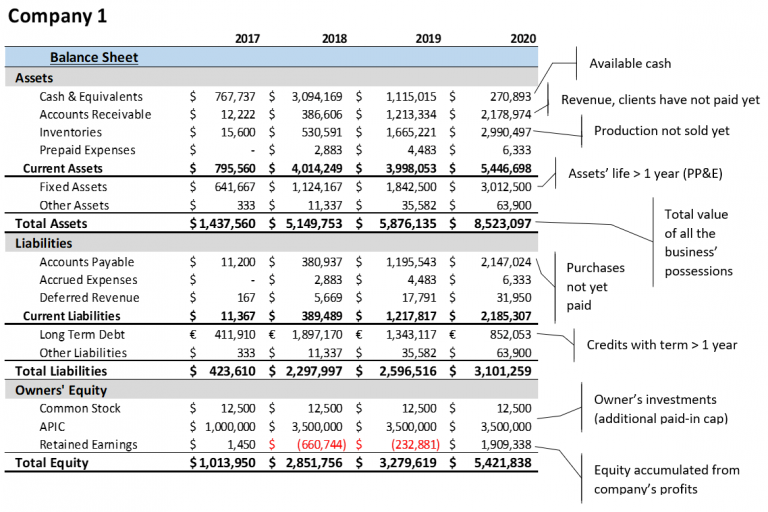

This margin is the derivative of activity from using funds from spending units that are capable of. A bank's balance sheet presents financial information that compares what a bank owns with what it owes and the ownership interest of stockholders. If you are seeking to step up your finances with the help of your balance sheets, calculating your balance sheet ratios could just be the perfect metric to track.

And competition measures such as the. Calculate balance sheet ratios with the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: During last spring’s banking crisis, when a competing lender went under, new york community bank pounced, acquiring a big chunk of its business.

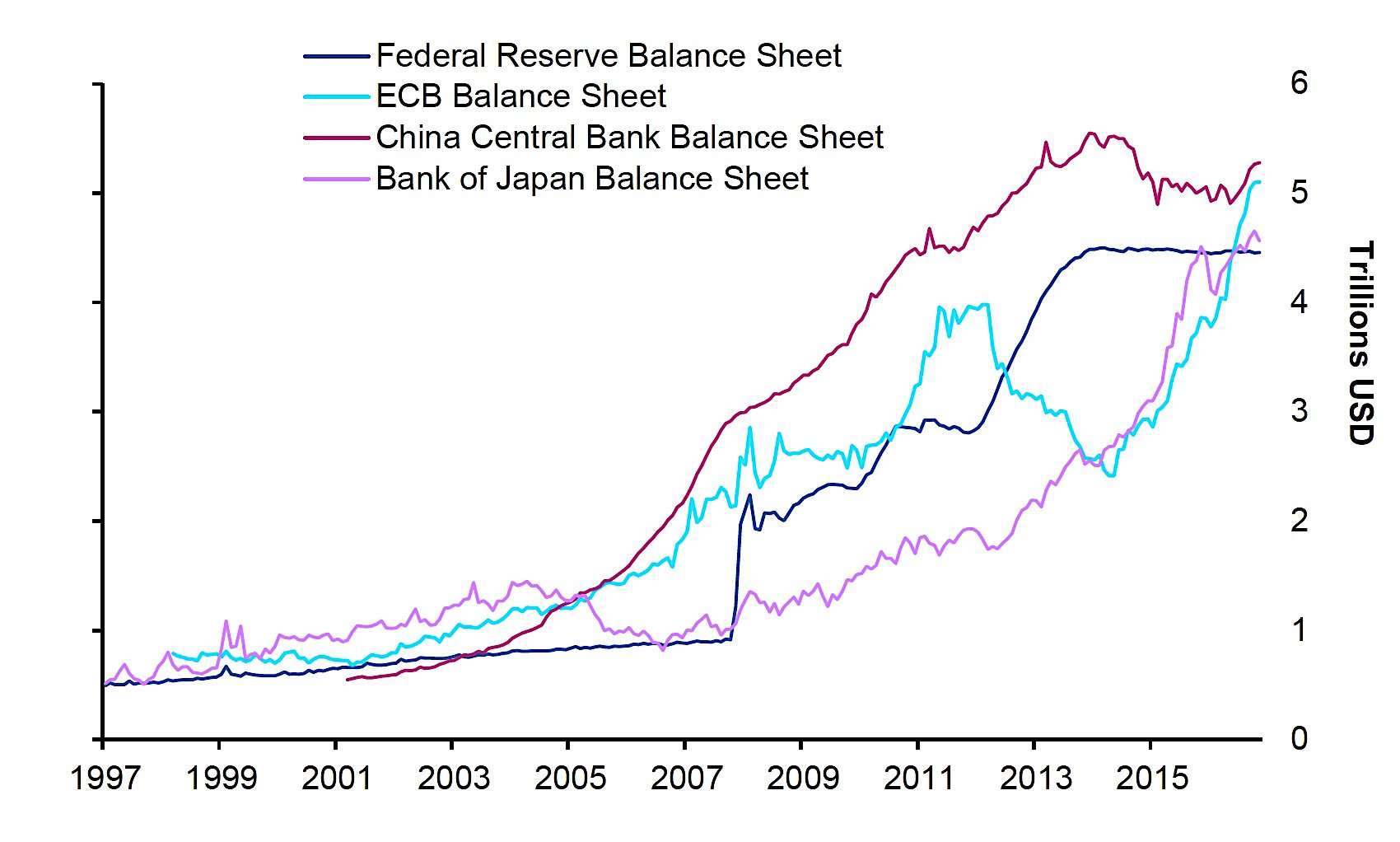

At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets. Using the inputs, the calculator will produce ratios that are important for the analysis of a bank’s balance sheet. In other words, it’s your money, not the bank’s, so it’s not.

How to calculate your debt to asset ratio. The rbi has set the minimum capital adequacy ratio at 9% for all banks. Two main aspects of central bank balance sheet financial ratios are particularly useful.

The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet. This template includes the following ratios: Most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends upon the business in which the company.

Chapter 7 financial ratios of the central bank balance sheet. A ratio below the minimum indicates that the bank is not adequately capitalized to expand. Say your business has $40,000 in total liabilities and $25,000 in total shareholder equity.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)