Underrated Ideas Of Info About Difference Between Direct And Indirect Method Of Cash Flow Statement

Direct cash flow statement.

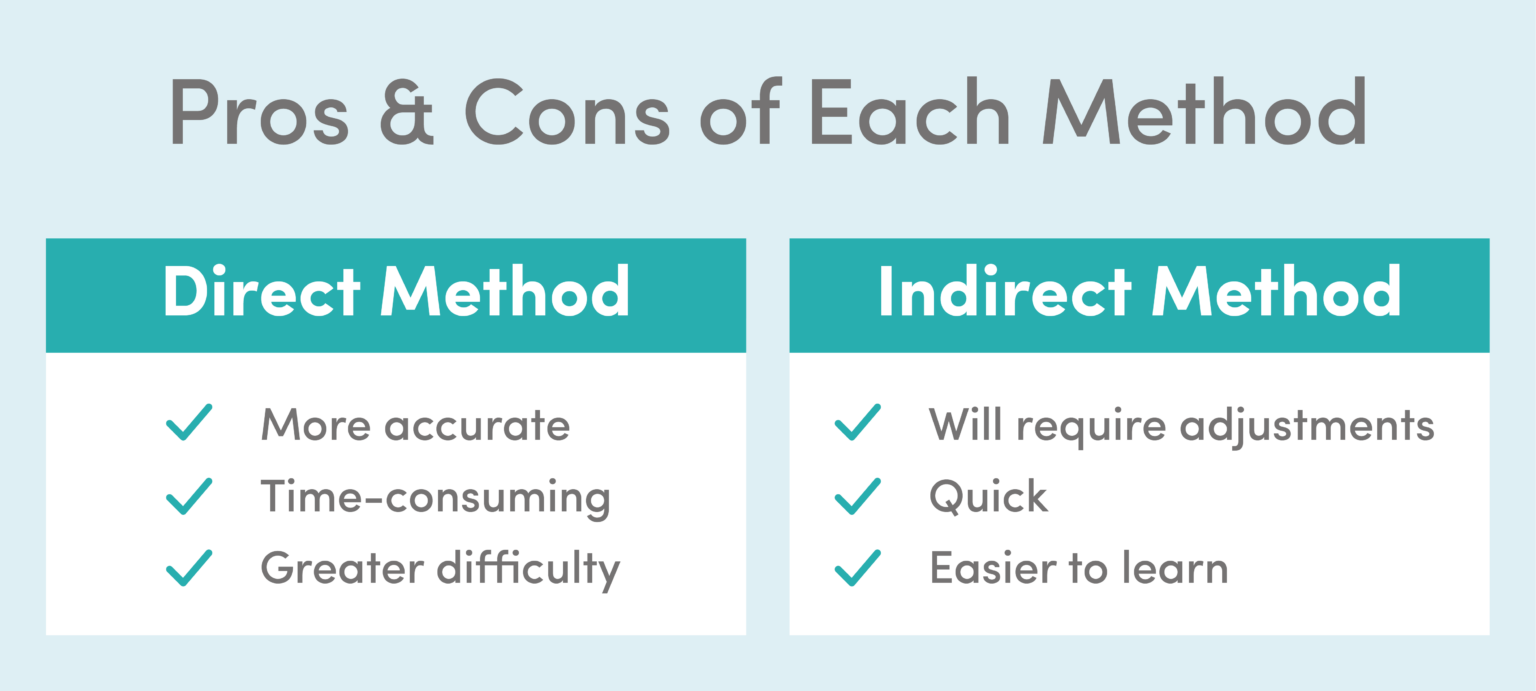

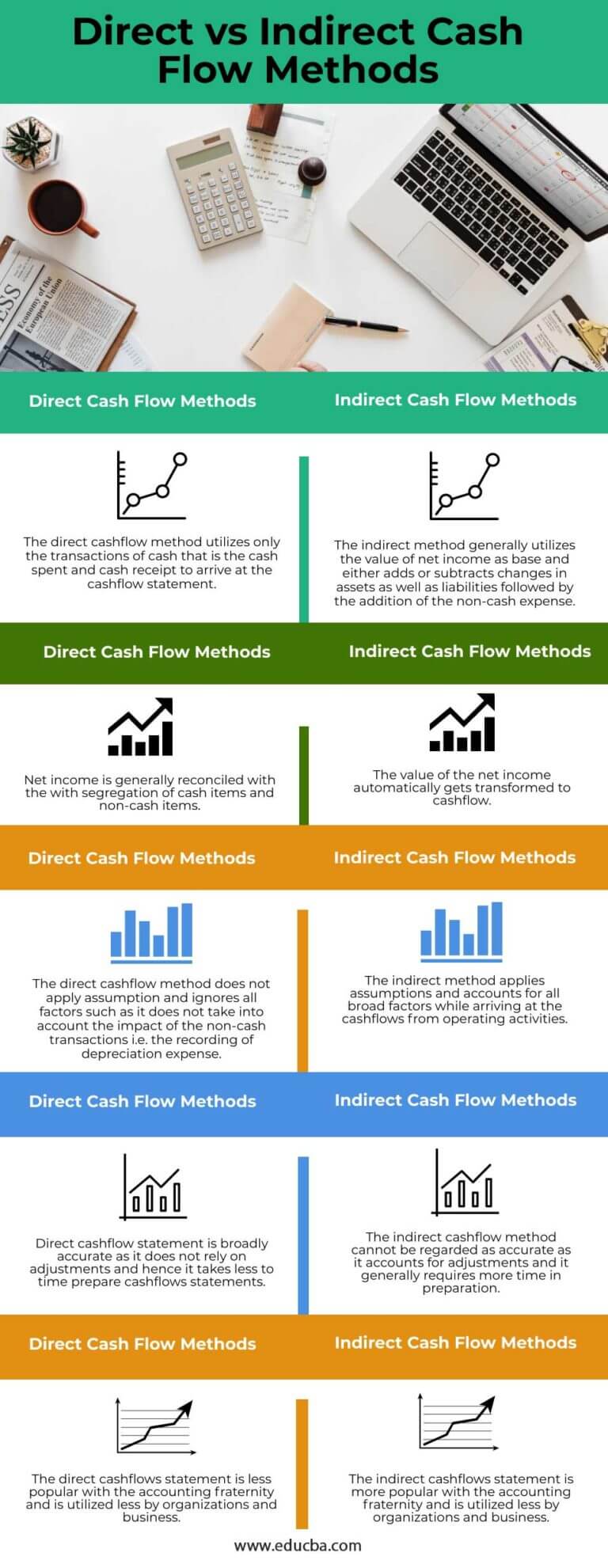

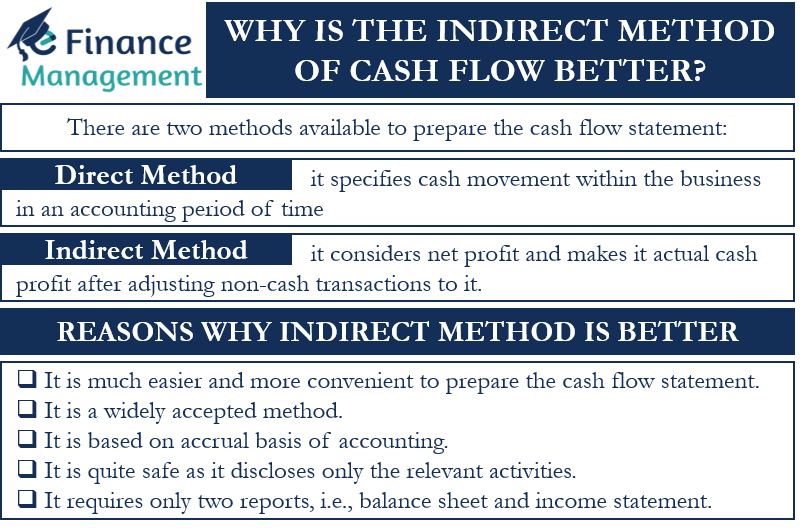

Difference between direct and indirect method of cash flow statement. One of the main reasons you might prefer the direct method over the indirect method for building cash flow statements is that it can provide better accuracy. This is not only difficult to create; When it comes to cash flows from operations, the standards allow us to choose between two distinct approaches.

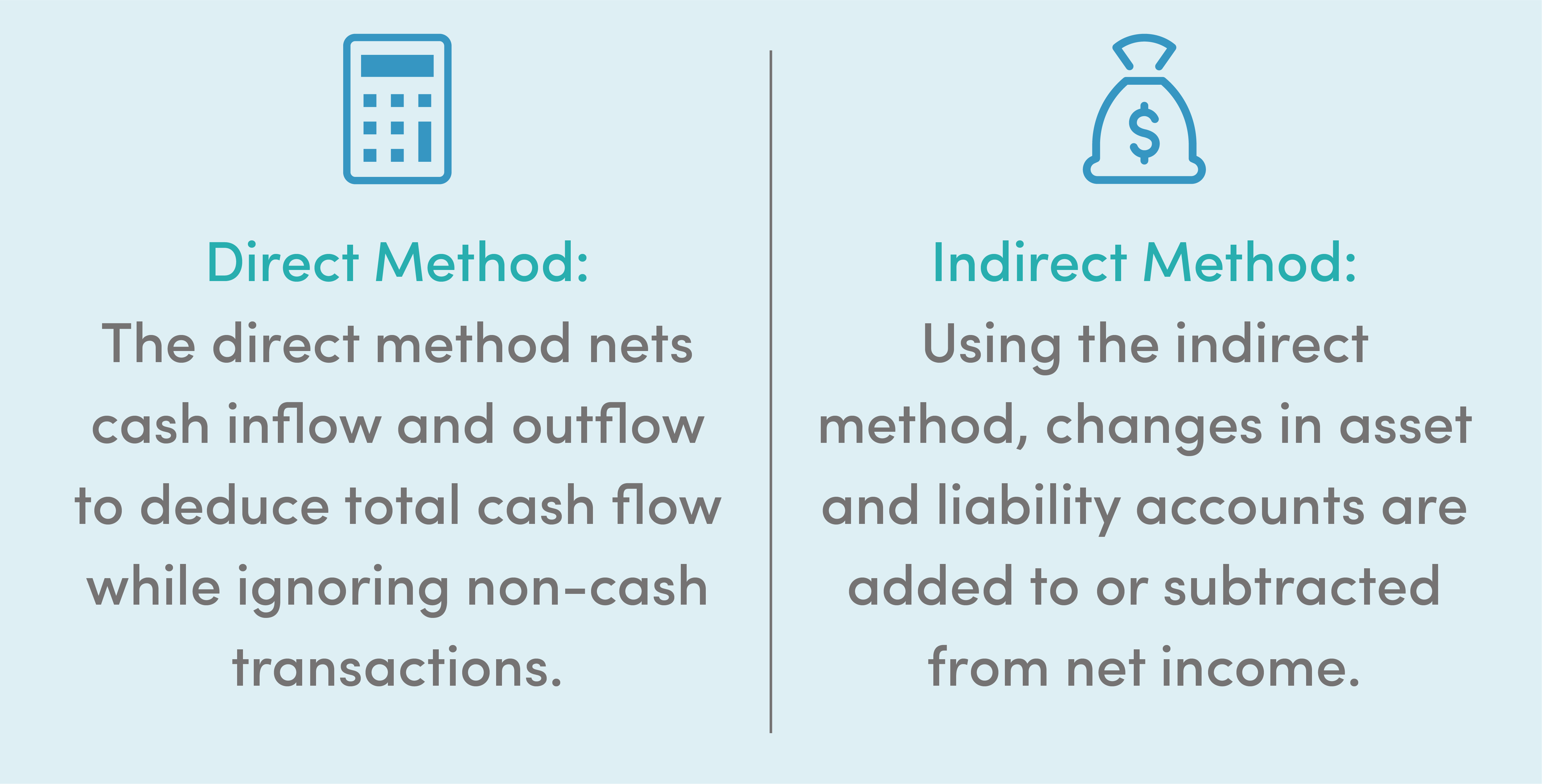

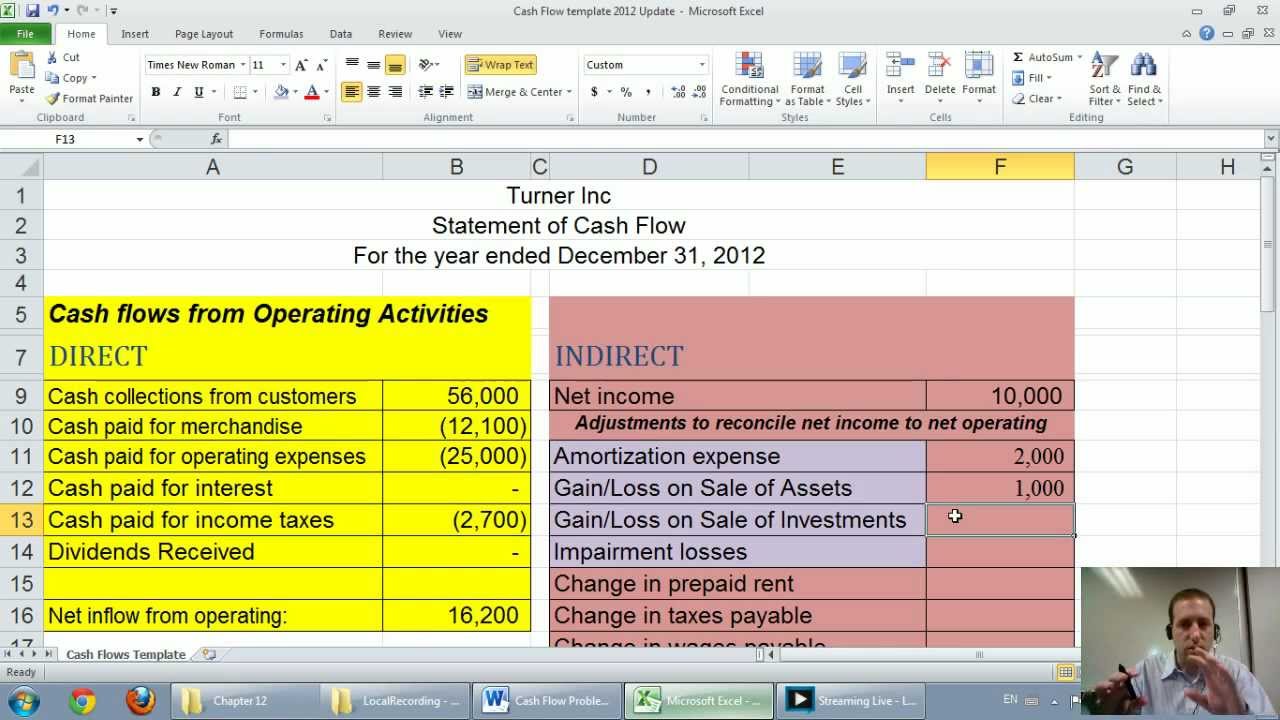

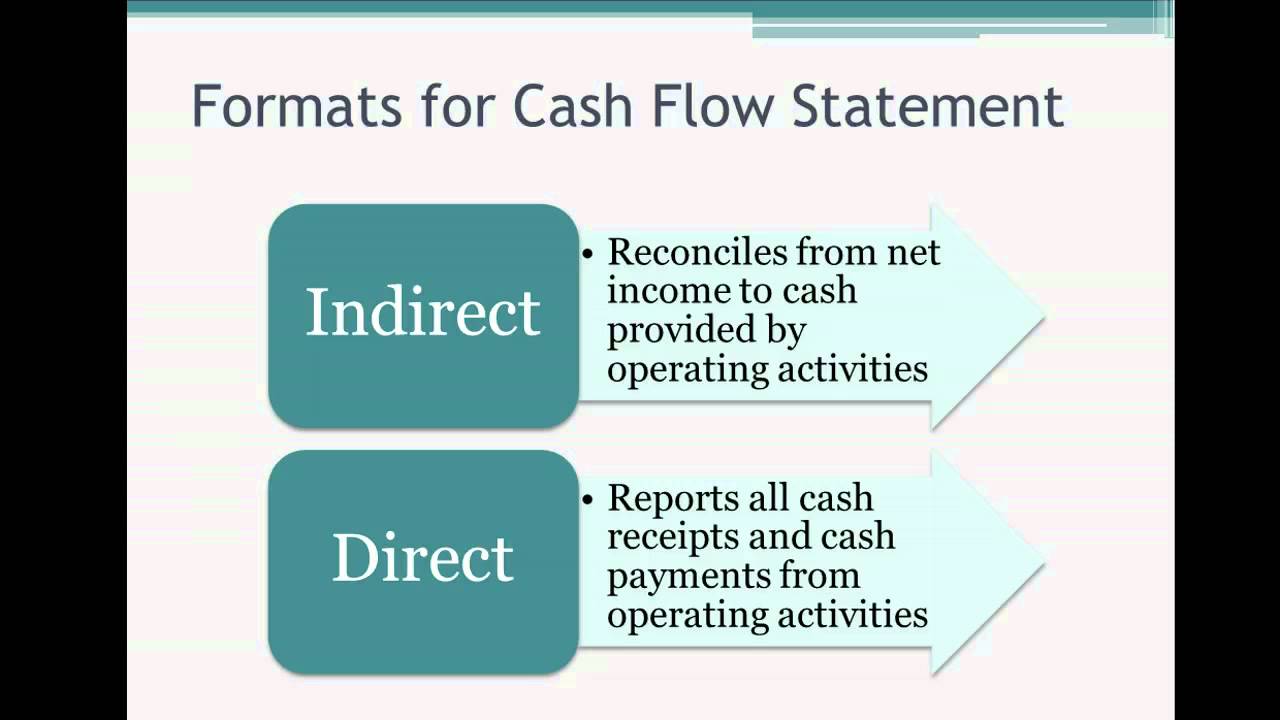

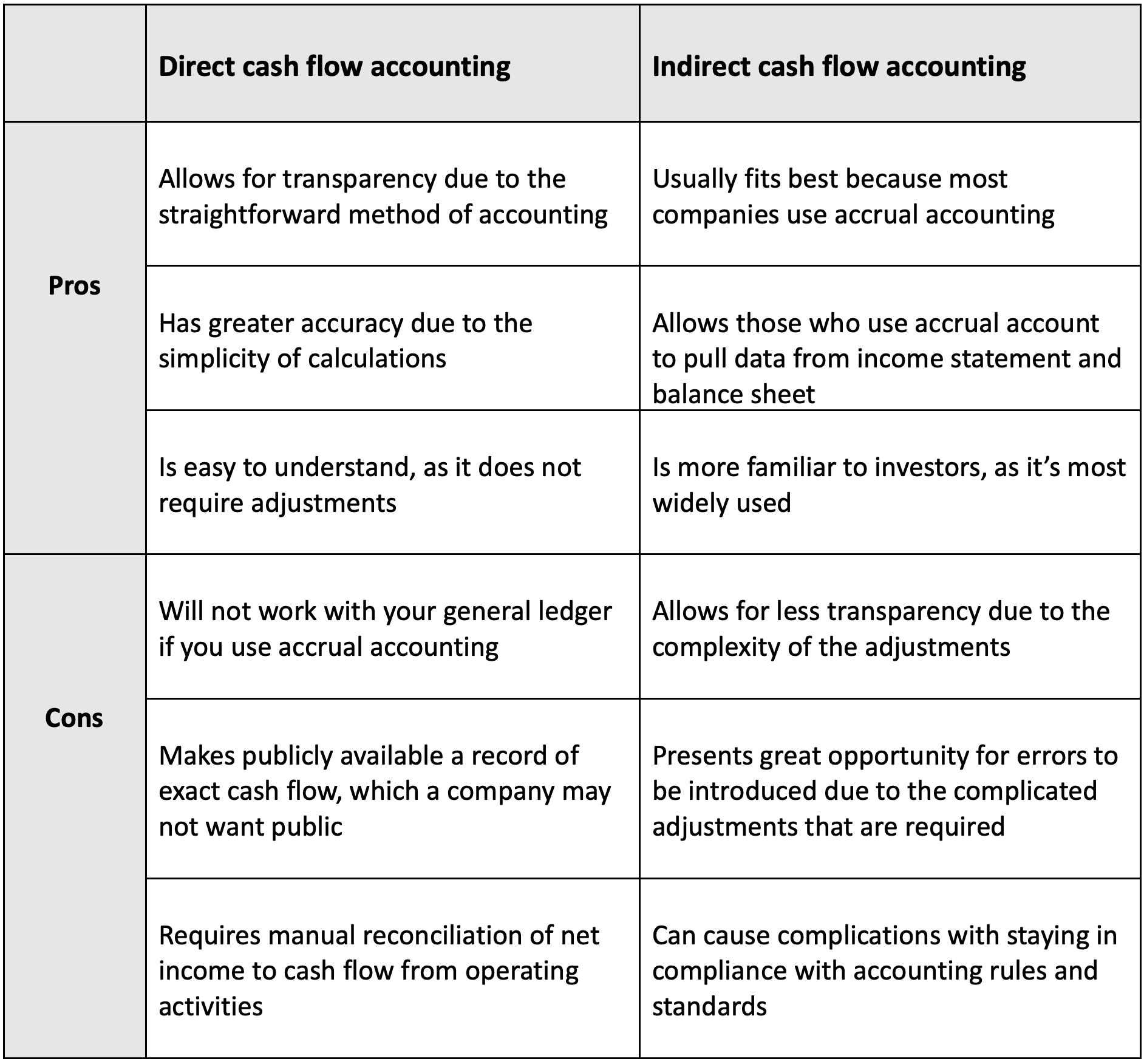

For both methods, the goal is to determine a company’s net cash flow. Direct and indirect cash flow methods use different techniques to report operating cash —the cash generated from your primary source of revenue. In reality, the only difference between direct and indirect cash flow resides in how the operating activities are calculated, as illustrated in this graphic.

The direct method and indirect method of preparation of cash flow statement differ in the way the cash flows from operating activities is calculated and presented. The statement of cash flows direct method uses actual cash inflows and outflows from the company's operations, instead of modifying the operating section from accrual accounting to a. When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this:

Since the method relies on the actual cash payments and receipts that occurred over the period, this method is highly accurate and exactly calculates the amount of cash that. As a result, you can. The direct method individually itemizes the cash received from your customers and paid out for supplies, staff, income tax, etc.

It also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate. In contrast, asset and liability changes in the indirect method are adjusted to net income to derive cash flow from. In the direct method of cash flow statement preparation, actual receipts from customers and actual payments to suppliers,.

Companies applying the direct method disclose major classes of gross cash receipts and cash payments. The primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring throughout the business in the direct method. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. The purpose of this is to identify changes in cash payments and company activity receipts.

Direct cash flow vs. The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later. The main way you can spot the difference between the direct method and indirect method is as follows:

Cash flow statement categories. Let’s explain it more thoroughly. This data will serve as a foundation for your forecast.

How to create an indirect cash flow forecast. Investment cash and financing cash are handled the same way in both methods. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows.