Heartwarming Tips About Adobe Income Statement Of Owners Equity Format

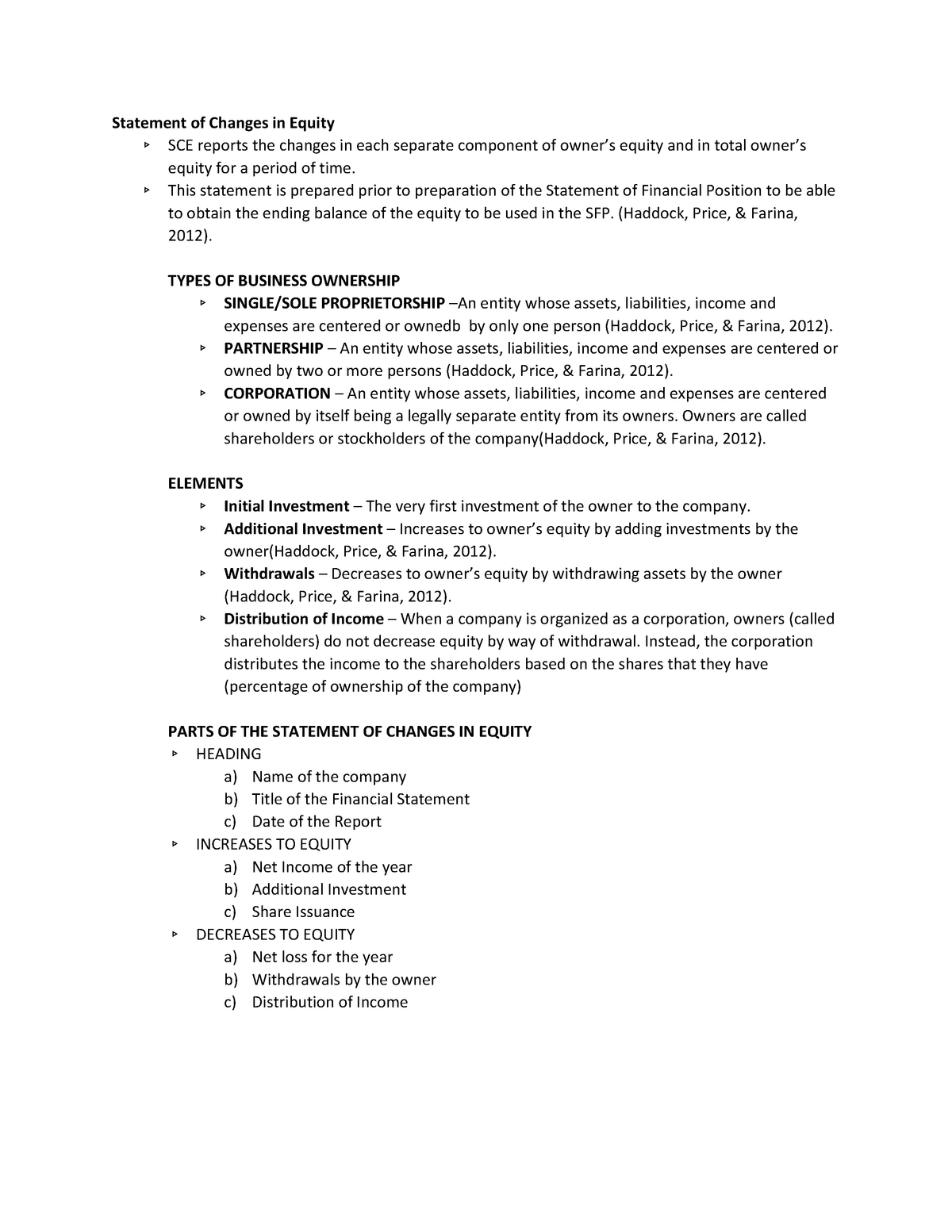

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses

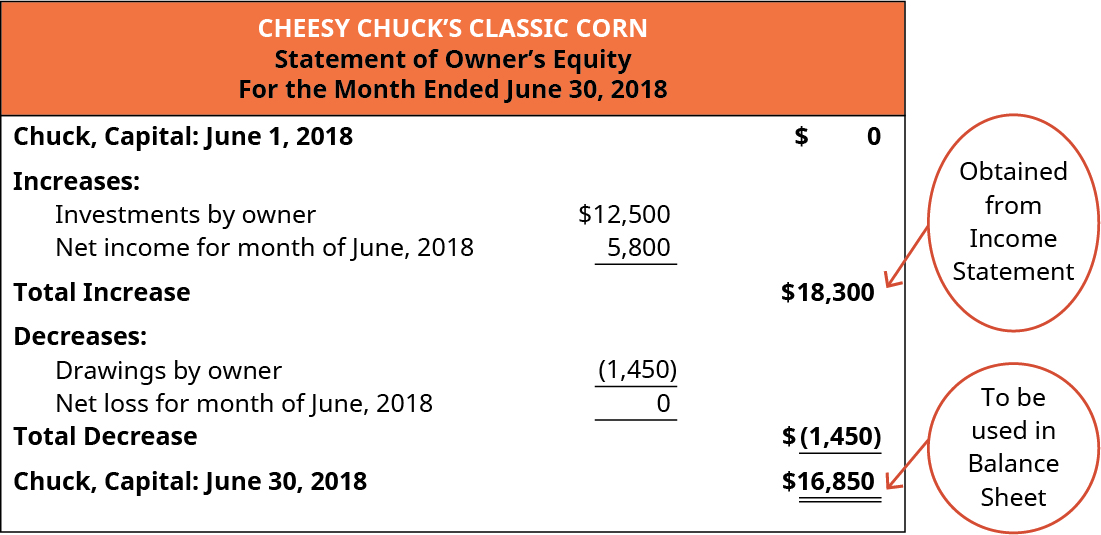

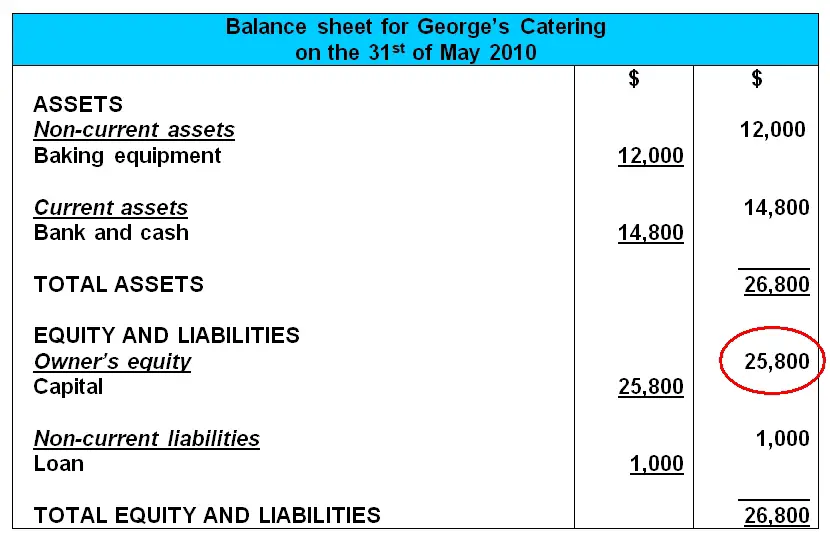

Adobe income statement statement of owners equity format. The balance sheet, however, lists the financial position at the close of business on a specific date. The statement of owner’s equity is a financial statement that reports changes in equity from net income (loss), from owner investment and withdrawals over a period of time.

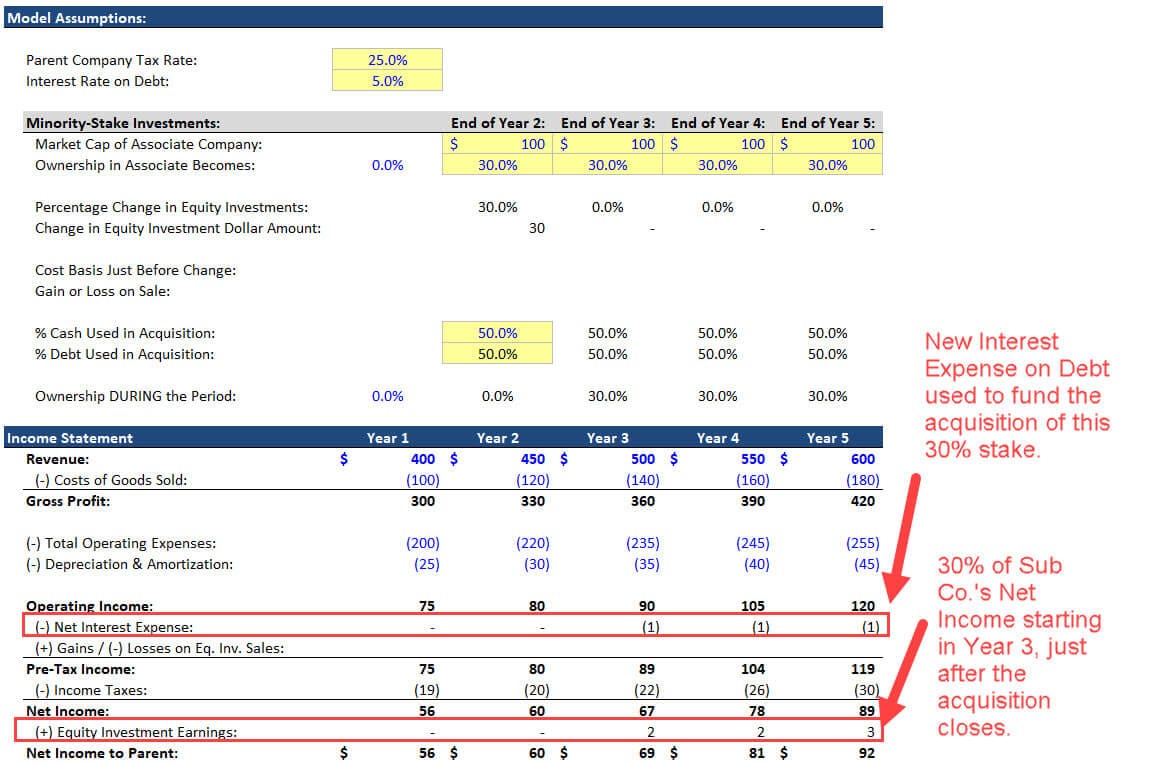

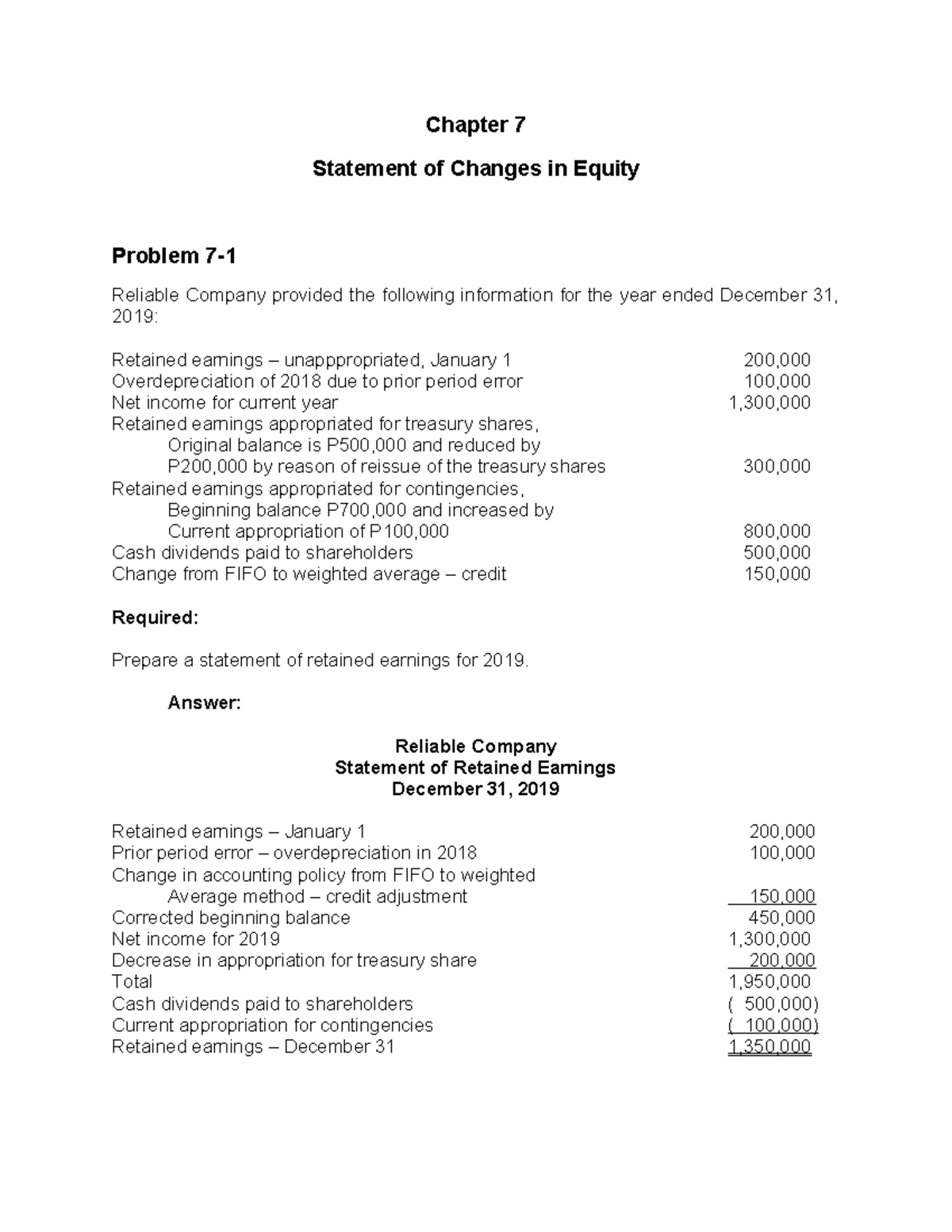

The income statement and statement of owner’s equity report the financial performance and equity change for a period of time. If the business is a corporation, this will be known as the statement of retained earnings. We will still be using the same source of information.

Investments by owners and distributions to owners are two activities that impact the value of the organization (increase and decrease, respectively). Accounting standards balance sheets financial statements View adbe financial statements in full, including balance sheets and ratios.

Owner’s equity is the set of account balances that have cumulative account balances of contributions to date, withdrawals till date, and earnings till date. Explanation “owner’s equity” is a commonly used terminology for sole proprietors. Recall that the accounting equation can help us see what is owned (assets), who is owed (liabilities), and finally who the owners are (equity).

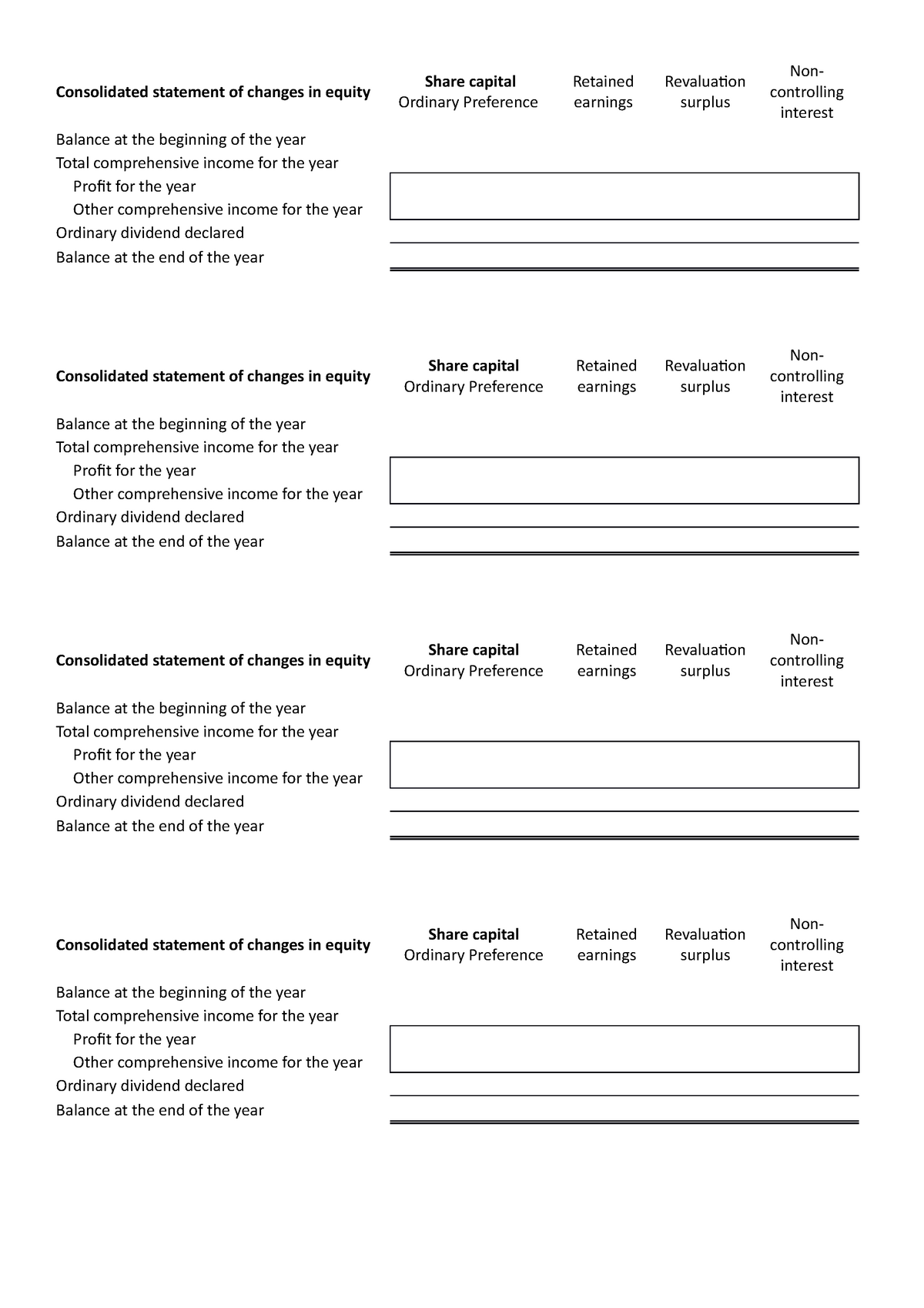

Gaap and ifrs require companies to include a document that outlines the changes in all equity accounts for greater investor. In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and the basic characteristics of the statement of cash flows. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate;

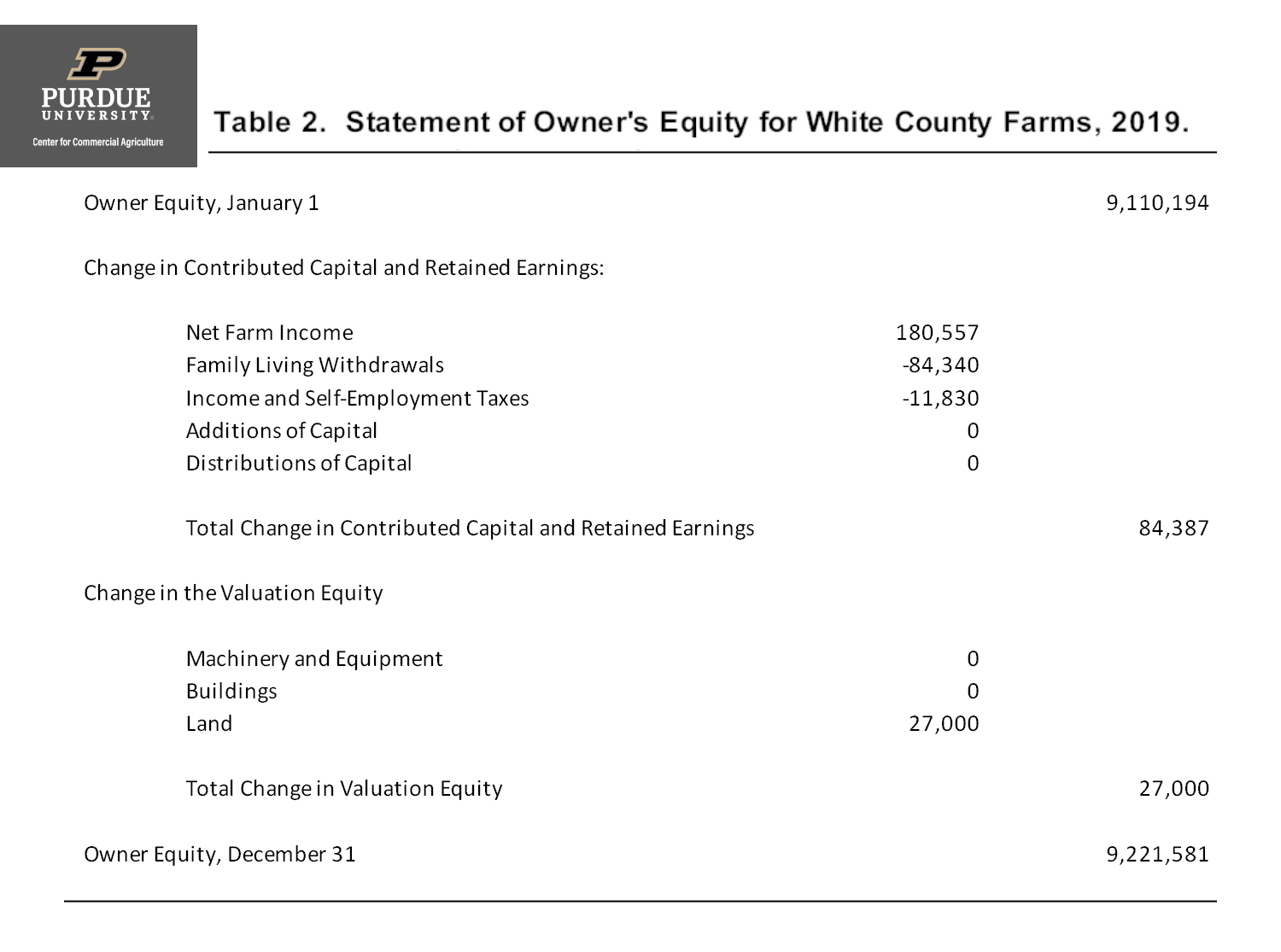

In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and the basic characteristics of the statement of cash flows. A statement of owner's equity (soe) shows the owner's capital at the start of the period, the changes that affect capital, and the resulting capital at the end of the period. Equity represents the ownership of the firm.

Prepare an income statement; The total is the ending balance in the capital account, which is the basic accounting equation of assets liabilities = owner’s equity. The statement of owner’s equity is a financial statement which gives details about the increase or decrease in the equity of the owner or the shareholder over a certain period of time through various events or transactions during that timeframe.

Statement of cash flows. On the statement of owner's equity, there is a direct transfer of the net income figure from. Tracked over a specific timeframe or accounting period, the snapshot shows the movement of cashflow through a business.

The elements of the financial statements shown on the statement of owner’s equity include investments by owners as well as distributions to owners. The specific objectives are to: Gather the needed information the statement of changes in owner's equity is prepared second to the income statement.

Provide an introduction to the income statement and show how it is used by producers and lenders Overview included materials related this note describes balance sheets, income statements, and statements of owners' equity and serves as an introduction to basic financial statements. This module will focus on the income statement and statement of owner equity which are critical in determining sources of earnings.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

![Free Printable Statement Of Owner's Equity Templates [Example]](https://www.typecalendar.com/wp-content/uploads/2023/09/Statement-of-Owners-Equity.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)