Here’s A Quick Way To Solve A Info About Balance Sheet Model Of The Firm

The capital structure of three corporations with differing amounts of debt.

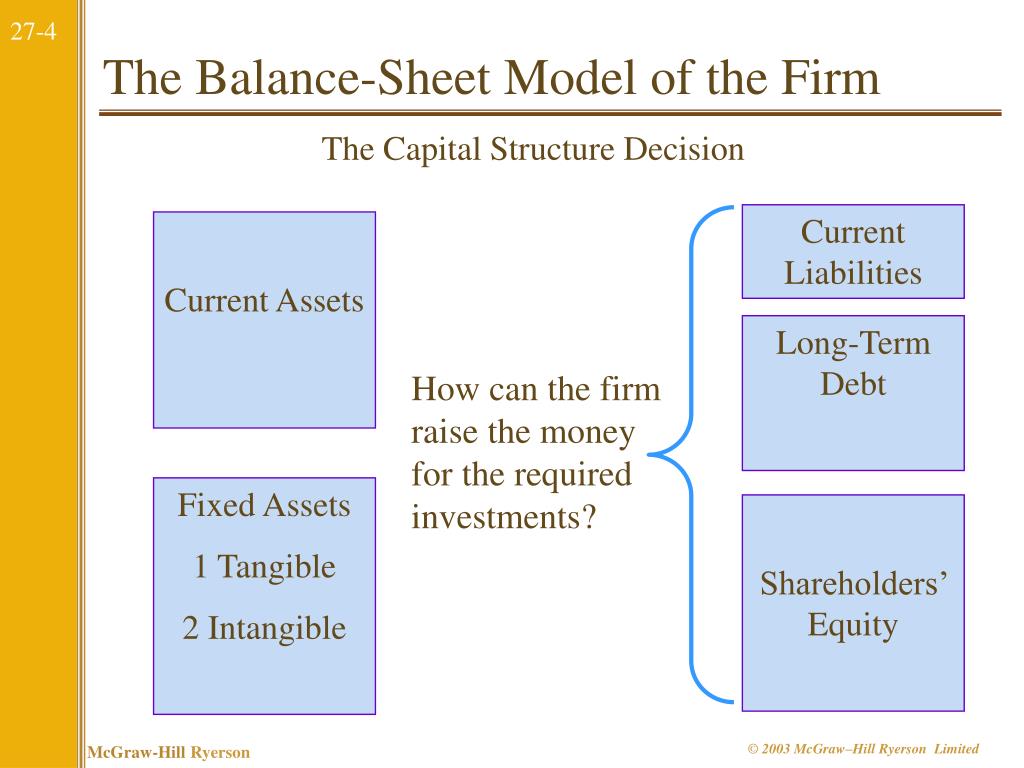

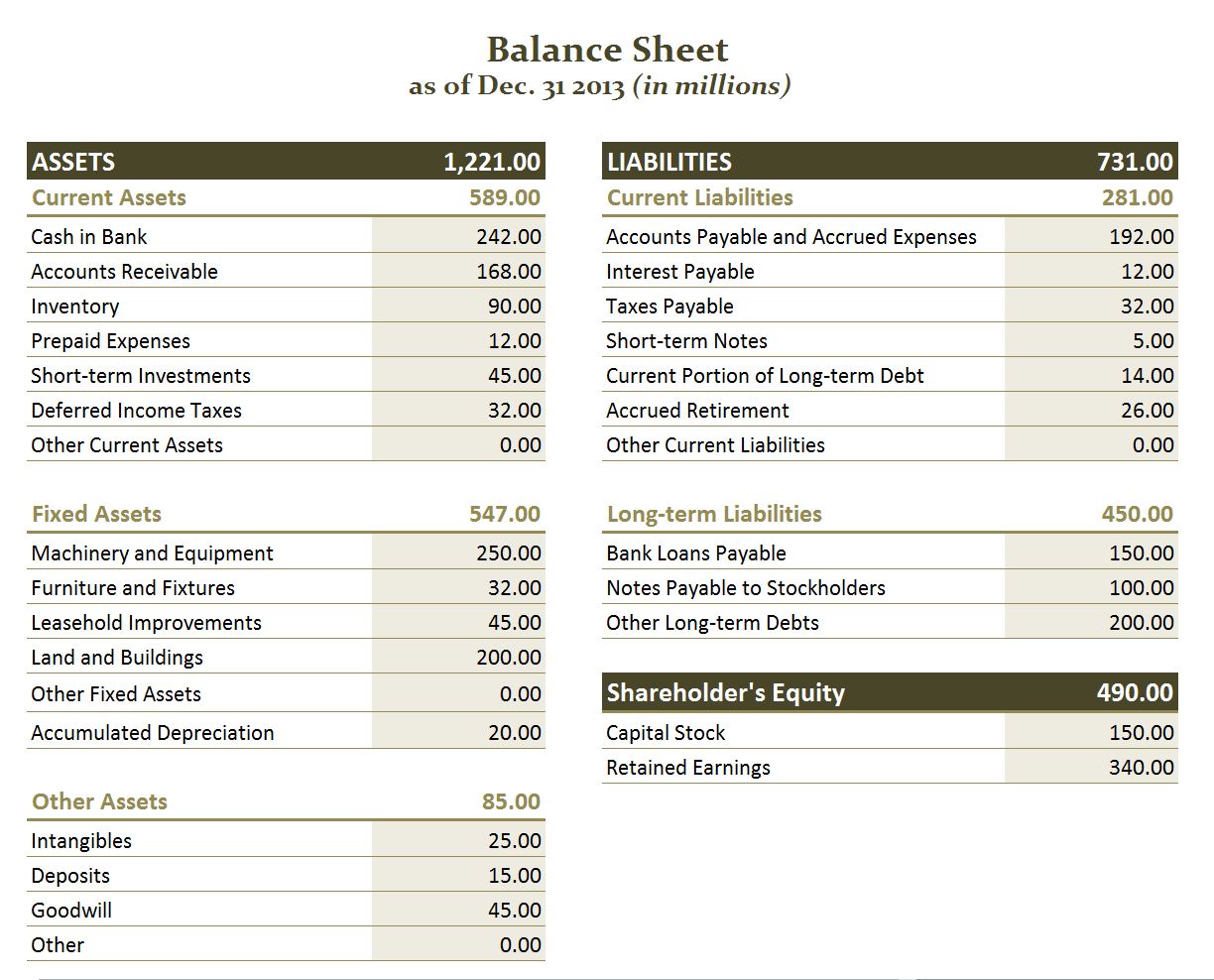

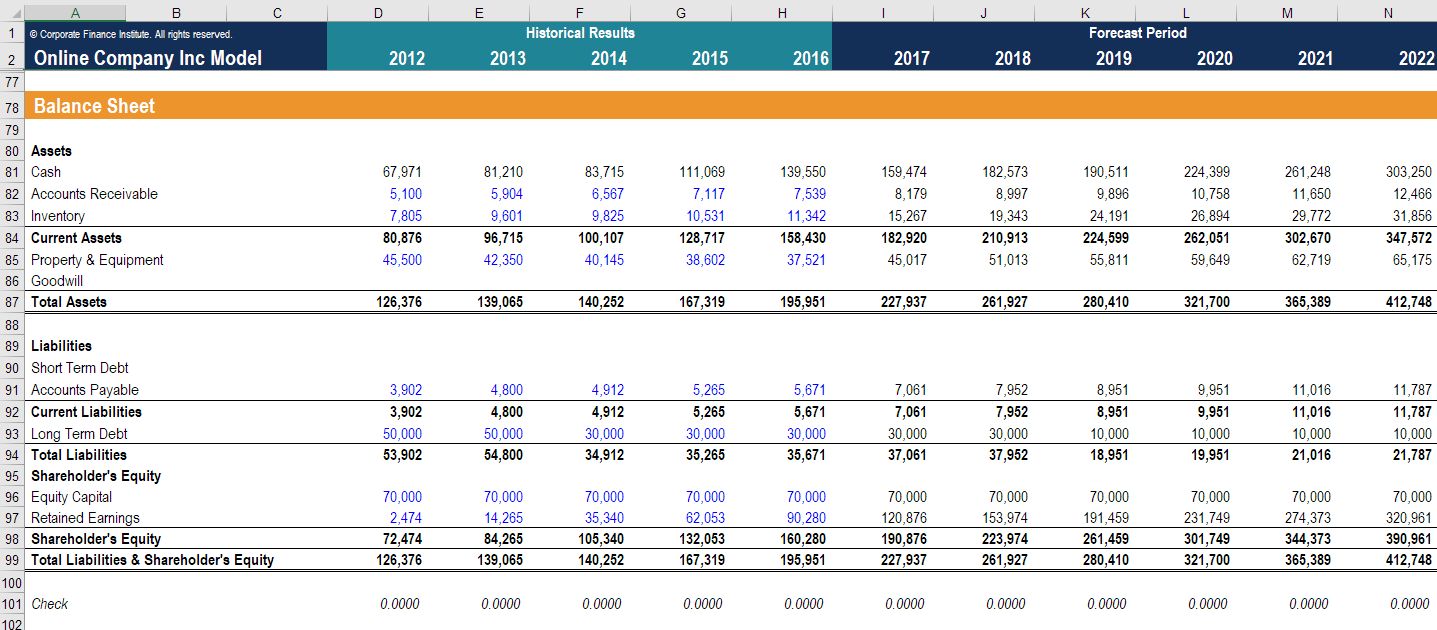

Balance sheet model of the firm. The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. Balance sheet model and example of balance sheet. The difference between assets and liabilities equals net worth and represents the firm’s equity.

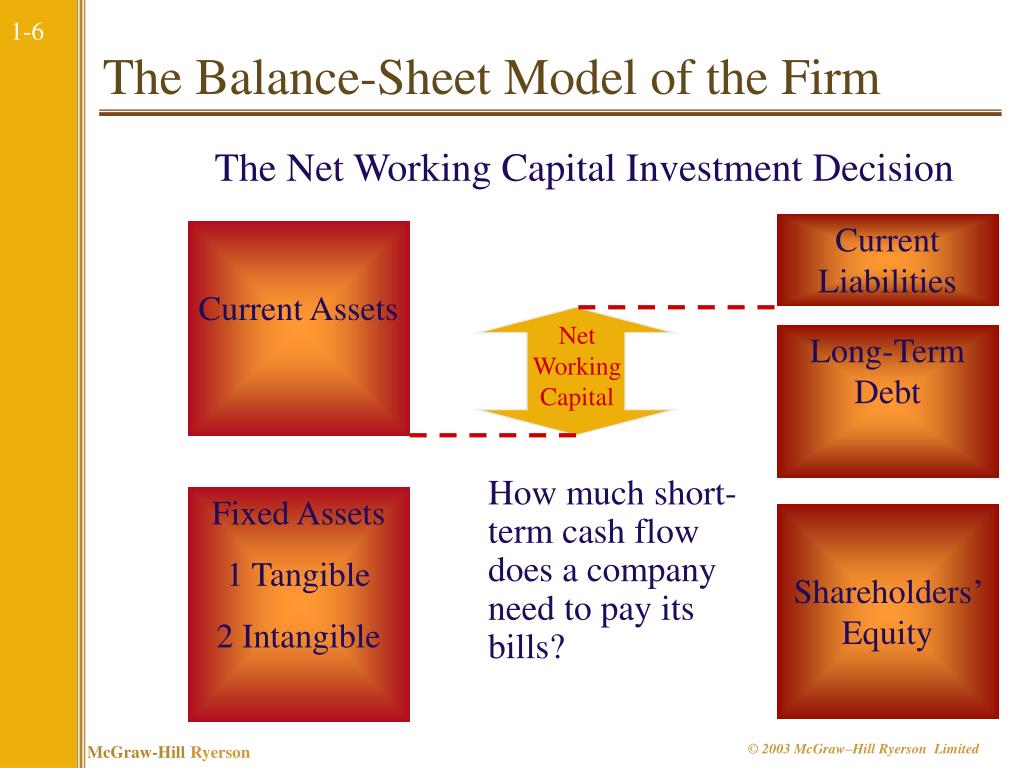

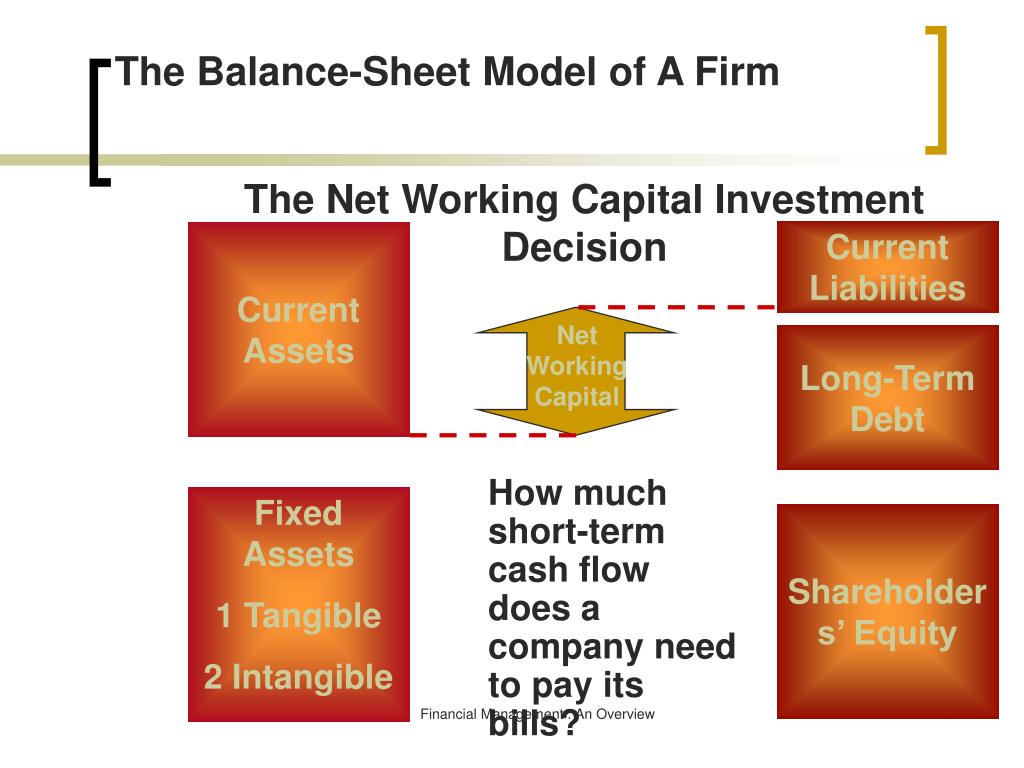

Thus, you can view the cash flow of your firm, working capital funding, trade receivable status and also how much daily transactions your business can afford. Capital budgeting, capital structure, net working capital. Having a proper balance sheet will let you get a clear idea of the liquidity conditions of your company.

Which of the following groups correctly lists these three areas? The resources belonging to the company) must’ve all been funded somehow, and the two funding sources available for companies are liabilities and equity (i.e. Which of the following groups correctly lists these three areas?

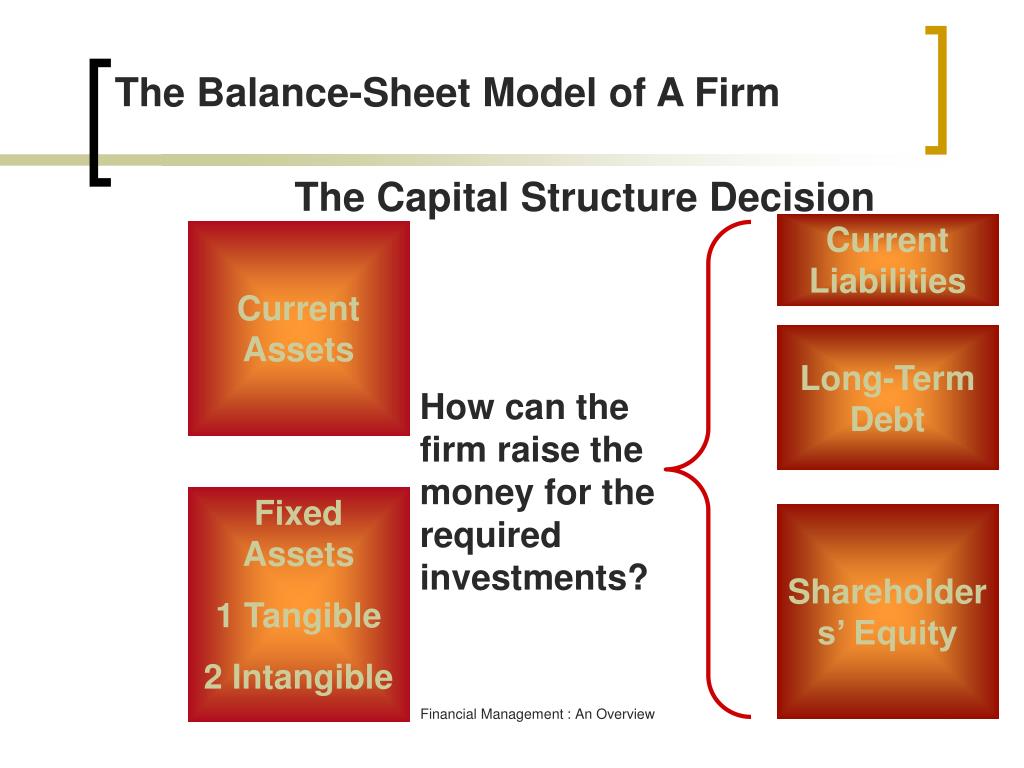

How can the firm raise cash for required capital expenditures? The balance sheet, one of three financial statements generated from the accounting system, summarizes a firm’s financial position at a specific point in time. Carefully review the balance sheet and analyze the various components.

Analyze the balance sheet: Finance exam 1 questions. For example, firm c in the diagram has 80% debt, which is too much.

It also lists the claims on the firm’s assets from outside the firm called liabilities. In the model, cash buildup allows firms to preserve internal funds for debt repayment and growth opportunities, thereby addressing both the downside risk and the upside potential triggered by higher uncertainty. Using the balance sheet model of the firm, corporate finance may be thought of as the analysis of three primary subject areas.

The balance sheet shows the balance of accounts at a given time. (2000) develop a theoretical model that can compare the macro implications of both the balance sheet channel and the bank lending channel and conclude that the presence of a balance sheet channel is most likely. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Balance sheets provide the basis for. This paper is closely related to the above work as we study the interaction between real activity and firms’ balance sheets.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Conceptually, the assets of a company (i.e. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

Such a company is always worried about its ability to pay interest to the bondholders. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet describes the firm’s assets—what the firm owns or controls.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)