Here’s A Quick Way To Solve A Tips About Accounts Payable On The Balance Sheet

What are accounts payable on a balance sheet?

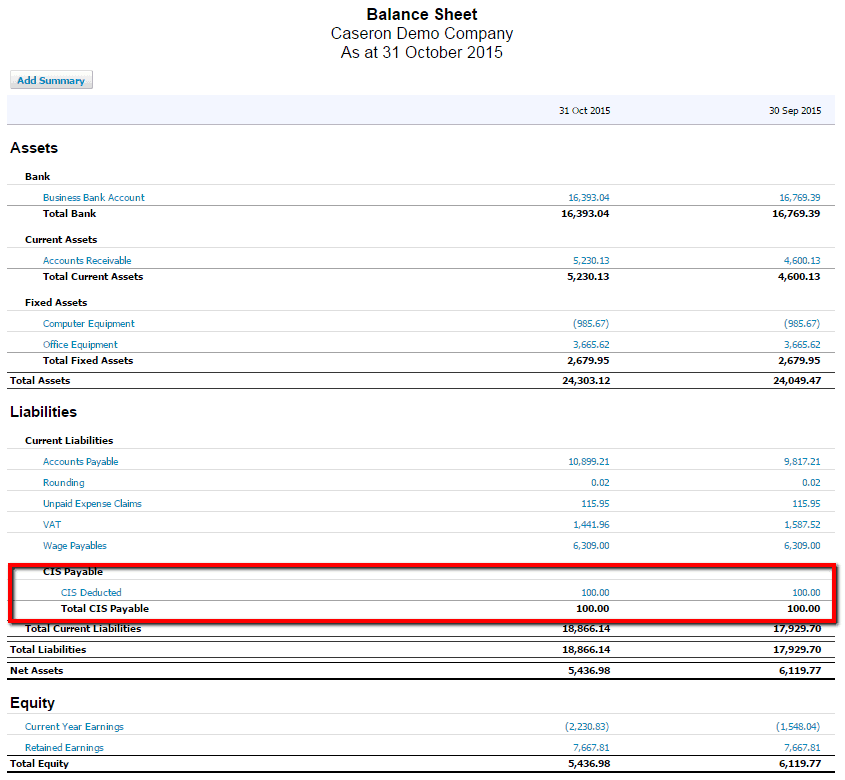

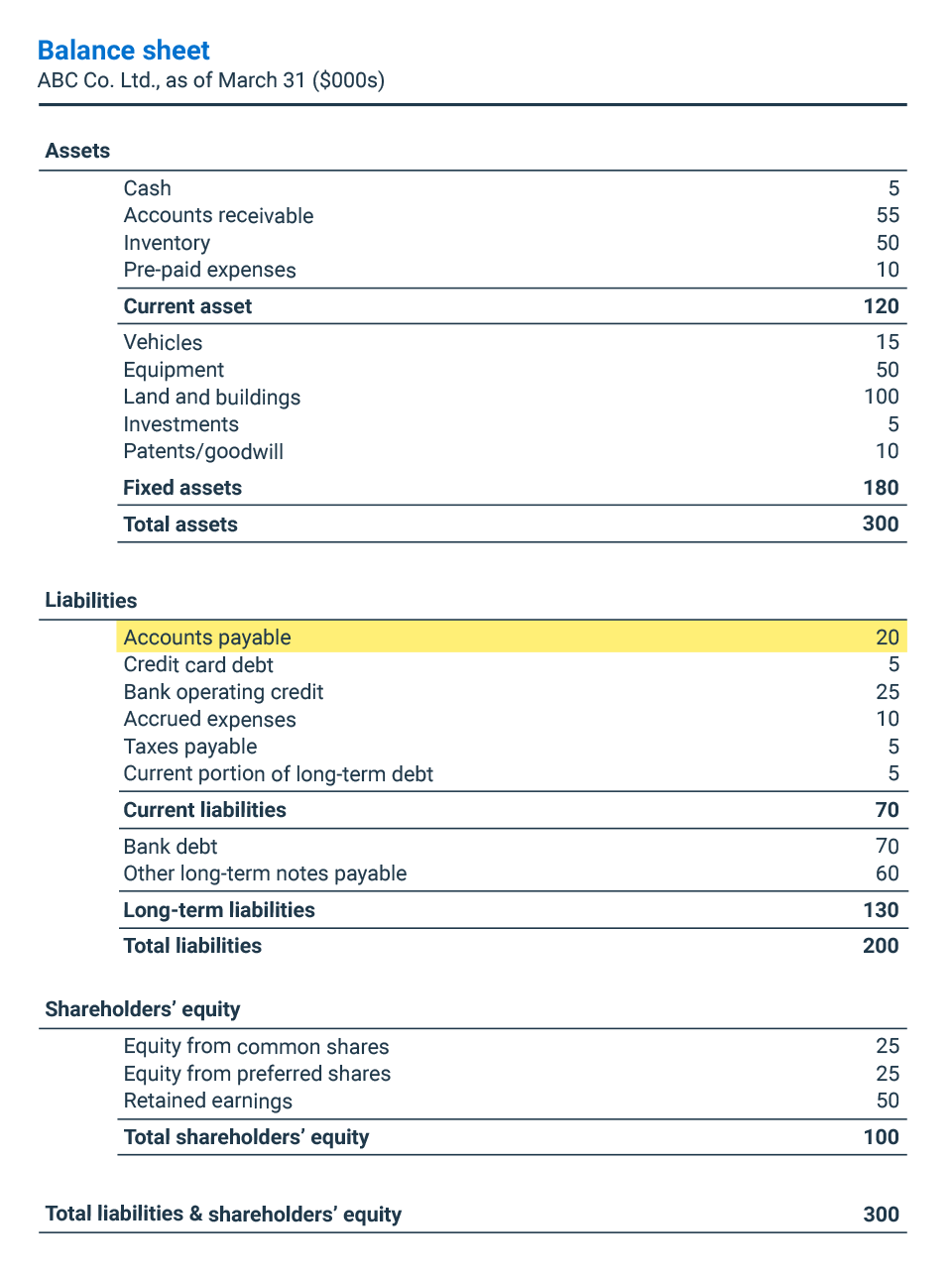

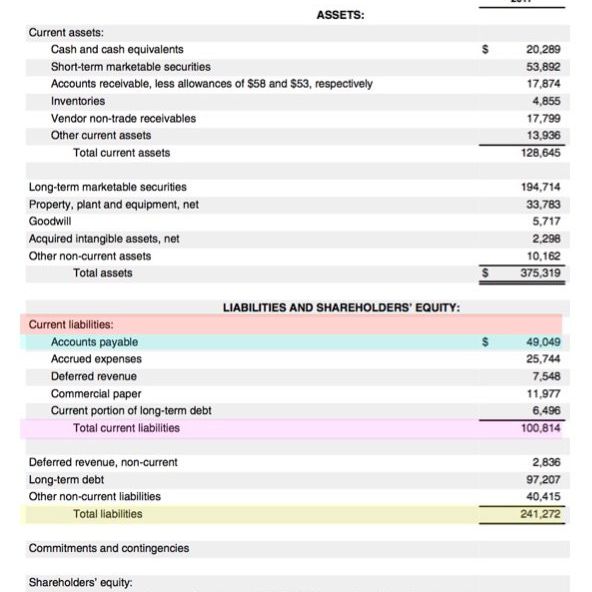

Accounts payable on the balance sheet. The cluster of liabilities comprising current liabilities is closely watched, for a business must have sufficient liquidity to. Accounts payable forms a part of the current liabilities in your company’s balance sheet. How accounts payable affects the balance sheet.

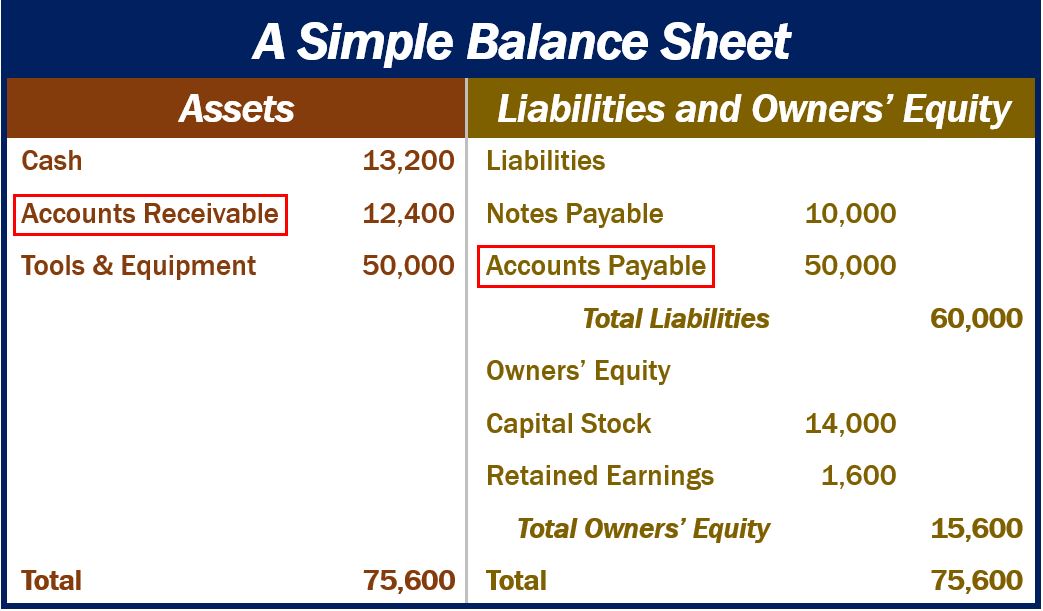

What is accounts payable on a balance sheet? The balance sheet is based on the fundamental equation: The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

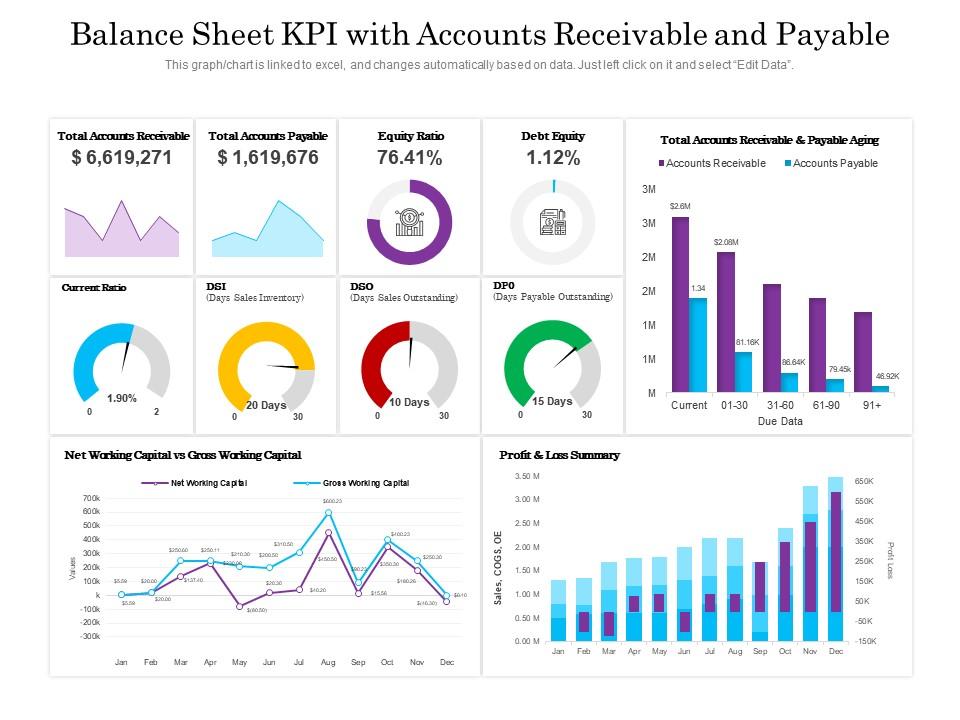

In this comprehensive guide, we'll explore accounts payable on a balance sheet and how to enhance it for better financial. When looking at the formula “assets = liabilities + shareholders’ equity,” accounts payable obligations will fall under the. Understanding the accounts payable balance sheet is crucial for maintaining a company's financial health.

Ap is considered one of the most current forms of the current liabilities on the balance sheet. If a business has accounts payable (a/p), they have received goods or services from other companies that they need to pay off in the near the future. Under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors.

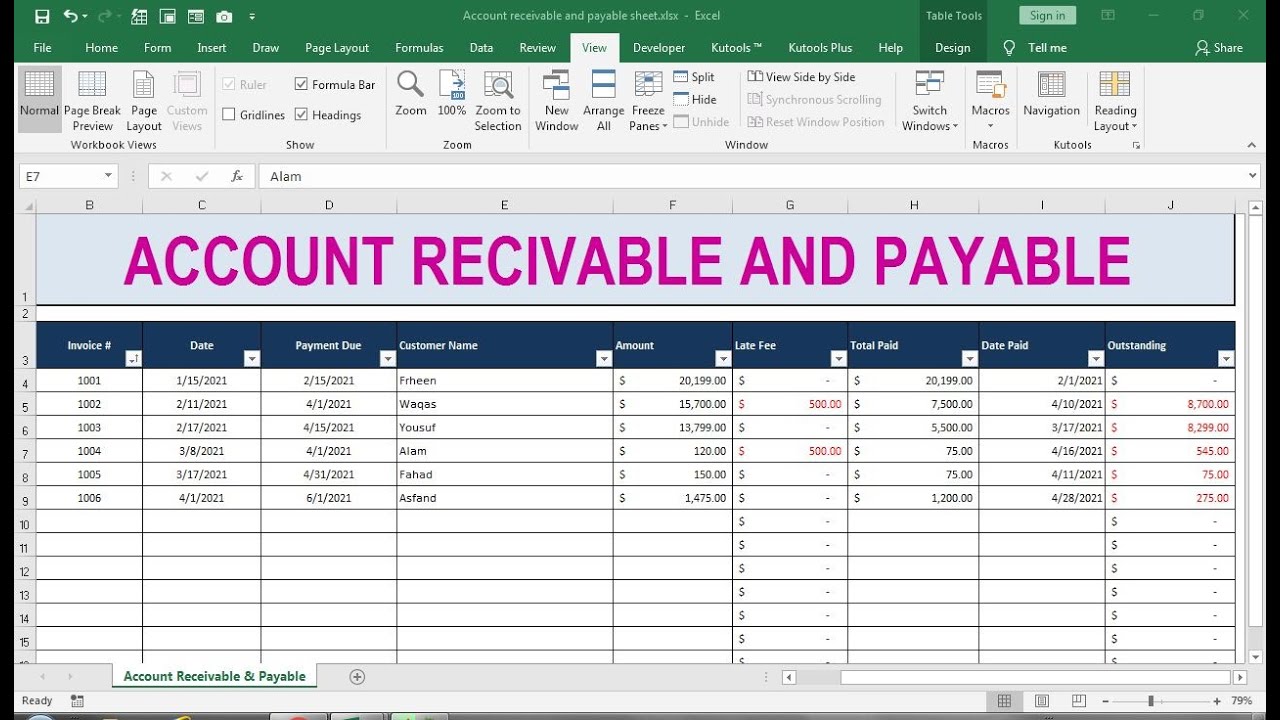

Accounts payables are the amounts owed to suppliers, employees, shareholders, vendors, or customers. It is a liability due within a specific time frame usually one year. Accounts payable (ap) is an account in a company's general ledger.

Accounts payable, often abbreviated as “payables” for short, represent invoiced bills to the company that have not been paid off. Accounts payable is not a business expense; Accounts payable are measured and subsequently recorded in the balance sheet depending on the invoiced amount.

The sum of all outstanding amounts owed to vendors is shown as the. Accounts payable refers to the outstanding debts or obligations that a company owes to its suppliers and vendors for goods or services received but not yet paid for. Accounts payable is the amount owed to suppliers and creditors for goods and services received by a company.

For example, abc printing purchased $1,500 worth of office supplies. The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out: Managing this aspect of the balance sheet effectively can help businesses maintain healthy cash flow, build strong relationships with vendors, and avoid costly mistakes.

It can display the company's current financial obligations and help improve company leaders' plans for debt repayment. Accounts payable are liabilities on the balance sheet. Accounts payable refers to a business’s obligations to suppliers and creditors for purchases made on an open account.

In terms of the balance sheet, accounts payable falls under the category of current liabilities. Additionally, accounts payable could refer to the department responsible for these expenses. The accounts payable components the accounts payable components include trades payable, debt, and credit card balances.