Divine Info About Financial Statements Of Non Profit Organisation

To determine the financial health of a nonprofit organization, you need to understand its financial statements.

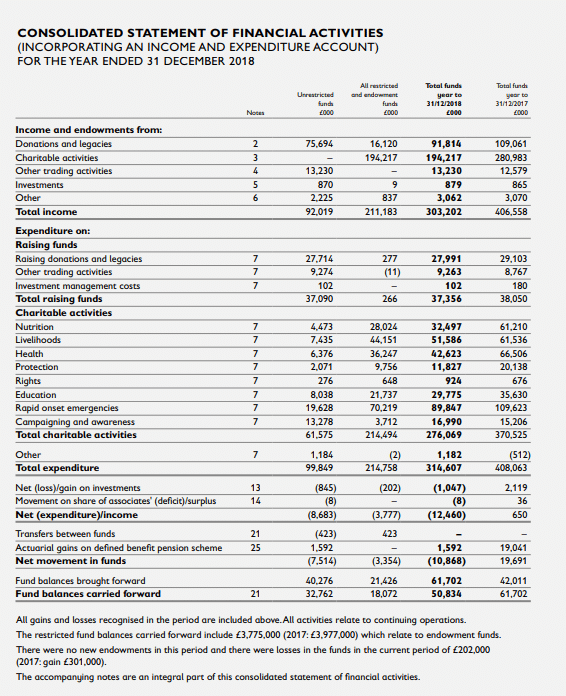

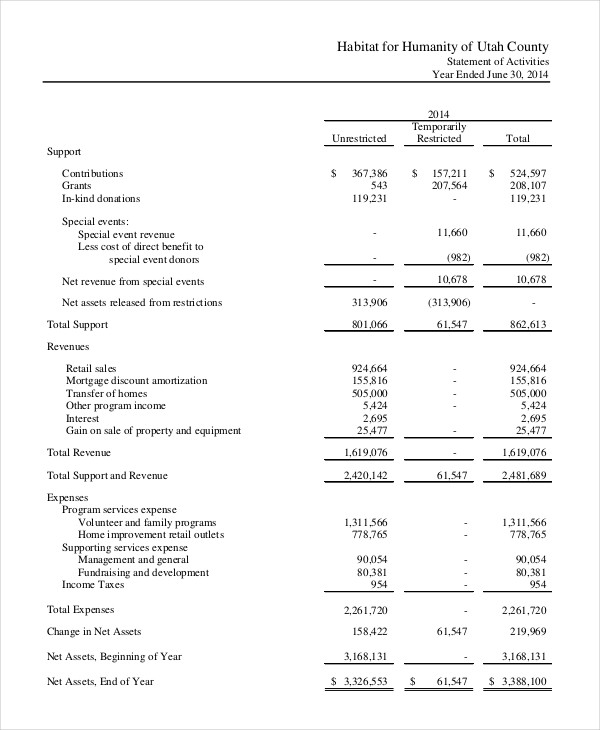

Financial statements of non profit organisation. These examples demonstrate some of the diversity of current practice. Everyone working in nonprofit accounting and finance, including members of the board of directors, should have a strong grasp of reading and understanding the unique way in which nonprofits present their financial statements. The main characteristics of such organisations are:

Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses. Irs form 990 * *note: In one example, the attorney general's legal team showed that trump's triplex in his eponymously named.

Your financial statement should include: Using nonprofit financial statements as a powerful marketing tool. In nonprofit accounting, there are four required financial statements that organizations must produce, and we will touch on each of these in this guide.

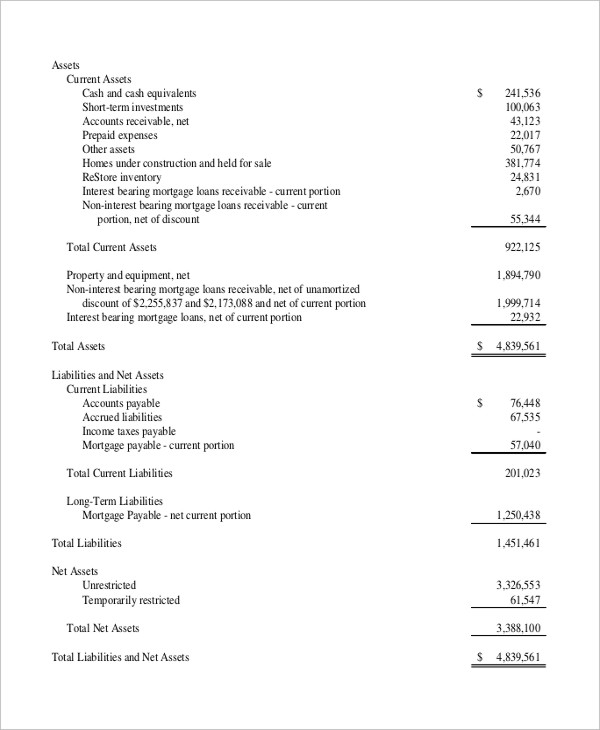

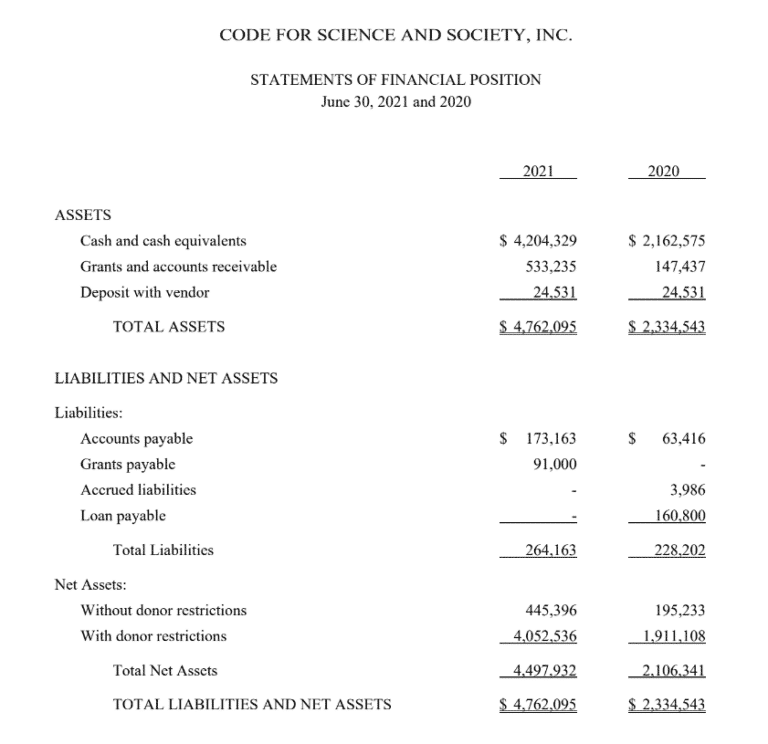

A nonprofit's statement of financial position (similar to a business's balance sheet) reports the organization's assets and liabilities in some order of when the assets will turn to cash and when the liabilities need to be paid. The short answer is no. Delivered positive adjusted earnings before interest, tax, depreciation, and amortisation (adjusted ebitda) of $58.4m an increase of $126.2m, compared to a loss of $67.8m in 2022.

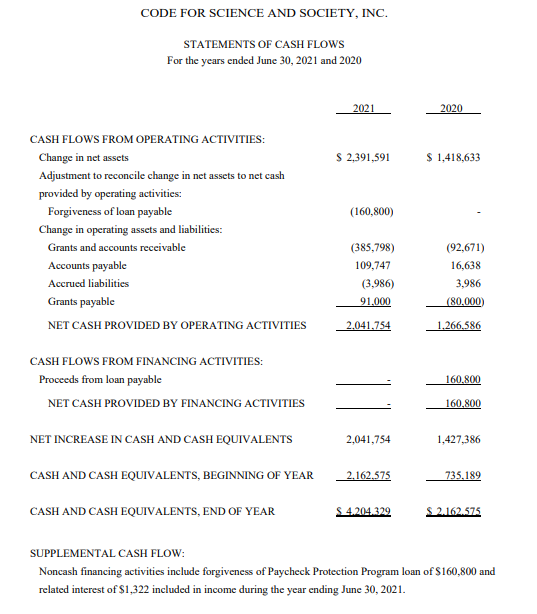

These are the statement of financial position, the statement of activities, the statement of cash flows and the statement of functional expenses. In this article, we’ll walk you through the five nonprofit financial statements that you’ll need regardless of your size or mission. Technically the 990 is a tax compliance form rather than a “financial.

Some, but not all, have charitable status. 4 types of nonprofit financial statements balance sheet. Some nonprofits are required to publish a form 990, which is a public document.

The financial statements issued by a nonprofit are noted below. It leads to a positive board experience, proper management of conflict of interest and risk, good understanding and. Typically, expenses are broken into two distinct sections—overhead expenses and.

Typically, this includes gifts, grants, membership fees, and/or income from fundraising events or investments. Sharing financial statements with donors is one of the best ways to ensure transparency and build trust. Include the value of their collections in their statements of financial condition under an fasb rule which, if they agree to adhere to, permits nondisclosure.

The statement of financial position and the balance sheet are two different terms that refer to the same report. Statement of financial position. Documents shown during trial ranged from spreadsheets to signed financial statements.

Online governance training for non profit organisationsgovernance training for non profit organisationsgovernance is a system of checks and balances which help leaders of not for profit organisations steer and grow their organisation. The portland museum last disclosed their collection value in the financial statements about 15 years ago at which time the collection had an estimated value of over $60 million dollars. The role and responsibilities of the board, management and the auditor in financial reporting