Supreme Info About Difference Between Cash Flow Forecast And Statement

What is the difference between a cash flow statement and a cash flow forecast?

Difference between cash flow forecast and cash flow statement. Difference between cash flow forecast and cash flow statement what is a cash flow forecast? Both cash flow statement and cash flow forecast only deal with cash. This is a crucial distinction because profits and cash are very different.

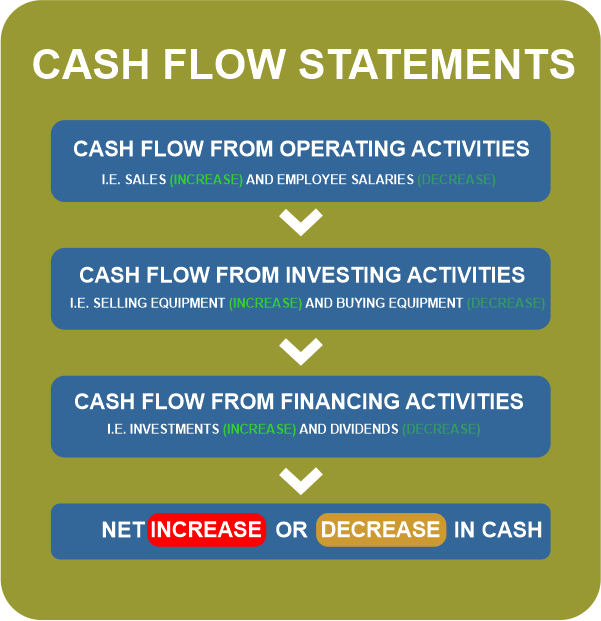

The cash flow statement is a financial statement. For example, cash flow statements can reveal what phase a business is in: Cash flow forecasting is a crucial element that can make or break any business, regardless of its size.

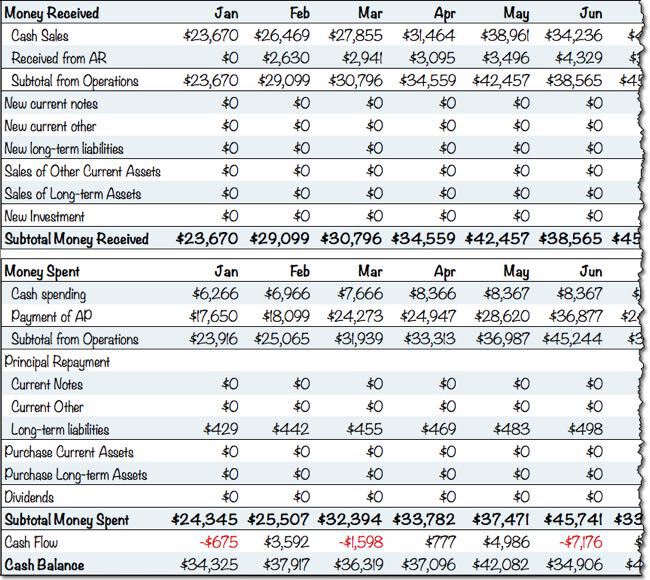

The cash flow statement provides a record of actual cash flows, while the cash flow forecast provides an estimation of expected cash flows. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. Both tools are essential for businesses to understand their financial health and cash flow situation and make informed decisions about their finances.

It can also reveal whether a company is going through transition or in a state of decline. Whether it’s a rapidly growing startup or a mature and profitable company. It’s not uncommon for a business to experience a cash shortage, even when sales are good.

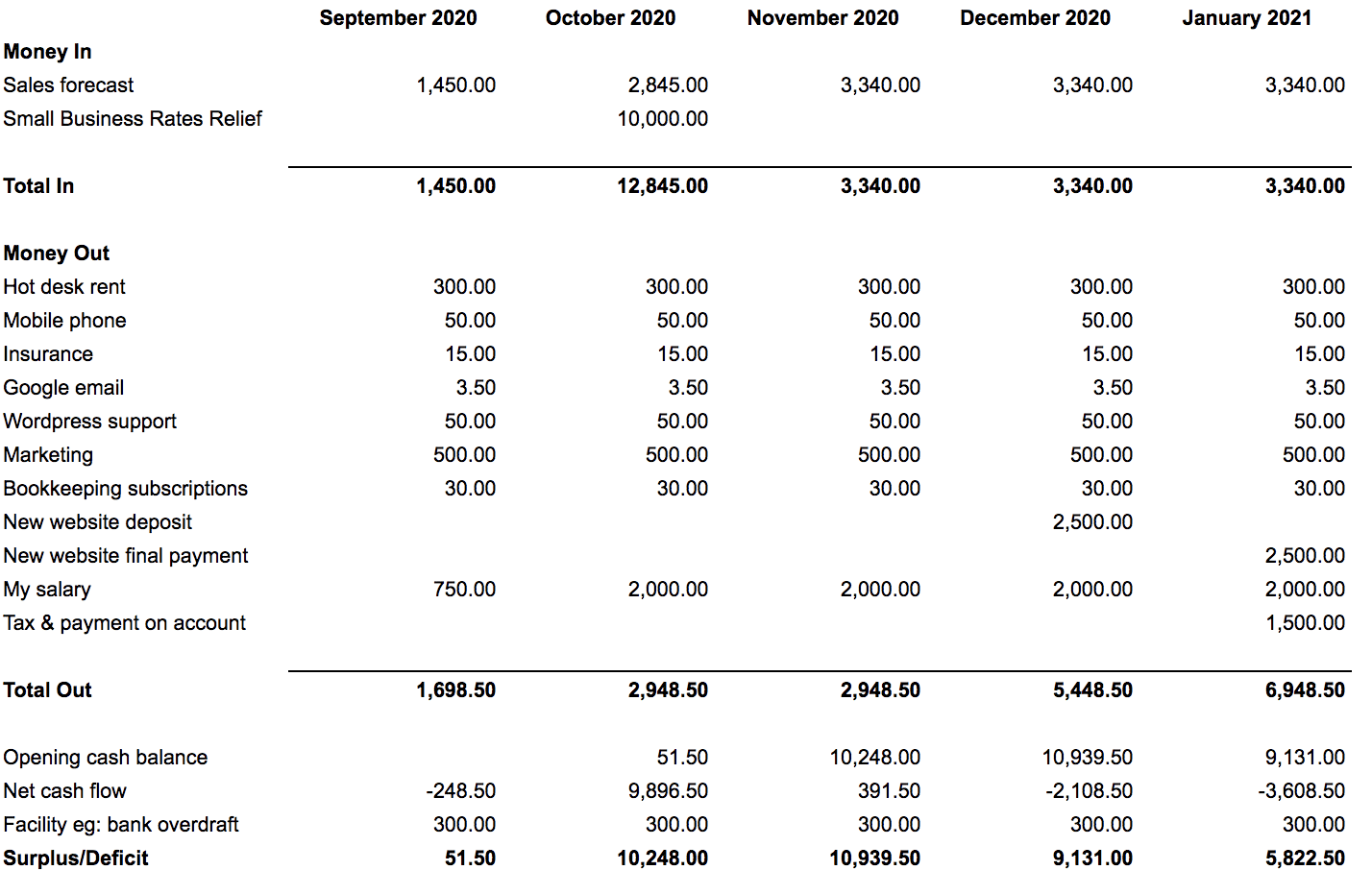

The difference between a cash flow forecast and a cash flow statement is that a cash flow forecast or projection is looking into the future to predict future cash flows. As the reporting tool for cash flow, a cash flow statement is foundational to cash flow forecasting. Your cash flow forecast:

Forecasting cash flow and cash balance. While forecast cash flow is a prediction based on calculations, actual cash flow is based on real figures and revenue streams and not dependent on any guess work. This video explains that concept of cash flow, how it can be.

The key difference between cash flow and profit is that while profit indicates the amount of money left over after all expenses have been paid, cash flow indicates the net flow of cash into and out of a business. A cash flow forecast helps you examine how key variables. The first step in our cash flow forecast is to forecast cash flows from operating activities, which can be derived from the balance sheet and the income statement.

Instead, the profitability of a firm can be found out from gross profit margin (gpm) and net profit margin (npm) based on the numbers from profit and loss account (p&l account). This will be your “net cash flow”. The cash flow forecast is also called cash.

A cash flow forecast shows if a business needs to borrow, how much, when, and how it will repay the loan. Your cash flow forecast predicts how much cash you will receive each month and how much cash you will spend each month to predict how much money you’ll have in the bank at the end of every month. A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time.

A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on past business performance. What is a cash flow statement? Cash received signifies inflows, and cash spent is outflows.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)