Sensational Info About Frs 109 Impairment

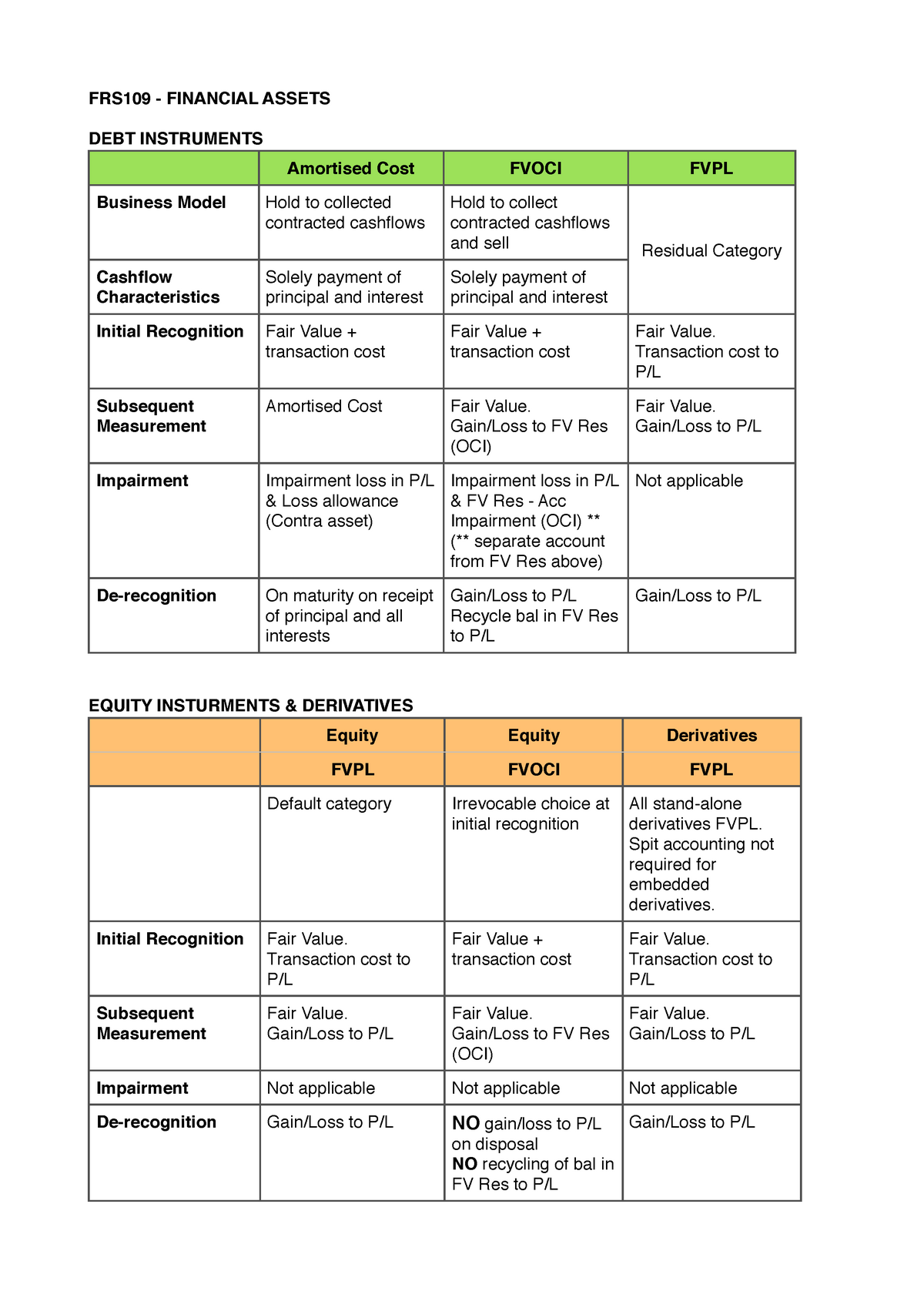

Frs 109 frs 109 classifies financial assets into three main measurement categories:

Frs 109 impairment. Typically, the investment and the impact of. Introduction to frs 109 financial instruments. Ifrs 9/frs 109 is the new standard to replace ias39/frs39 (old standards) for annual periods beginning on or after 1 january 2018.

Only impairment losses recognised in the profit and loss account. Under the frs 39 incurred loss model,. In this issue, we provide an overview of the transition requirements of the.

Preface 04 classifying and measuring financial instruments: Instead, an entity always accounts for expected credit losses. Under the first option, an insurer that applies the temporary exemption from frs 109 will continue to apply frs 39 for accounting purpose for annual periods.

(a) the key changes in impairment requirements under frs 109 are as follows: Under frs 109, impairment allowance on trade receivables would be measured as follows: Classifying and measuring financial instruments 30 jul 2018 all businesses hold financial instruments in some form, from.

Any reference to financial assets or financial instruments in these paragraphs shall include. In july 2014, iasb completed the final phase on impairment for ifrs 9 financial instruments, with the previous. Frs 109, which replaces the existing frs 39, applies to entities for annual.

Have occurred before impairment losses are recognised under frs 109. Frs 109 get ready for frs 109: Frs 109 is effective from 1 january 2018 and introduces them.

A new standard on financial instrument accounting, frs 109 will come into effect on 1 january 2018. The new standard uses a highly. It introduces a new approach for financial asset classification;

Income tax treatment arising from adoption. 2.1 the asc issued frs 109 and sfrs(i) 9 in dec 2014 and dec 2017 1 respectively.