Fabulous Tips About Budgeted Balance Sheet Explained In Detail

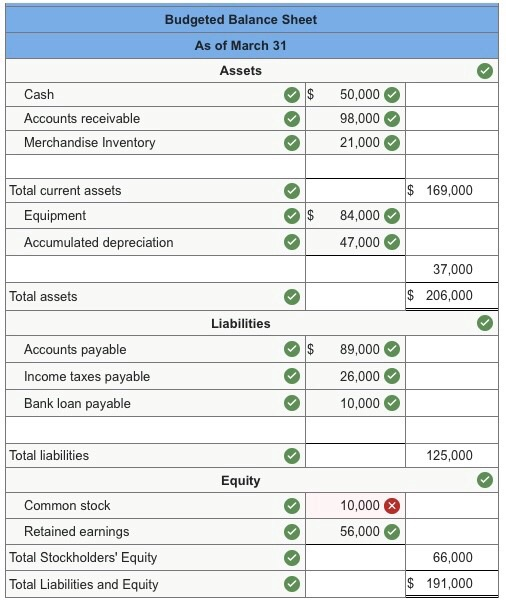

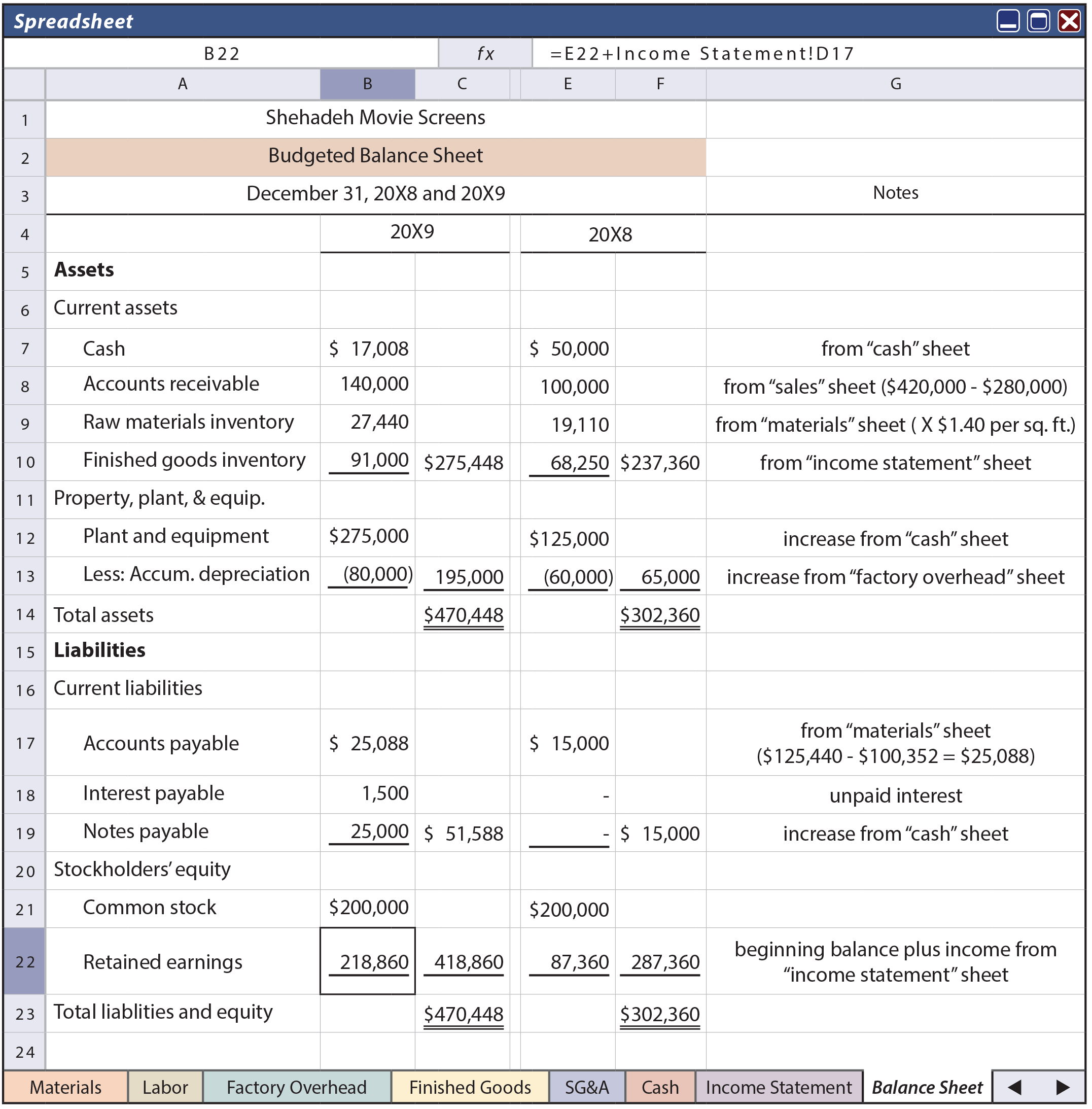

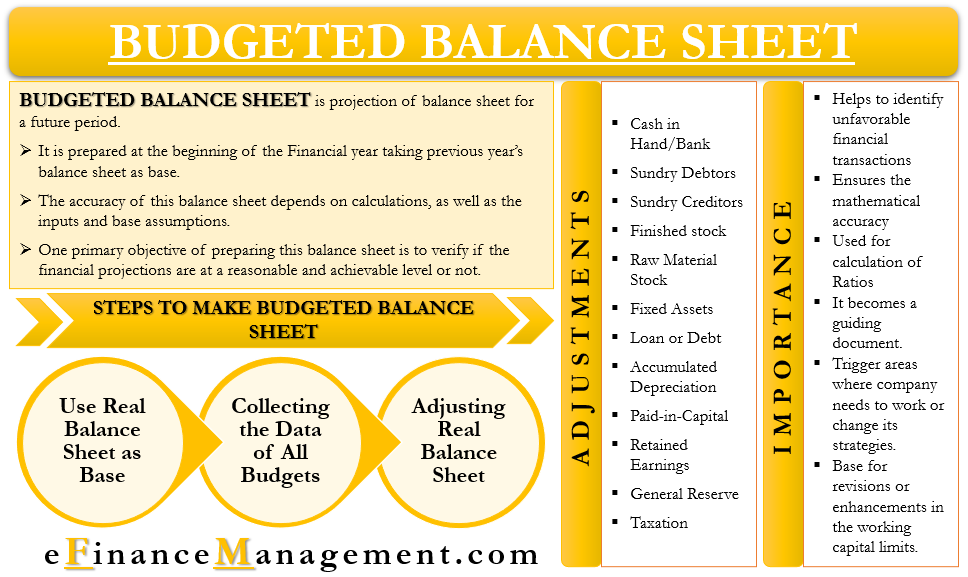

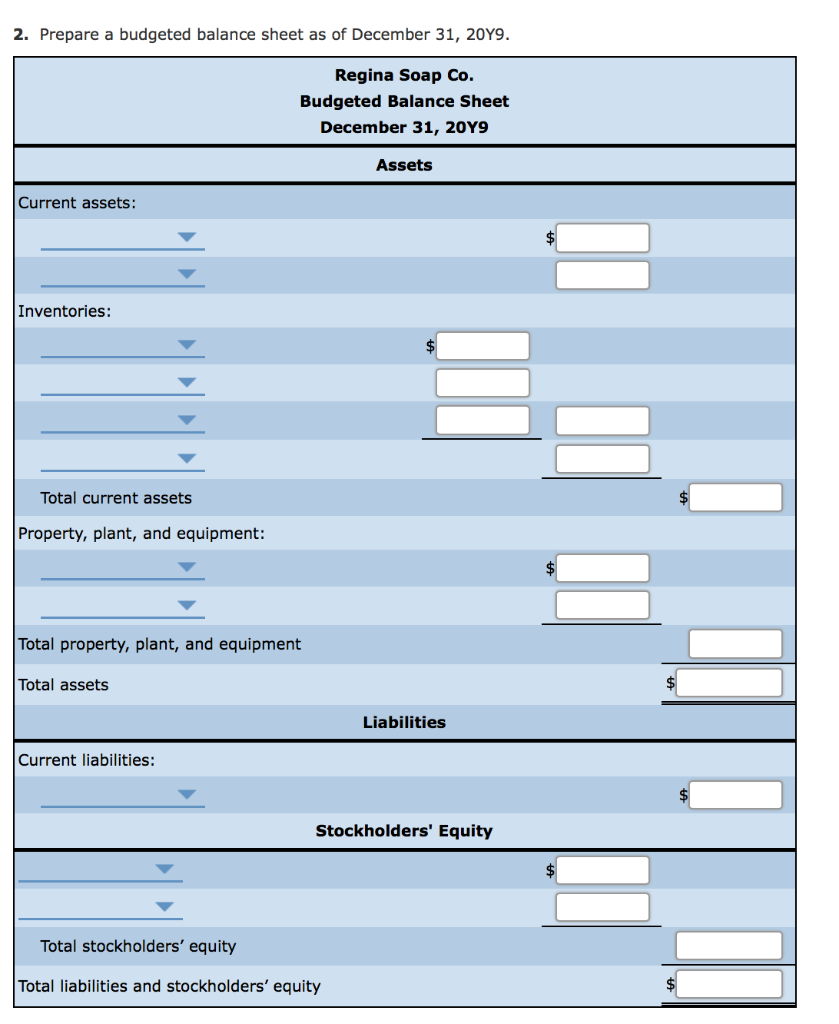

Preparing a projected balance sheet, or financial budget, involves analyzing every balance sheet account.

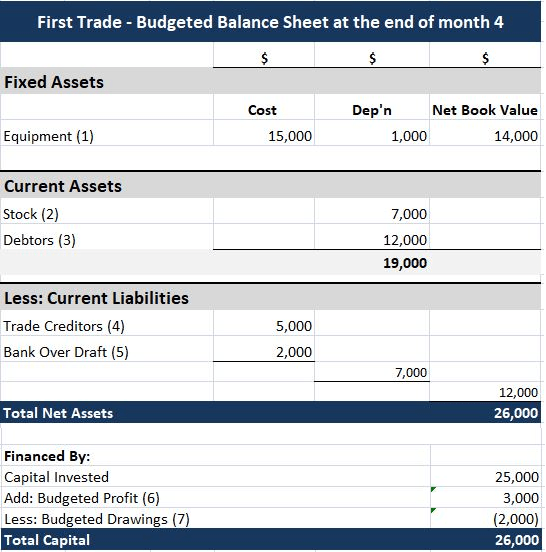

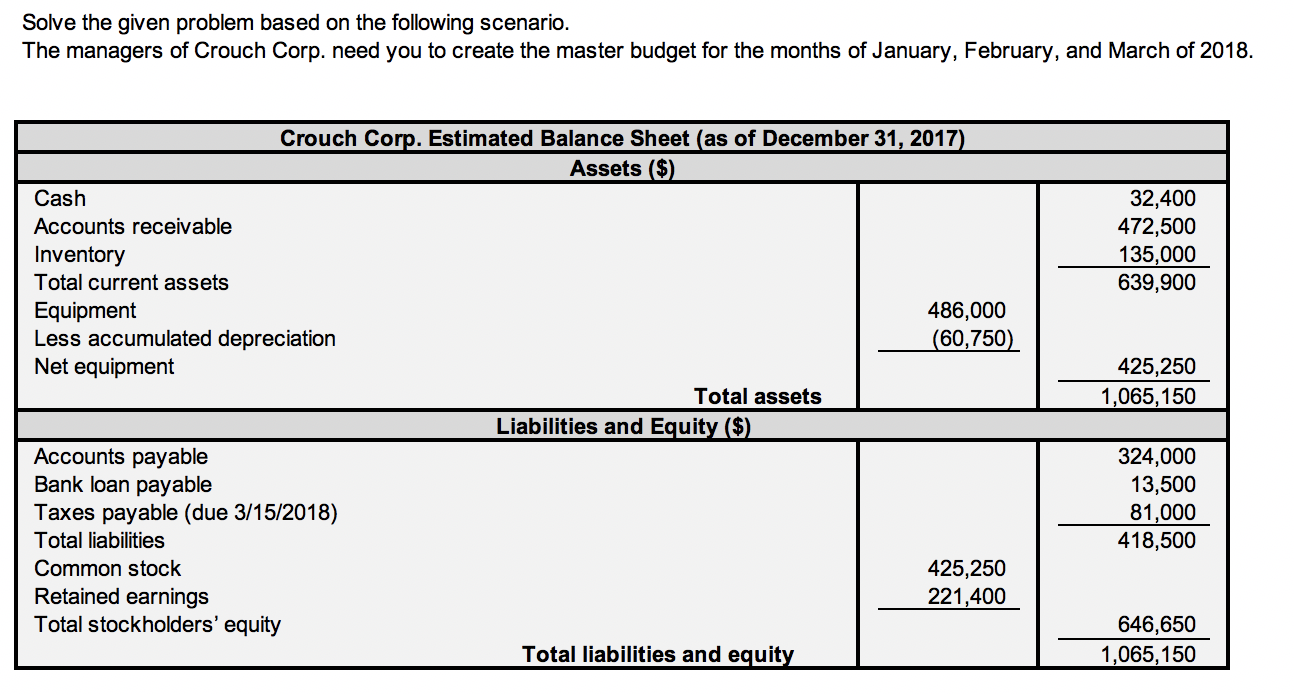

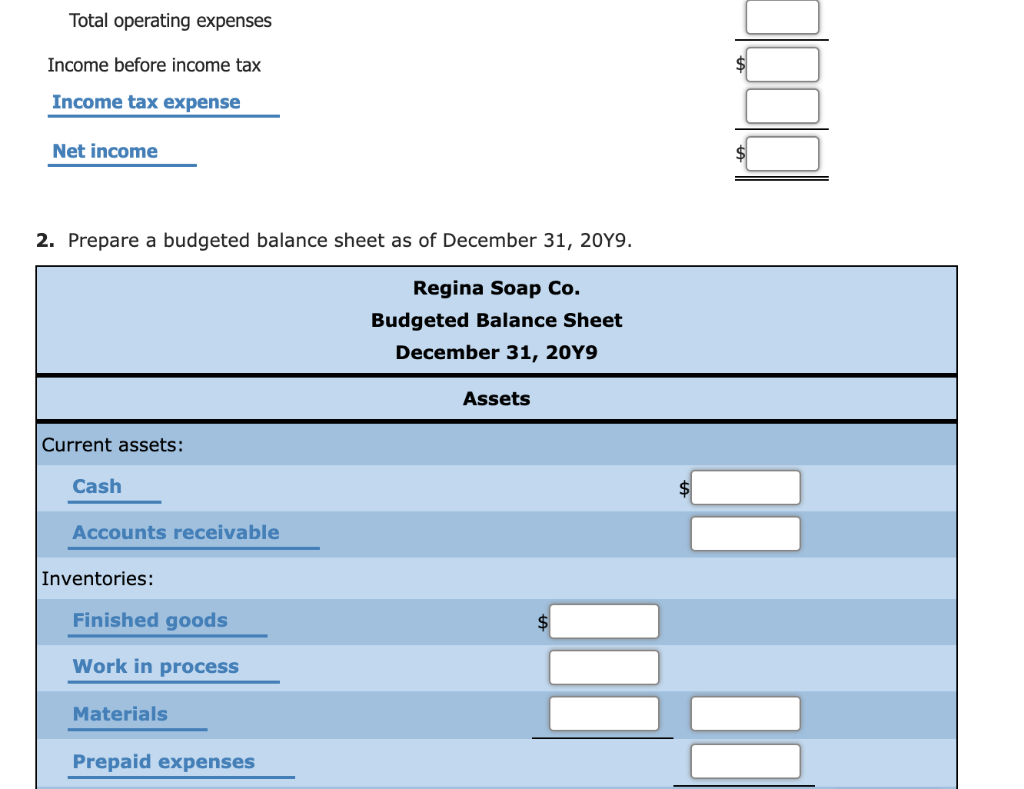

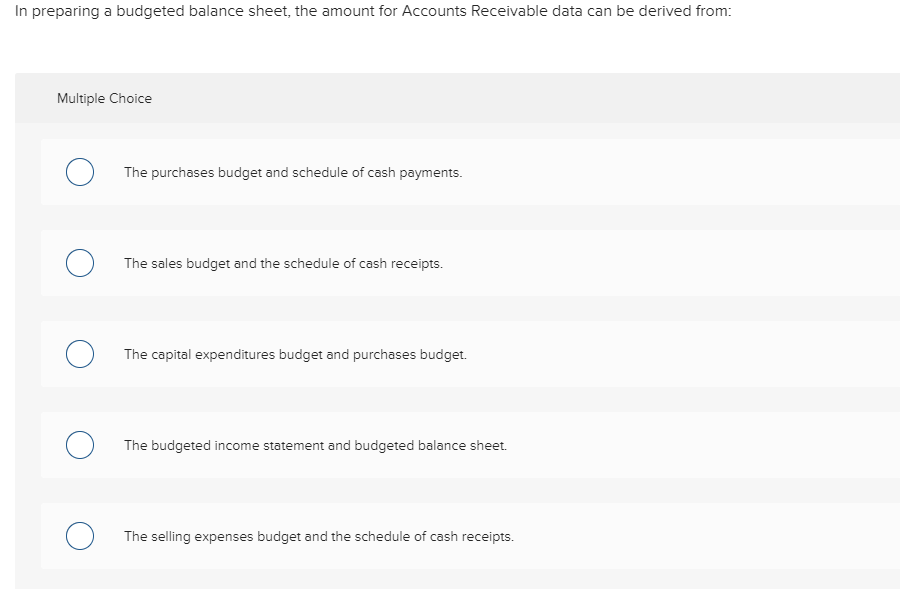

Budgeted balance sheet balance sheet explained in detail. A budgeted balance sheet is a financial document that presents the estimated value of a startup's assets, liabilities, and equity in the foreseeable future. There are lots of pieces of the puzzle, so let’s review the various budgets we’ve already created leading up to this point: A balanced budget is a situation in financial planning or the budgeting process where total expected revenues are equal to total planned spending.

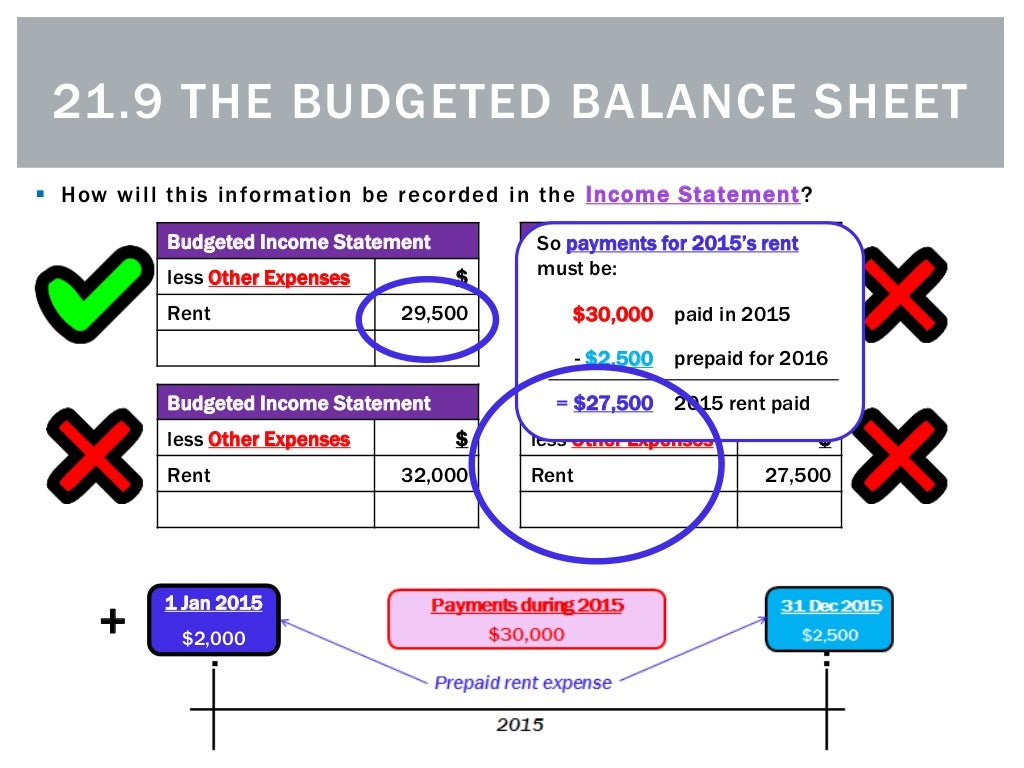

Also, all the other transactions during. As such, it provides a picture of what a business owns and. This predicted value is calculated by factoring in inflation and, possibly, increasing/decreasing capacity.

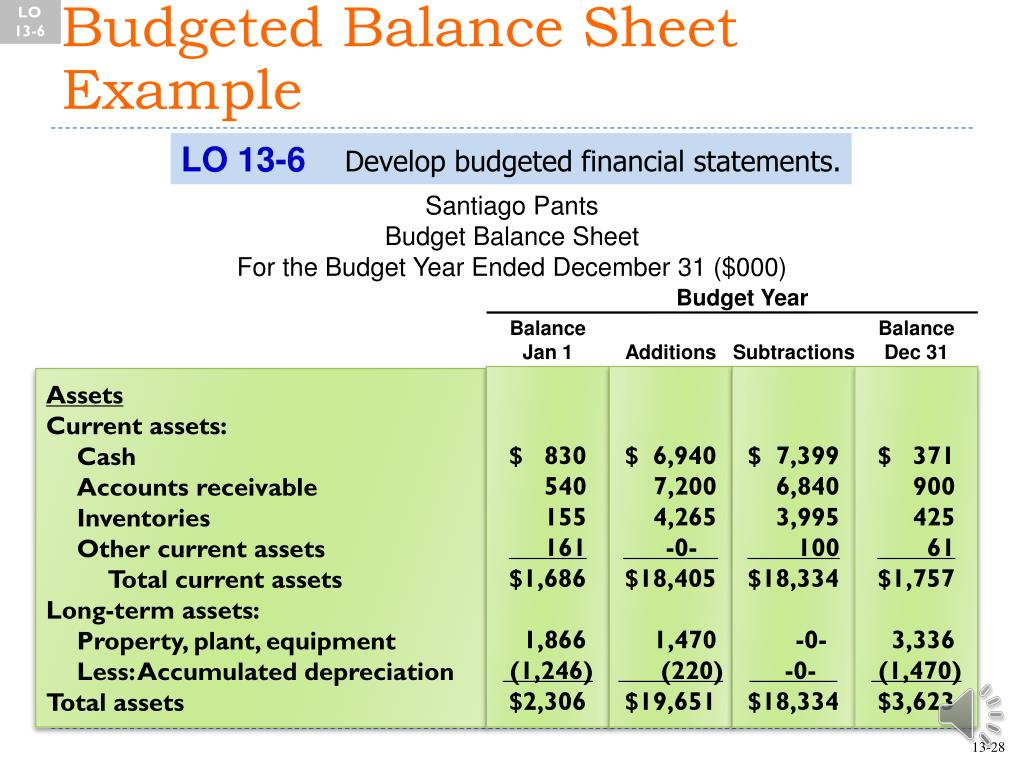

However, the budgeted balance sheet is prepared for a future period. Budgeted bs involves several calculations, and thus, one needs to be careful while preparing it. Budgeted balance sheet budgeted balance sheet the budgeted or pro forma balance sheet projects the financial position of the company as of the end of the year.

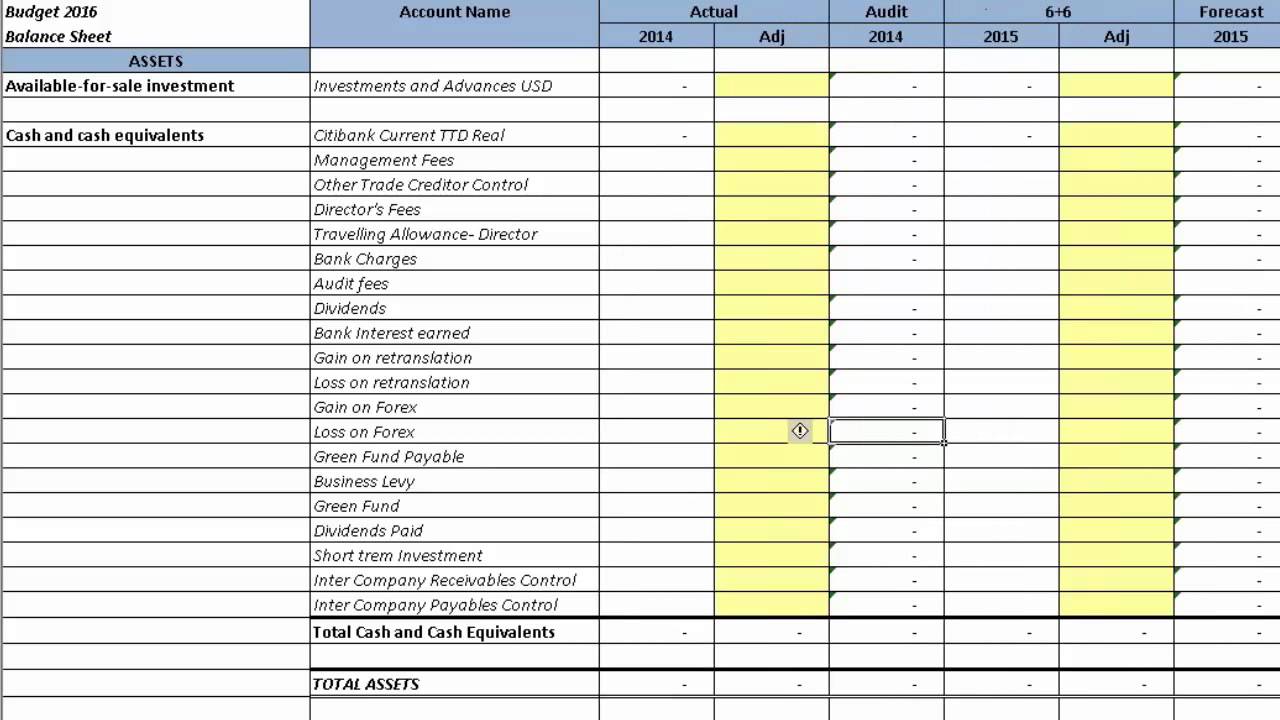

Hence, a budgeted balance sheet is a financial statement that reports the expected value of assets, liabilities, and equity that a company will be held in the future. The budgeted balance sheet is the estimated assets, liabilities, and equities that the company would have at the end of the year if their performance were to meet its expectations. Collect the data of all budgets.

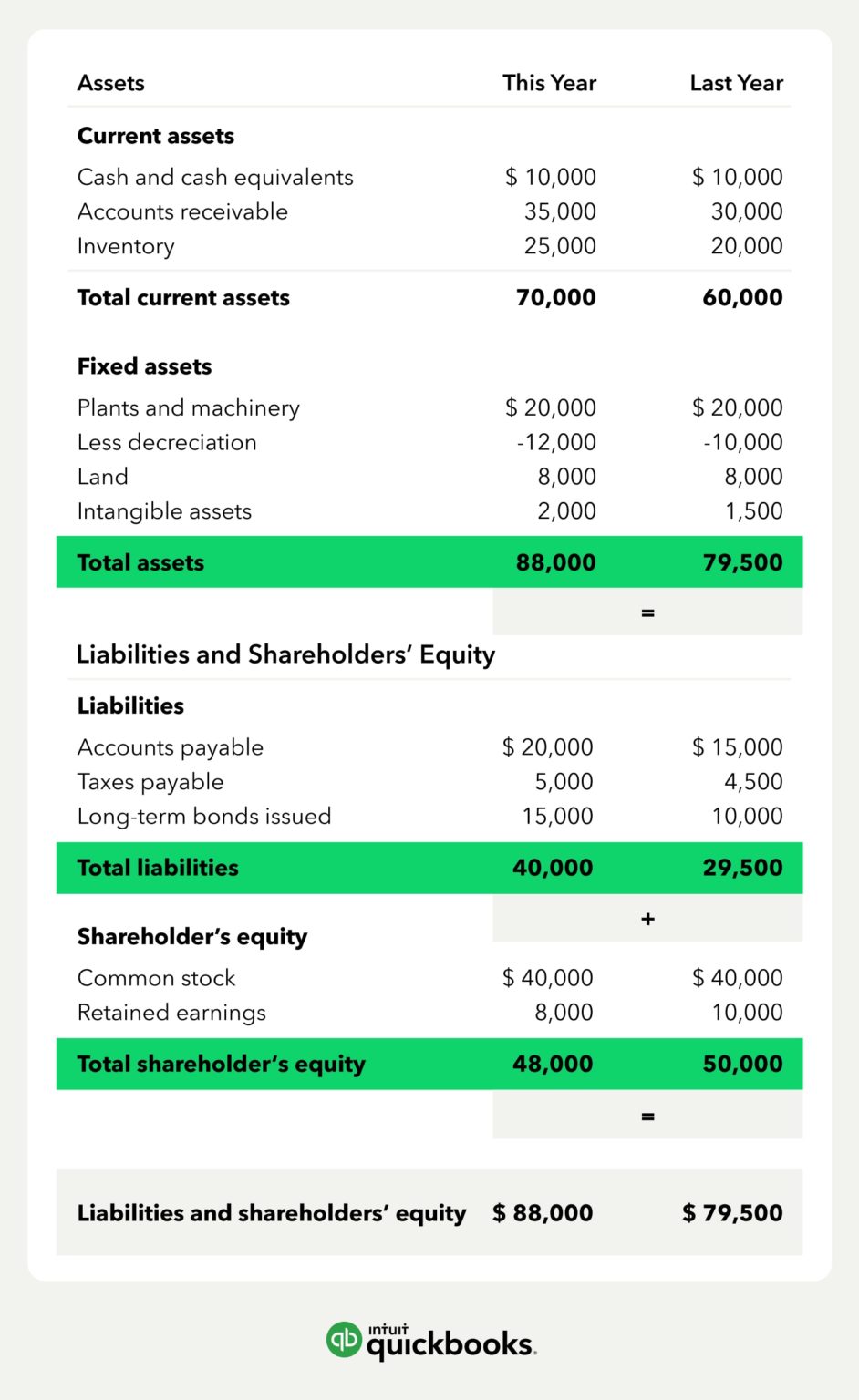

A balance sheet provides a summary of a business at a given point in time. This expected value is arrived at by making inflation adjustments or maybe increasing or decreasing capacity. The beginning balance for each account is the amount on the balance sheet prepared at the end of the preceding period.

Therefore, it needs to be prepared before the cash budget. A balance sheet lays out the ending balances in a company's asset, liability, and equity accounts as of the date stated on the report. Budgeted balance sheet and master budget.

It should be based on the projected, budgeted transactions. Balance sheets serve two very different purposes depending on the audience reviewing them. In other words, the budgeted balance sheet shows where all of the accounts would be at the end of a period if the actual company performance matched the budgeted.

Table 7.1 shows a list of the most common changes to the balance sheet and where the information is derived. Making adjustments to real balance sheet. Then, managers consider the effects of any planned activities on each account.

What is a balance sheet? T he budgeted statement of financial position depends on the various individual budgets which have been prepared. It all depends upon the needs and requirements of the company, budgeted balance sheets are also a great tool for the budget department to help them prepare a budget.

Preparing a projected balance sheet, or financial budget, involves analyzing every balance sheet account. Positive amounts indicate an increase, regardless of. The budgeted balance sheets just like the balance sheets can be prepared on a monthly, quarterly, or annual basis.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)