Impressive Info About Other Comprehensive Income Balance Sheet

For example, gain or loss on an investment can be realized when it is sold.

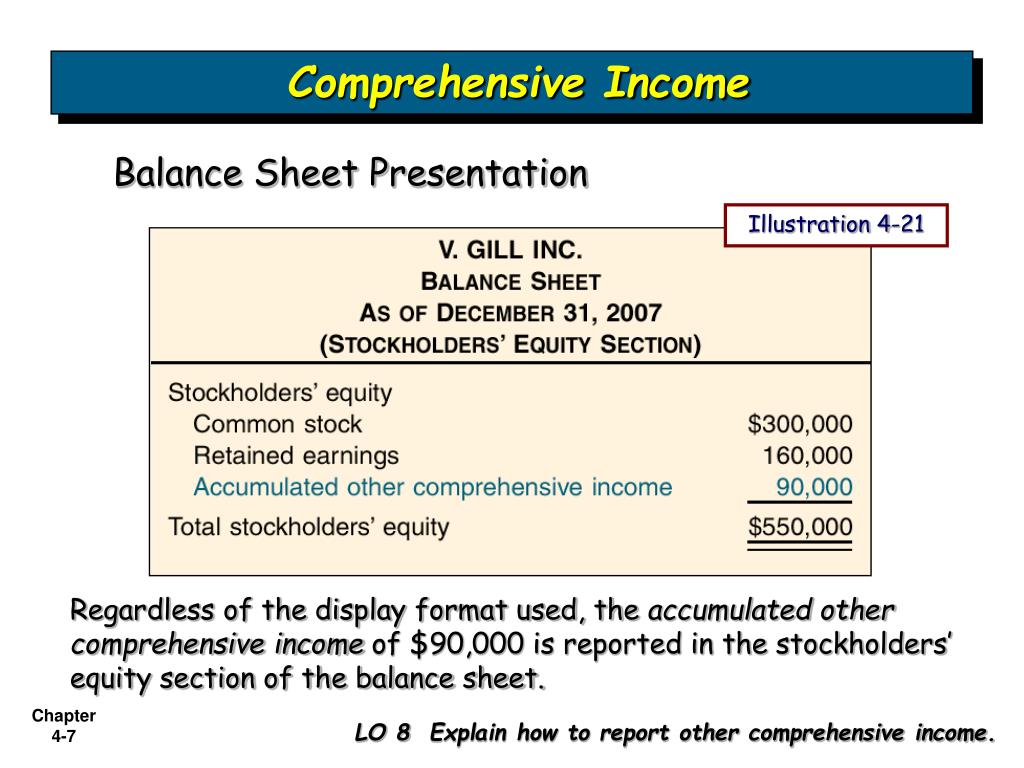

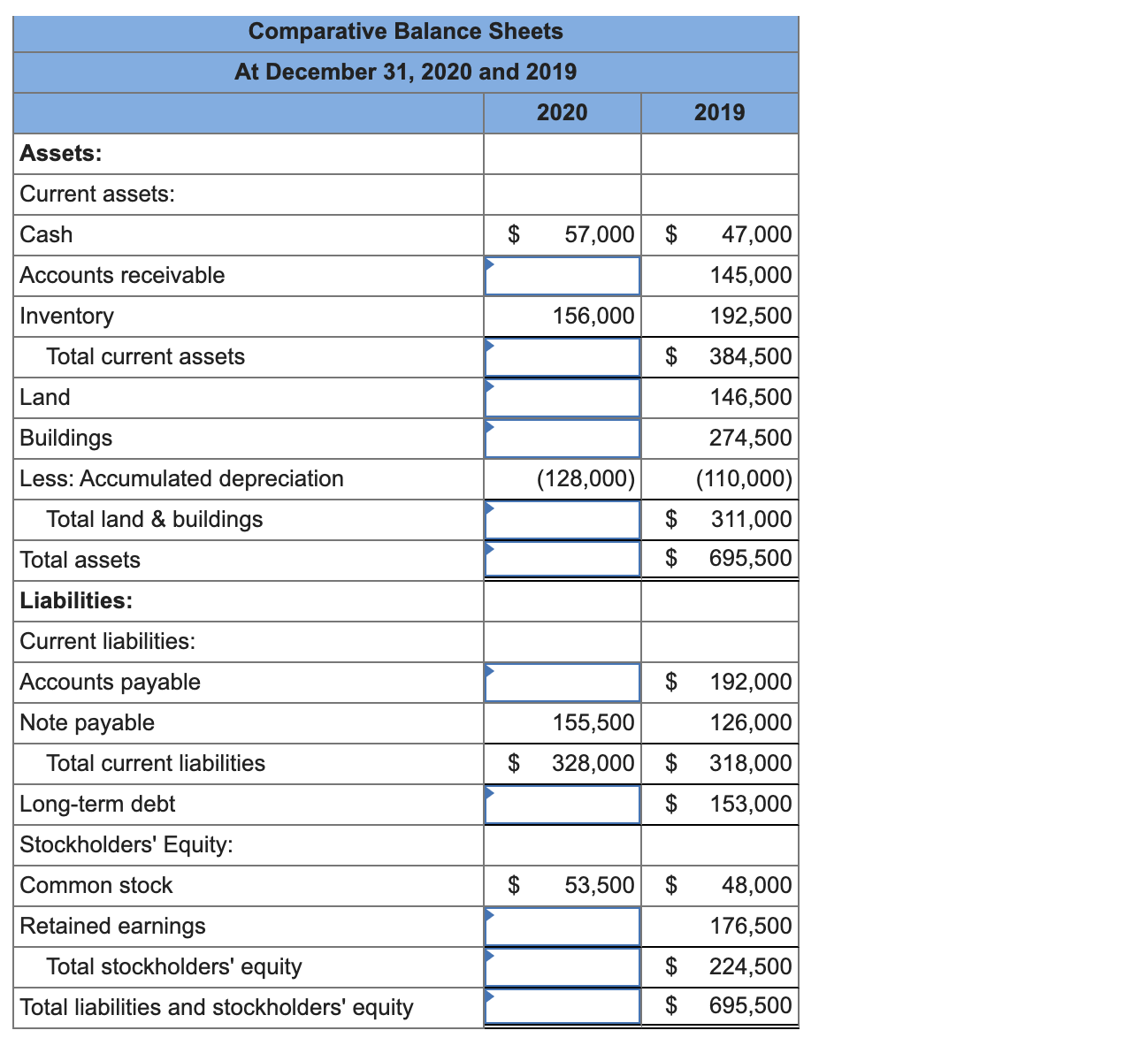

Other comprehensive income balance sheet. Comprehensive income and a change in terminology in the titles of financial statements. In addition to reporting the gains or losses (and other elements of comprehensive income) that occur in the current reporting period, we also report these amounts on a cumulative basis in the balance sheet. In june 2011 the board amended ias 1 to improve how items of other income comprehensive income should be presented.

In simple words it is gain or loss that has not been realized. An overview in financial accounting, corporate income can be broken down in a. Accumulated other comprehensive income (aoci) are special gains and losses that are listed as special items in the shareholder equity section of a company’s balance sheet.

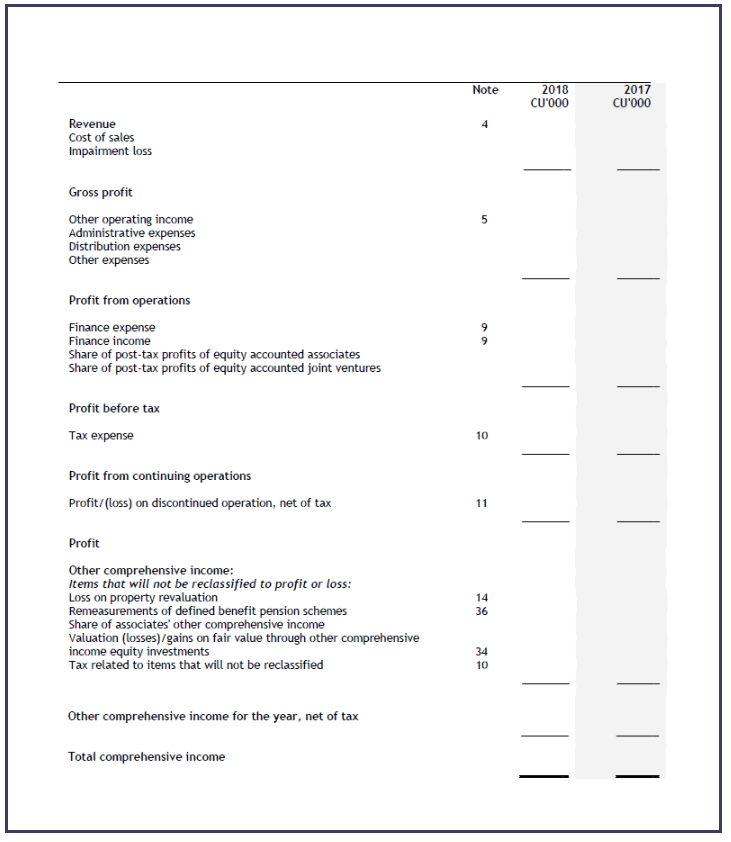

The other comprehensive income section is required to present line items which are classified by their nature, and grouped between those items that will or will not be reclassified to profit. Items that will be recognized in the income statement in the future (known as “recycling”) and items that will not be reclassified to. Accumulated other comprehensive income is the accumulation of any gains or losses on the change in fair value of certain investments.

Accumulated other comprehensive income is displayed on the balance sheet in some instances to alert financial statement users to a potential for a realized gain or loss on the income. Accumulated other comprehensive income is an accumulator account that is located in the equity section of a company’s balance sheet. If a company bought an investment for $1 million at the beginning of 2019, it would reflect that purchase price on its balance sheet.

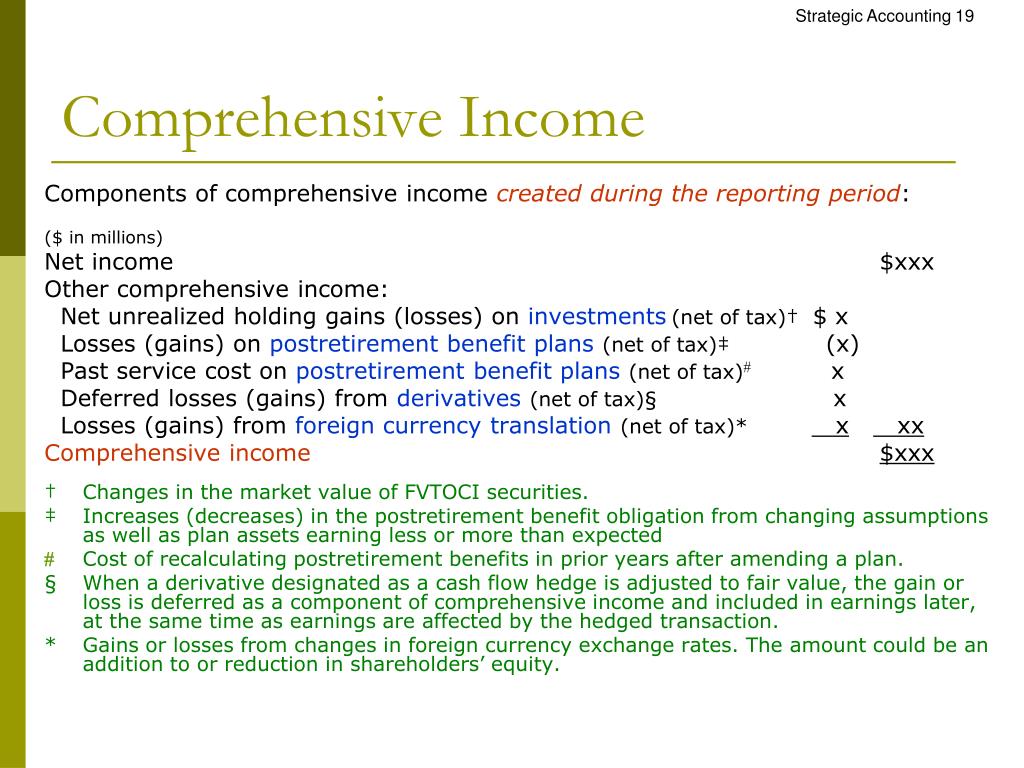

What is other comprehensive income? The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income (oci). The “other comprehensive income (oci)” line item is recorded on the shareholders’ equity section of the balance sheet and consists of a company’s.

Other comprehensive income, or oci, consists of items that have an effect on the balance sheet amounts, but the effect is not reported on the company's income statement. Aoci appears in the shareholders’ equity section of the balance sheet and gives clues about future financial health that. Other comprehensive income is shown on a company’s balance sheet.

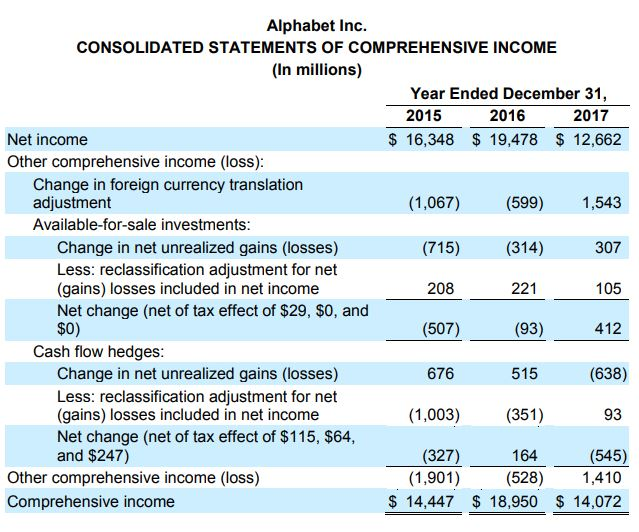

The information reported on the statement of other comprehensive income (oci) is an integral part of performance reporting. Instead, these changes are reported on the statement of comprehensive income along. Updated may 28, 2021 reviewed by charlene rhinehart comprehensive income vs.

In december 2014 ias 1 was amended by disclosure initiative (amendments to ias 1), Those items of oci that might be recycled subsequently; The aoci account is the designated space for unrealized profits or losses on items that are placed in the other comprehensive income category.

These can be from things like foreign currency changes or investments. Accumulated other comprehensive income (aoci) is part of a company’s equity that records gains and losses not yet realized in net income. Comprehensive income is the sum of a company's net income and other comprehensive income.

The expenses and income shown in other comprehensive income are divided into two categories: Accumulated other comprehensive income is a subsection in equity where other comprehensive income is accumulated (summed or aggregated). This helps reduce the volatility of net income as the value of unrealized gains/losses moves up and down.