First Class Tips About Cash Flow Fund

Free cash flow represents the cash a company generates after accounting for cash payments to.

Cash flow fund flow. Cash flow refers to the movement of money in and out of a company over a specific period. There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its weekly roundup of fund flows. Investors, financial analysts, and management use these statements to make important investment decisions regarding the company or the stock.

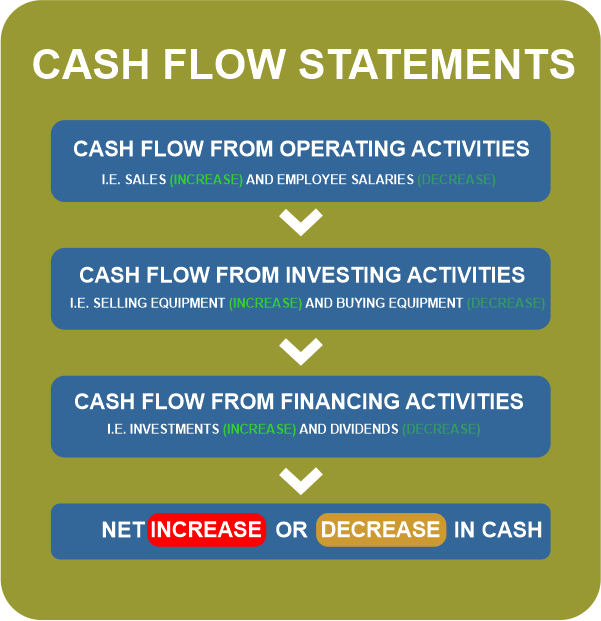

It also helps keep track of changing opening and closing cash balances. Difference between cash flow and fund flow statements meaning It is calculated as the total of cash from operations, cash flow from financing, and cash flow from investing activities.

Companies that exhibit high free cash flow yields, relative to the broader domestic equity market. A cash flow analysis should be preceded by a funds flow analysis. Cash flow kings 100 etf (flow) offers exposure to u.s.

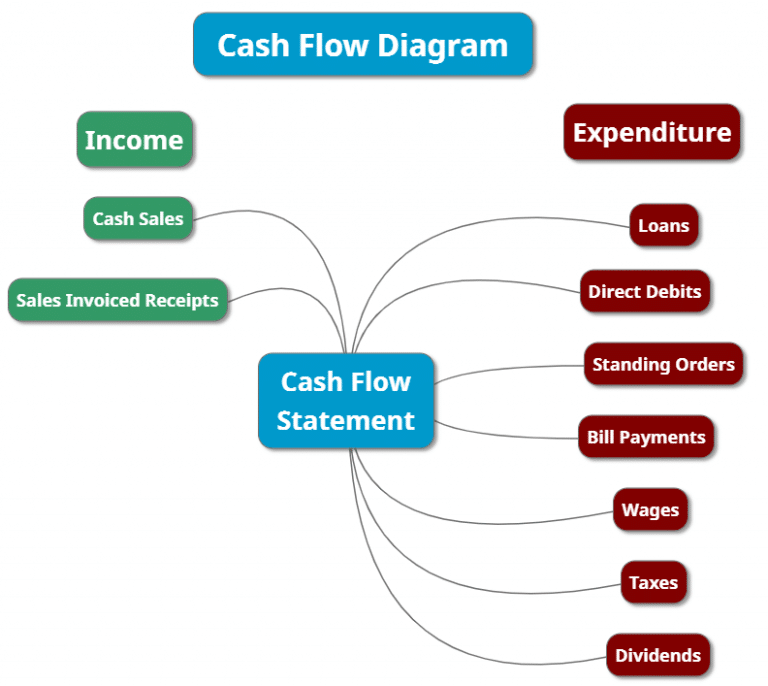

A fund flow is solely concerned with cash movement, indicating the net movement after assessing monetary fund inflows and outflows. The period of time can be monthly, quarterly or as required by the business. Moreover, it has two diverse functions.

One is for accounting, while the other is for investment. Fund flow doesn't measure the. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric.

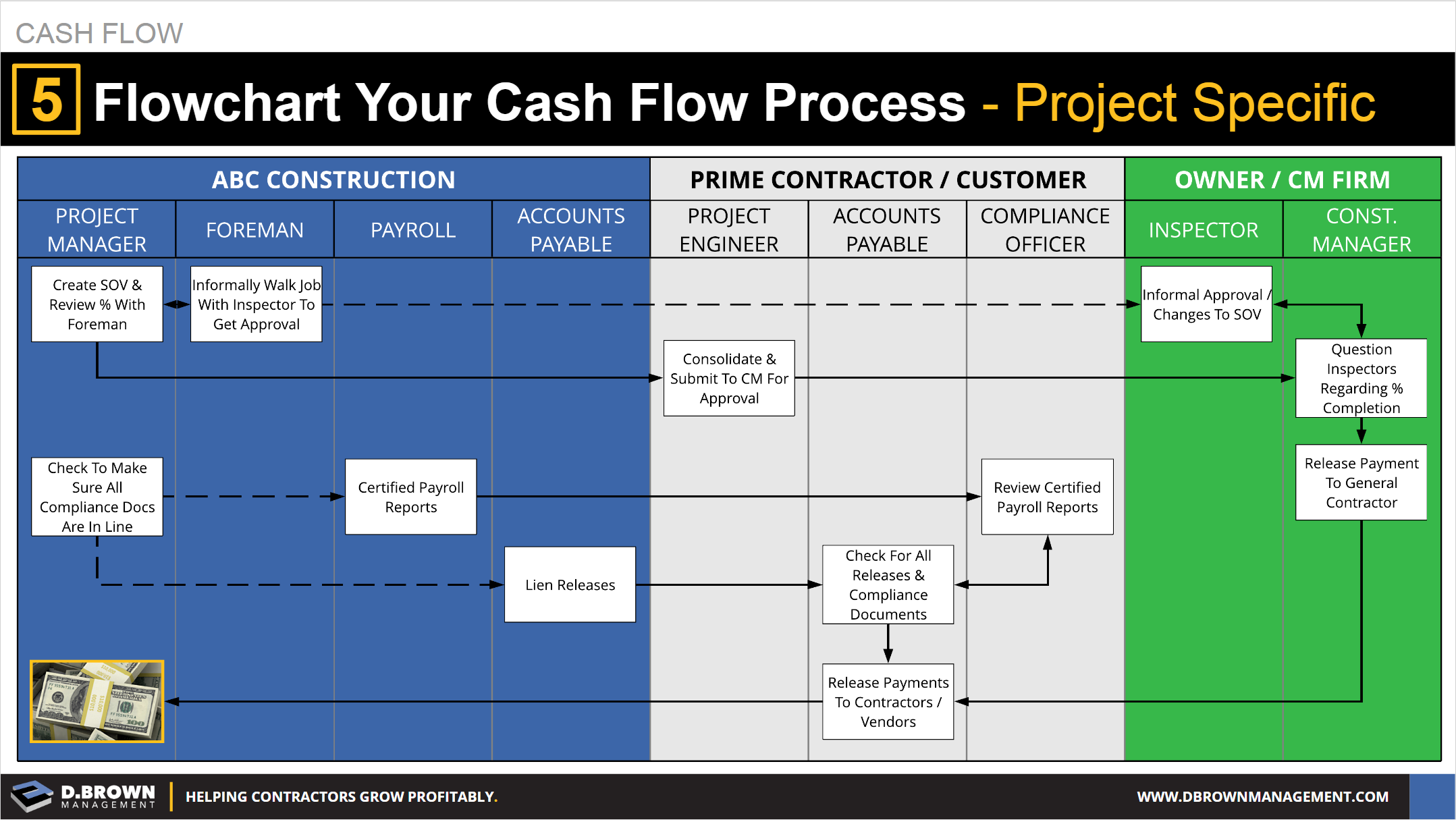

The cash flow statement shows opening cash balance, closing cash balance, and causes of changes in cash balances during the accounting period whereas the fund flow statements indicates sources from where the funds are raised and areas where the funds are deployed. Payments to investors or payments are given to the firm in return for goods and services are examples of these transactions. Fund flow, on the other hand, registers the activities of money that comes in and out of business.

The cash flow statement shows the inflow and outflow of cash, whereas the fund flow. A company creates value for. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

It's usually measured on a monthly or quarterly basis. Fund flow is the cash that flows into and out of various financial assets for specific periods of time. Free cash flow is a measure of profitability that correlates with quality, growth and value factor orientations, 2 making flow a potentially appealing.

Cash flow refers to the overall cash generated by the firm in a specific accounting period. In this chapter, the importance of cash flow analysis as a modern day tool of appraisal and monitoring is highlighted. Cash flow statement vs fund flow statement:

Fund flows reveal a tidal shift in active vs. A fund flow statement is a financial statement that provides information about the inflow and outflow of funds in a business, both from internal and external sources. Some exchange traded funds, including.

/GettyImages-1163745146-8e67b32f7c8042d5b10b799dd850cec7.jpg)