Outrageous Tips About Indirect Method In Cash Flow Statement

The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources.

Indirect method in cash flow statement. Sandhill company statement of cash flows for the year ended december 31, 2025. What is the cash flow statement indirect method. These adjustments include deducting realized gains and other adding back realized losses to the net income total.

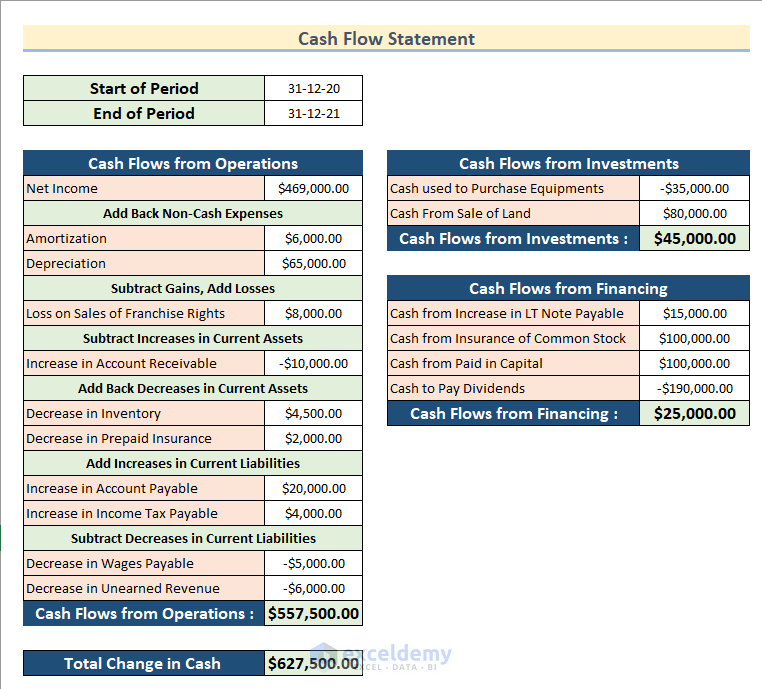

Indirect cash flow method. The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income.

Using the balance sheet changes, the indirect. It is used to generate a cash flow statement. In this course, designed for class 12 students, you will learn the esse.

Add back noncash expenses, such as depreciation, amortization, and depletion. Instead, most companies use the indirect method to prepare the statement of cash flows. Accordingly, even when a reporting entity is using the indirect method, it should consider the direct method framework when evaluating the proper classification of a cash flow.

The indirect method requires combining information from the company’s income statement (or profit and loss statement) and its balance sheet. The direct method is intuitive as it means the statement of cash flow starts with the source of operating cash flows. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories.

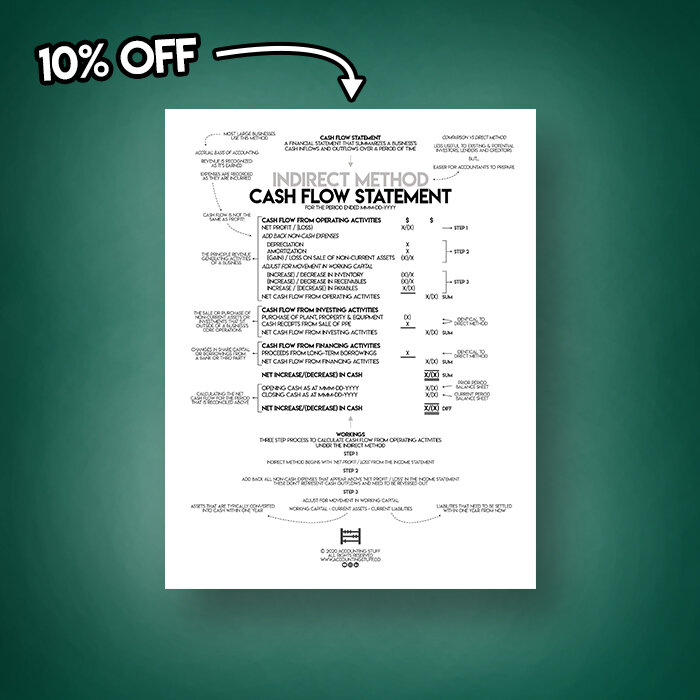

Welcome to pek academy's class 12 course on the cash flow statement for cfa students! Depreciation loss or gain on sale of fixed assets miscellaneous expenses written off investment income interest dividend operating profit before working. Under the indirect method, the format of the cash flow statement (cfs) comprises of three distinct sections.

The indirect method reports cash flows from operating activities into categories such as: Determine net cash flows from operating activities. There are two ways to prepare the cash flow statements.

It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: Company a had net income for the year of $20,000 after deducting depreciation of $10,000, yielding $30,000 of positive cash flows. The cash flow statement indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities.

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. What is the cash flow statement indirect method? It takes the company's net income and adds or deducts balance sheet items to determine cash flow.

Adding interest expense and subtracting interest paid; Add tax expense and subtracting tax paid; The indirect method is one of the two treatments for creating cash flow statements.