Heartwarming Tips About The Reports And Financial Statements Prepared By Accountants Best Balance Sheet Format

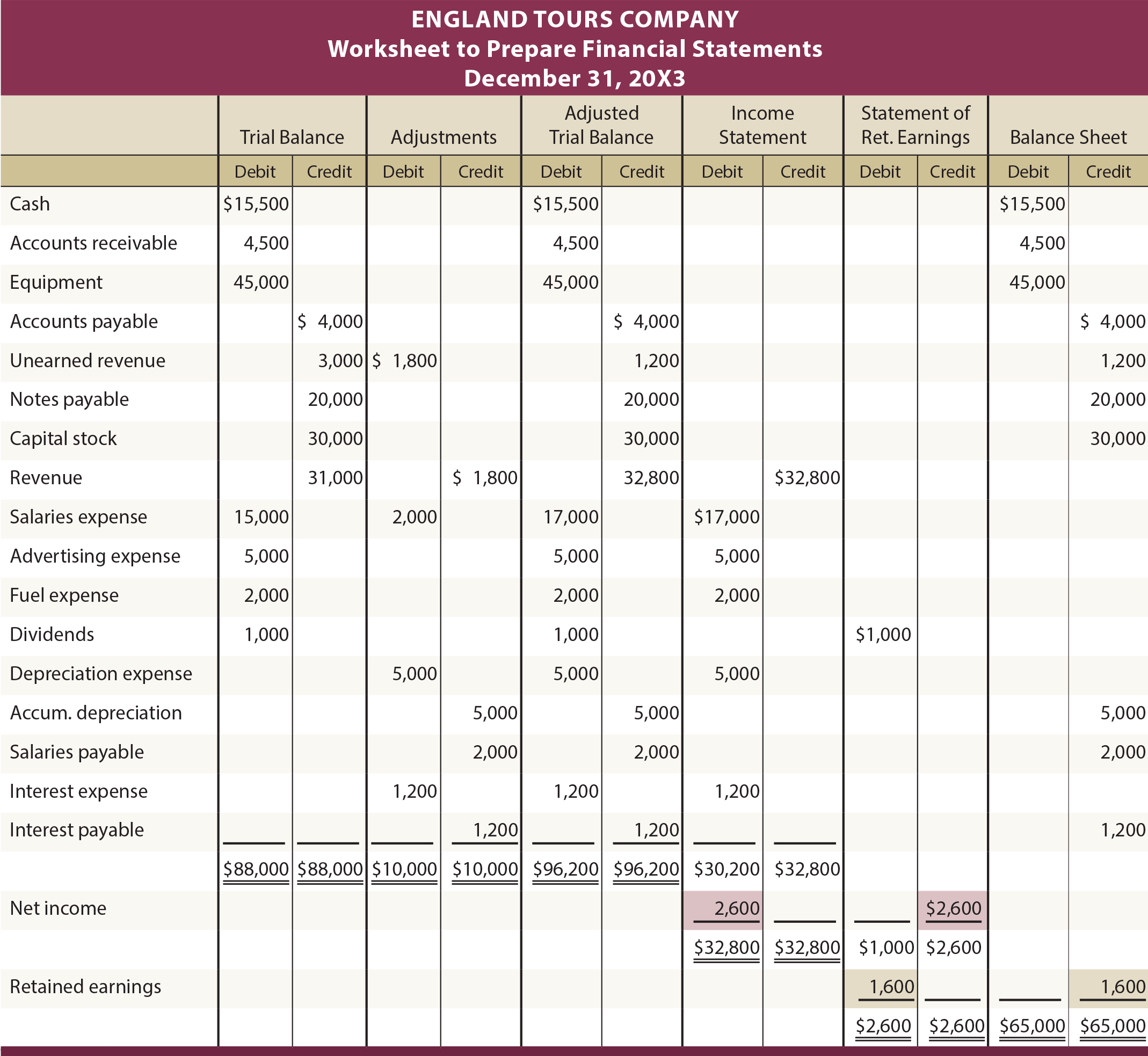

Preparing financial statements is the seventh step in the accounting cycle.

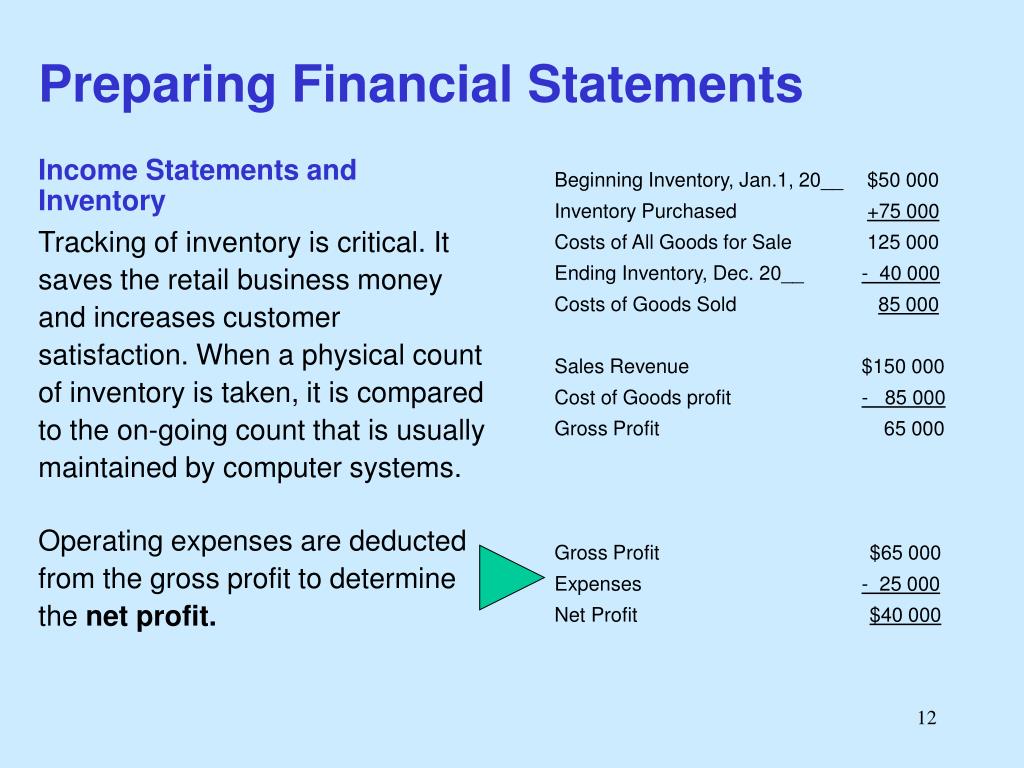

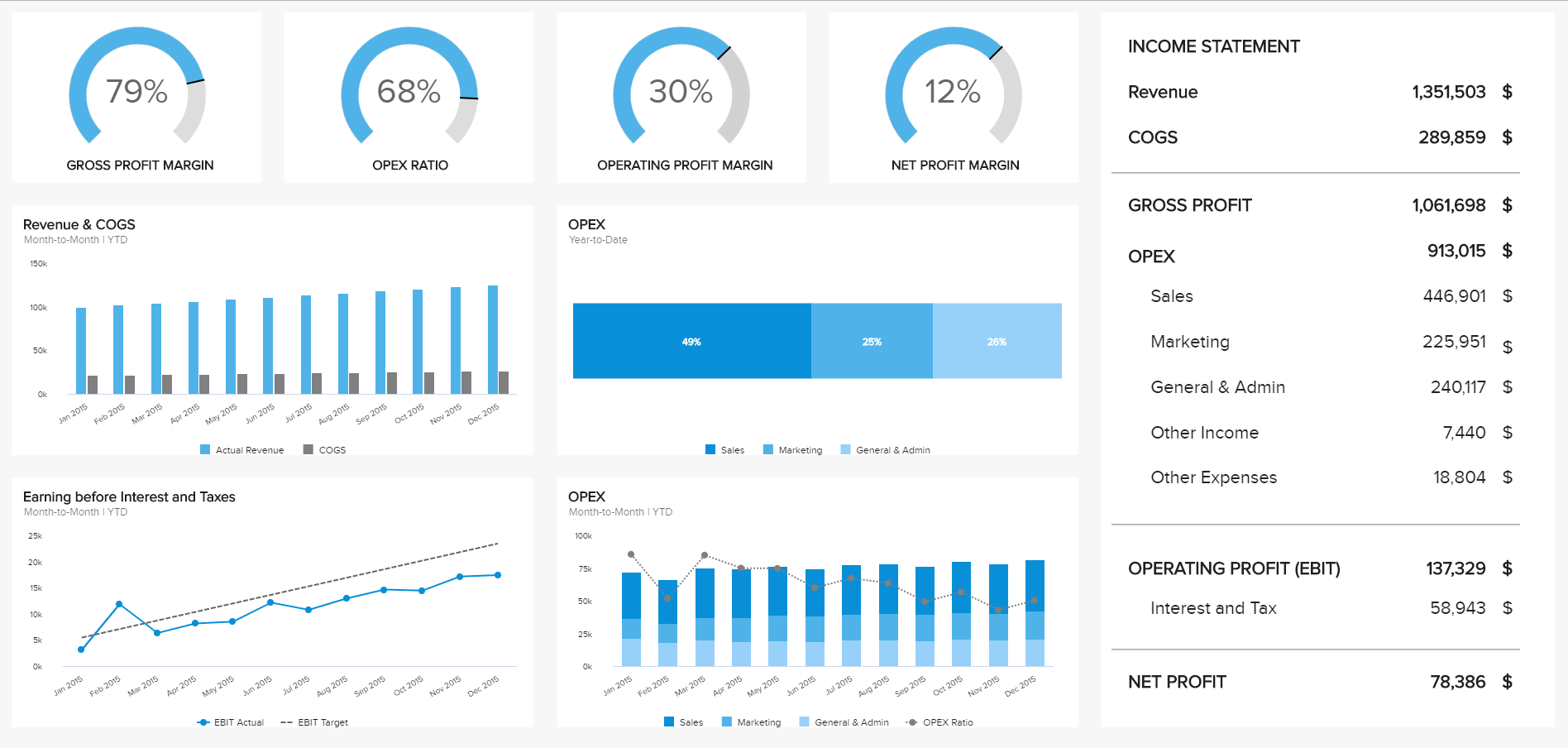

The reports and financial statements prepared by accountants best balance sheet format. Balance sheet, income statement, and statement of cash flows. A financial statement is made up of four main documents: A good cash flow has more money coming in than going out.

Financial statements are prepared in the following order: A cash flow statement also looks at how. The four financial statements include the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity.

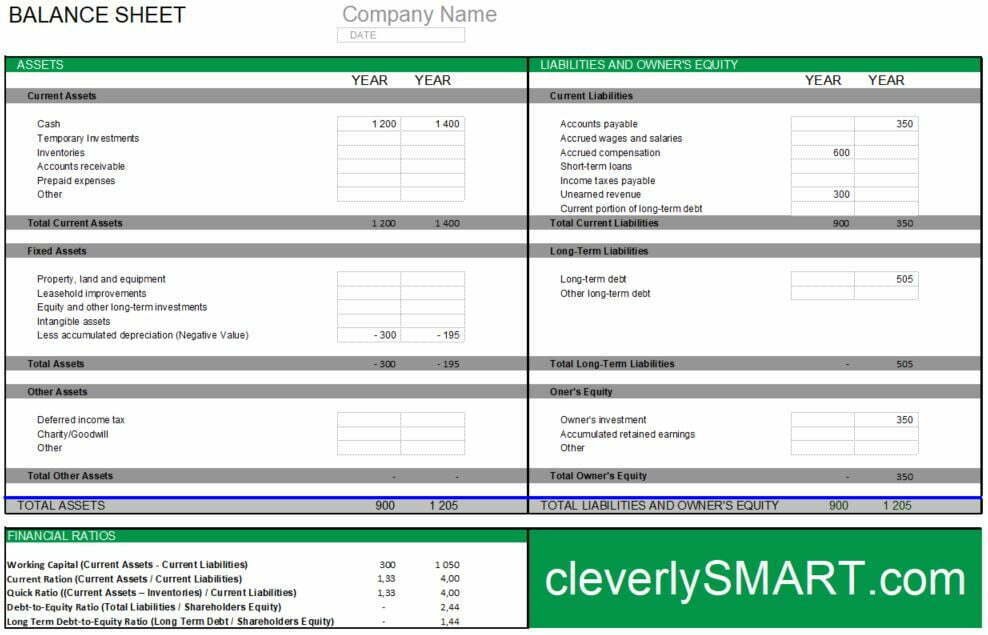

Click the card to flip 👆. Statements required by generally accepted accounting principles are the balance sheet, the income statement, and the statement of cash flows, but you'll likely see more in reports. A set of financial statements includes two essential statements:

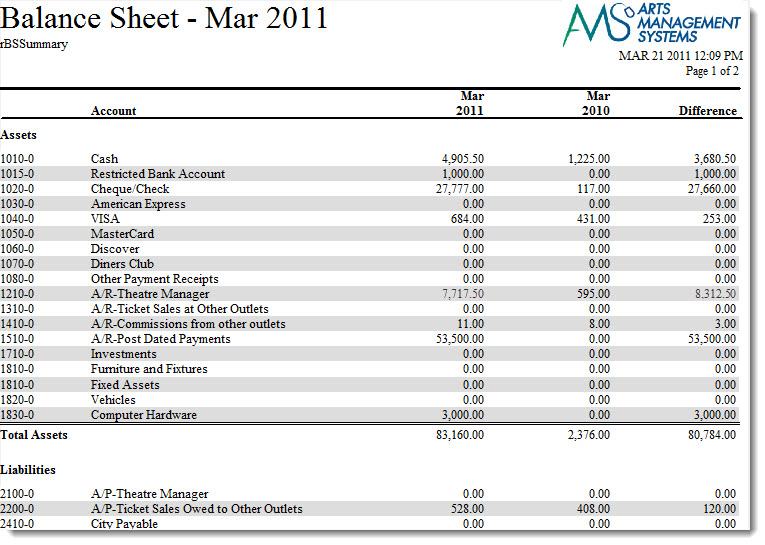

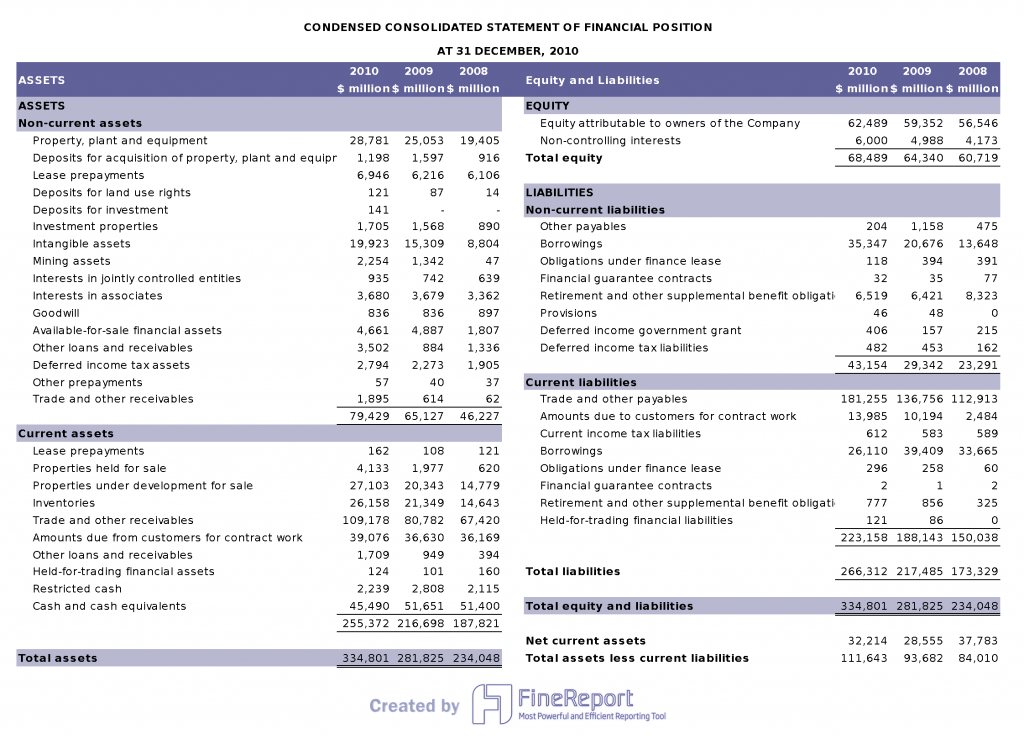

Data found in the balance sheet, the income statement, and the cash flow statement. It provides insights into a company’s inflows and outflows of cash during a specific period of time, which can conclude in a positive or negative cash flow. Sequence of accounts in a balance sheet analyzing the balance sheet a.

A set of financial statements is comprised of several statements, some of which are optional. Often, the reporting date will be the final day of the accounting period. With assets listed on the left side and liabilities and equity detailed on the right.

A statement of cash flow on any balance sheet should be positive. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. Ledger, journal, and trial balance.

Determine the reporting date and period. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Provide information that can be used by decision makers both inside and outside the organization.

Financial accounting calls for all companies to create a balance sheet, income statement, and cash flow statement, which form the basis for financial statement analysis. Limited companies are legally required to produce financial statements (both a balance sheet and profit and loss account) when they file their company accounts at the end of the financial year. The information found on the financial statements of an organization is the foundation of corporate accounting.

This involves carefully reviewing your financial statements, such as income statements, balance sheets, and cash flow statements, to understand how your business is performing financially. Heading into 2024, it’s essential to dedicate your time to thoroughly examining and analysing the inflow and outflow of cash in your business. The three important financial statements prepared by accountants are.

Consistent with the equation, the total dollar amount is always the same for each side. The balance sheet or statement of financial position of a firm contains a list of its resources and. Revenue summary, expense summary, and consolidation statement c.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)