Outstanding Info About Gaap Financial Statements Balance Sheet Format Ifrs

Us gaap lists assets in decreasing order of liquidity (i.e.

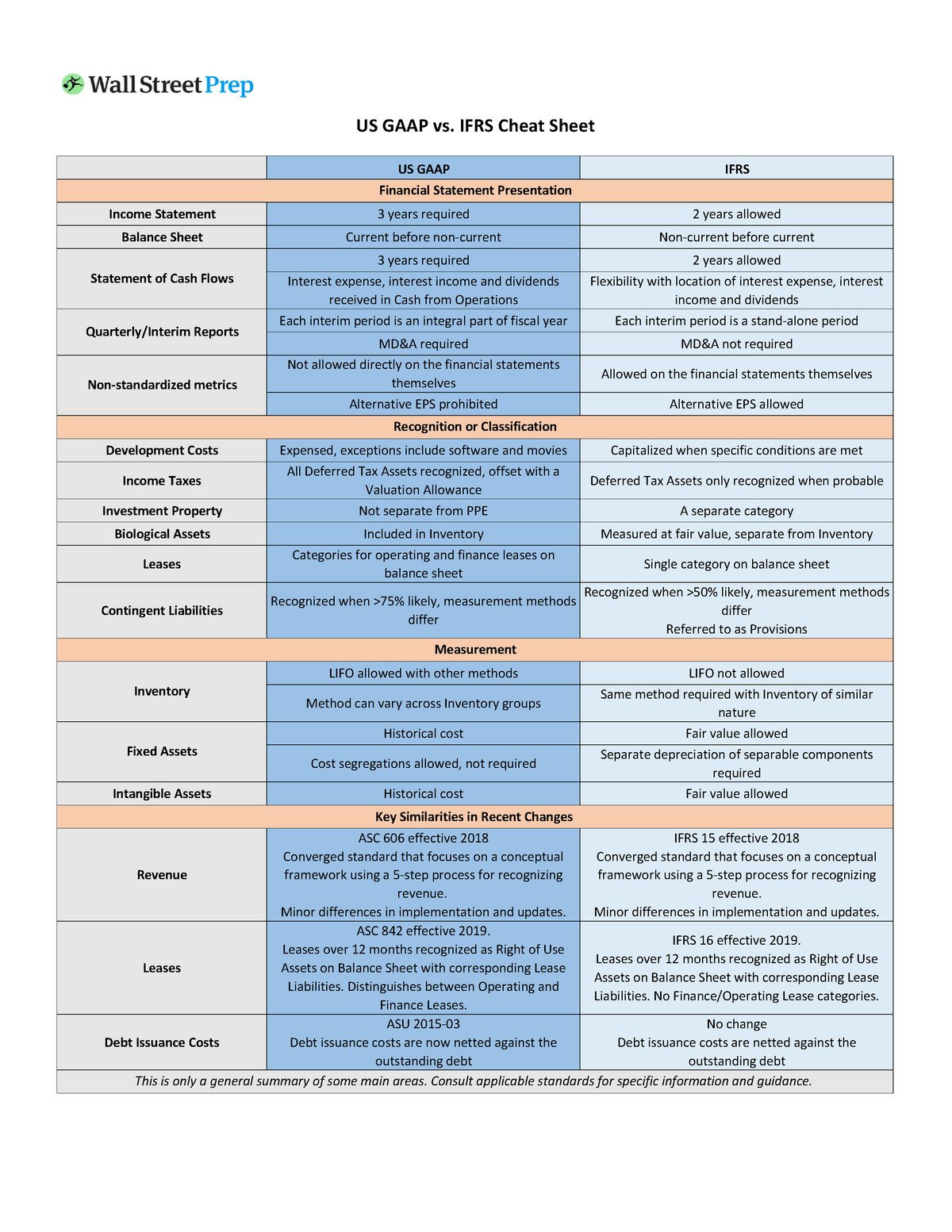

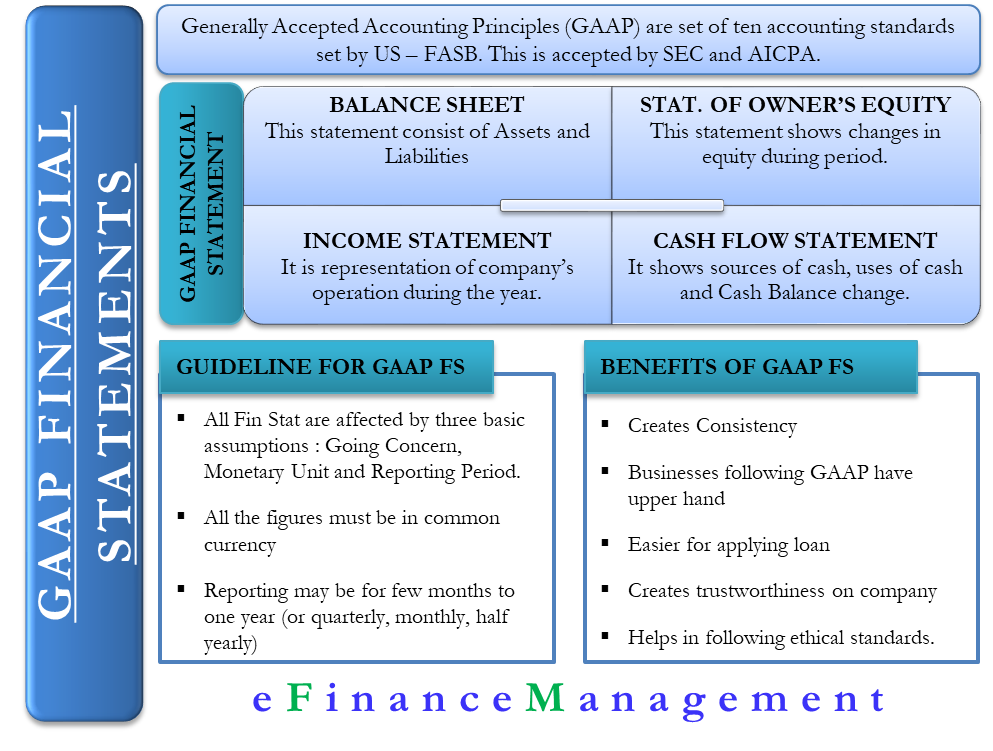

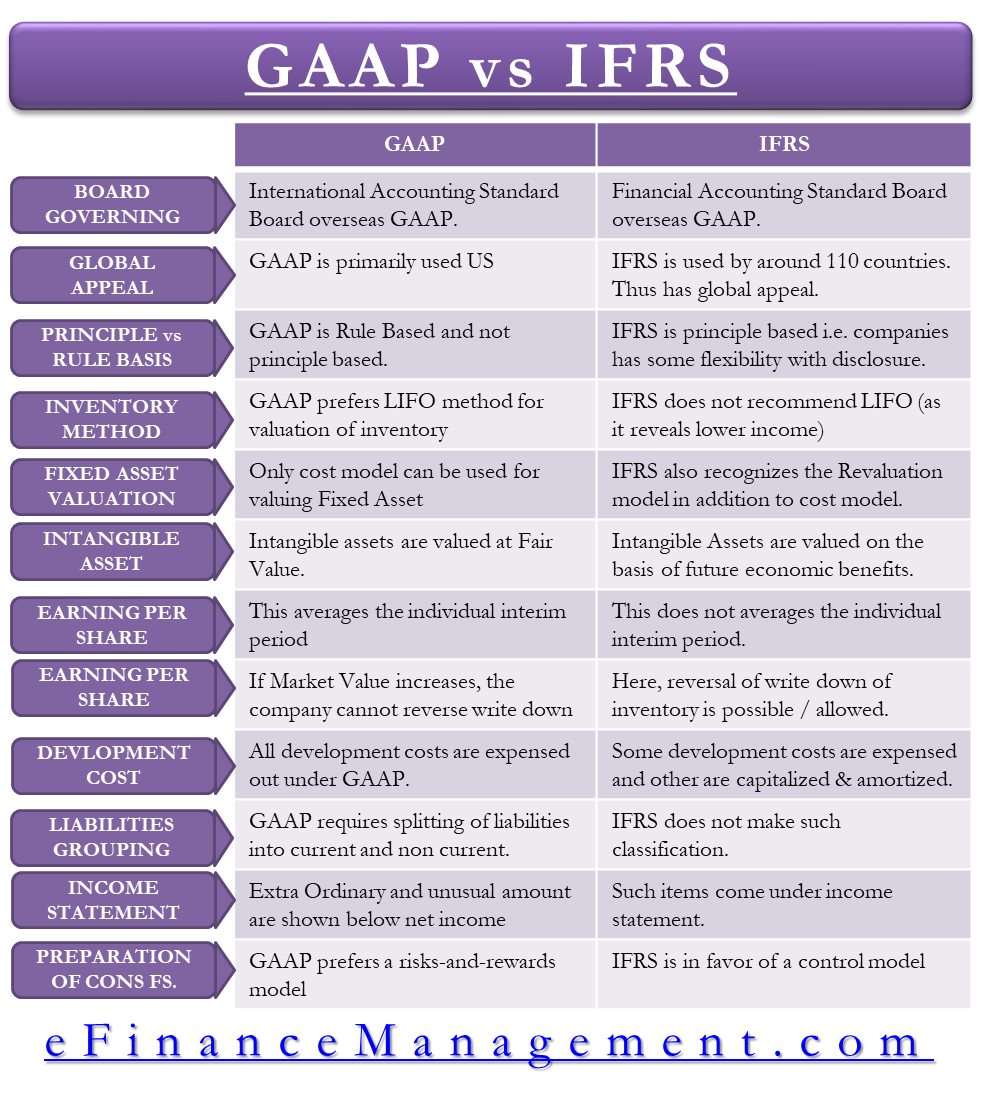

Gaap financial statements balance sheet format ifrs. Ebit excluding certain items which do not reflect the corporations core performance or where their separate presentation will assist users of the consolidated financial statements in understanding the corporation’s results for the period. The two standards both offer the same guidelines when entities and companies deal with cash and cash equivalents on the balance sheet. Both gaap and ifrs require the presentation of balance sheets, statements of cash flows, and income statements.

Under gaap, current assets are listed first, while a sheet. Petrus uses net debt as a key indicator of its leverage and strength of its balance sheet. One of the features of this ifrs is that it includes guidelines for the structure and content of financial statements, including information about the statement of profit or loss and other comprehensive income (p&l and oci) and the statement of financial position (balance sheet).

Under both sets of standards, the components of a complete set of financial statements include a statement of financial position (balance sheet), a statement of profit or loss (income statement) and of other comprehensive income (in. Gaap vs ifrs balance sheet similarities. Because of its importance, its format is often debated and scrutinized by preparers, users, regulators, standard setters and others.

4 i luxembourg gaap compared to ifrs financial statements topic lux gaap treatment and disclosure ias/ ifrs reference. The way a balance sheet is formatted is different in the us than in other countries. There are many similarities in us gaap and ifrs guidance on financial statement presentation.

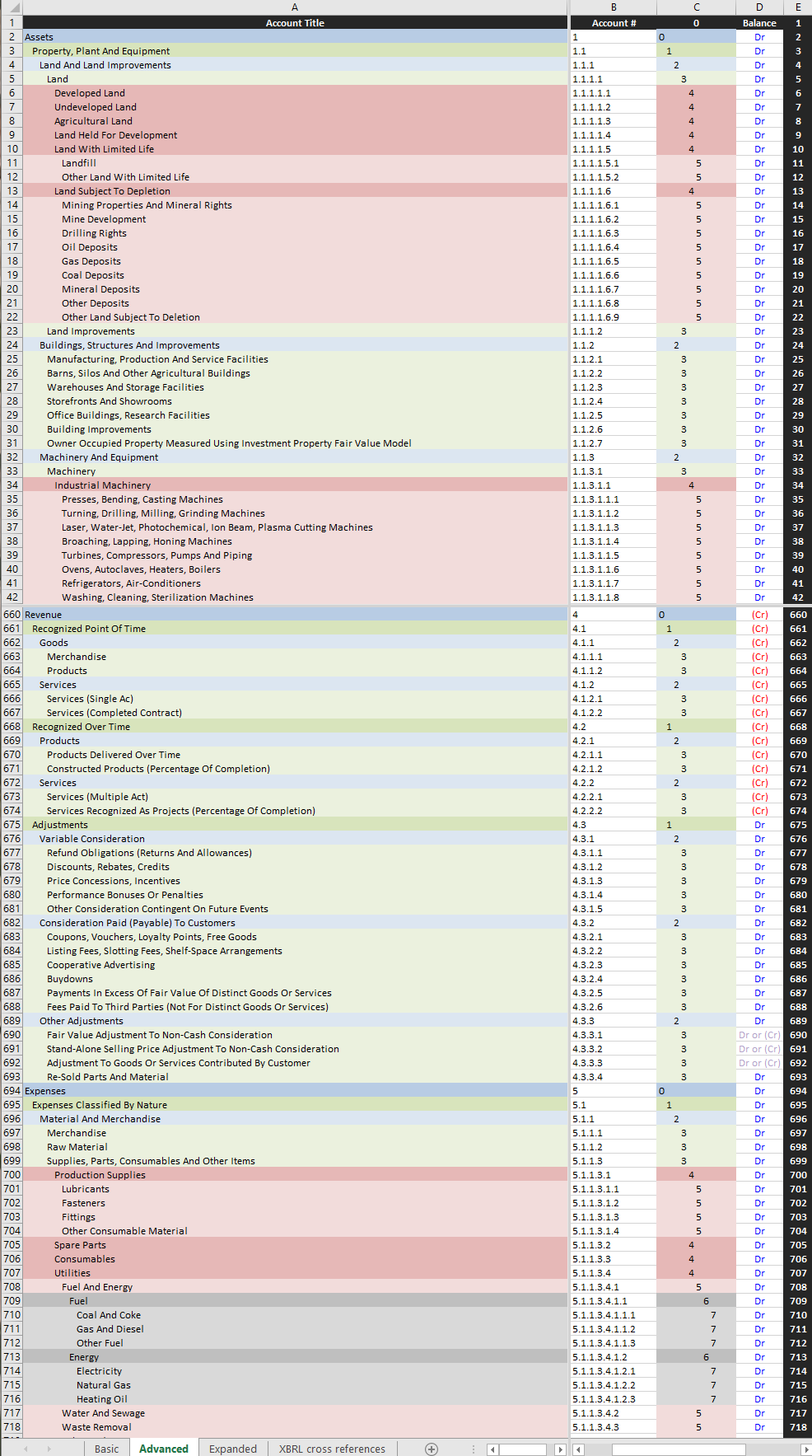

This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. The statement of cash flows Organising the statement of profit 106 or loss by function of expenses appendix b:

Presentation of financial statements. Reported in the financial statements. International gaap holdings limited is assumed to have presented financial statements in accordance with ifrs standards for a number of years.

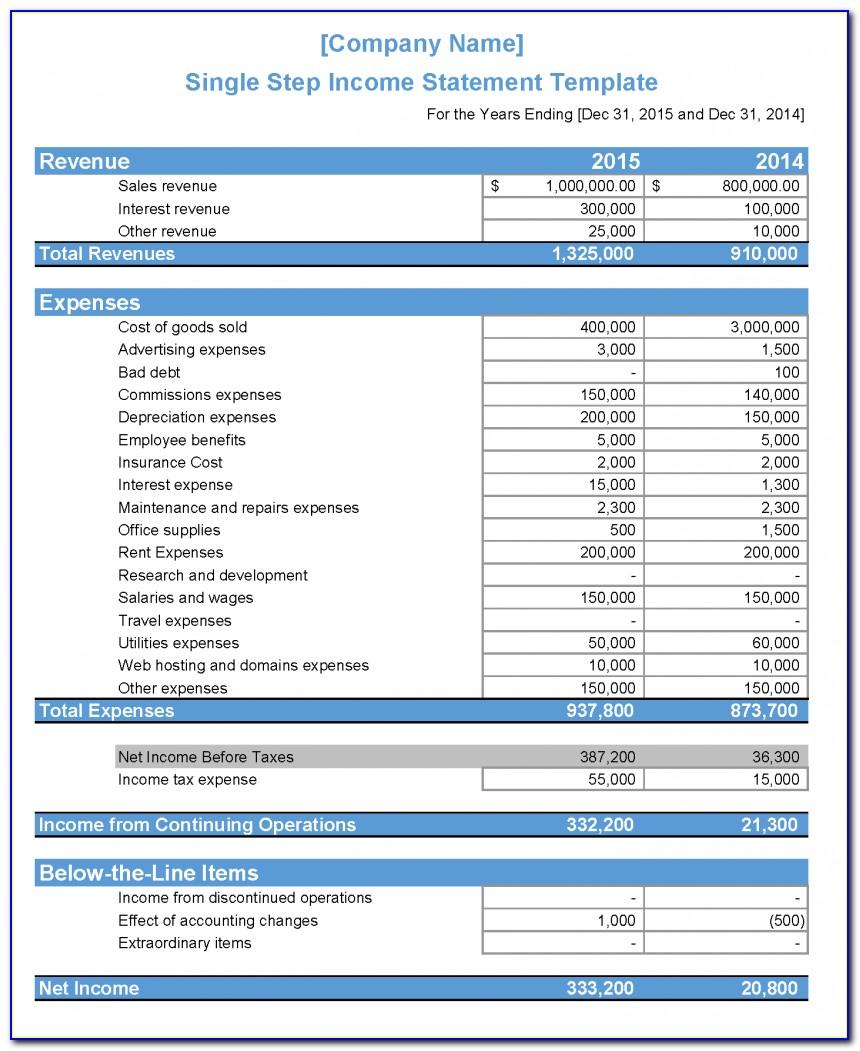

It is intended to help entities to prepare and present financial statements in accordance with ifrs standards a by illustrating one possible format for financial statements for a fictitious multinational corporation (the group) involved in general business activities. Under ias 1 [1], the income statement is the primary financial statement used to provide an understanding of a company’s performance and operations over a defined period of time. This publication provides illustrative financial statements for the year ended 31 december 2021.

Readers should refer to ifrs 1 for specific requirements regarding an entity’s first ifrs financial statements. The us gaap and ifrs require the components of a complete set of financial statements which include a balance sheet (or statement of financial position), an income statement, a statement of comprehensive income as well as a statement of cash flows and accompanying notes to the financial statements. This hypothetical reporting entity has been applying

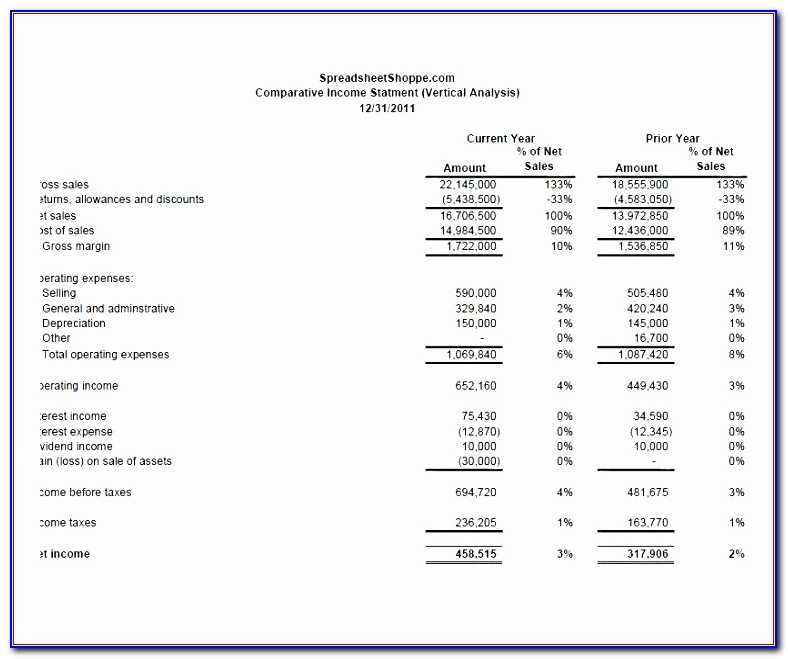

You’ll learn the key differences between us gaap and ifrs on the 3 main financial statements (income statement, balance sheet, and cash flow statement). The most directly comparable financial measure that is disclosed in the company's primary financial statements is oil and natural gas revenue, which was $152.4 million for the year ended december. While gaap and ifrs share many similarities, there are several contrasts, beyond the regions in which they’re applied.

These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk companies reporting under frs 102, 'the financial reporting standard applicable in. It sets out overall requirements for the presentation of financial You’ll also learn how to adjust an international company’s financial statements to make it easier to model and project over time.