Breathtaking Tips About Understanding Financial Reports

Financial reports provide vital information to investors, lenders, and managers.

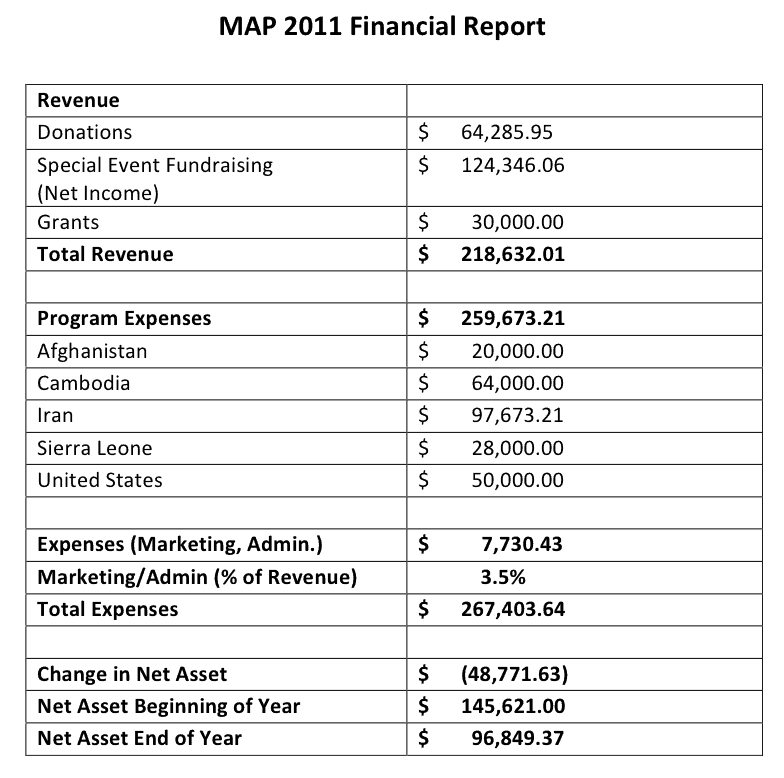

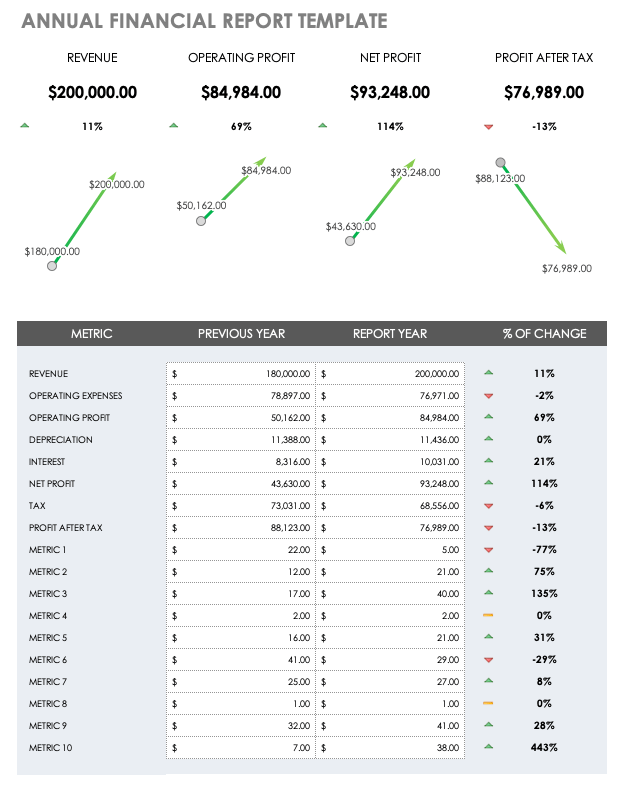

Understanding financial reports. However, financial reports aren’t used only because they are practical; Financial reports are used to track, analyze, and display your company’s cash flow. 15 financial report examples to communicate financial data.

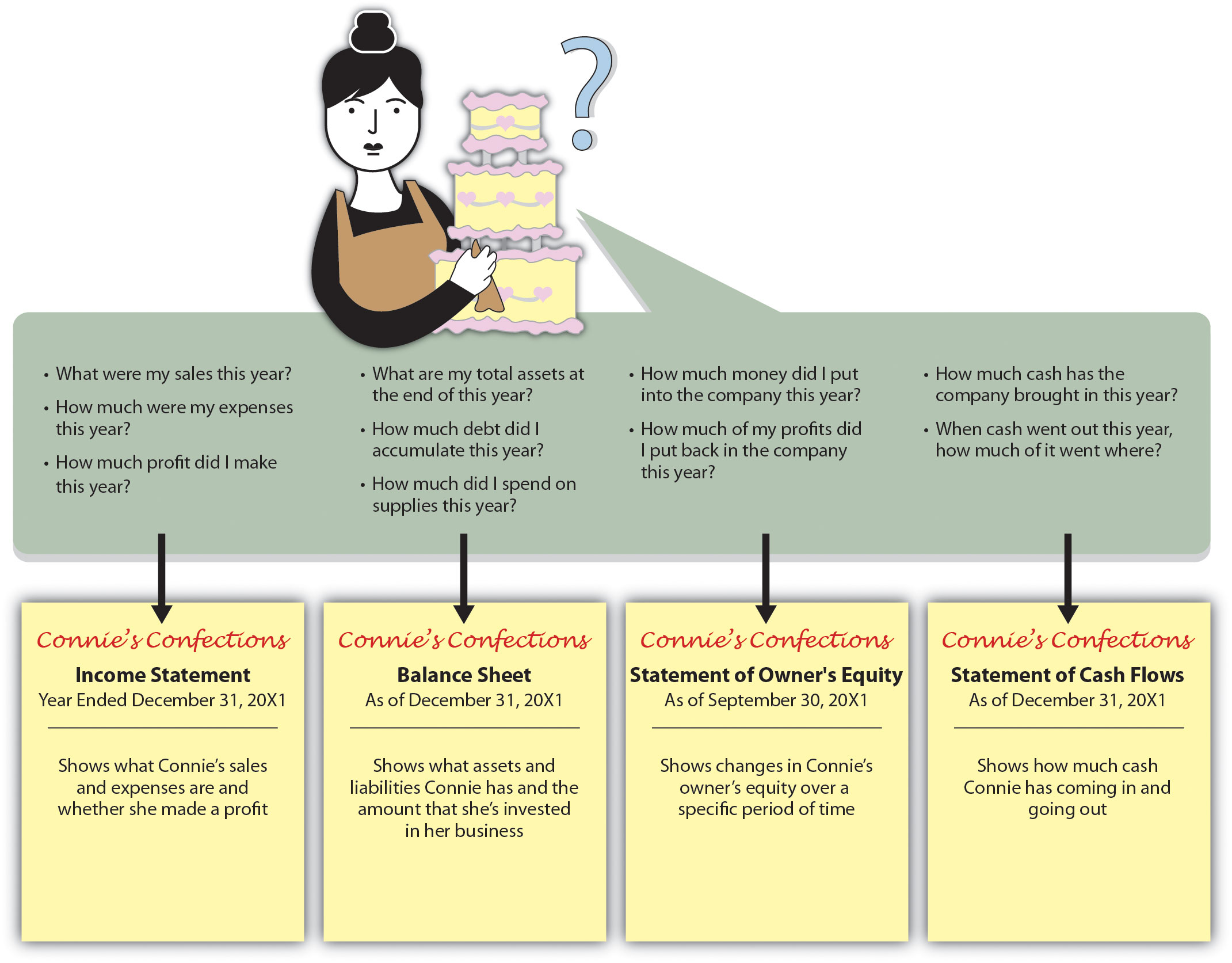

The primary financial statements that businesses use are the balance sheet, income statement, and cash flow statement. Understanding financial statements can benefit those looking to invest in or partner with companies that offer secured credit cards. Learn how to read these documents, and you will gain insight into your own finances and those of any company you may invest in.

What are financial statements? Financial statements will tell you how much money the firm has and how much debt it owes. Not all financial statements are created equally.

Financial statements should be read in the context of the company’s. What is a financial report? Just as a cpr class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement.

Financial reporting involves documenting and communicating a company’s financial activities and performance during specific time periods, usually on a quarterly or yearly basis. The updated new edition of the comprehensive guide to reading and understanding financial reports. Financial statements play an important role in helping you to understand the financial position of your business.

Financial reporting is how a business shows its financial data to key figures both internal and external. You are legally required to include them. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements:

It reveals a company’s true financial position. It’s a way to show the financial health of your company, and to get an understanding of where improvements can be made. Financial statements are formal reports that provide information about the economic activities of a company, including its revenue, expenses, profits, and cash flow.

In this free guide, we will break down the most important types and techniques of financial statement analysis. What is the purpose of financial reporting? (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return.

Balance sheets, income statements, cash flow statements, and annual reports. Balance sheet (statement of financial position) Companies utilize financial reports to organize accounting data and present their current financial status.

Financial reporting is the accounting process for communicating financial information. Think of it like your company mot. These financial reports are used for a number of different reasons, such as organizing your accounting data and reporting on the company’s current financial status.