Ace Tips About Subsidiary Meaning In Accounting

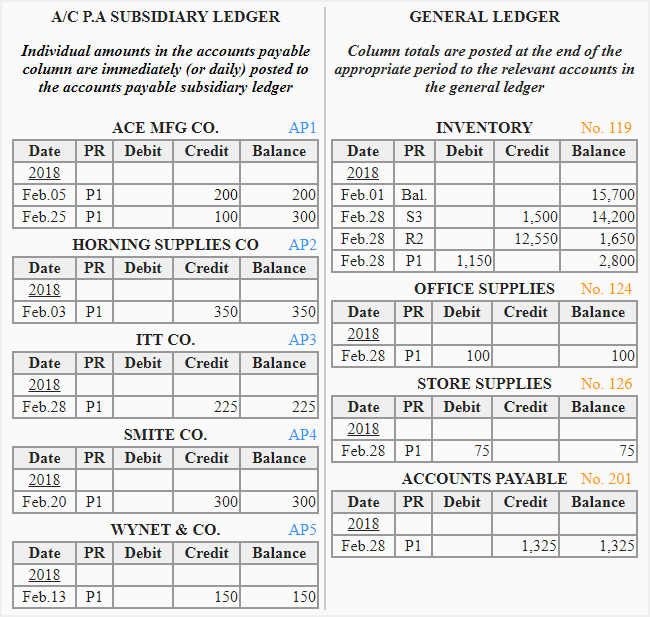

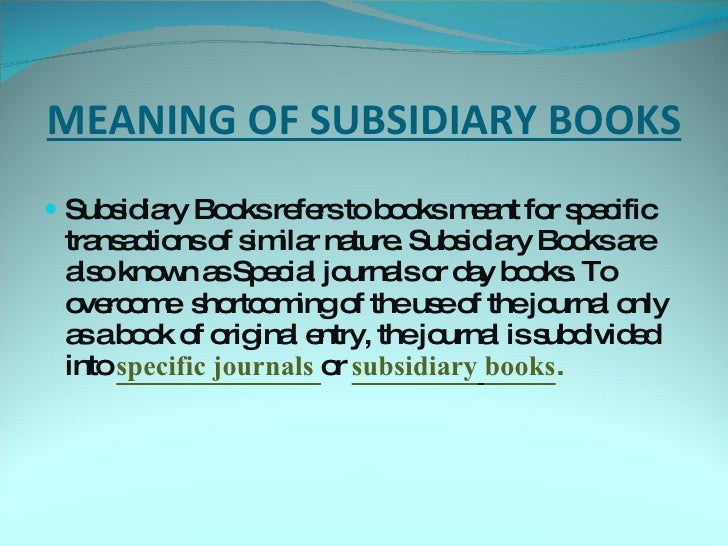

A subsidiary account is an account that is kept within a subsidiary ledger, which in turn summarizes into a control account in the.

Subsidiary meaning in accounting. The sub can sue and be sued separately from its parent. Let’s explore the different types of. In other words, it’s a group of.

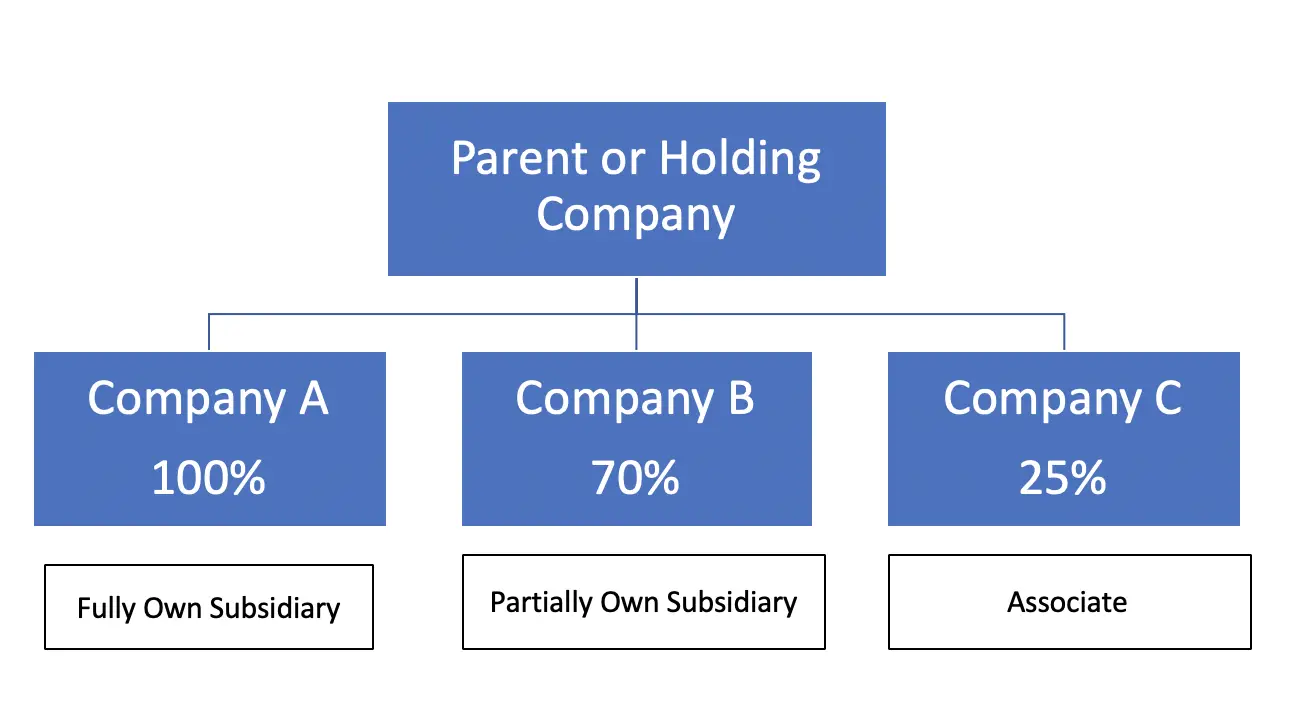

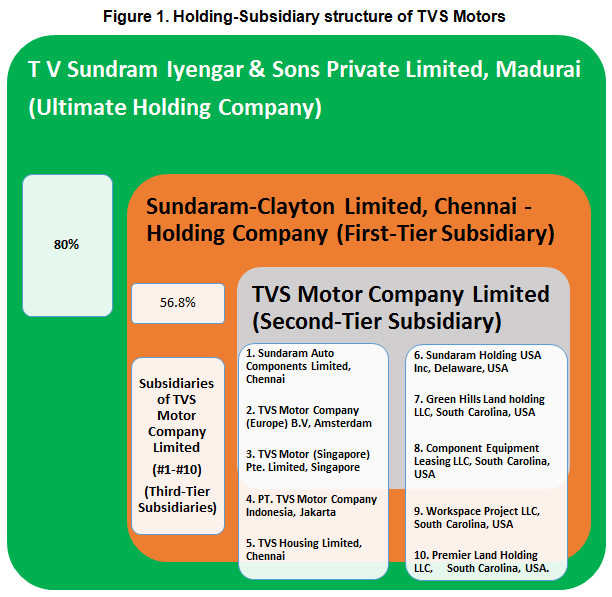

A subsidiary (aka a joint company structure) is owned and/or controlled, either fully or partially (at least 50%), by another company (called the parent company). A subsidiary ledger is a list of individual accounts that record transactions with common characteristics linked to a controlling account. An affiliate is used to.

Accounts payable subsidiary ledger: In accounting, subsidiary ledgers play a crucial role in organizing and tracking transactions for specific general ledger accounts. A subsidiary is a company whose parent company is a majority shareholder that owns more than 50% of all the subsidiary company's shares.

So a subsidiary is an investment by an entity (the parent) in an other entity (investee or subsidiary ). Subsidiary accounts definition the accounts outside of the general ledger which provide the detail for the balance reported in a general ledger account. For this reason, they differ from divisions, which are businesses.

From an accounting standpoint, a subsidiary is a separate company, so it keeps its own financial records and bank accounts and track its assets and liabilities. This benefits the company for the purposes of taxation, regulation, and liability. What is a subsidiary company?

For a parent company to have. The difference between a subsidiary and a sister company lies in their relationship to the parent company and to each other. A subsidiary is an entity that is controlled by another entity.

A division must use the same name as the parent company. (the account in the general. In other words, it’s an entity that is.

A subsidiary operates as a separate and distinct corporationfrom its parent company. A subsidiary company is one that is owned by another, larger company, which is commonly called the parent or holding company. An accounts payable subsidiary ledger is an accounting ledger that shows the transaction history and amounts owed.

A subsidiary must not be confused with an affiliate either, which is less than 50 percent owned by the parent. Details subsidiaries are separate, distinct legal entities for the purposes of taxation, regulation and liability. A subsidiary company is a business entity that is controlled by another organization through ownership of a majority of its common.

The typical account code structure uses a four or five digit numeric code that describes a primary account, followed by a hyphen, and then a two or three digit numeric. It may also be seen as an enlargement of the traditional general ledger, which is used to meticulously record all transactions. A subsidiary ledger is a list of individual accounts.

:max_bytes(150000):strip_icc()/EquityMethod_Final_4196997-4a403840ea2d4bf4aee5ff825b931e67.jpg)

:max_bytes(150000):strip_icc()/Subsidiary_Final_4188418-eaa203b00a2c4192bfd00863d51f8e85.jpg)

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)

:max_bytes(150000):strip_icc()/whollyownedsubsidiary.asp-final-d5a14f7bbd454e3b9922d066bd95650b.png)

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)