Sensational Tips About Journal Entry To Eliminate Intercompany Dividends

Prepare the consolidated profit and loss account for courage ltd.

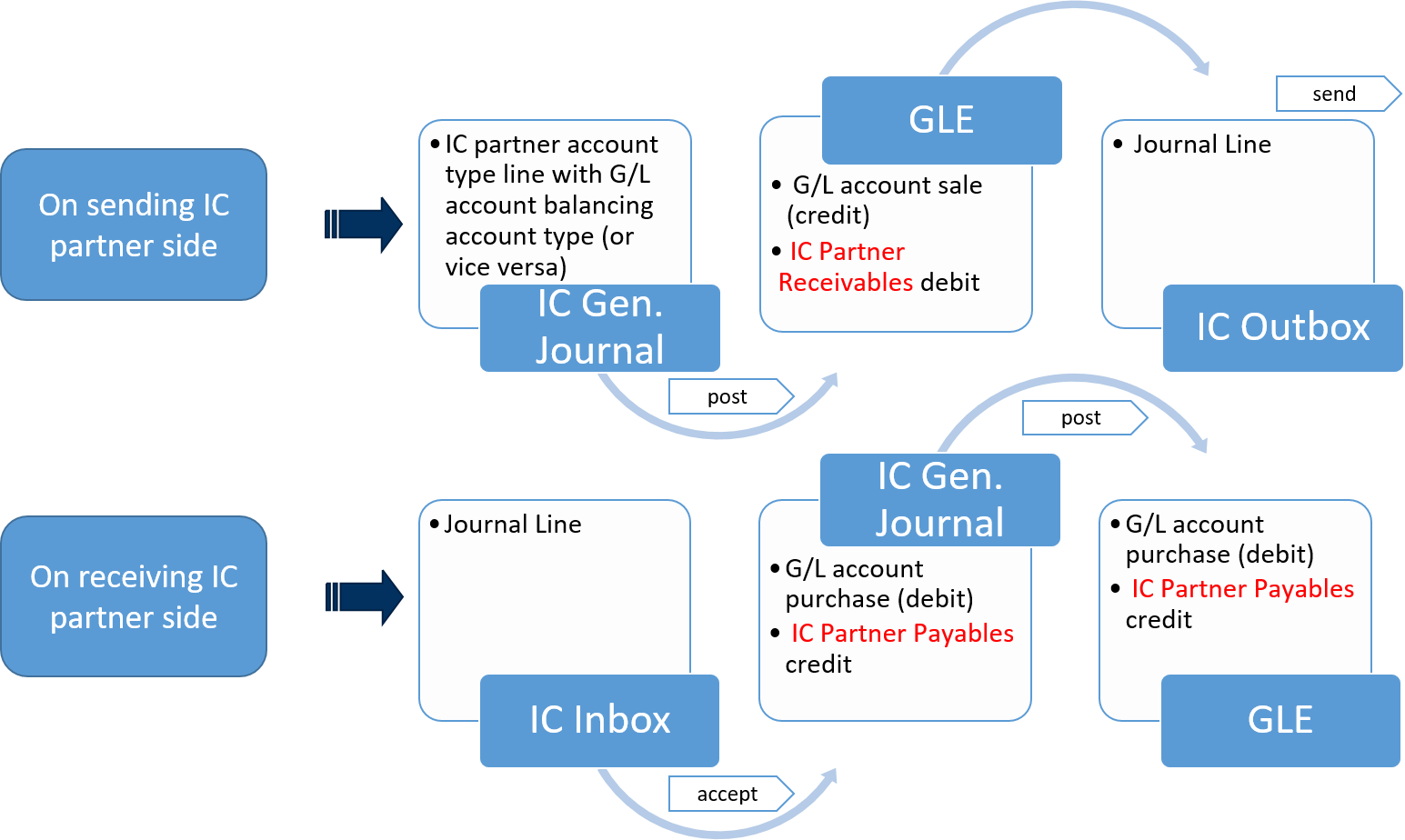

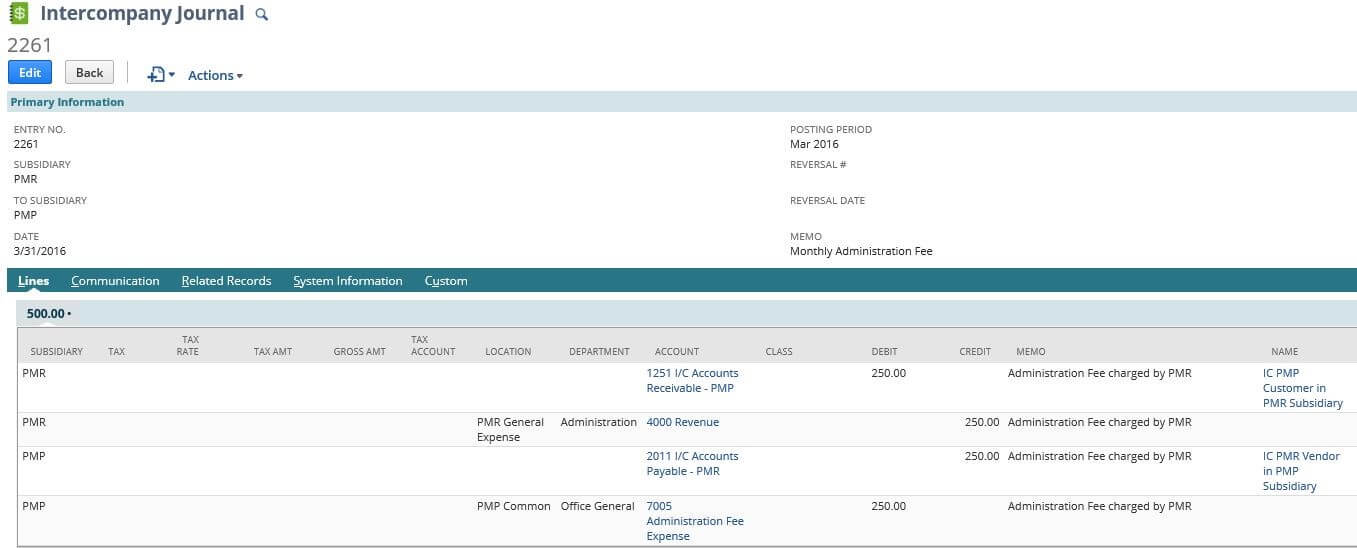

Journal entry to eliminate intercompany dividends. The following assumptions apply to all examples. The process of intercompany elimination involves identifying and removing any transactions or balances between group companies that could result in double counting. Asc 810 establishes basic consolidation principles, which include (1) any intercompany income on assets remaining within the consolidated group of companies should be.

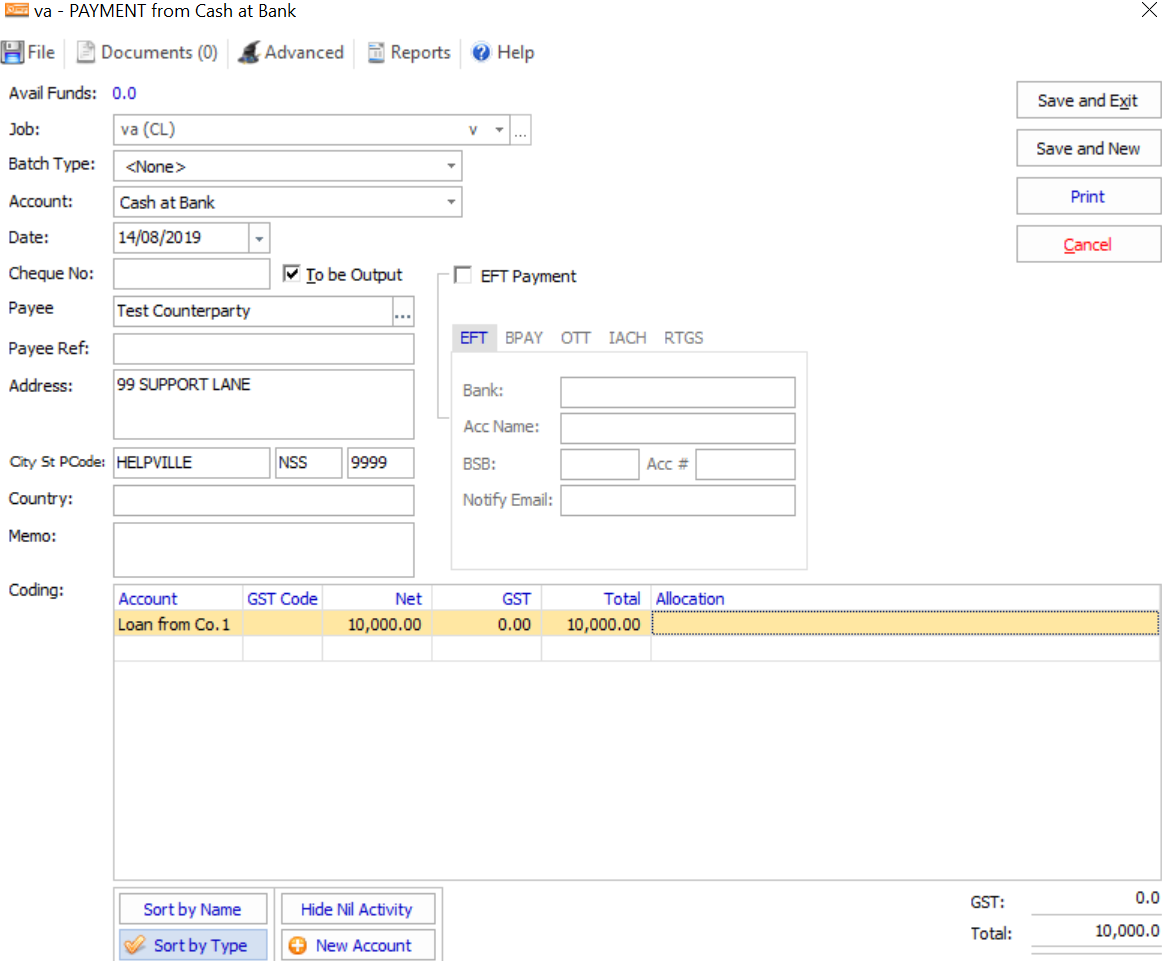

To eliminate intercompany dividends between related parties is done with the following journal entry: If, in eg 2, the correct date is 2011, then my original post is still valid. Journal entry for payment of a dividend.

Effectively reversing the effect of ic dividend from consolidated financial statement. Intercompany eliminations occur when a business has subsidiaries that engage in activities with each other. The elimination entry removes ic dividend and increases retained earnings.

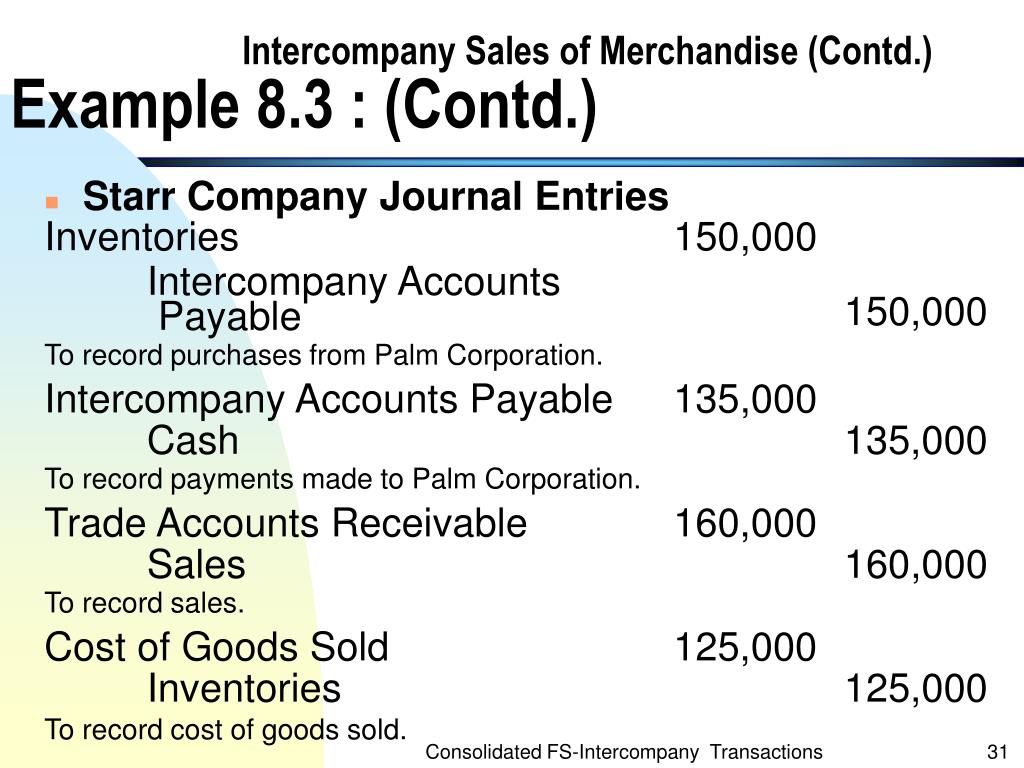

Asc 810 establishes basic consolidation principles, which include (1) any intercompany income on assets remaining within the consolidated group of companies should be. Question 2 to eliminate intercompany dividends between related parties is done with the following journal entry: The following eliminating entry is needed in the consolidation workpaper:

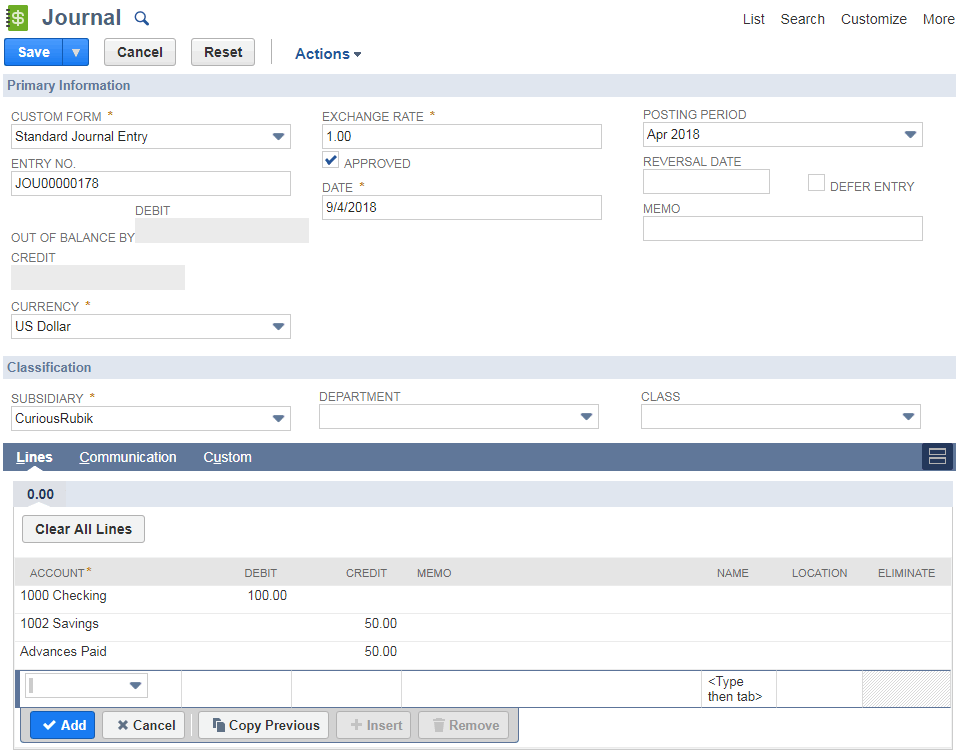

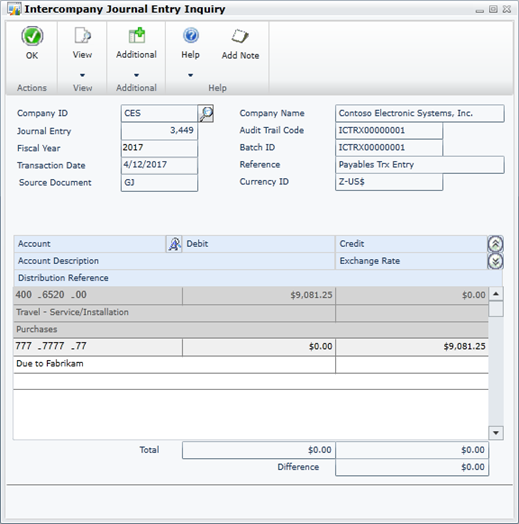

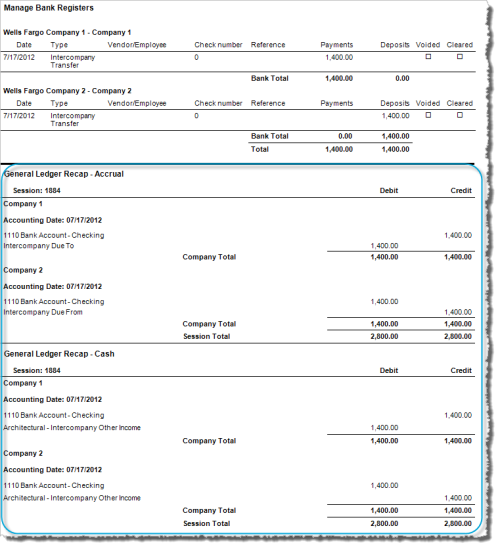

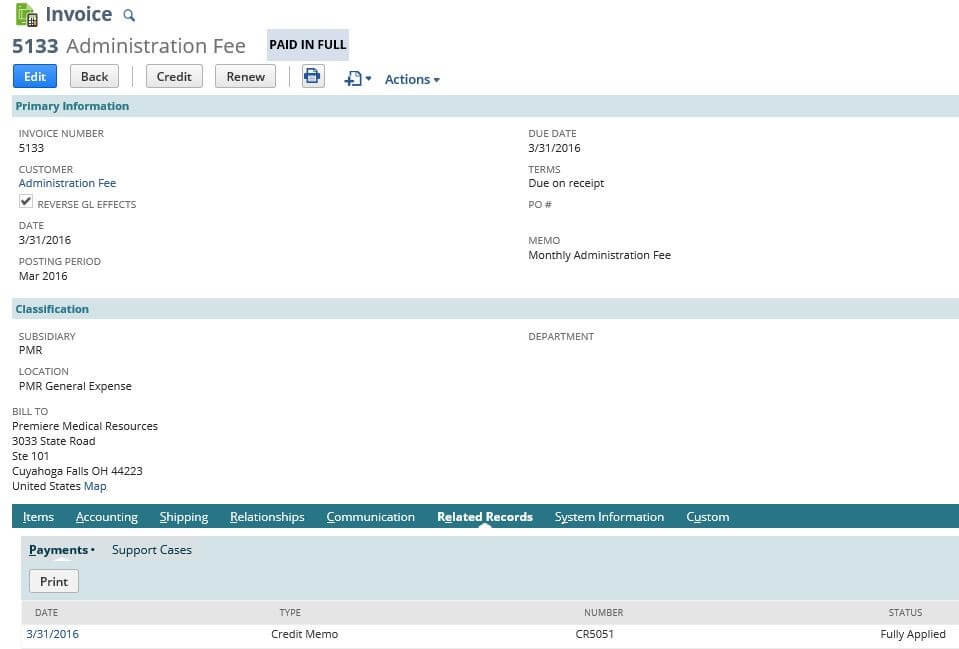

The following examples show how to eliminate intercompany transactions recorded in the infusion ledgers during consolidation. Declares dividends of $30,000 in 20x1 and $40,000 in 20x2. This journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend.

For example, a manufacturing subsidiary sells some. To record the payment of a dividend, you would need to debit the dividends payable account and credit the cash. Journal entry for dividend received from subsidiary.

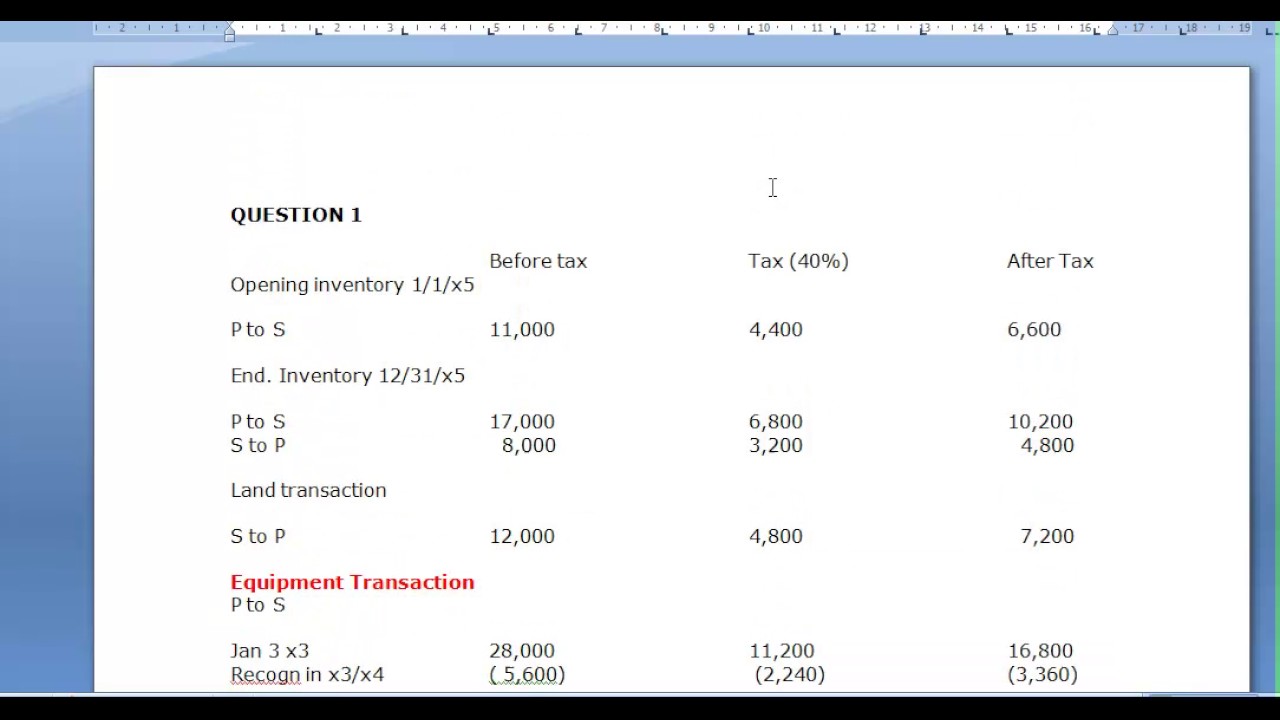

E(34) sales 35,000 cost of goods sold 20,000 inventory 5,000 loss on decline in value of inventory. For year ended 31 december,. For example, assume an investor holds a 25% interest in an investee entity and sells.

We can make the journal entry for the dividend received from the subsidiary by debiting the cash account and crediting the. An investor should eliminate its intercompany profits or losses related to transactions with an investee until profits or losses are realized through transactions with third parties. This document provides guidelines to eliminating intercompany dividends that require the use of movement extensions/movement accounts.

31 may 2022 us foreign currency guide as a component of shareholders’ equity, dividends are recorded using the exchange rate at the declaration date.