Nice Tips About Sundry Expenses In Income Statement

Sections sundry expenses definition providing an exact definition of sundry expenses is a bit difficult because the term refers to a variety of small, insignificant.

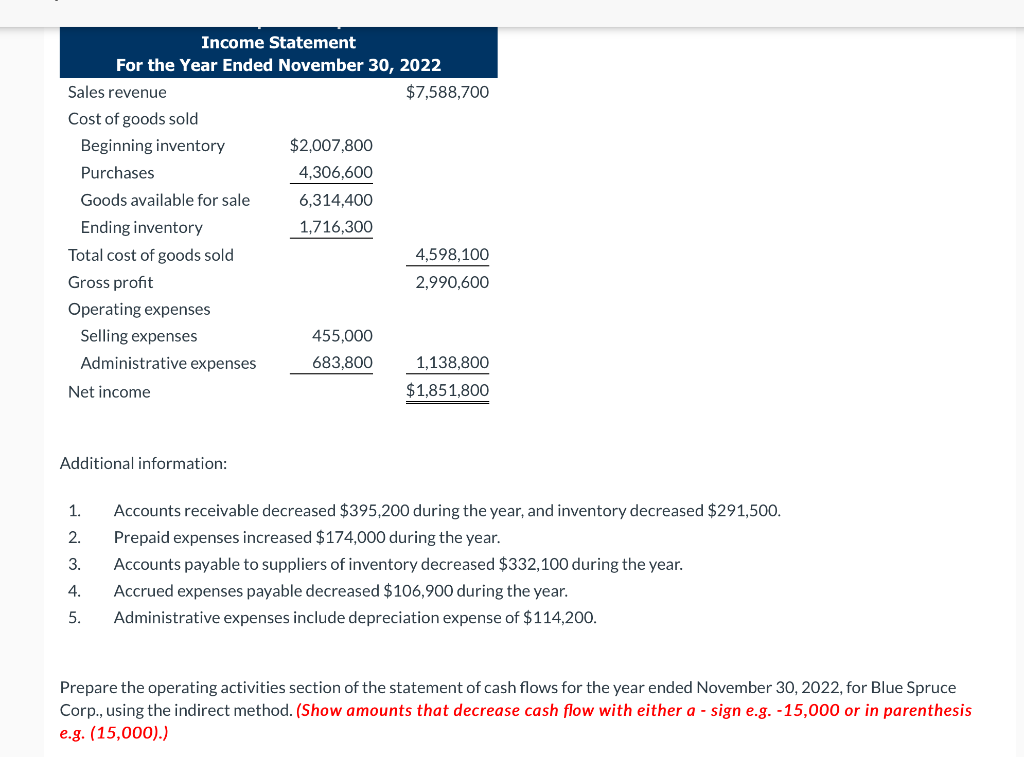

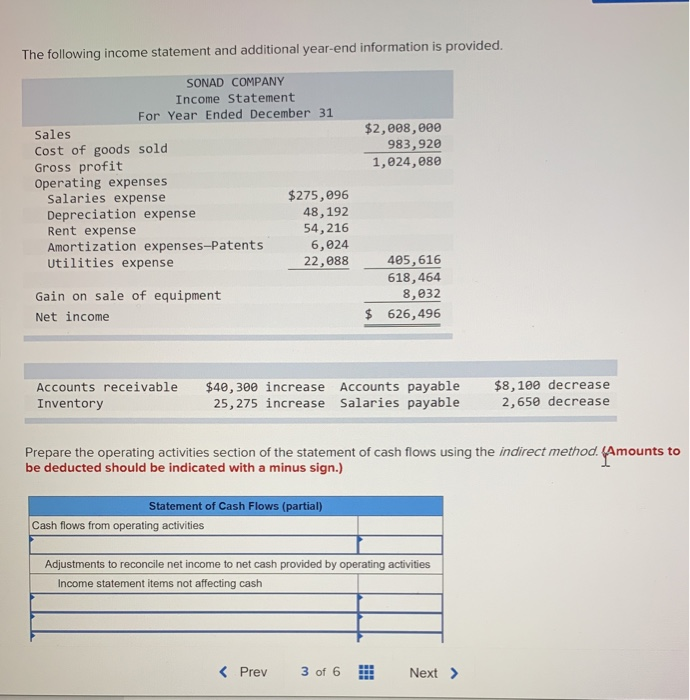

Sundry expenses in income statement. What are sundry expenses? Sundry income is revenue generated outside a company's regular business operations. In accounting and bookkeeping, sundry.

Sundry income or sundry expenses are also known as other or miscellaneous income, sundry business income, or costs that come from sources. How to record your sundry expenses in accounting. Sundry expenses, or sundries, include all the small, irregular, and infrequent expenses that can’t fit into any other expense category.

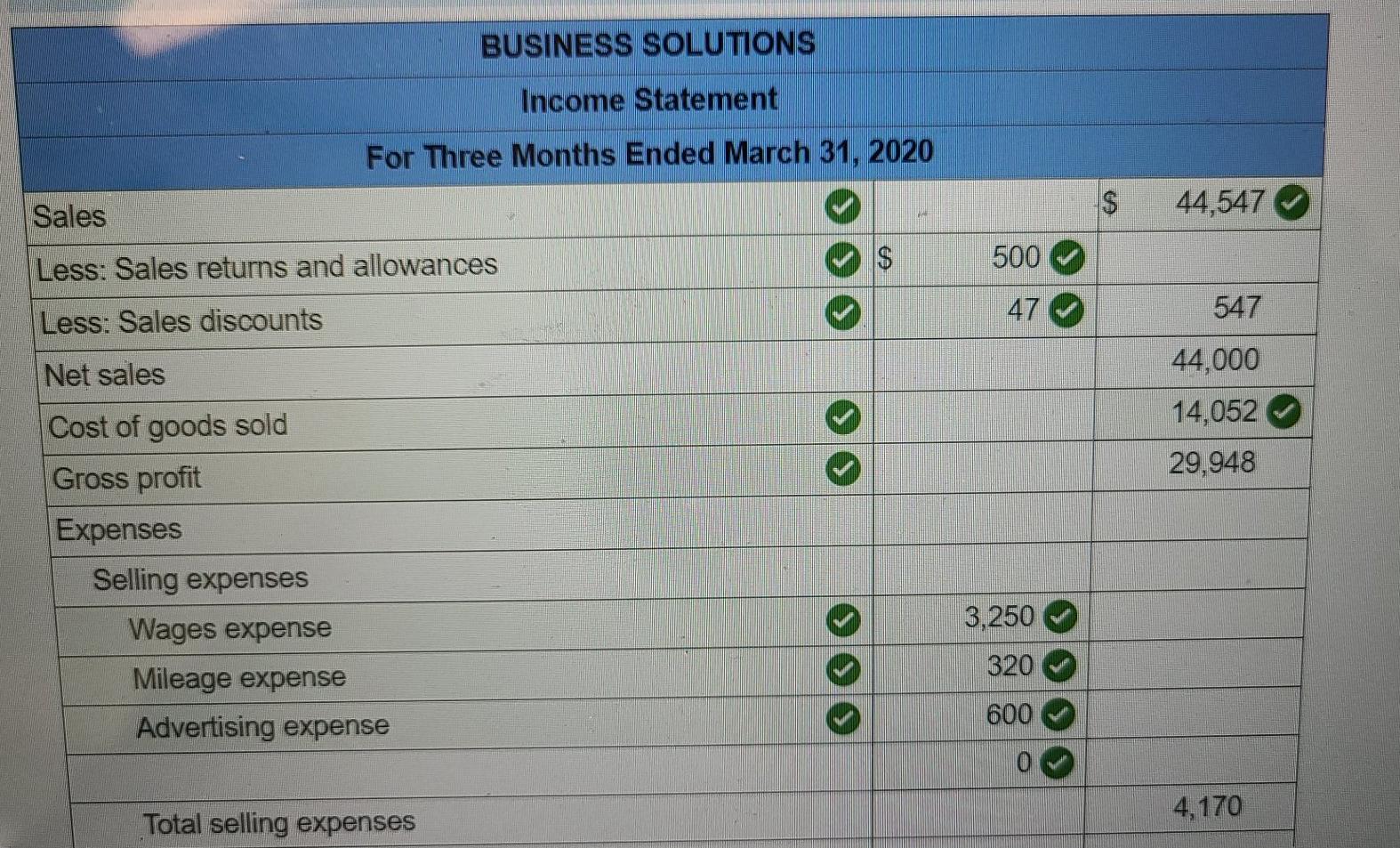

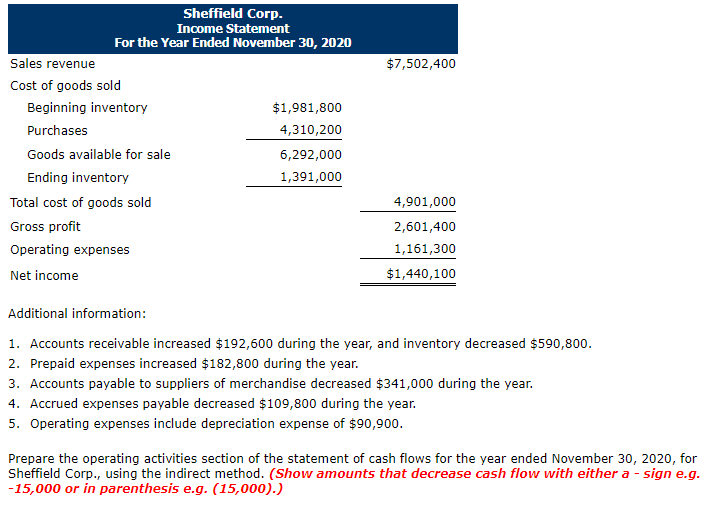

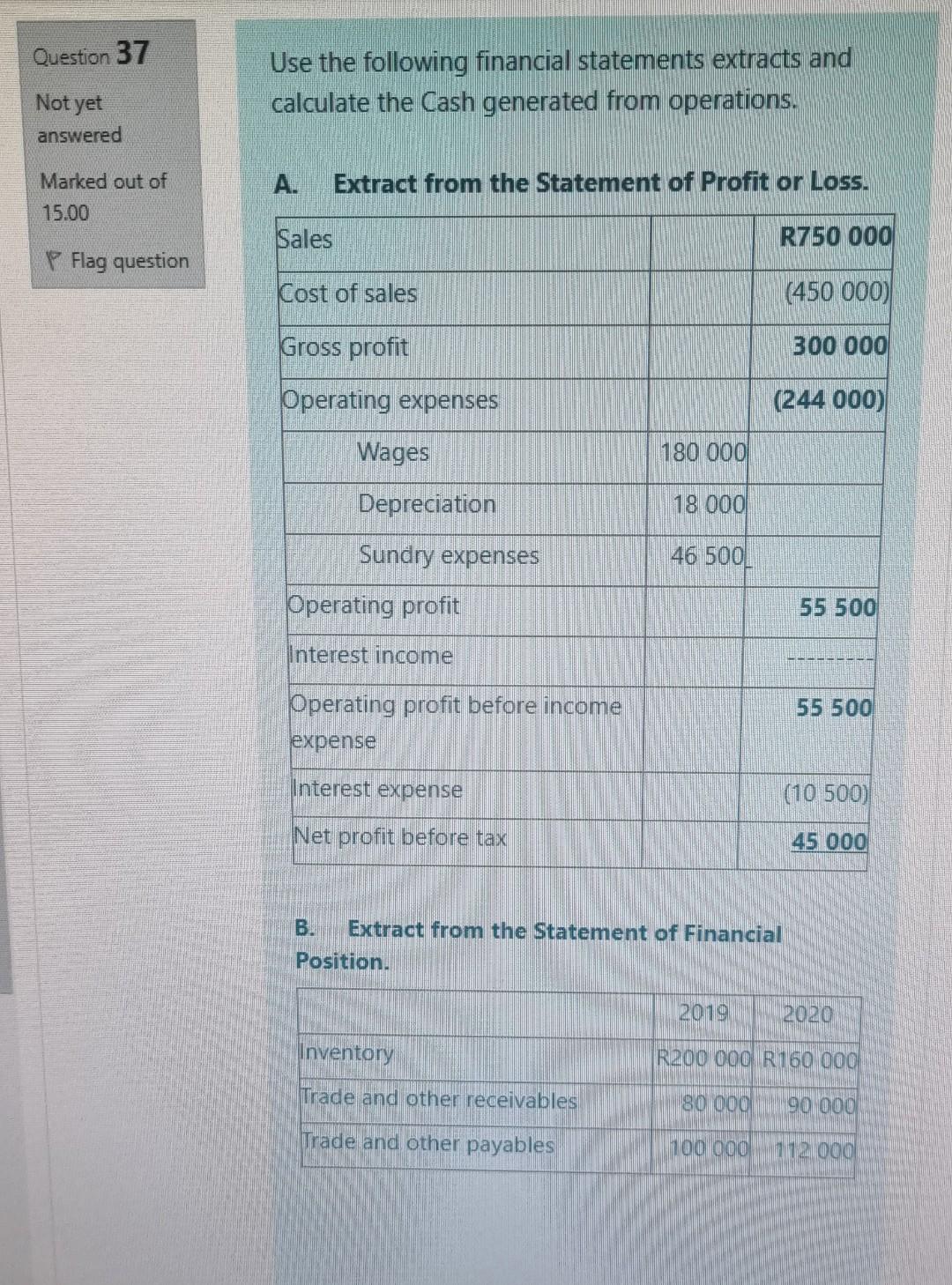

Adding them to an income statement. An income statement is a financial statement that reports a company's financial performance over a specific accounting period. This is because their individual costs are.

These expenses are recorded within an. Accountants may report sundry income as miscellaneous or other operating income on the income statement or the balance sheet. If income exceeds expenses, there is a net income.

The cost is insignificant to your business operations, but using a sundry account lets you lump all these small, random, miscellaneous expenses together. Sundry costs will appear in the statement of profit & loss (sopl) as they are an ‘outflow of economic. Sundry expenses are items or expenditures that are rare, amount to very little, or are relatively.

Sundry expenses are a regular business expense line item found in the income statement of all organizationincome statement of all organizationthe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to. If expenses exceed income, there. Accountants will show a credit for sundry income in an income statement, also known as a profit and loss statement.

The defining characteristic of sundry income is the irregularity of the revenue, not the amount generated, so there’s no limit to the amount that can qualify as. Home › accounting › income statement › what are sundry expenses? Nonetheless, miscellaneous expense or sundry expense is presented last.

Sundry income, also called miscellaneous income or other operating income, is generated from sources other than a company's normal business operation. Sundry expenses, or sundries, are miscellaneous expenses that occur infrequently.

They also do not fit. Sundry expenses are miscellaneous expenditures that are not frequently incurred. October 12, 2023 what are sundry expenses?

General expenses why is it important to register sundry. Sundry expenses refer to miscellaneous small costs typically incurred by a business but not categorised under main expense categories. They might include expenses for items.

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

/SundryIncome-c3adabaa4b7d407caf0316f9463e0a91.jpg)