Great Tips About Profit And Loss Account Items List

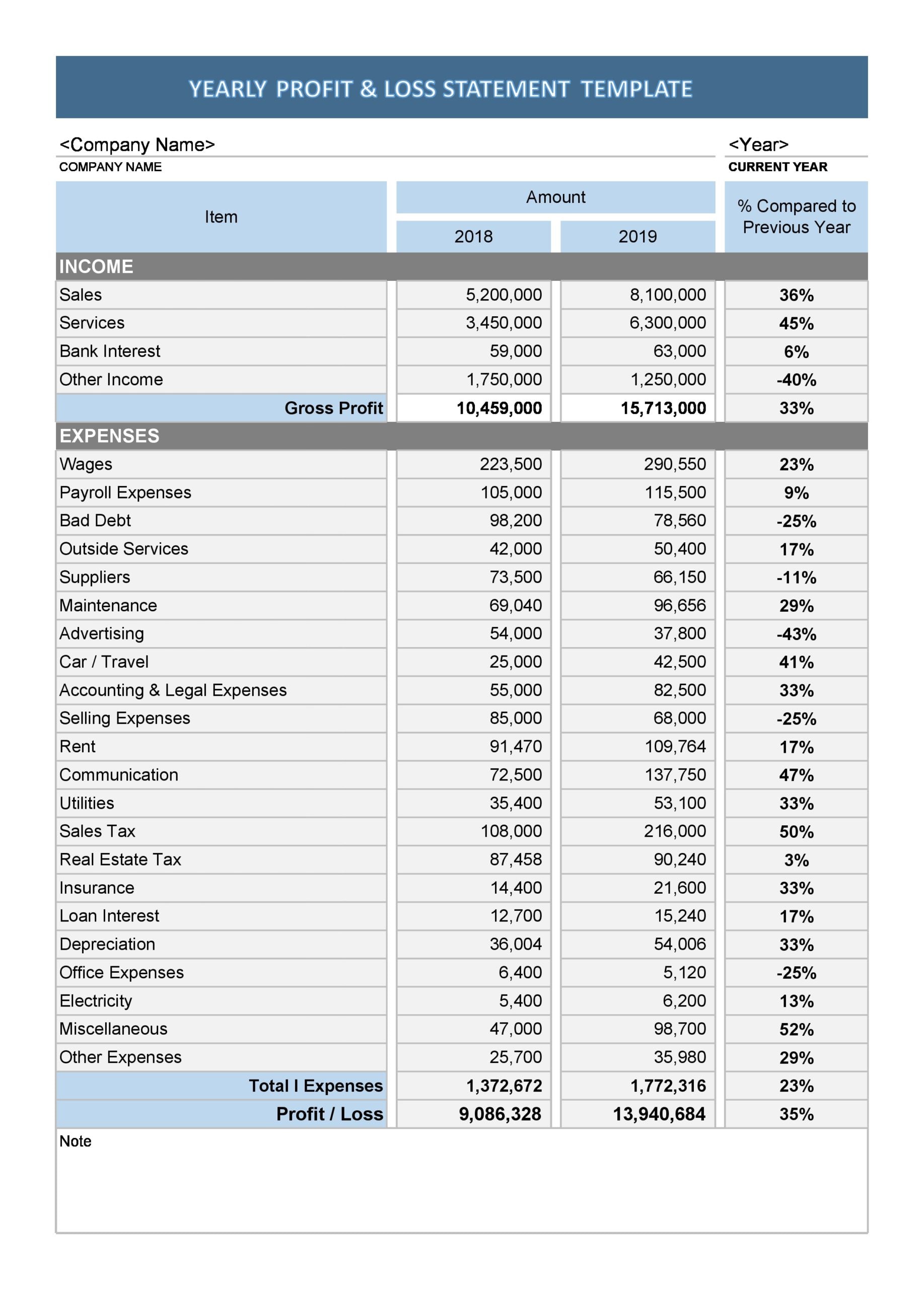

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Profit and loss account items list. A profit and loss account (also known as p&l) is one of two main statements (the other is the balance sheet) that is prepared to measure the performance and position for a business for a. The profit and loss account shows all indirect expenses incurred and indirect revenue earned during the particular period. To expenses a/c (individually) (being the accounts of all the expenses closed) 2.

What is a profit and loss account? The main categories that can be found on the p&l include: Profit and loss statement calculator we’ll now move on to a modeling exercise, which you can access by filling out the form below.

Costs not directly involved in the production process (indirect costs) e.g. The p&l statement is one of three financial. It shows all the company’s income and expenses incurred over a given period.

Tankers and gas shipbuilding south korea. What is the format of a p&l statement? It’s like a financial report card that summarizes whether a business is making a profit or incurring losses.

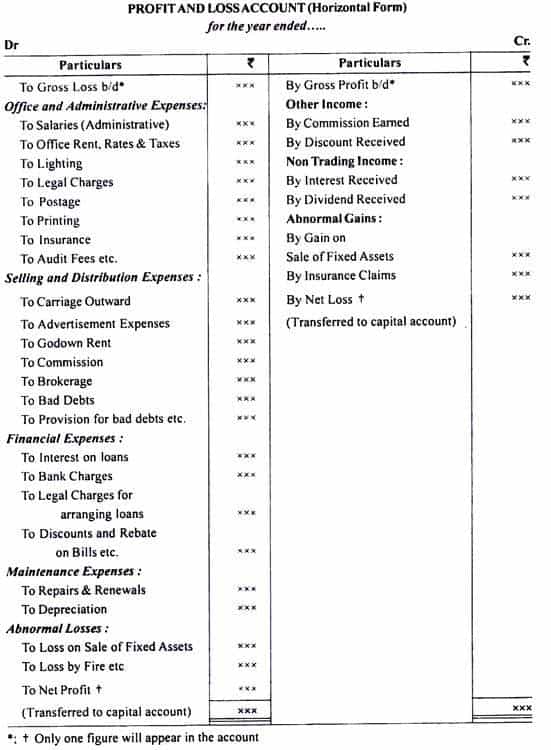

A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. The result is either your final profit (if. 1.3.1 sales 1.3.2 sales returns / returns inward 1.3.3 abnormal loss 1.3.4 closing stock 1.4 balancing of trading account 2 profit and loss account 2.1 profit and loss account items (dr.

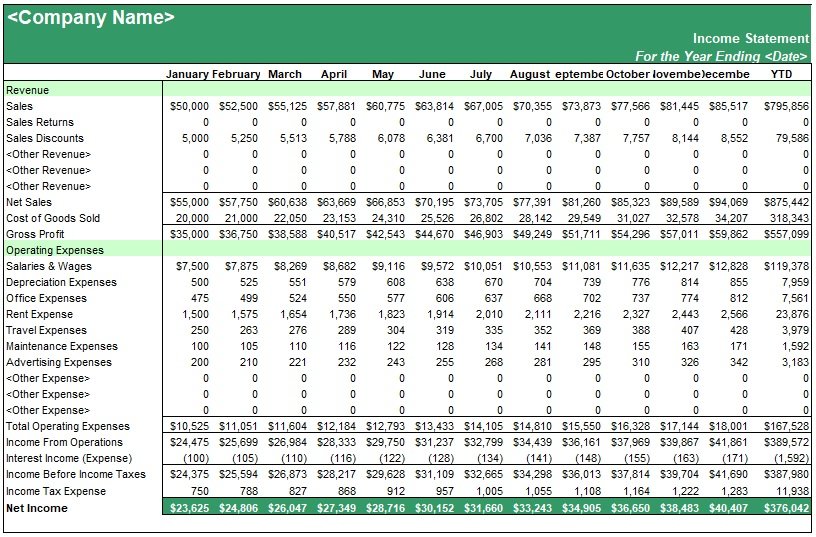

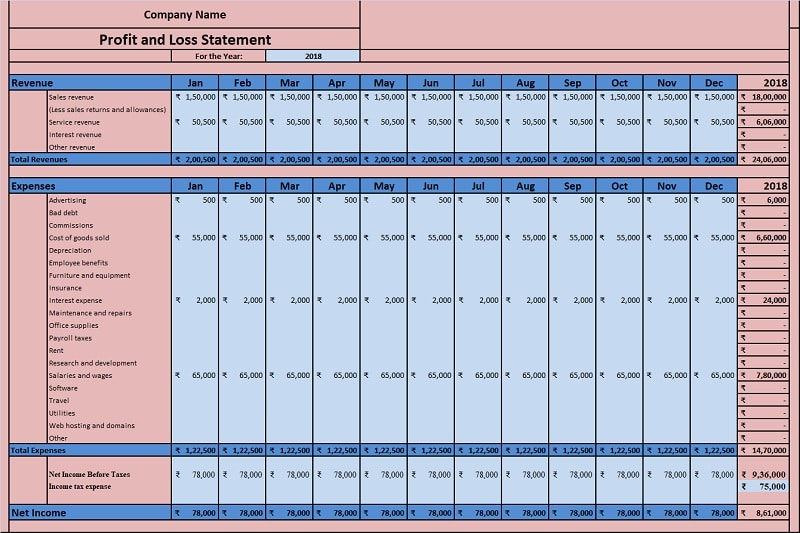

The profit and loss statement, also called an income statement, details a company’s financial performance for a specific period of time. The amount of money generated by sales. Create the report either annually, quarterly, monthly or even weekly.

The period may be for a month, a quarter, or a year. To capital a/c (being net profit. Side) 2.1.1 management expenses 2.1.2 selling and distribution expenses 2.1.3 maintenance expenses 2.1.4 financial expenses 2.1.5 abnormal.

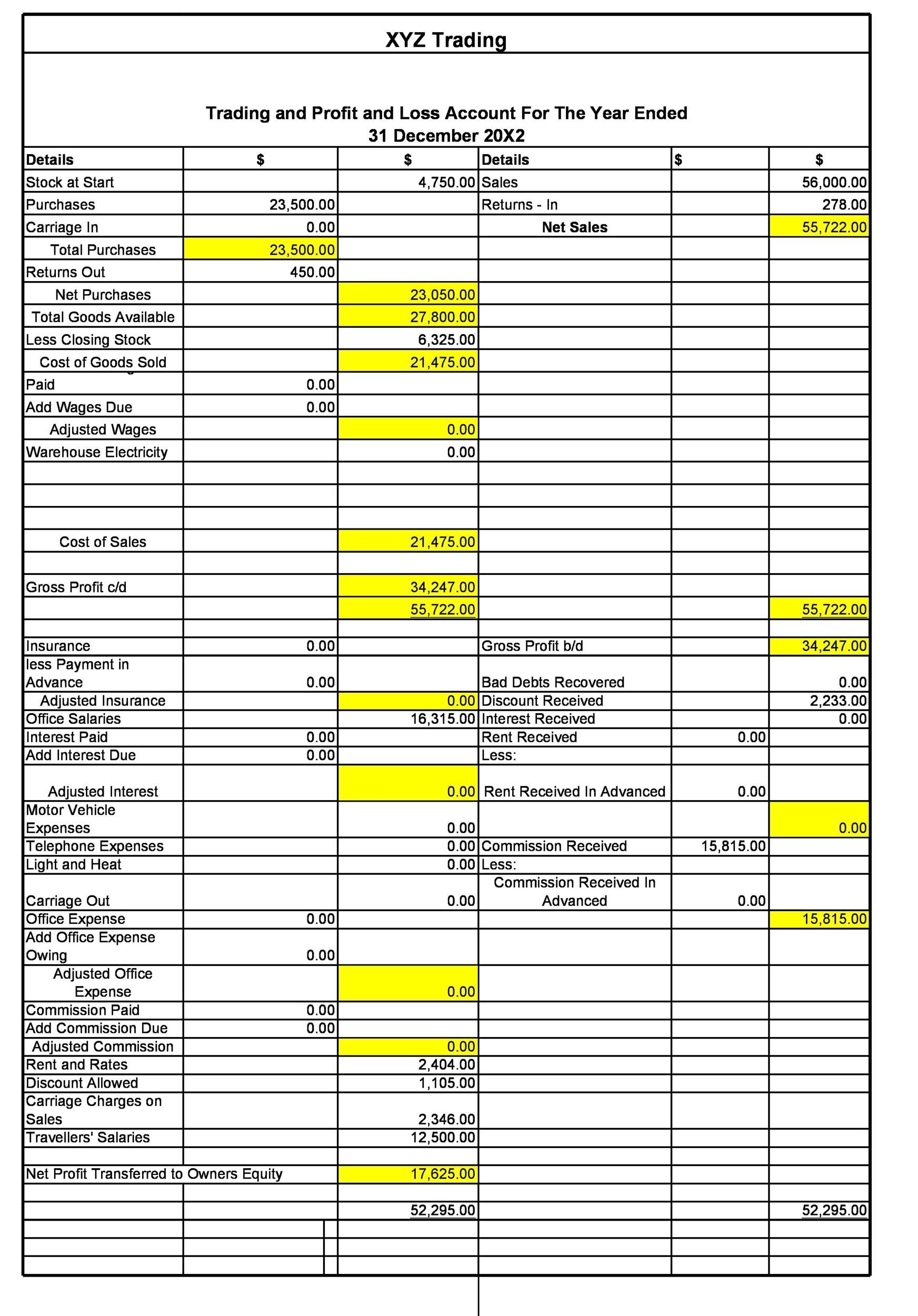

Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business. Each entry on a p&l statement provides insight into. A p&l statement provides information about whether a company can.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. It is prepared to find out the net profit/loss of the business for the particular accounting period. The purpose of a p&l statement

They differ on the basis of what you include in your p&l account, and their structure varies accordingly. Profit and loss accounting is when companies prepare the profit and loss statements to figure out their financial performance for a fiscal quarter or year. A profit and loss statement is a financial statement that typically covers the following items: