Who Else Wants Tips About A Financial Statement That Summarizes Company Revenue And Expenses Is Permanent Differences Tax Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

An income statement might use the cash basis or the accrual basis.

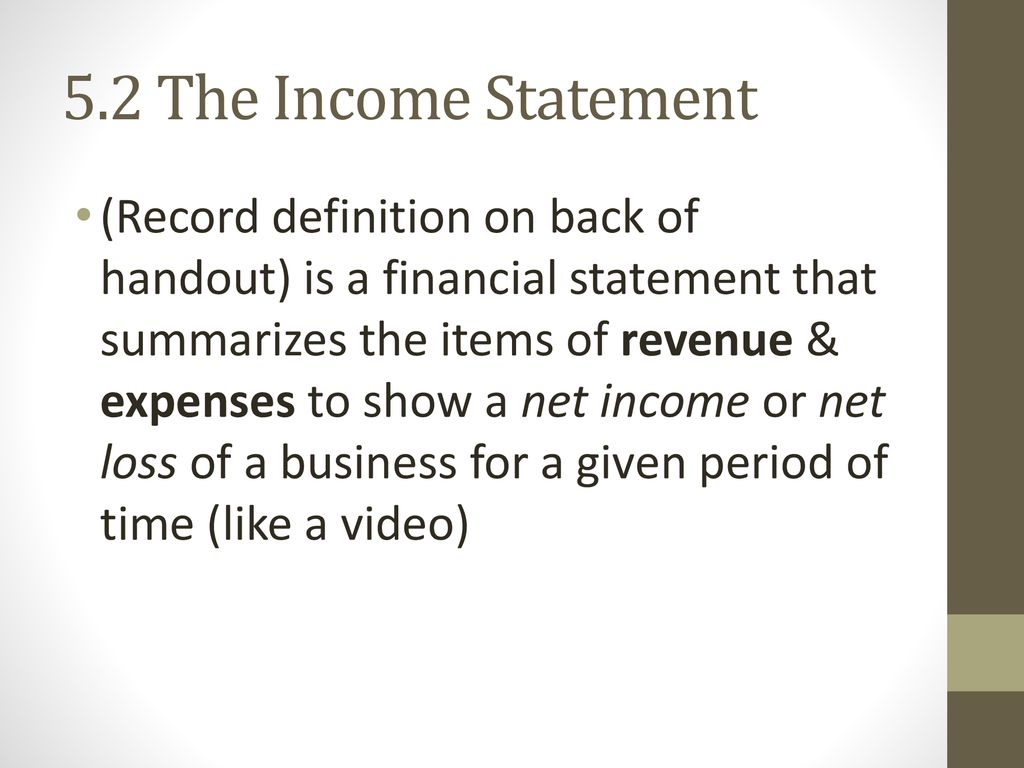

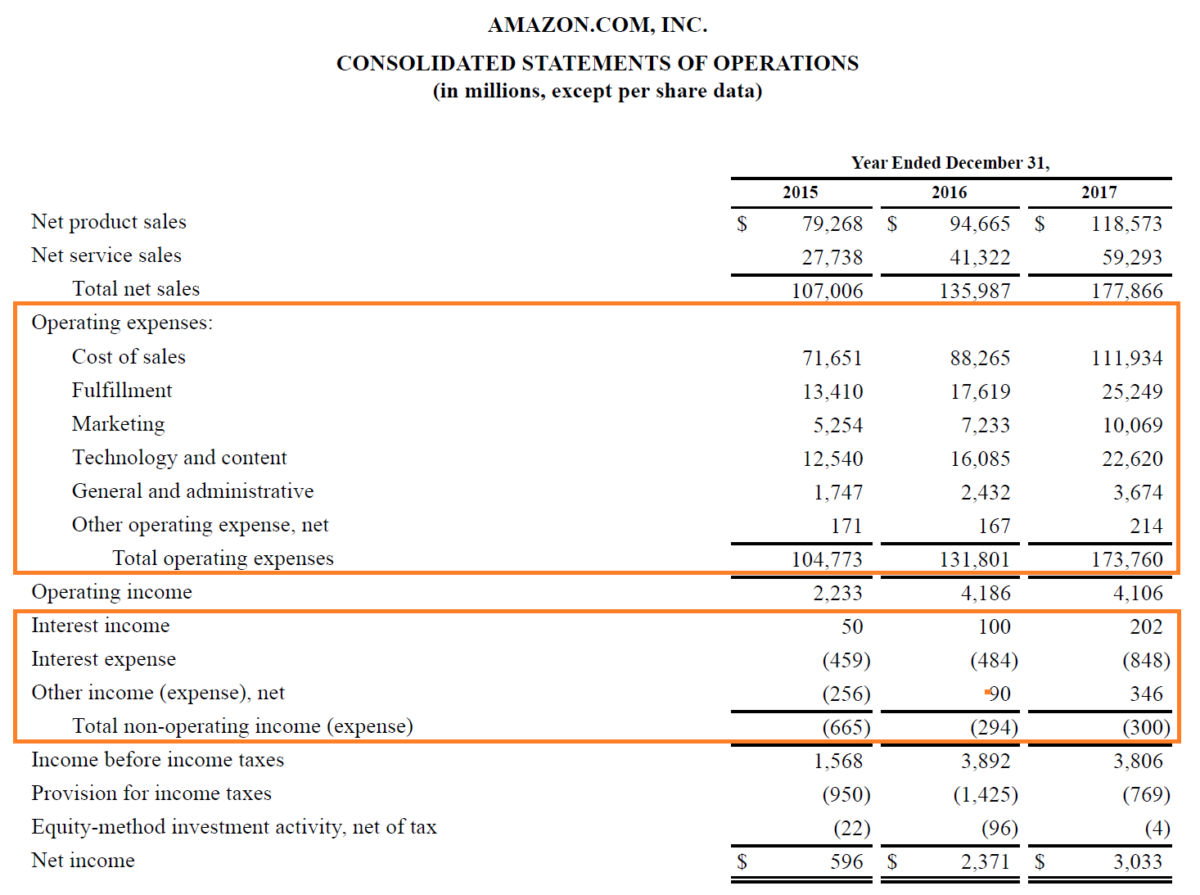

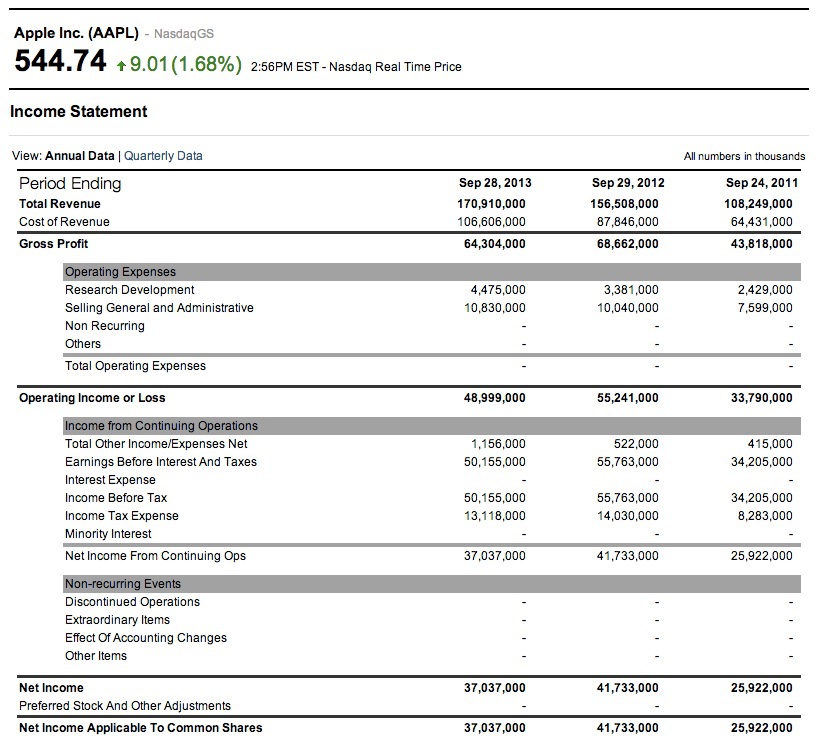

A financial statement that summarizes company revenue and expenses is permanent differences tax examples. Is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year. The three financial statements are the income statement, the balance sheet, and the statement of cash flows. Revenue−expenses= net income (or net loss) revenue − expenses = net income (or net loss) revenue is shown first.

The income statement is a useful way to see. The income statement is a summary of the firm’s operations over a stated period of time. Revenue minus expenses equals profit or loss.

A profit and loss statement (p&l) is a financial document that summarizes a company's revenues and expenses over a specified period of time. A financial statement that summarizes company revenue and expenses is? The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

The main parts of the statement are revenues (gross and net sales),. A list of expenses follows, and their total is subtracted. A financial statement that summarizes company revenue and expenses is statement of profit and loss.

Statement of owner's equity c. Statement of profit and loss d. The main 4 financial statements are:

A financial statement that summarizes information about the cash inflows(receipts) and cash outflows (payments) for a specific period of time. (a) balance sheet (b) statement of owner equity (c) income statement (d) cash flow statement 2. Also known as the profit and loss (p&l) statement or the statement of revenue and expense, an income statement provides valuable insights into a.

Statement of cash book please scroll down to see the correct answer and solution. The cfs highlights a company's. The permanent and temporary differences in tax accounting result from the differences between financial statements and tax returns.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Statement of profit and loss. A p&l statement is a financial report that summarizes a company’s revenue, expenses and profits or losses over a fiscal year or quarter.

Temporary differences occur whenever there is a difference between the tax base and the carrying amount of assets and liabilities on the balance sheet. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. These records provide information about a company’s ability or inability to generate profit by increasing revenue, reducing costs, or both.

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. A financial statement that summarizes company revenue and expenses is? It shows what the company owes and owns at a specific point in time;

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)

![[Solved] On January 1, 2021, Ameen Company purchased majo](https://media.cheggcdn.com/media/7b4/7b4c8fdf-3e09-4213-b642-936c363cef82/php2ZXBJX)