Real Tips About Consolidated Financial Statements Of Group Companies

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989.

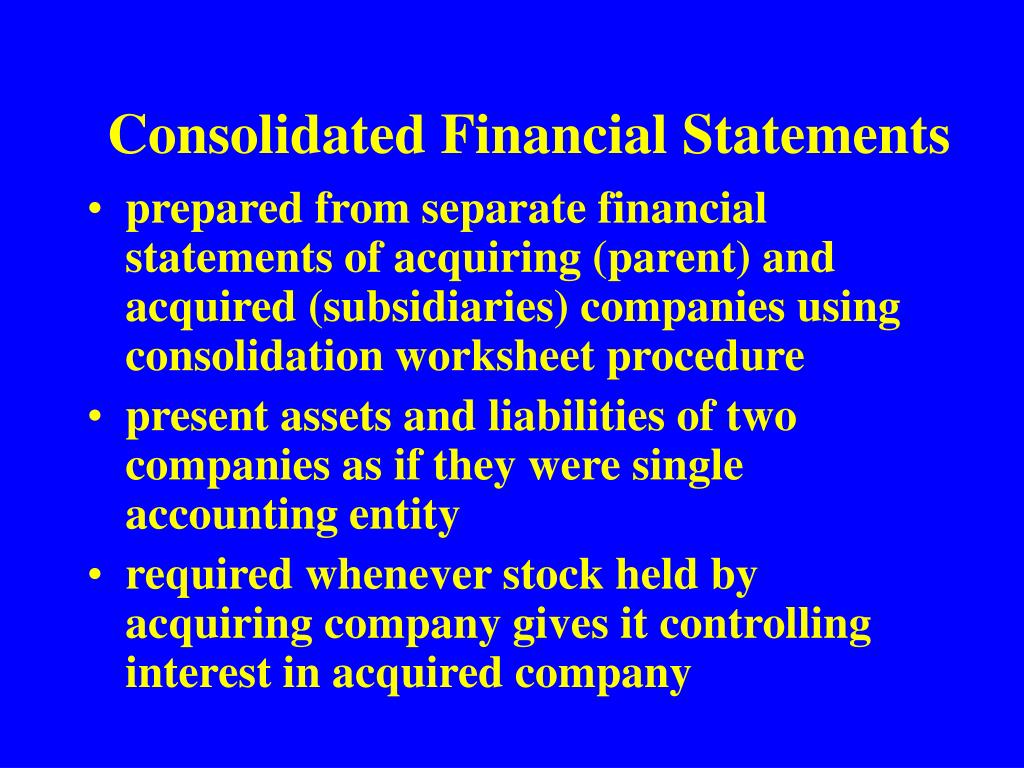

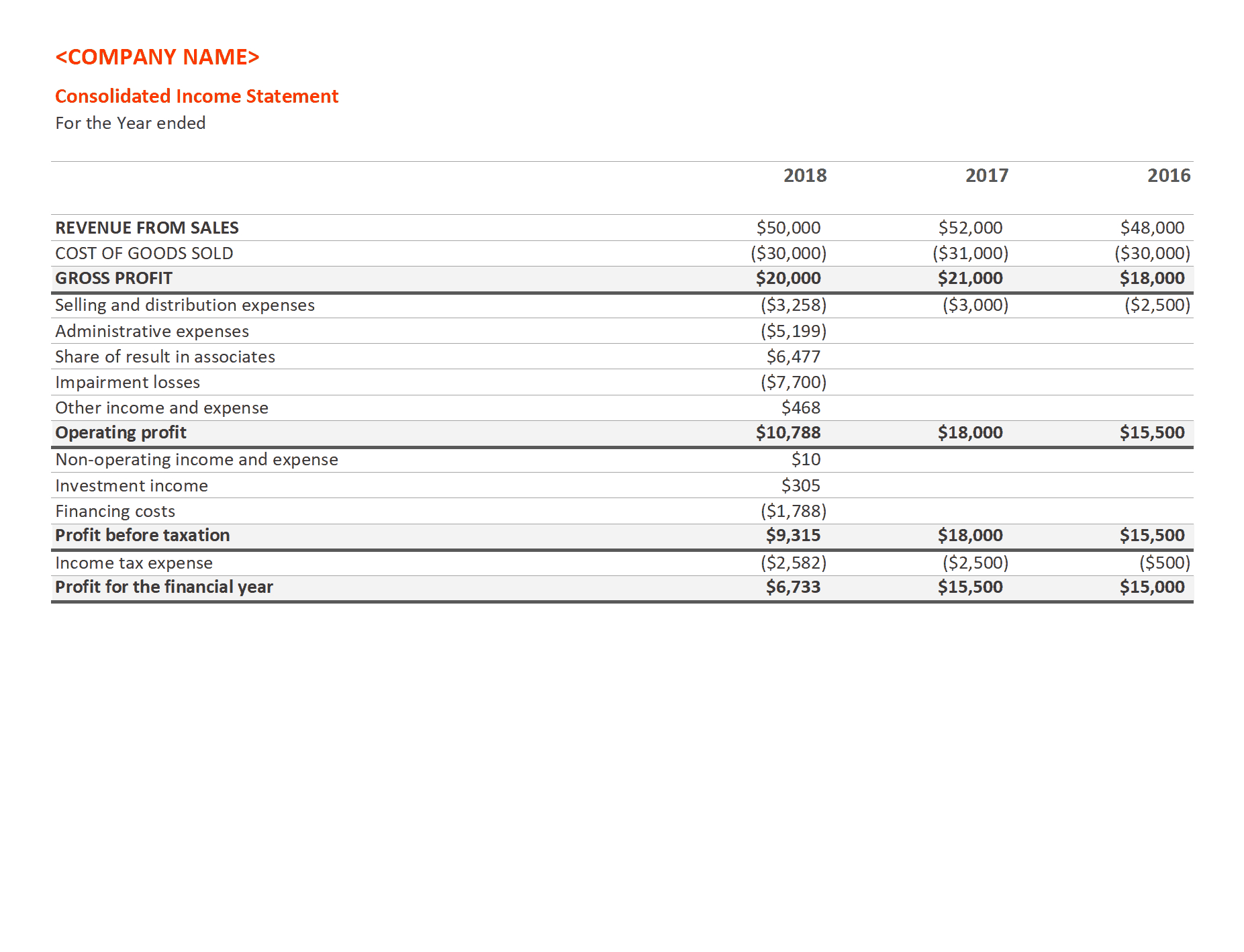

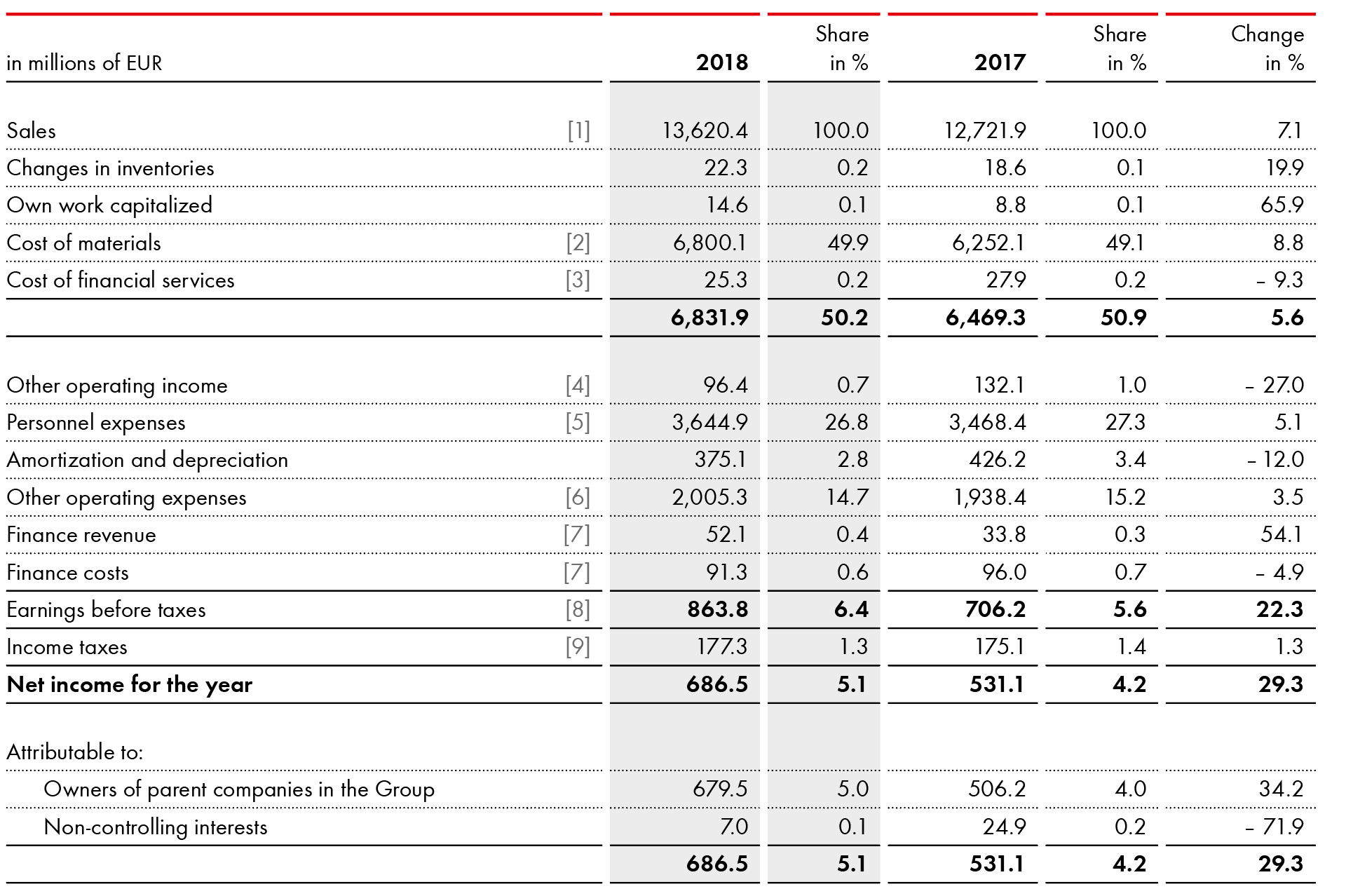

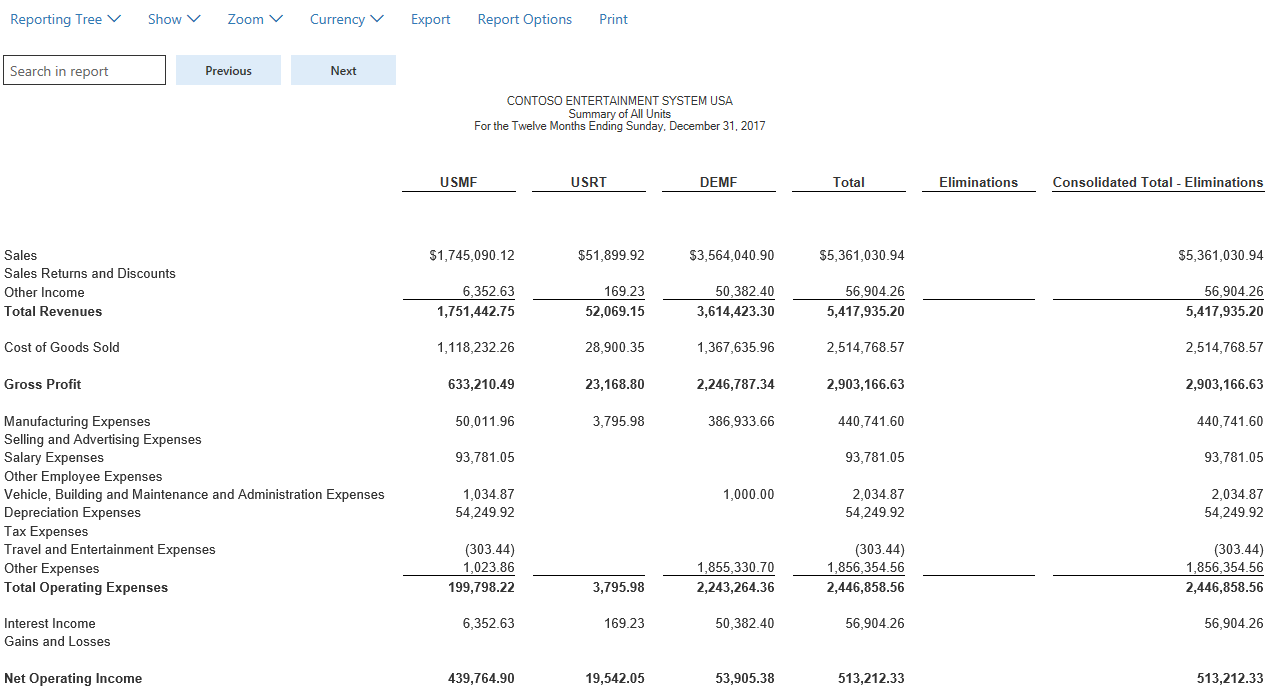

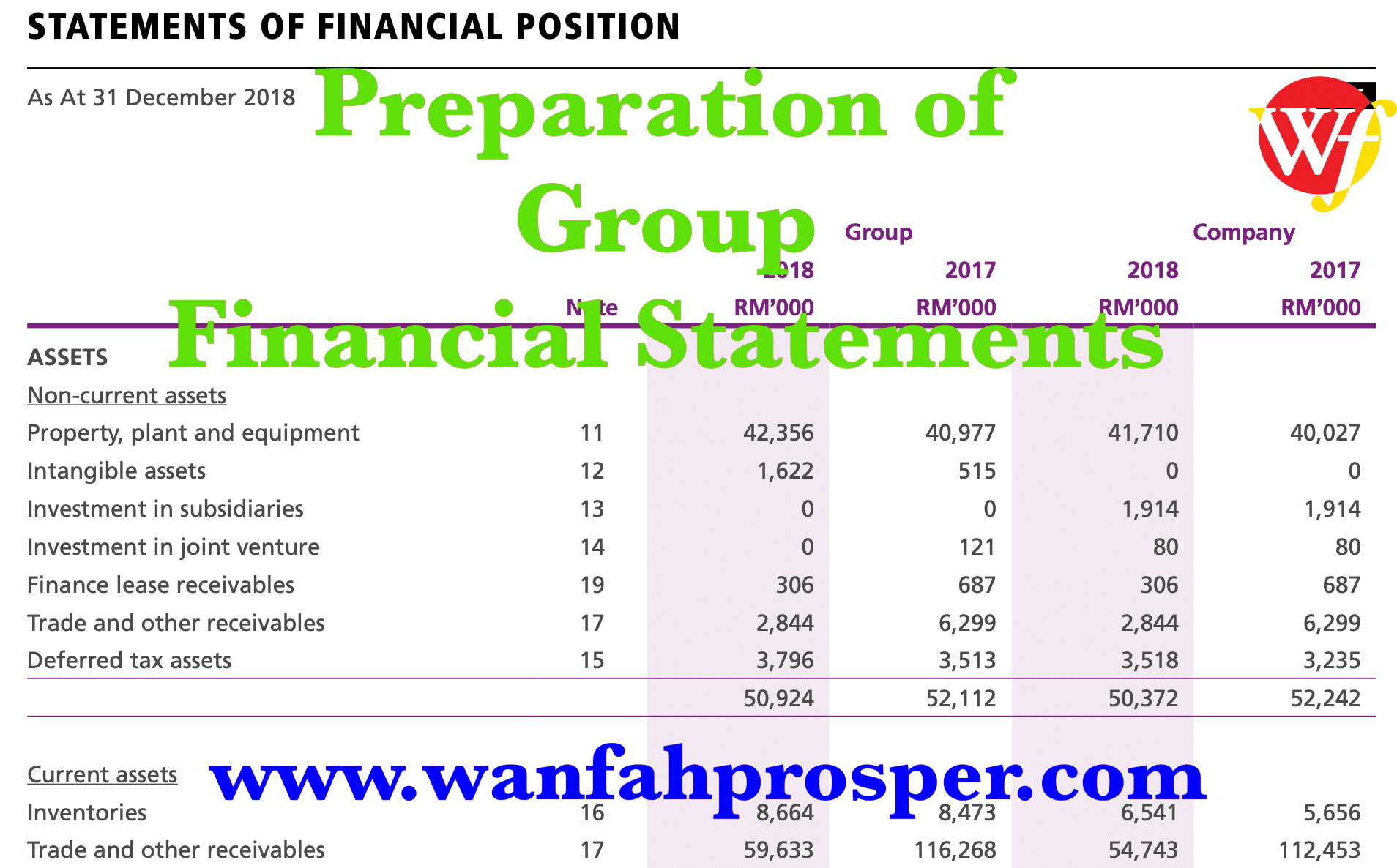

Consolidated financial statements of group companies. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. Financial statements are formal financial performance records which shows how a company has performed in the last quarter/year and whether or not the company has made money. Consolidated financial statements are financial statements that present the assets, liabilities, equity, income, expenses and cash flows of a parent and its subsidiaries as those of a single economic entity.

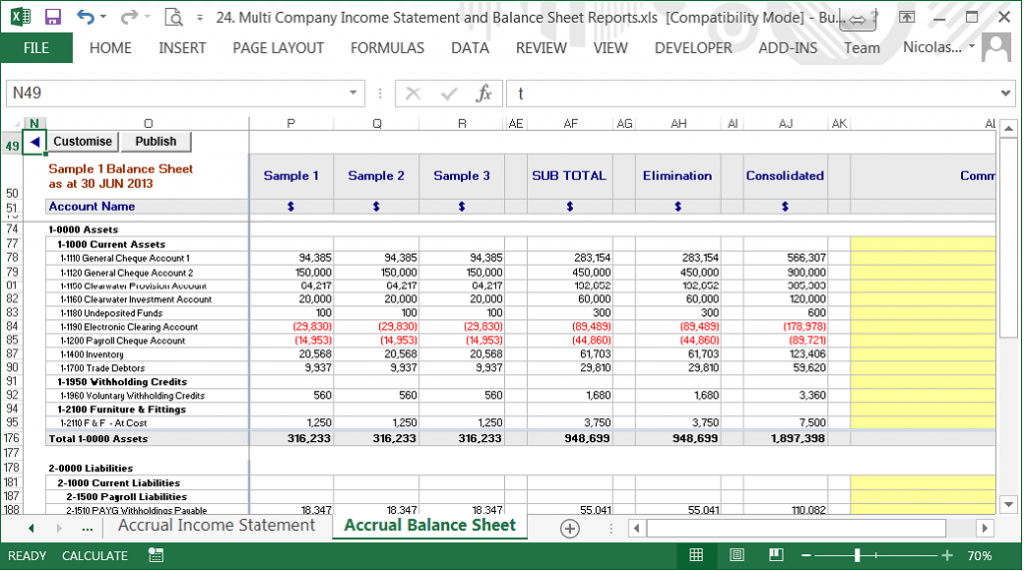

Consolidated financial statements provide a comprehensive overview of a company's financial operations for the entire group of entities. These statements are prepared in accordance with ifrs 10. Consolidated financial statements are the financial statements of a group of entities that are presented as being those of a single economic entity.

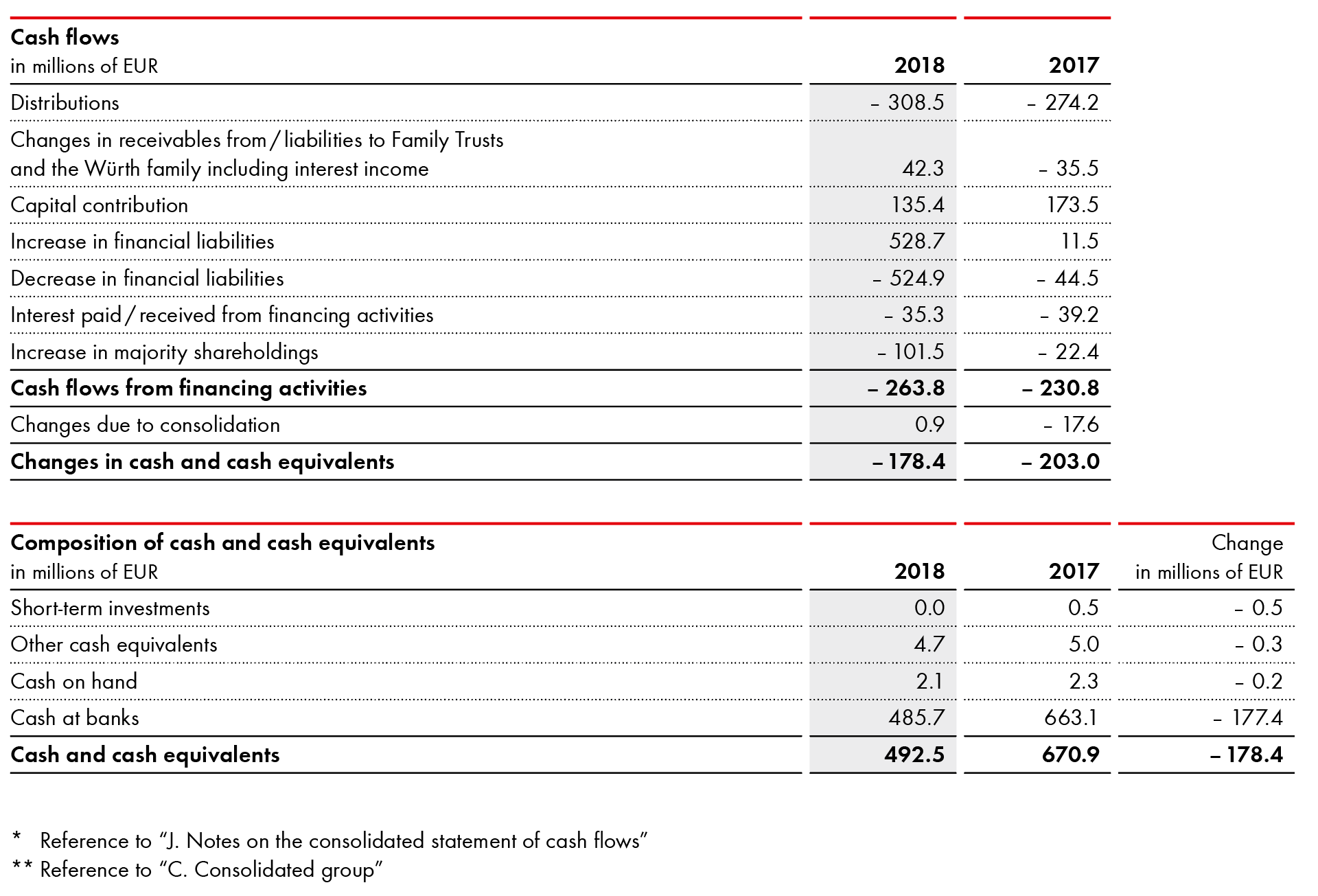

Intercompany transactions, balances and unrealized gains on transactions between group companies are eliminated. The ppa in the consolidated financial statements 6. They include three key financial statements;

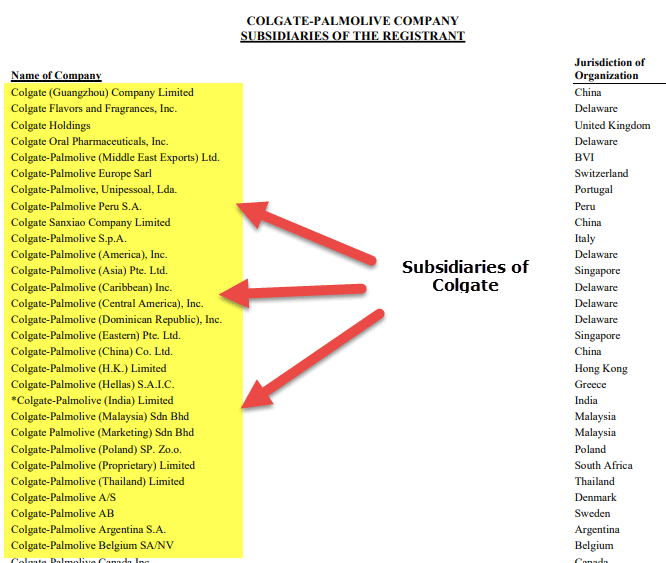

It gives a clear picture of the existing and potential investors about the company and its future. The information (including management information) inferable from the analysis of the cancellation differences 7. Sec, as the controlling company, consolidates its 232 subsidiaries, including samsung display and samsung electronics america.

Requirements for consolidated financial statements. The ferrero group, through its holding company ferrero international s.a., approved the consolidated financial statements for the 2022/2023 financial year, which ended on august 31, 20231. Size of group turnover balance sheet total number of employees.

Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. Consolidated financial statements are an essential part of the accounting process for group companies. In my opinion, the consolidated financial statements and the separate financial statements present fairly, in all material respects, the consolidated financial position of thachang green energy public company limited.

Consolidated financial statements are prepared by using uniform accounting policies for all of the entities in a group. Consolidated financial statements play a very important role in helping the investors to make proper investment decisions. But they always don’t help until you take a detailed approach.

Ifrs 10 was issued in may 2011 and applies to annual. The thresholds relevant to groups according to companies act 2006 are as follows: The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the entities.

This includes consolidated income statement, balance sheet and cash flow statements the purpose of preparing consolidated financial statements is to provide a comprehensive view of the financial performance and financial position of a group of companies as if they were a single entity. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. Consolidation is mandatory for a group to be able to transparently present its complete.

Unrealized losses are also eliminated unless the transaction. Income, cash flow, and financial position. The consolidated financial statements report the financial results of the entire group's transactions with people and companies outside of the group.