Underrated Ideas Of Info About Pik Interest Cash Flow Statement

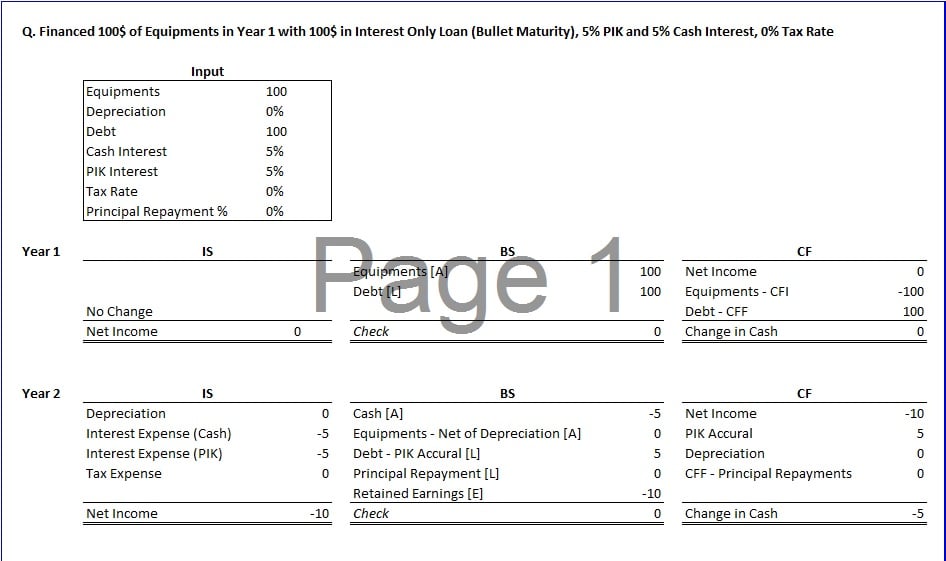

In the cash flow statement:

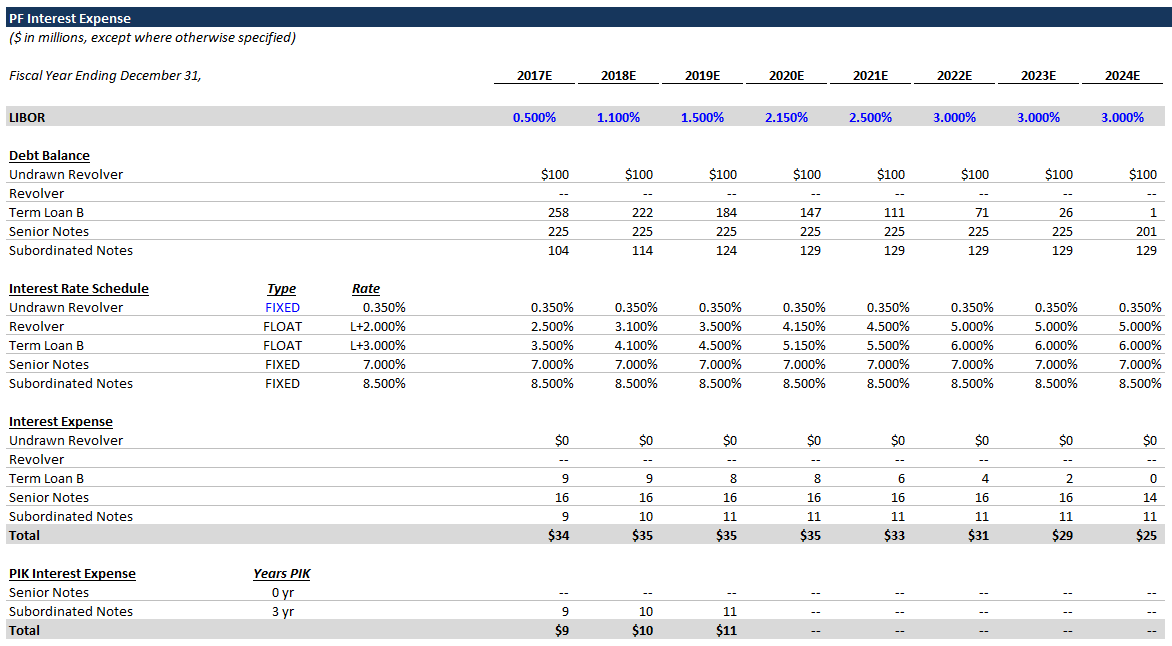

Pik interest cash flow statement. Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. 31 may 2022 us financial statement presentation guide 12.5 the terms of debt instruments may permit or require the borrower to satisfy accrued interest on the. Free cash flow per share.

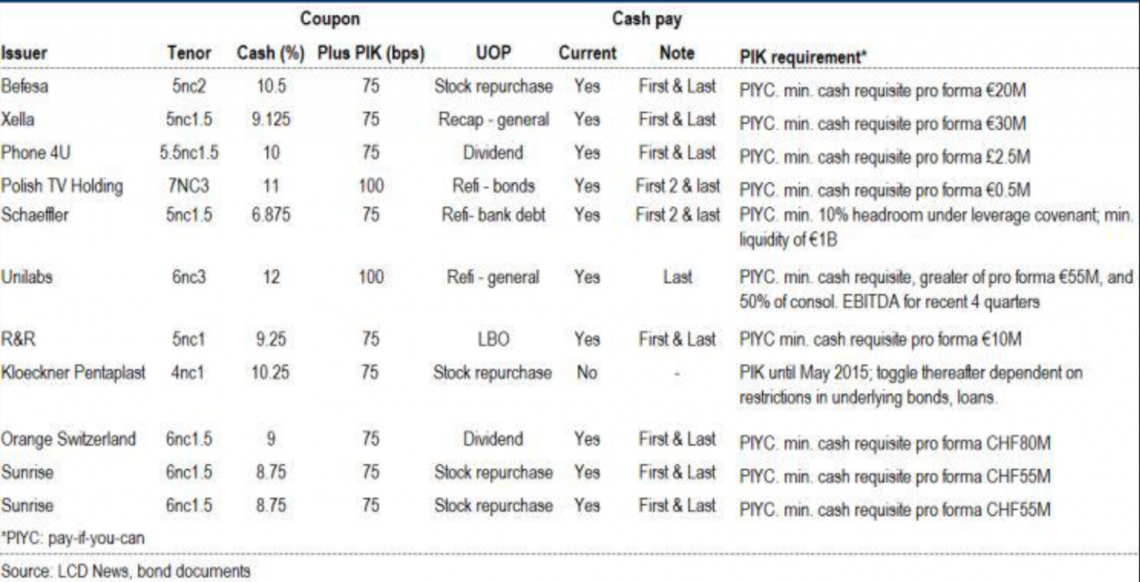

Subordinates records, beginning balance (year 1) = $1m. A pik loan allows borrowers to defer interest payments to the lender, with the interest balance being accrued until the loan matures. May 5, 2021 what is “paid in kind (pik) interest”?

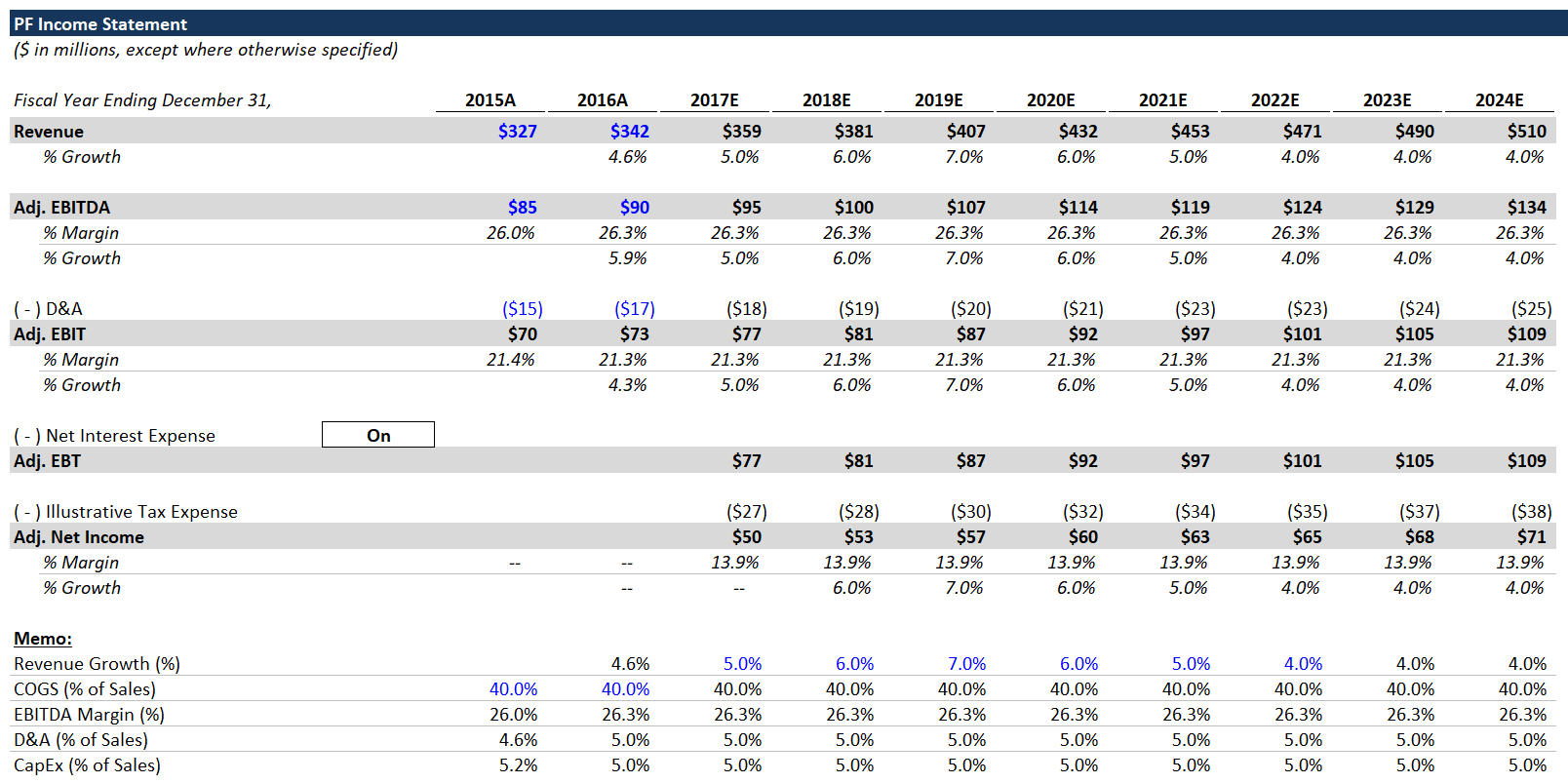

Reading between the lines, s&p are forecasting a big. Pik interest accrues during the applicable accrual period and is then paid in kind through either the issuance of additional debt instruments or an increase in the. Cash flows from operations before income taxes and interest paid:

Financeable training 8.56k subscribers subscribe subscribed 169 9.9k views 2 years ago all videos we continue here from our last video with another 3. The current interest, $1.4 million, is paid in cash as required by the note. Pik interest rate = 8.0%.

Pik interest is also referred to as. Net income is down by $6 from the income statement; Or in the case of.

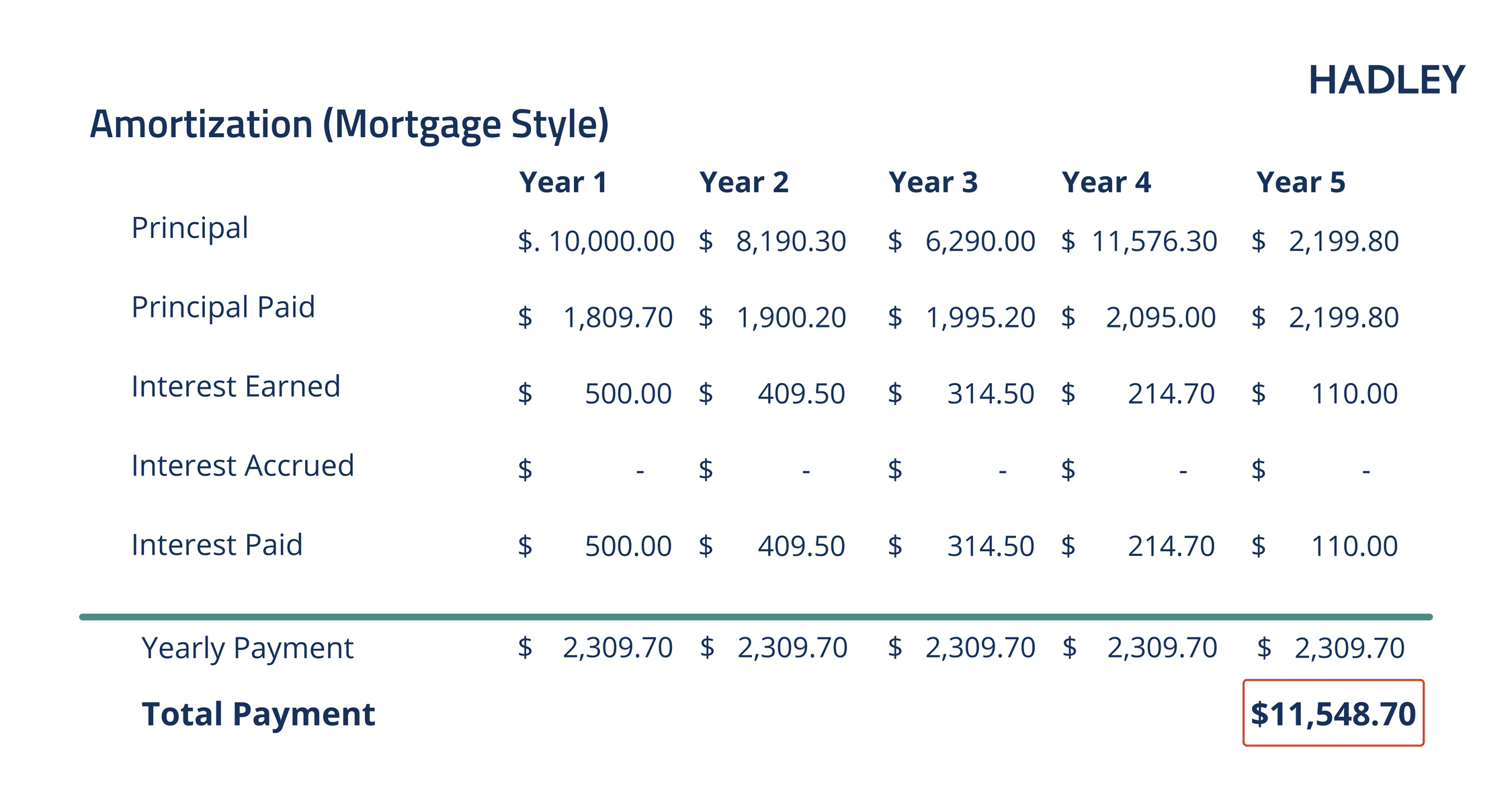

The three approaches for classification in the cash flow statement of the borrowing, interest, and repayment cash flows over the life of the debt are: If we have an outstanding debt of $1, 000 with 10 percent pik interest, then at the end of the period, we incur a $100 pik interest expense. Cash interest rate = 4.0%.

The pik interest, $200,000, is paid in a security and is added to the principal amount of the note,. Rather than a straight 12.0% cash interest rate, 4.0% will be paid. Say $10 of interest accrues (pik) to the principal.

Overall net change in cash at the bottom is. Statement of cash flows. If we assume a 40 percent tax rate,.

Pik interest, also known as a payment in kind, is an option to pay interest on preferred securities or debt instruments in kind instead of cash. The pik loan enables the debtor to borrow without. Opting for pik helps the borrower conserve cash, since the interest payments are pushed back to a later date.

When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments along with. For operations, we have a decrease in net income from the pik interest.