Awesome Info About Insurance Statement For Income Tax

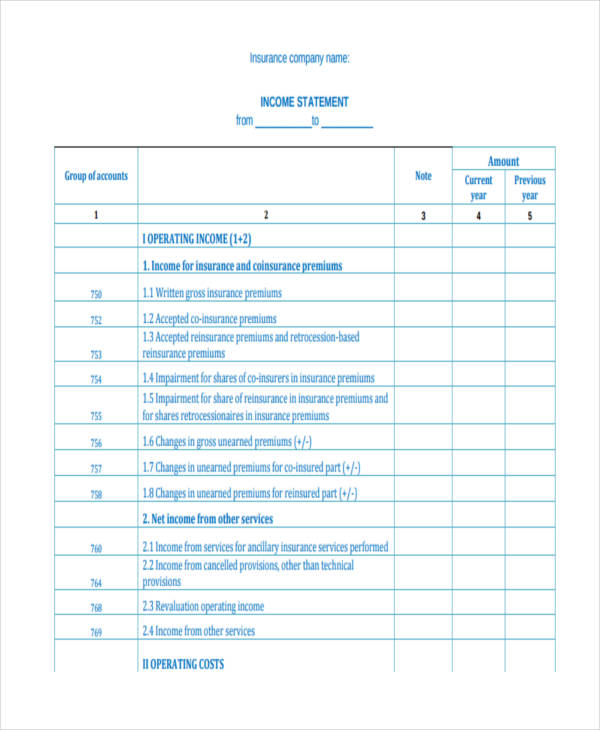

18 rows health care insurance purchased through the marketplace.

Insurance statement for income tax. For instance, under section 80d, income tax deduction for payment of premium towards health insurance plan is allowed as deduction (rs. On the view statement page, click on policy. Enter the total amount of insurance premiums paid by you for insurance policies that did not mature on 31st march {financial year end}.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). You file a joint return, and you and your spouse have a. But there is a floor.

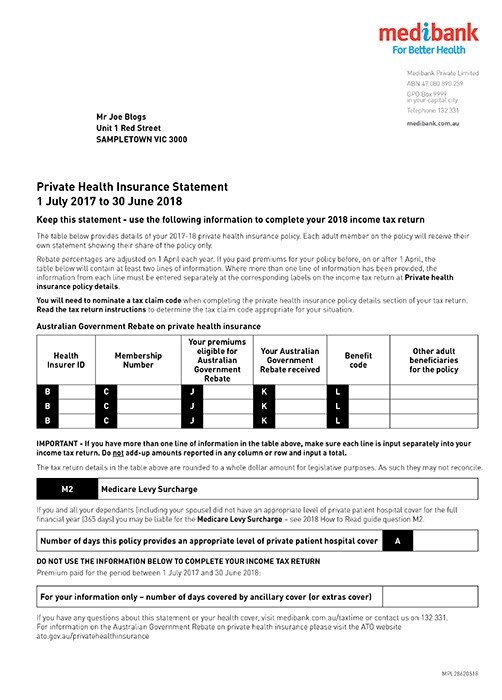

Register and/or login to your my aia account upon logging in, click on my statements & letters. What is income tax? The presentation and disclosure of policyholder income tax and the mitigation of any related income statement volatility is of particular interest for life insurers in those jurisdictions.

According to the new rules, life insurance policies issued after 1 april 2023 will be eligible for tax exemption on maturity benefits under section 10 (10d) of the. For example, if you itemize,. The premium tax credit you used in advance during the year;

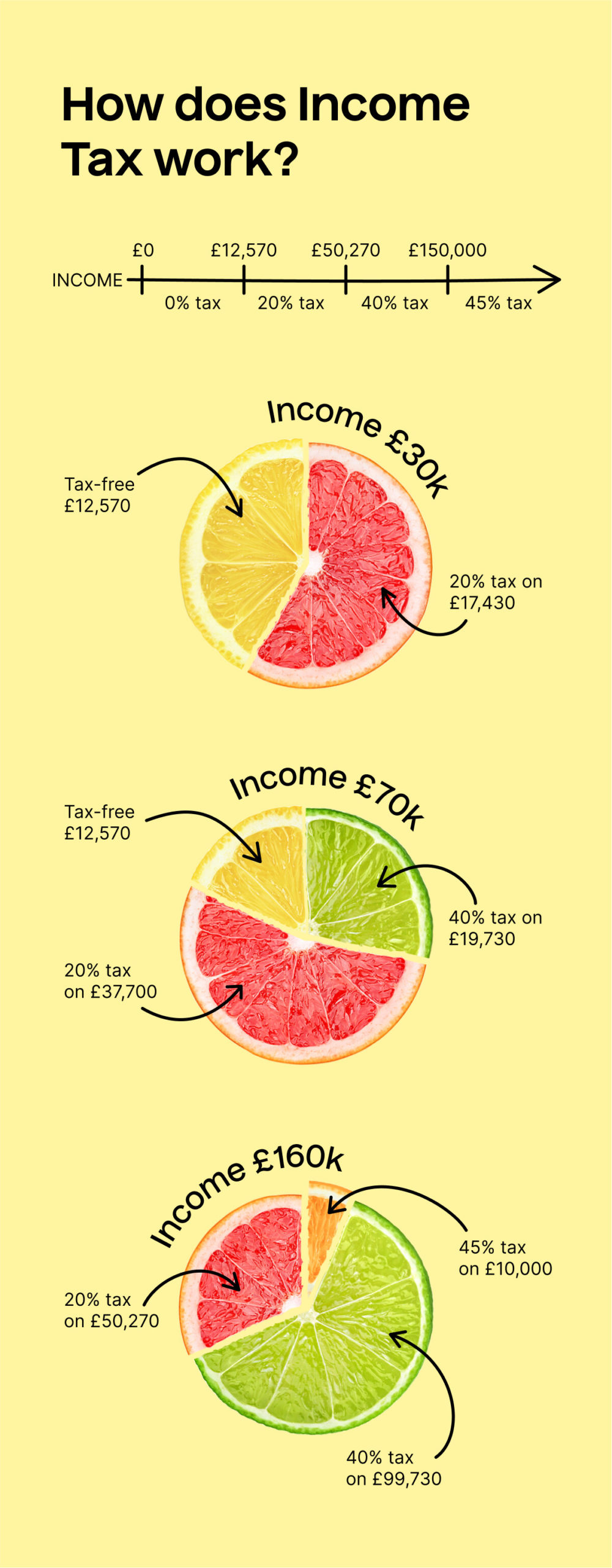

Income tax and national insurance. Income tax and insurance tax reliefs: For tax years other than 2020, if advance payments of the premium tax credit (aptc) were made for your or a member of your tax family's health insurance coverage through the.

What you need to know 4 april 2020 4 mins read the tax season is here and before you know it, many of you will be. Just follow these 3 simple steps: Income tax is a tax on the annual income earned by the individual or company during the fiscal year.

How to claim faqs qualifying for relief you may claim life insurance relief for the year of assessment (ya) 2023 if you satisfy all these conditions: The maximum limit on investment to claim a tax break under section 80c remains rs 1.5 lakh as it is now i.e. For 2023, hsa limits are $3,850 for individual coverage and $7,750 for family coverage.

Understanding the tax treatment insurance premium insurance premium tax treatment of insurance premiums paid by employers including personal insurance policies, group. And the amount of tax credit you qualify for based on your final income. As described in paragraph b65 of ifrs 17, cash flows within the boundary of an insurance contract are those that relate directly to the fulfilment of the contract.

Contributing up to the limit results in a fairly sizeable tax deduction and you do not need. 25,000 for yourself, spouse, and children. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Irs to report certain information about. A gift of a life insurance policy to a. To reconcile, you compare two amounts: