Awesome Info About Deferred Compensation Balance Sheet

Deferred compensation is earned in one period but paid out in a later period.

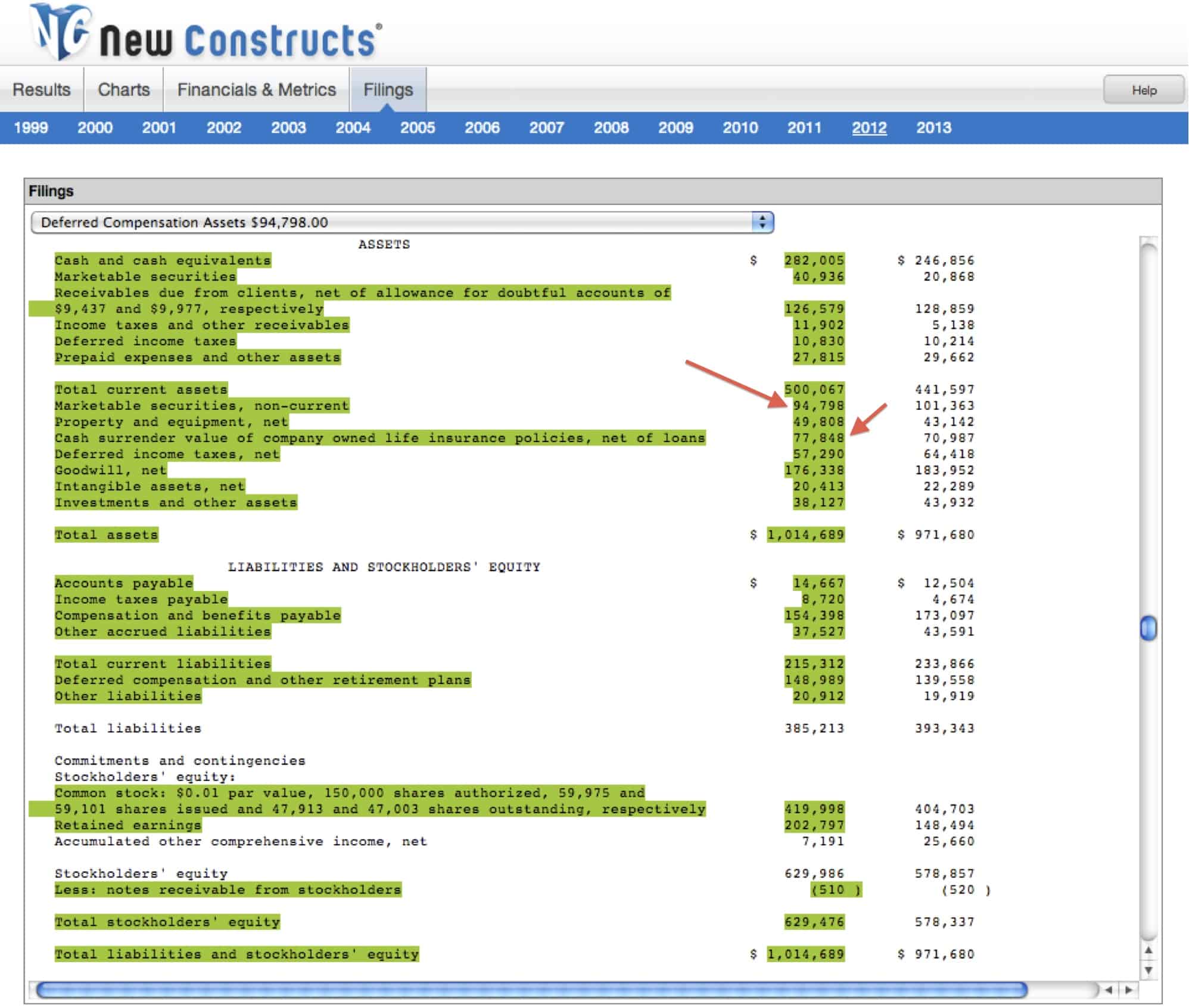

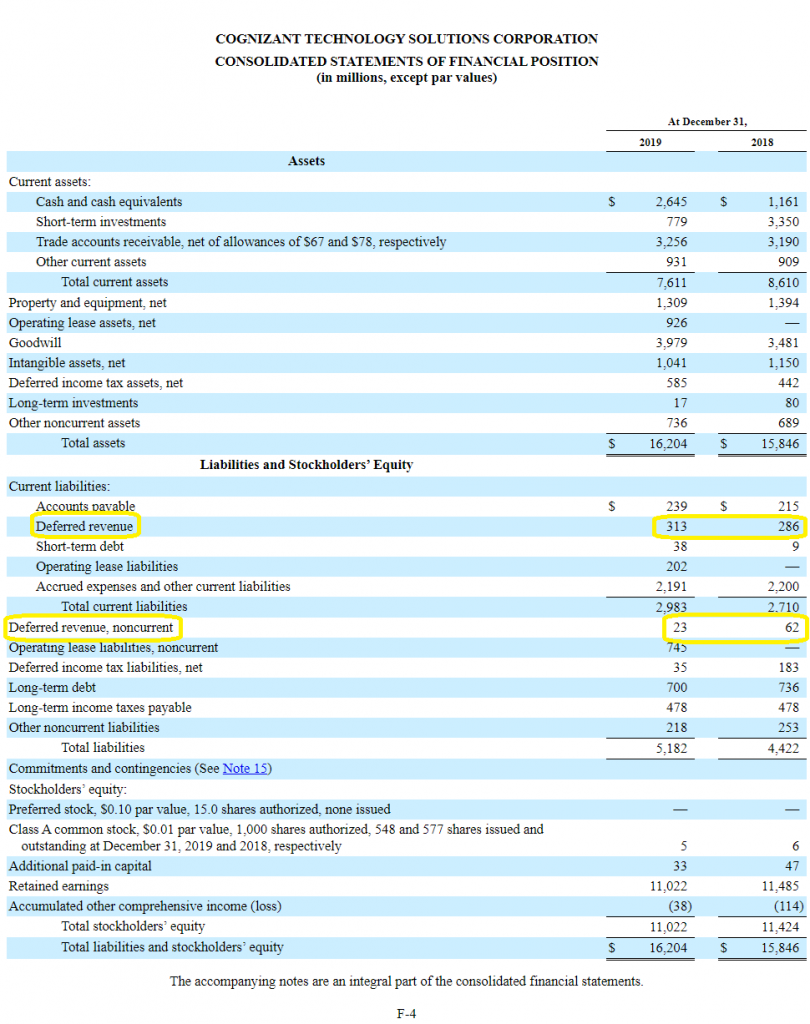

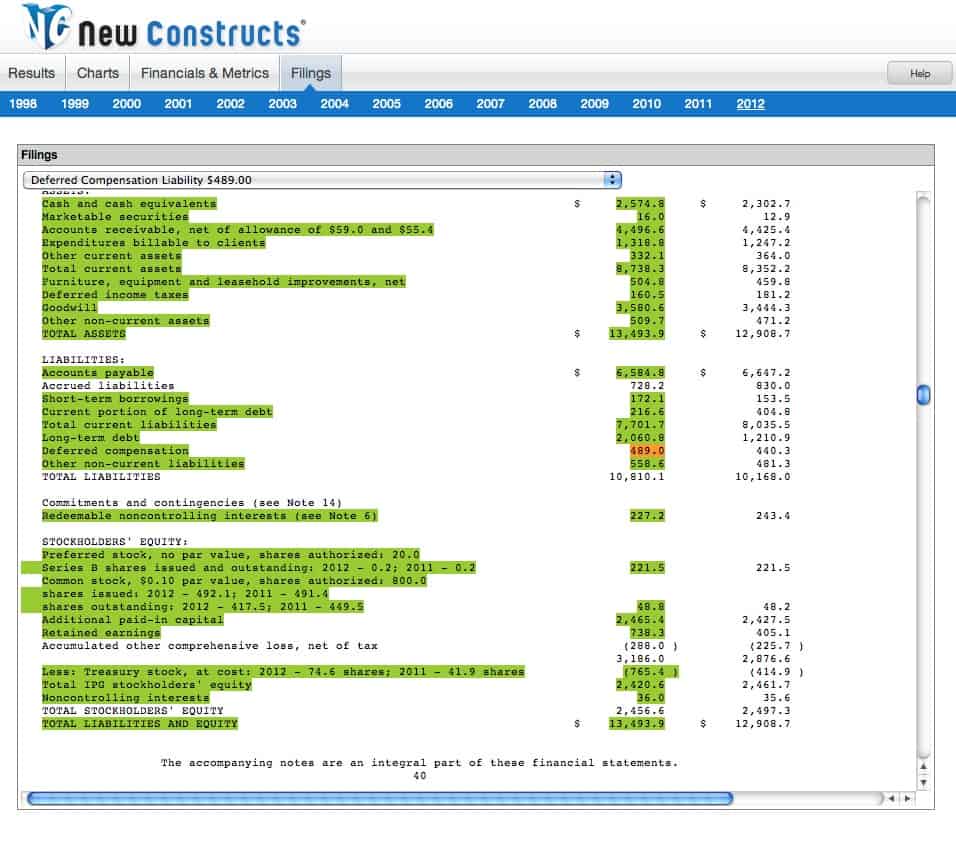

Deferred compensation balance sheet. The asc 715 guidance requires that netting of plan assets and liabilities is only for the pension plans. Deferred compensation refers to that part of one’s contribution that is withheld and paid at a future date. There are two ways of handling deferred charges to expense.

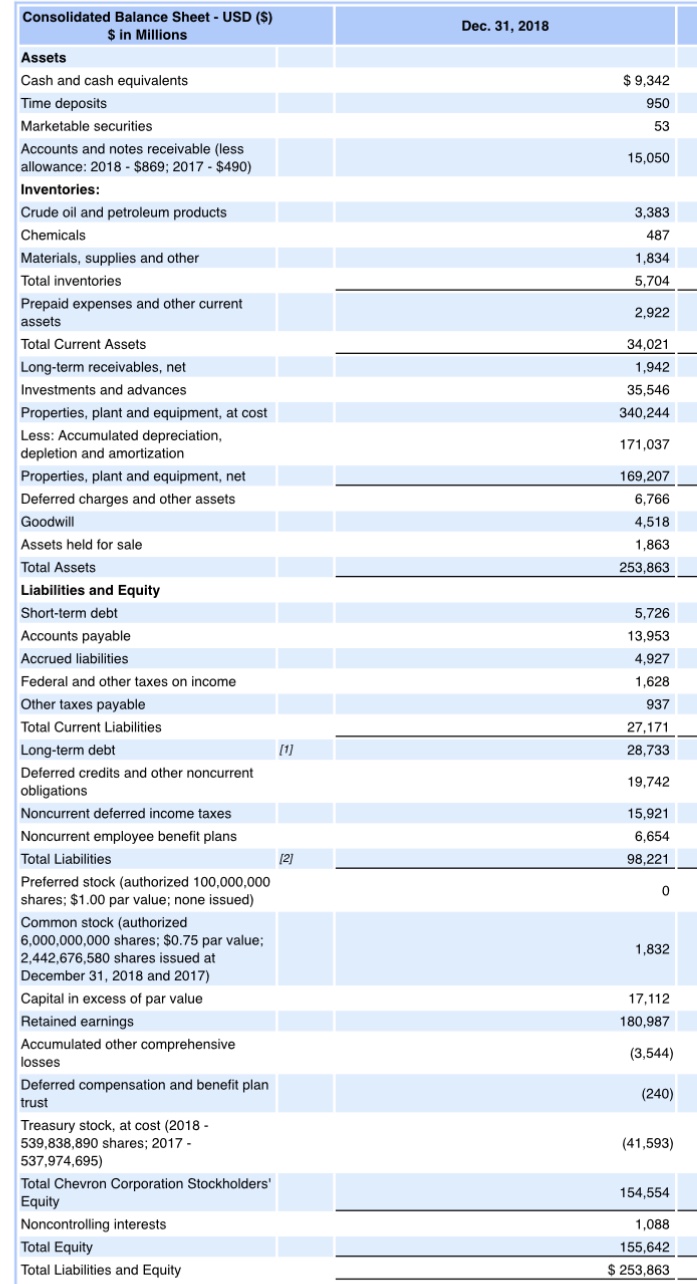

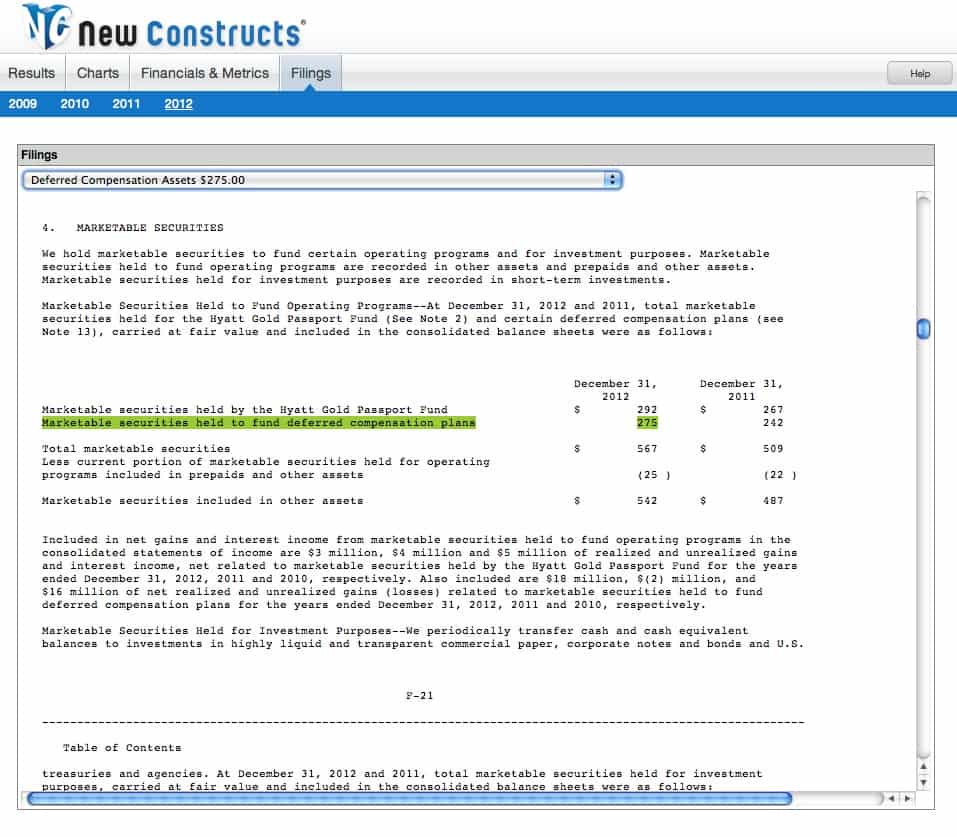

Retirement plans and employee pensions are examples of deferred. For instance, fluor corporation (flr) has $333 million in deferred compensation assets clearly broken out under “deferred compensation trusts” on its. When a business pays out cash for a payment in which consumption.

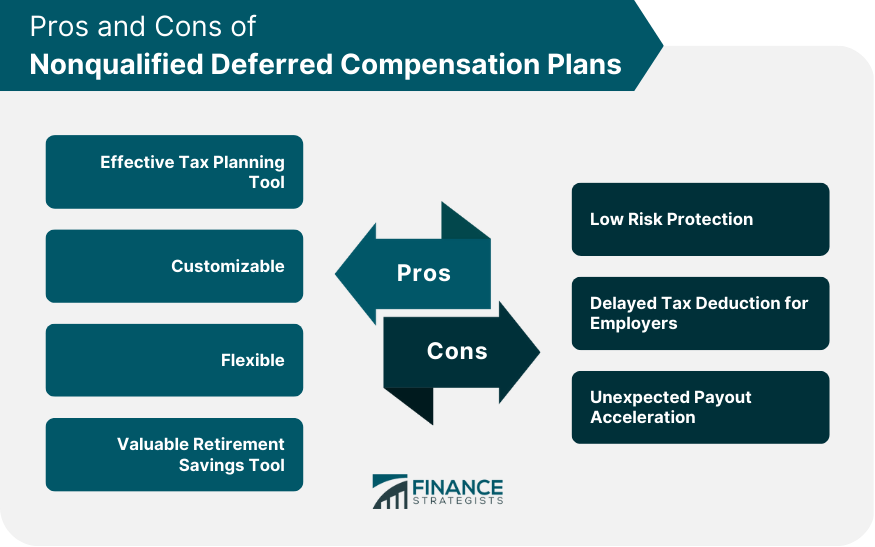

Asc 710 addresses the accounting for deferred compensation when a portion of an employee’s compensation (e.g., bonuses) is invested in the stock of the employer. Broadly speaking, deferred compensation refers to any and all compensation plans that allow you to postpone a portion of your income to the future,. In general, deferred compensation plans allow the participant to defer income today and withdraw it at some point in the future (usually upon retirement) when.

13, 2023, at 10:21 a.m. On the company balance sheet, the accounting for deferred compensation appears on the left — or assets — side as salaries expense, and on the right — or. How to account for deferred compensation.

One is to provide in each case two accounts, one for assets and one for the expenses, and sometimes a third. You must list deferred gains on your company's balance sheet so that your accounting statements properly state your company's financial position. Without adjusting for this liability in its.

You record the amount of the deferred compensation on your balance sheet, and it remains there until you pay it out. Thus, assets set aside for deferred compensation liability should not be. In most cases, taxes on this.

Deferred tax it sounds great, but don’t.

:max_bytes(150000):strip_icc()/deferred-credit_final-309c8fbbe2584a3a97d44a9e81c5b62c.png)