Glory Tips About Loss In Profit And Account

Profit and loss accounts elaborate various business activities, such as expenses and revenues, which are the most useful for risk assessment, cost trend.

Loss in profit and loss account. The profit and loss account forms part of a business’ financial statements and shows whether it has made or lost money. The profit and loss account is compiled to show the income of your business over a given period of time. Hanwha ocean hanwha ocean’s shipyard in geoje, south korea.

Eatclub, which owns and operates several popular cloud kitchen brands such as box8 and mojo pizza, has demonstrated strong recovery. In september, new york civil court judge. 11 rows in this article, we will see types of profit and loss account and profit and loss account.

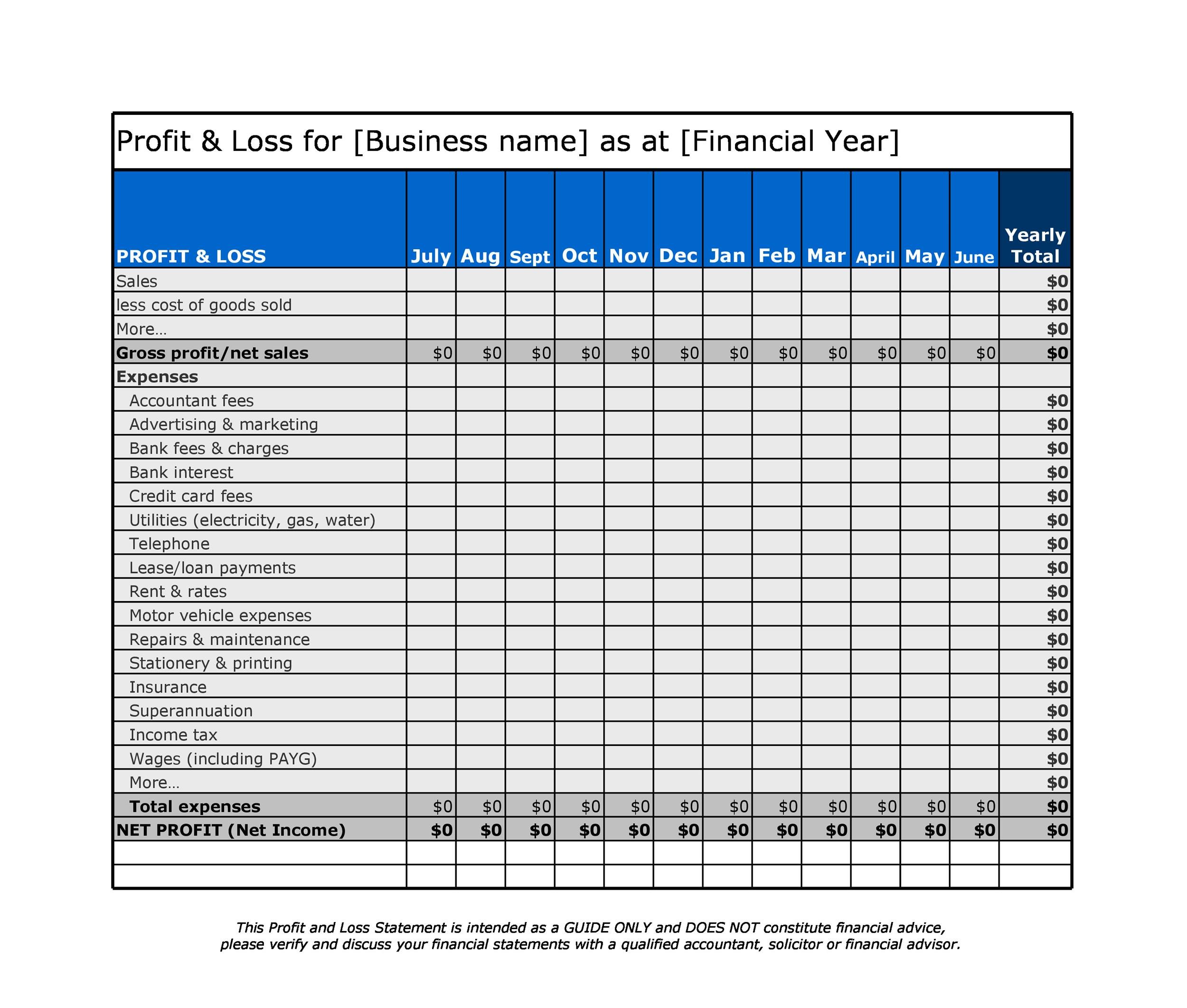

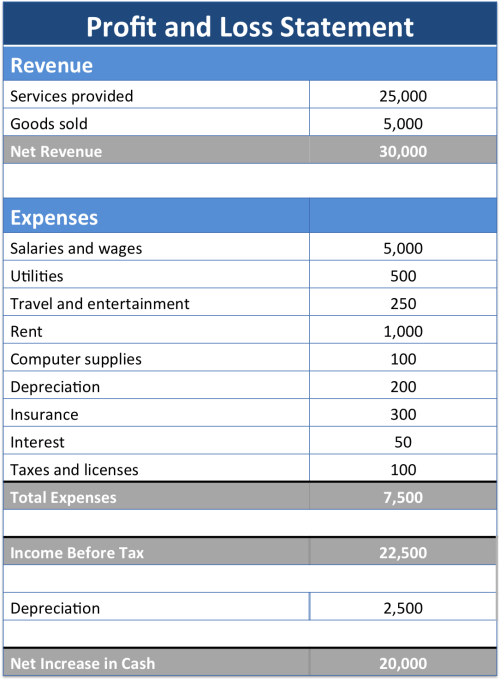

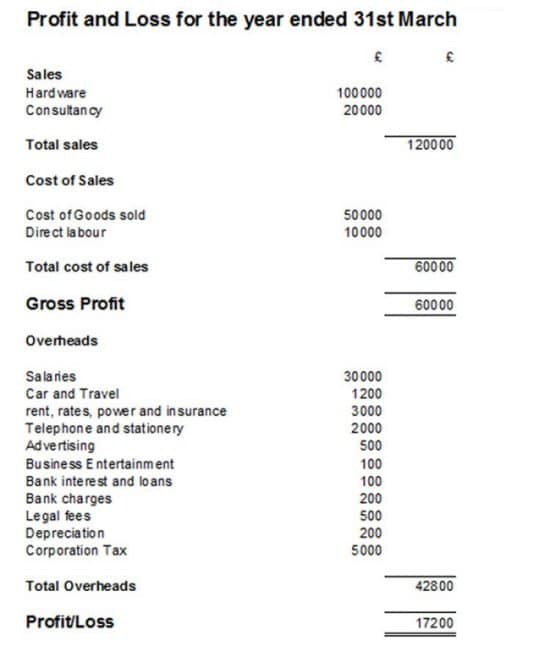

It could be for a week, a quarter or a financial year. In simple terms, a profit and loss account (p&l) is an accounting document that shows the revenue earned by a business and its expenses. The starting point for any p&l is the sales and income that the organization makes and earns.

A profit and loss account in report form (and according to the nature of expense method) mentions sales revenue as the first item. Show whether a business has made a profit or loss over a financial year.; The purpose of the profit and loss account is to:

This is the most significant information to be reported for decision making. Net income or net profit is calculated by charging all operating expenses and by considering other incomes earned. Profit & loss account shows the net profit or loss earned by the company.

The income statement is one of three. It summarises the trading results of a business over. A p&l statement provides information.

Describe how the profit or loss. February 21, 2024. In the past, it was only.

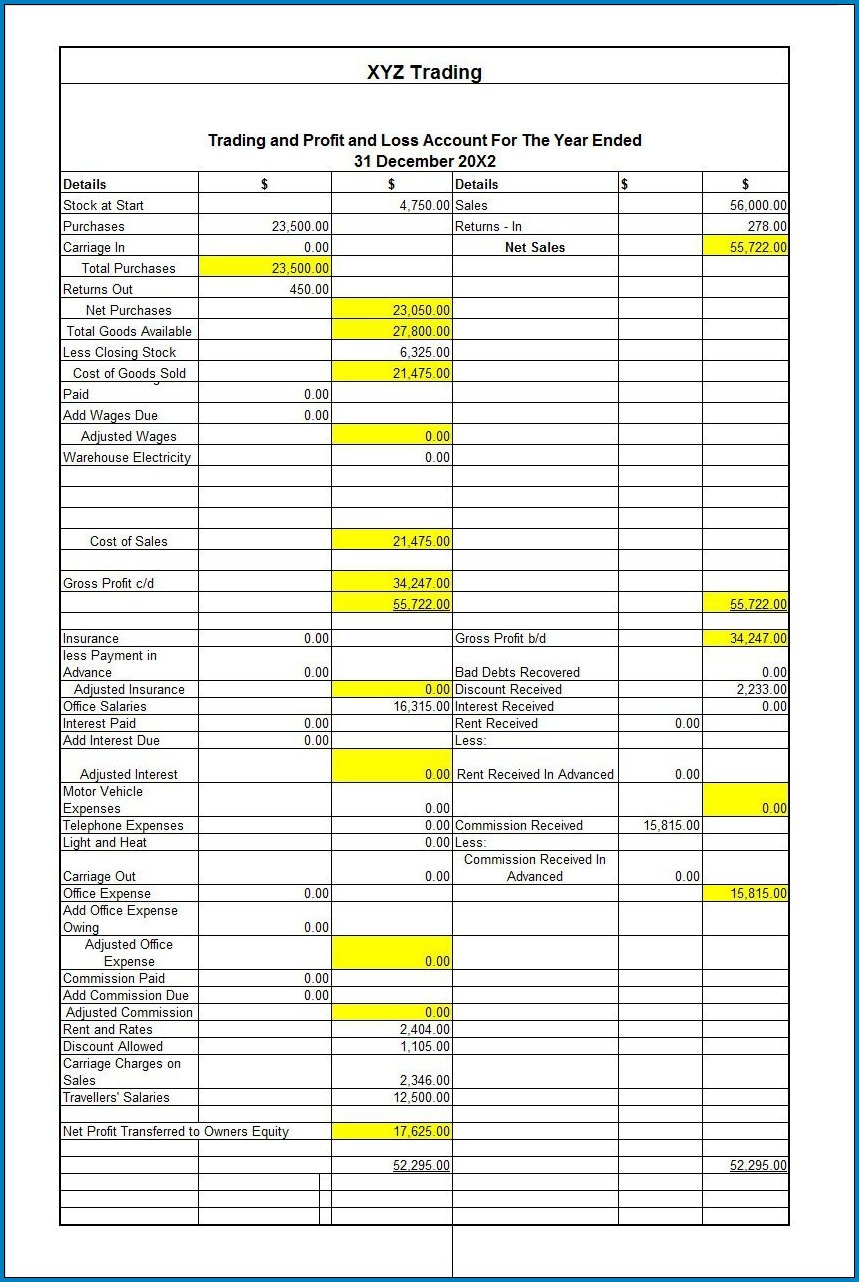

Calculations in the profit & loss account would be as follows: A profit and loss account is prepared to determine the net income(performance result) of an enterprise for the year/period. Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns.

The motive of preparing trading and profit and loss. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing.

In private sector organizations this is often referred to as turnover. The georgia election subversion case against donald trump and 14 of his allies took a stunning turn thursday when two top prosecutors testified under oath about. Your p&l statement shows your.