Fun Tips About Formula For Calculating Free Cash Flow

With au$118 share price, xero appears to be trading close to its estimated fair value.

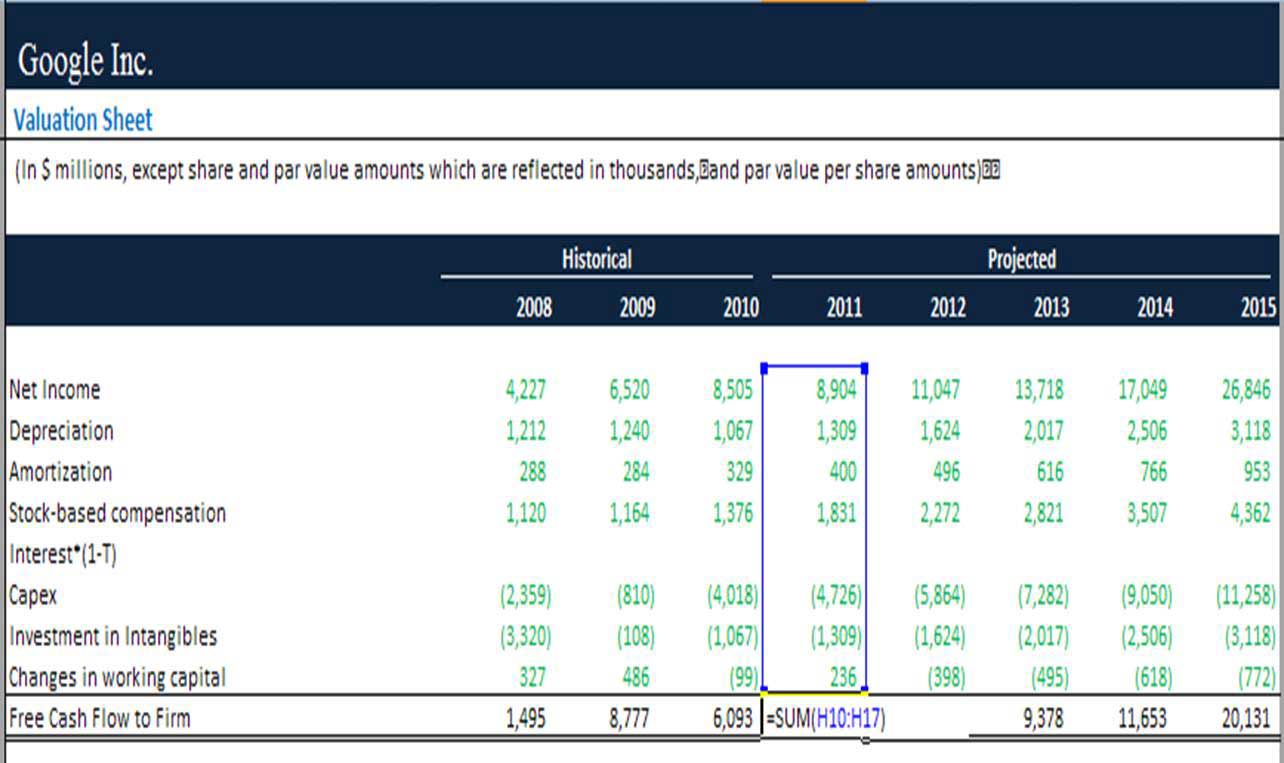

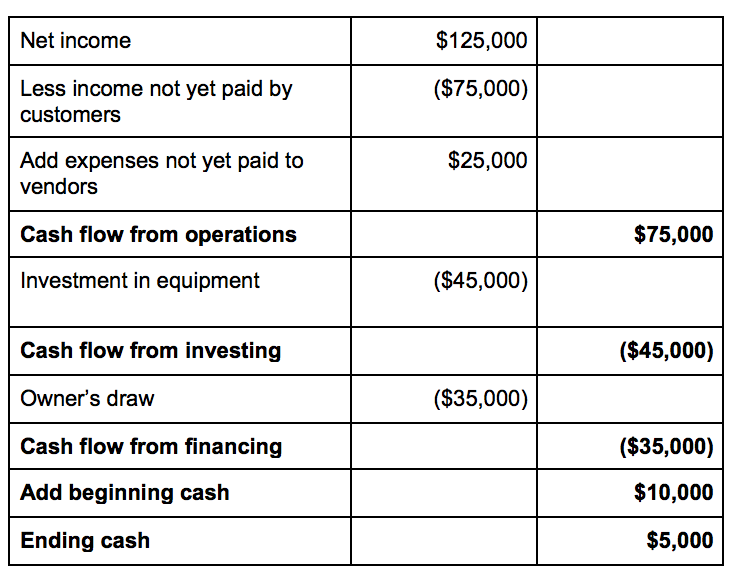

Formula for calculating free cash flow. Free cash flow is one of a number of incredibly important financial metrics that help investors, founders, and finance leaders interpret and understand the financial health of a company. Using the 2 stage free cash flow to equity, xero fair value estimate is au$100. The formula for free cash flow yield is:

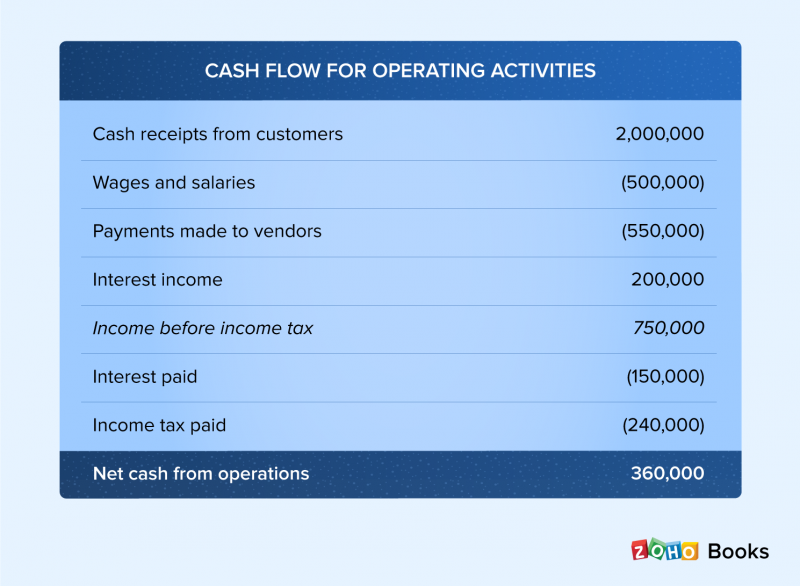

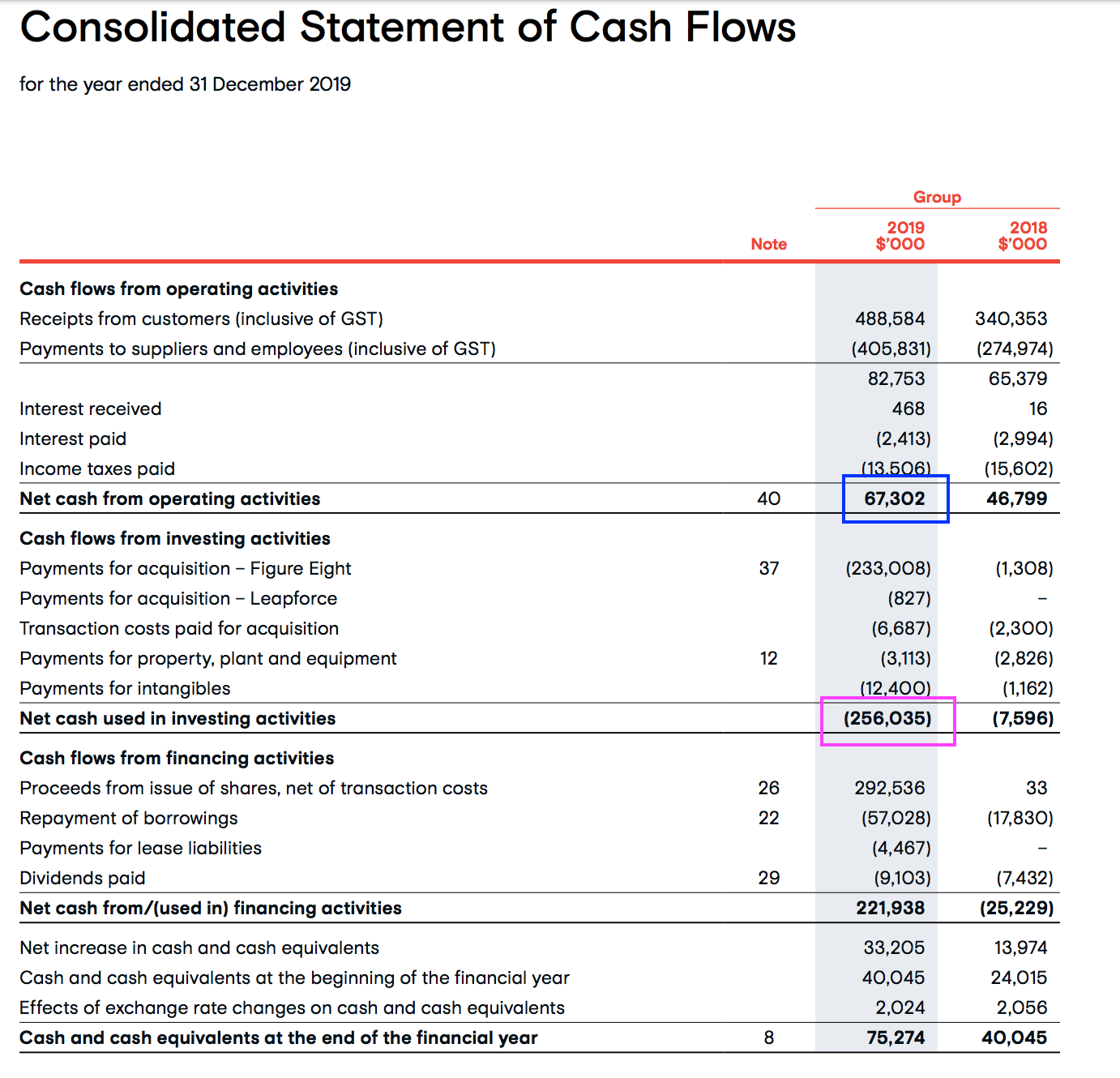

Calculating free cash flow. Putting the above all together, the fcff formula is as follows. Corporate finance financial statements free cash flow to the firm (fcff):

Having a variety of formulas helps you calculate free cash flow even if you don’t have every. Free cash flow formula. Formula with net operating profits.

Key takeaways free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Free\ cash\ flow\ yield=\frac {free\ cash\ flow\ per\ share} {market\ price\ per\ share} f ree c ash f low y ield = m arket p rice per sharef ree c ash f. By analyzing and understanding a company’s free cash flow, you can determine whether there is a likely increase in future earnings, whether the business is.

Home what is free cash flow? The resulting fcf of apple is $73.36 billion. The fcfe metric is often.

The following are different types of such methods: So now that you know why free cash flow is an important metric, it’s calculation time. This is the most commonly used method.

The formula is: Calculate the fcf formula. 31, 2020 into cell c2.

But the most common formula to use when calculating free cash flow is: Now, enter the date dec. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow.

Examples and formulas by adam hayes updated march 19, 2022 reviewed by julius mansa fact checked by timothy li what is. As you can see, the free cash flow equation is pretty simple. We’ll break down the free cash flow equation from above as follows:

The third method for calculating free cash flow is even more detailed. Aurora solar technologies' estimated fair value is ca$0.019 based on 2 stage free cash flow to equity. There are quite a few variations of the formula out there that you can use.

/GettyImages-1271201074-5a42861b08dc47ef9de865892dfba962.jpg)

/cash-flow-f604be91c4b0407e97f5e9a4cca5925f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

:max_bytes(150000):strip_icc()/latex_300b8ac692ce74e2b90995d329441dea-5c64d381c9e77c0001566f37.jpg)