Out Of This World Tips About Balance Sheet Full Details

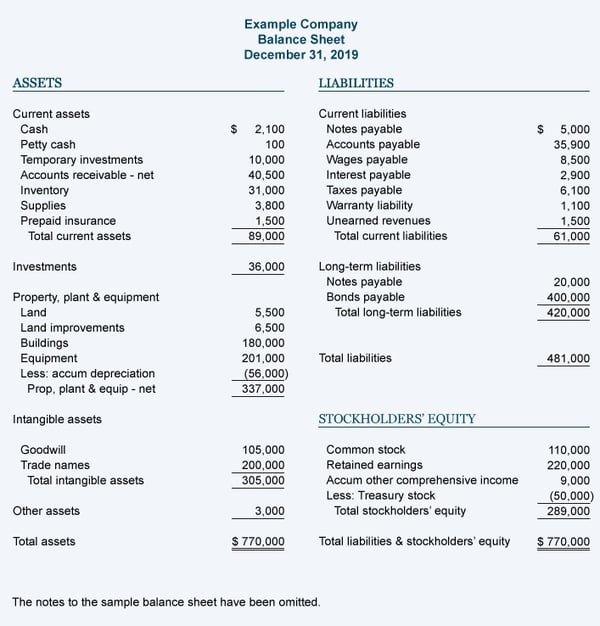

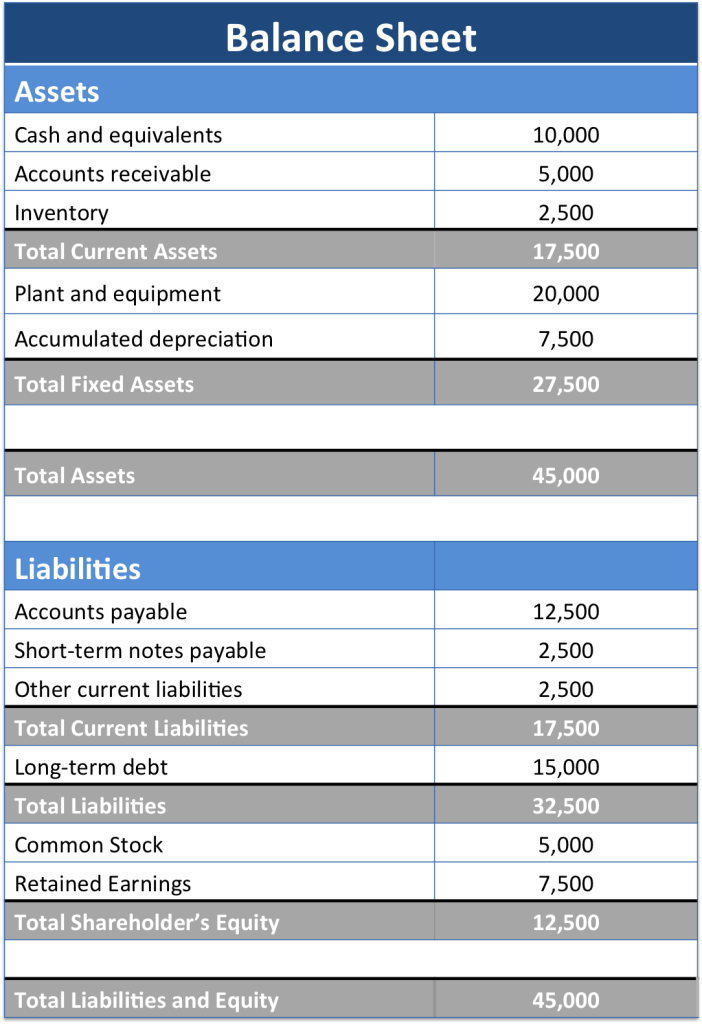

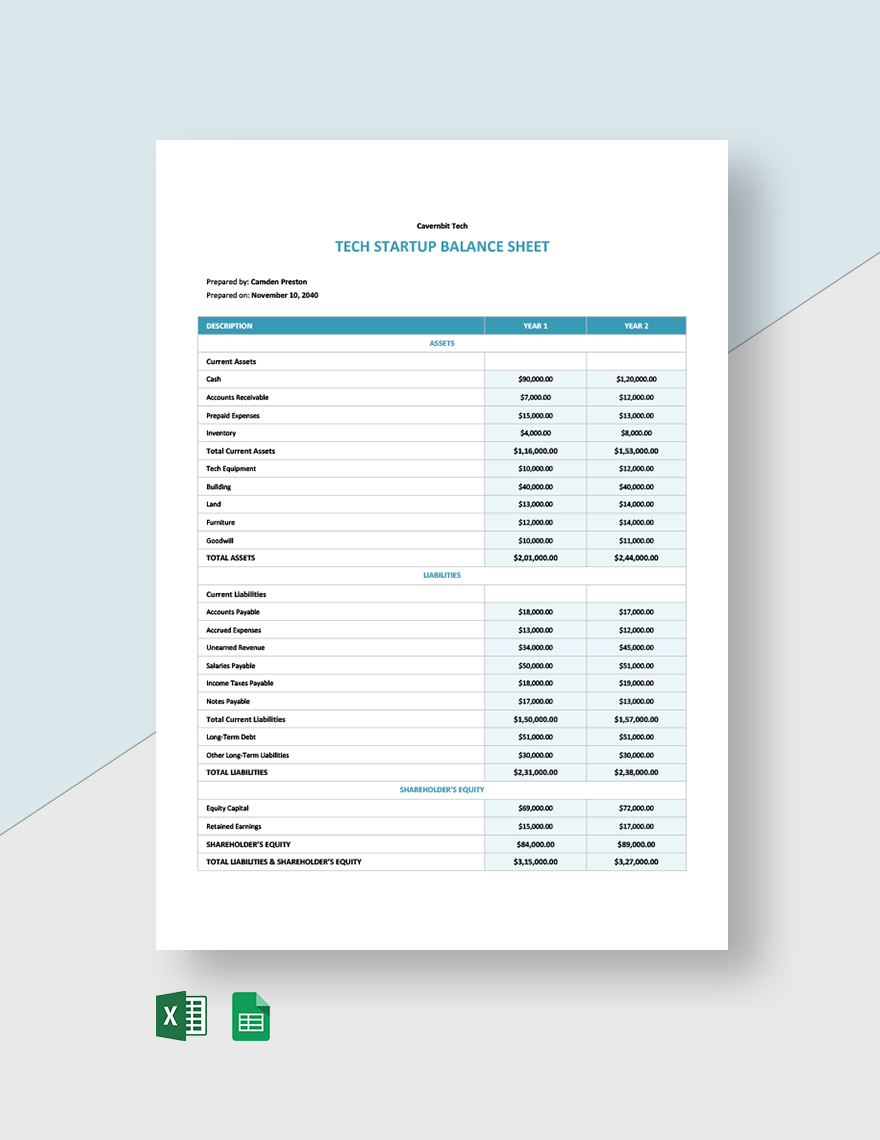

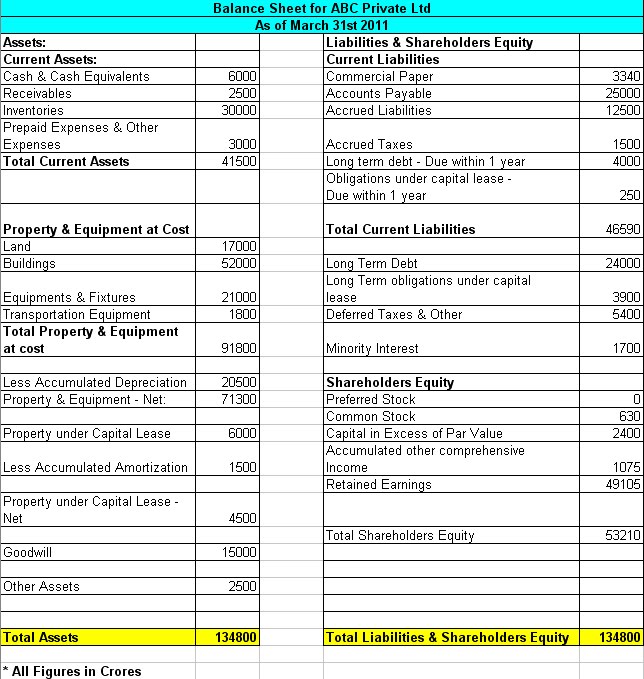

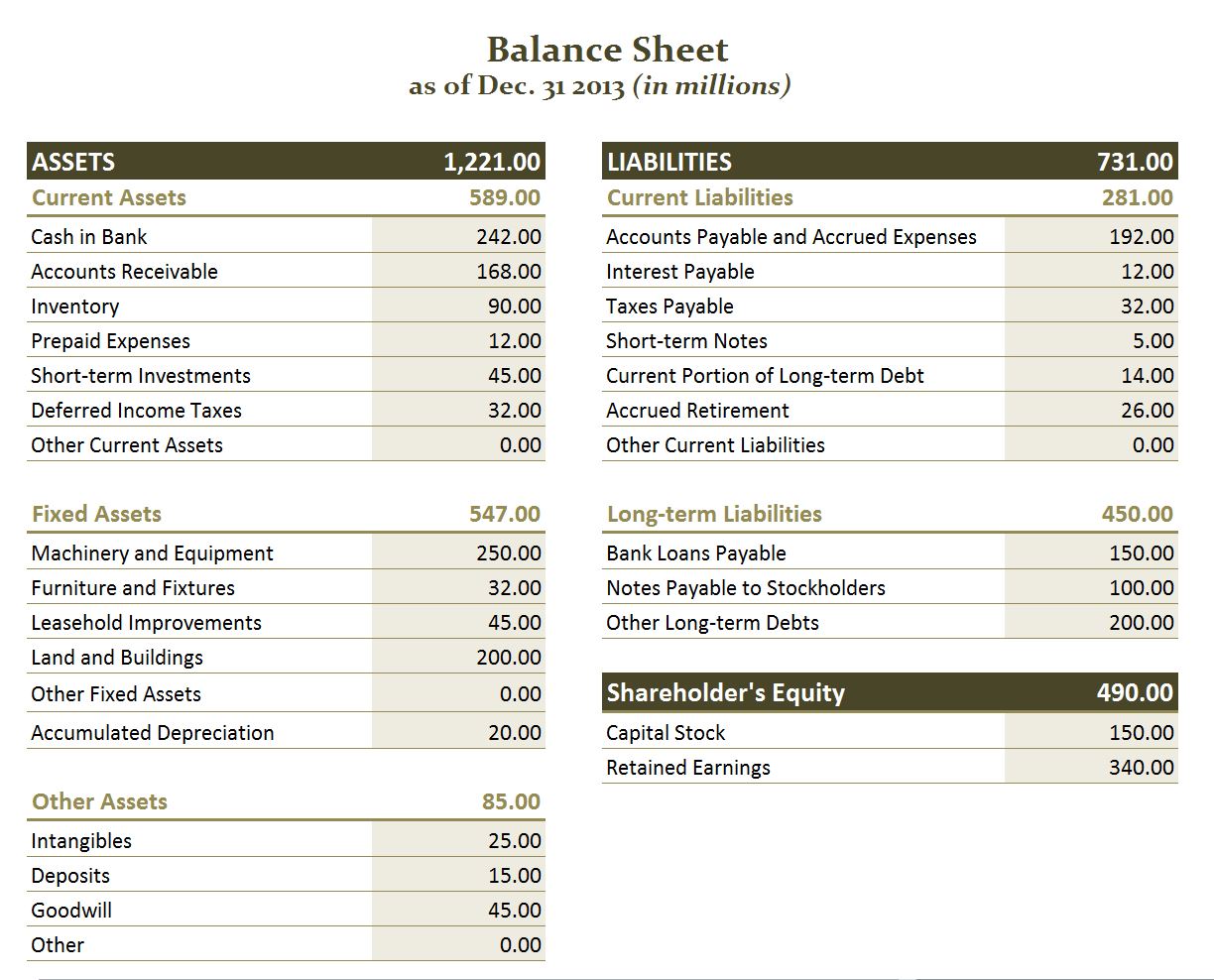

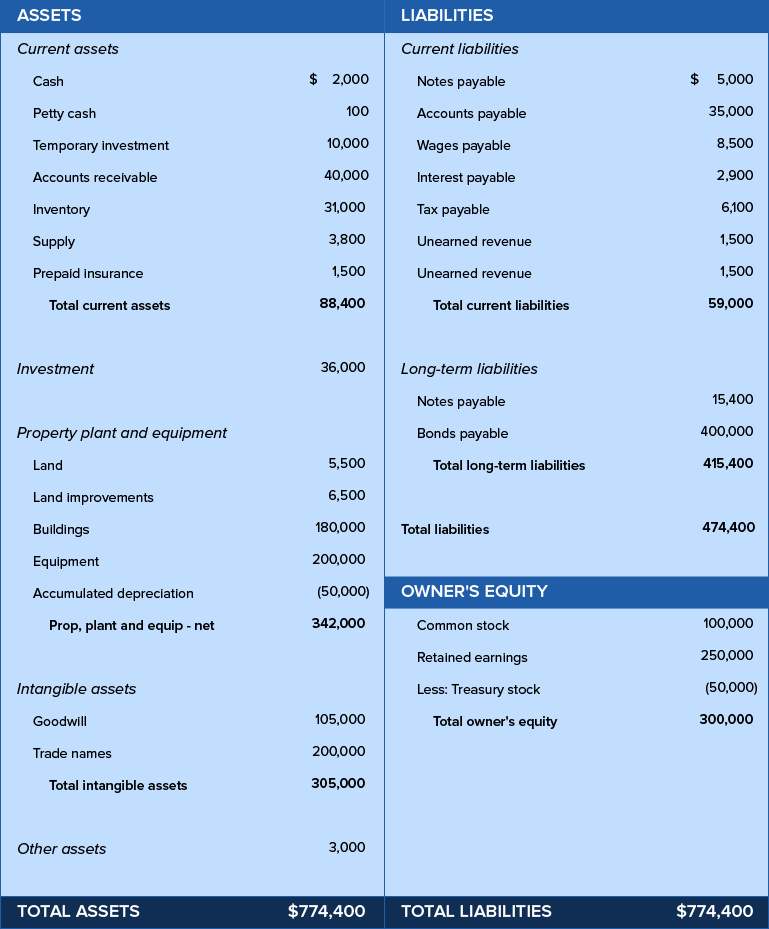

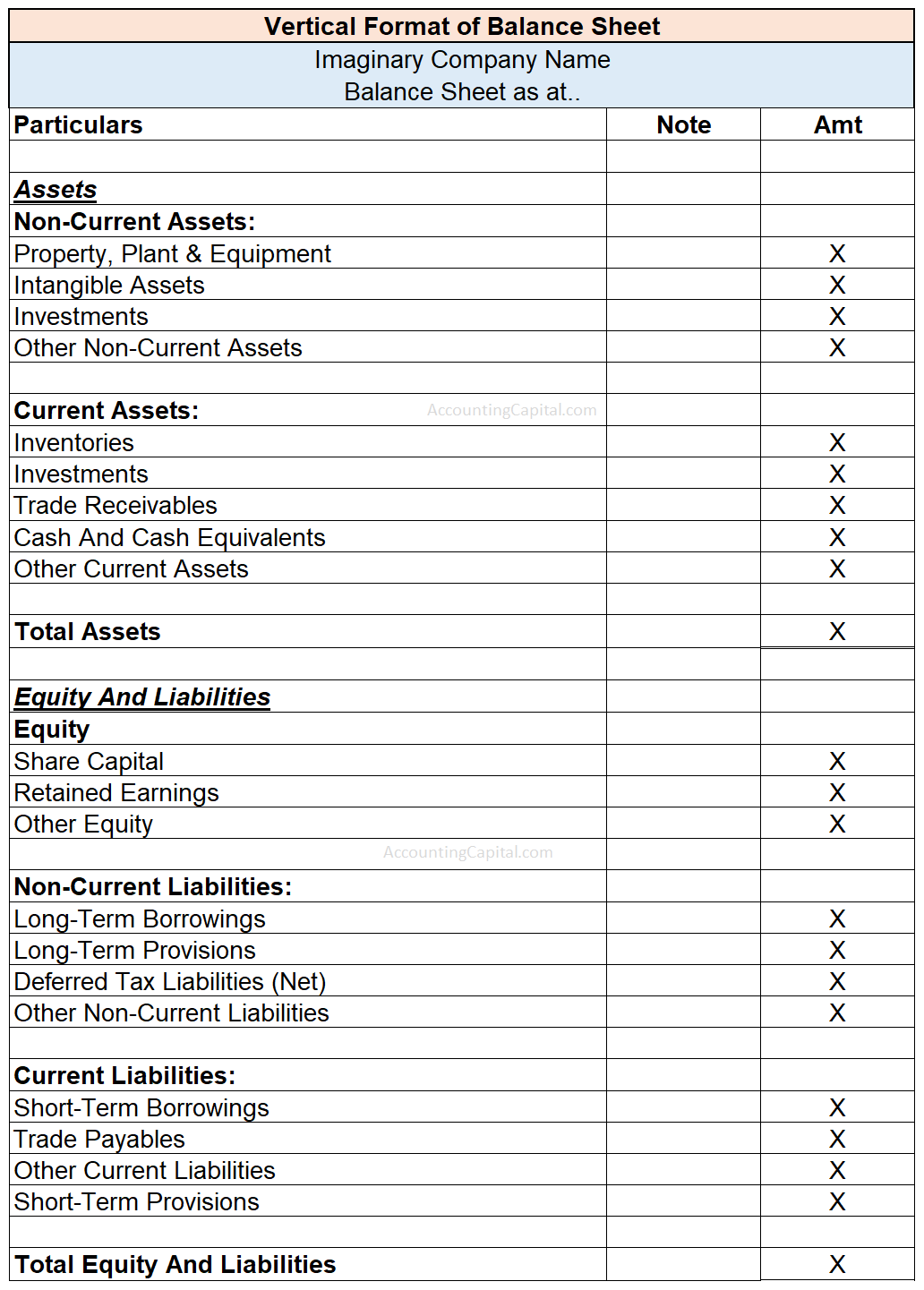

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.

Balance sheet full details. It can also be referred to as a statement of net worth or a statement of financial position. The most common format companies use to present. It summarizes a company’s financial position at a point in time.

What is the balance sheet? It is based on an accounting equation stating that the total liabilities and the owner’s capital equal the company’s total assets. What is a balance sheet?

The balance sheet is based on the fundamental equation: The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

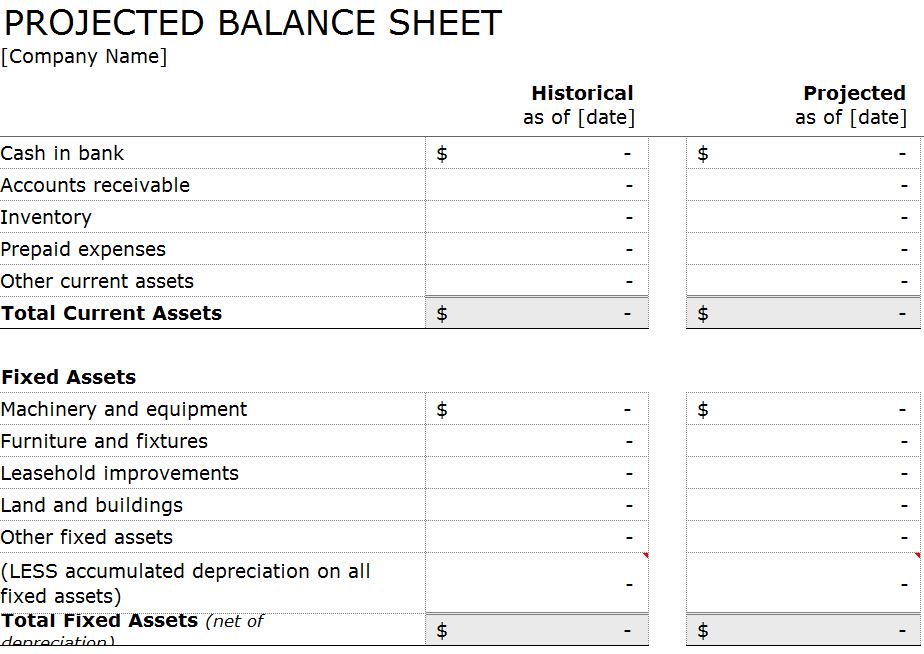

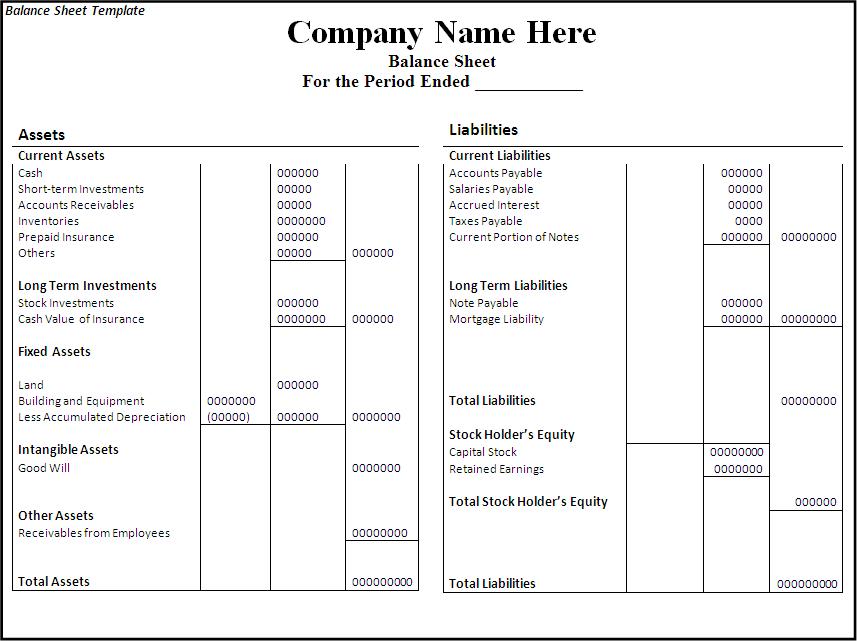

Using this template, you can add and remove line items under each of the buckets according to the business: Assets = liabilities + equity. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date. A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time. The balance sheet is one of the financial statements through which a company presents the shareholders’ equity, liabilities, and assets at a particular time.

It is one of the three core financial statements ( income statement and cash flow statement being the other two) used for evaluating the performance of. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

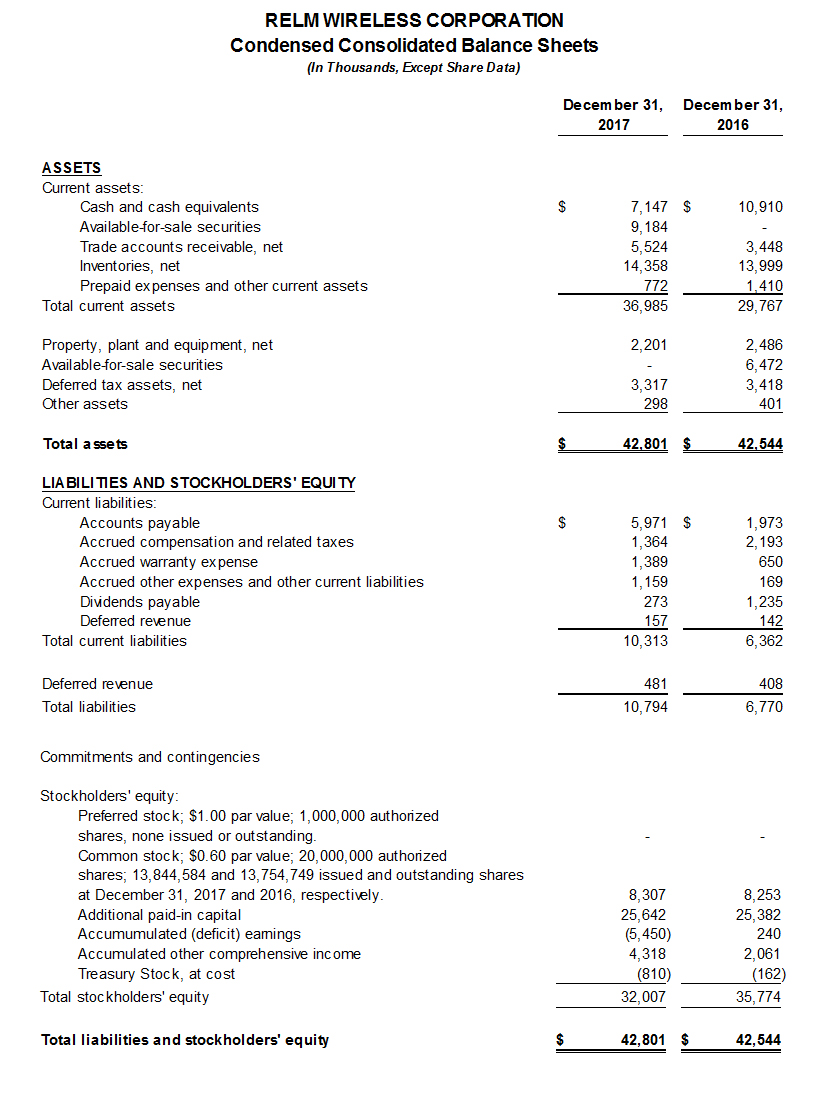

With this information, a company can quickly assess whether it has borrowed a large amount of money, whether the assets are not liquid enough, or whether it has enough current cash to fulfill current demands. Balance sheets examine risk. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

What is a balance sheet? A business’ balance sheet offers a comprehensive overview of a company's financial health by detailing a company's assets, liabilities and shareholders’ equity. The balance sheet shows a company’s.

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. It provides a snapshot of the company’s financial position, showcasing what it owns,. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

A business has primarily two sources of funds which are shareholders and lenders. Nomic flows of all previous periods. The balance sheet presents an account of where a company has obtained its funds and where it has invested them.