Underrated Ideas Of Info About Comparative And Common Size Balance Sheet

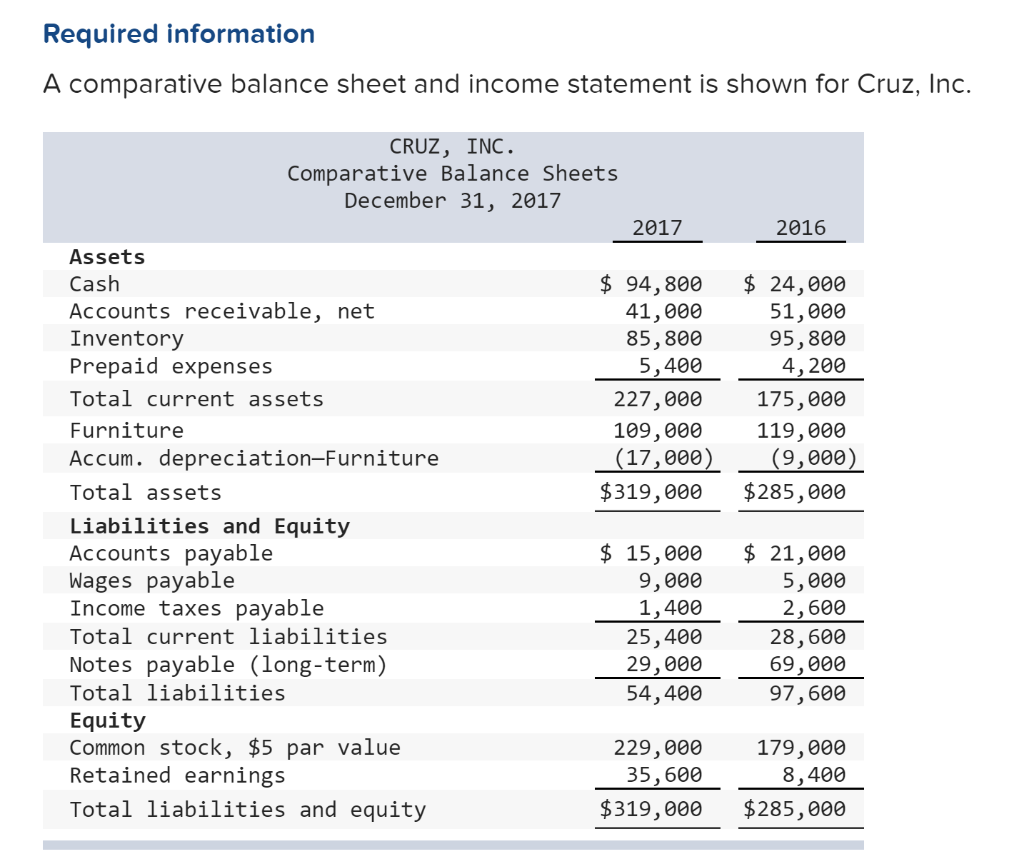

Demonstrate how changes in the balance sheet may be explained by changes on the income and cash.

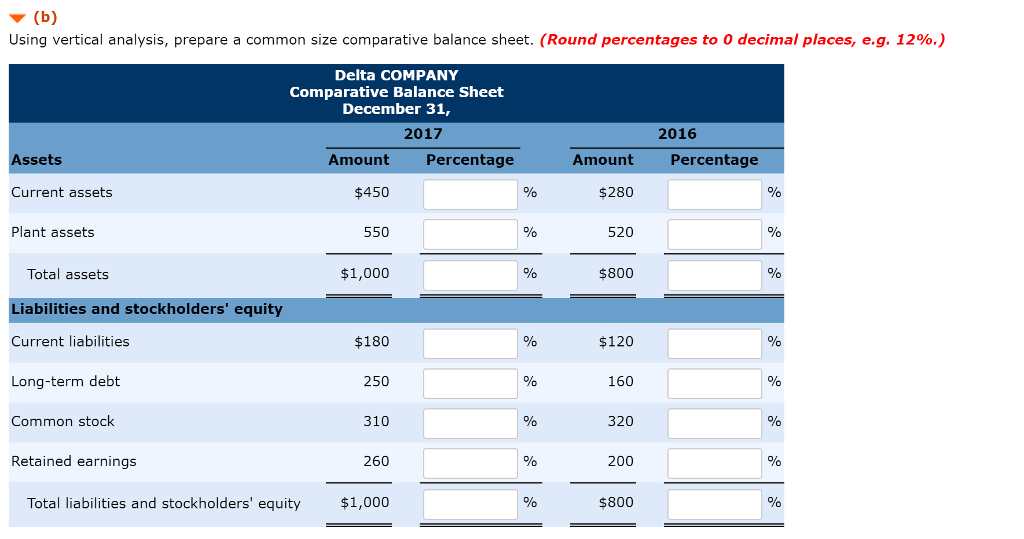

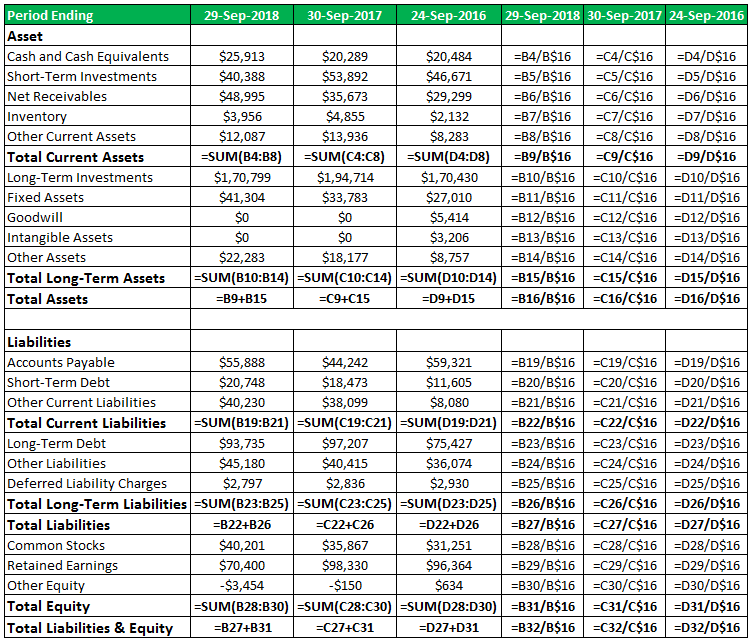

Comparative and common size balance sheet. A comparative balance sheet showcases: Give any two uses of common size statements. This template illustrates how to convert a balance sheet into a.

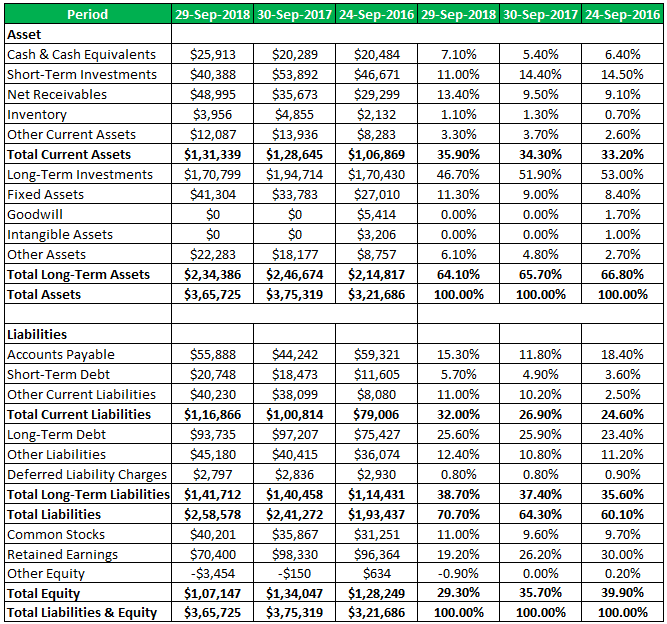

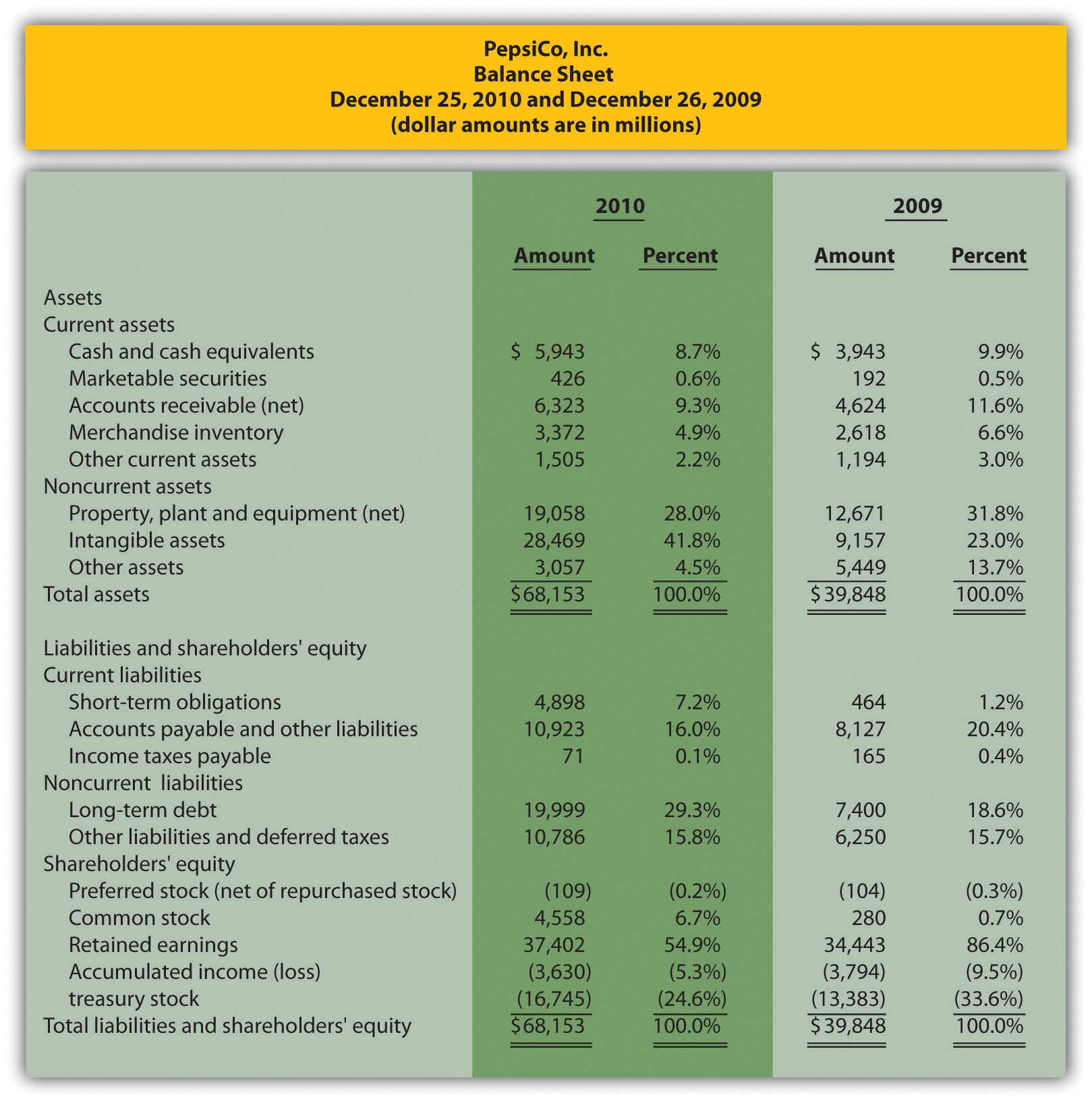

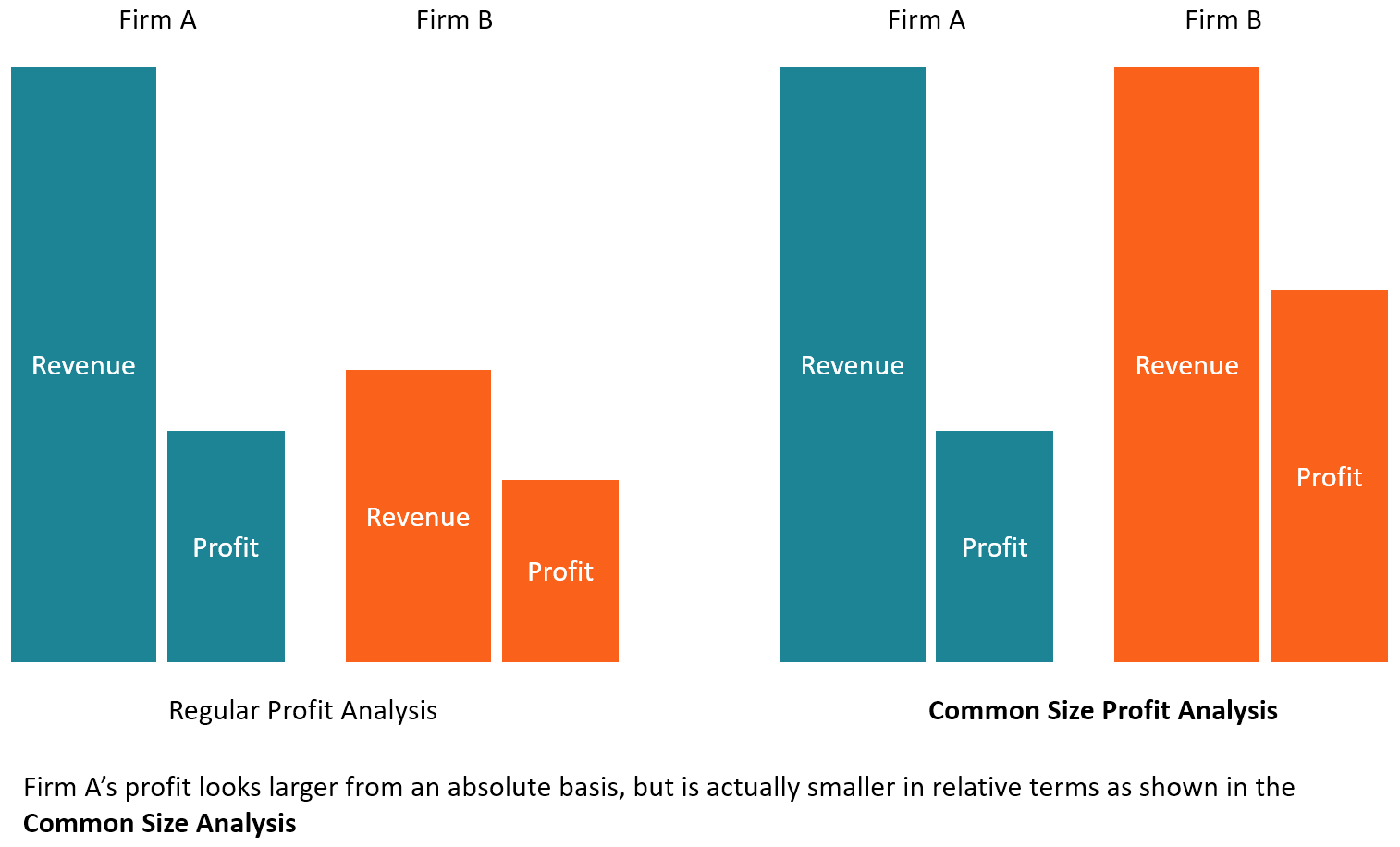

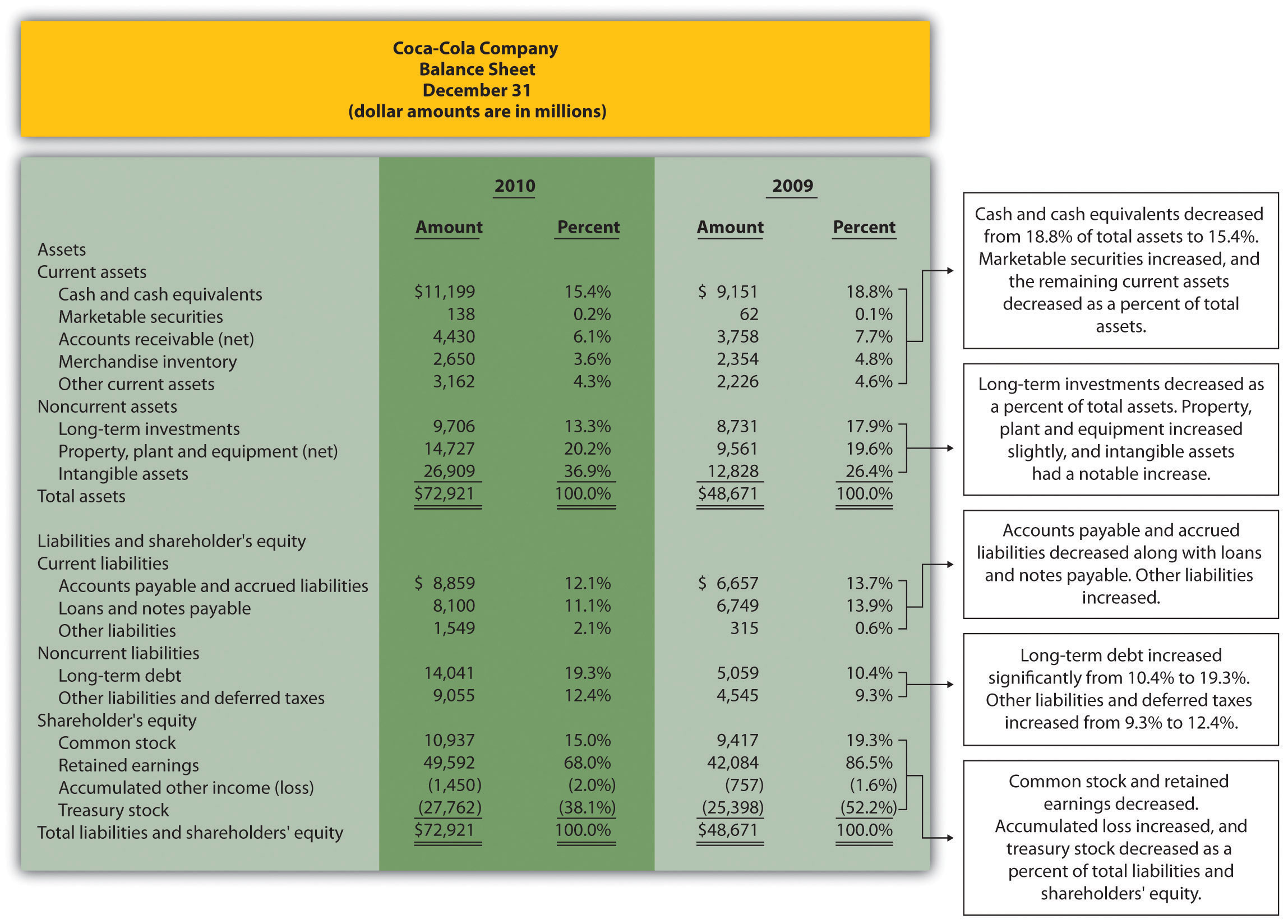

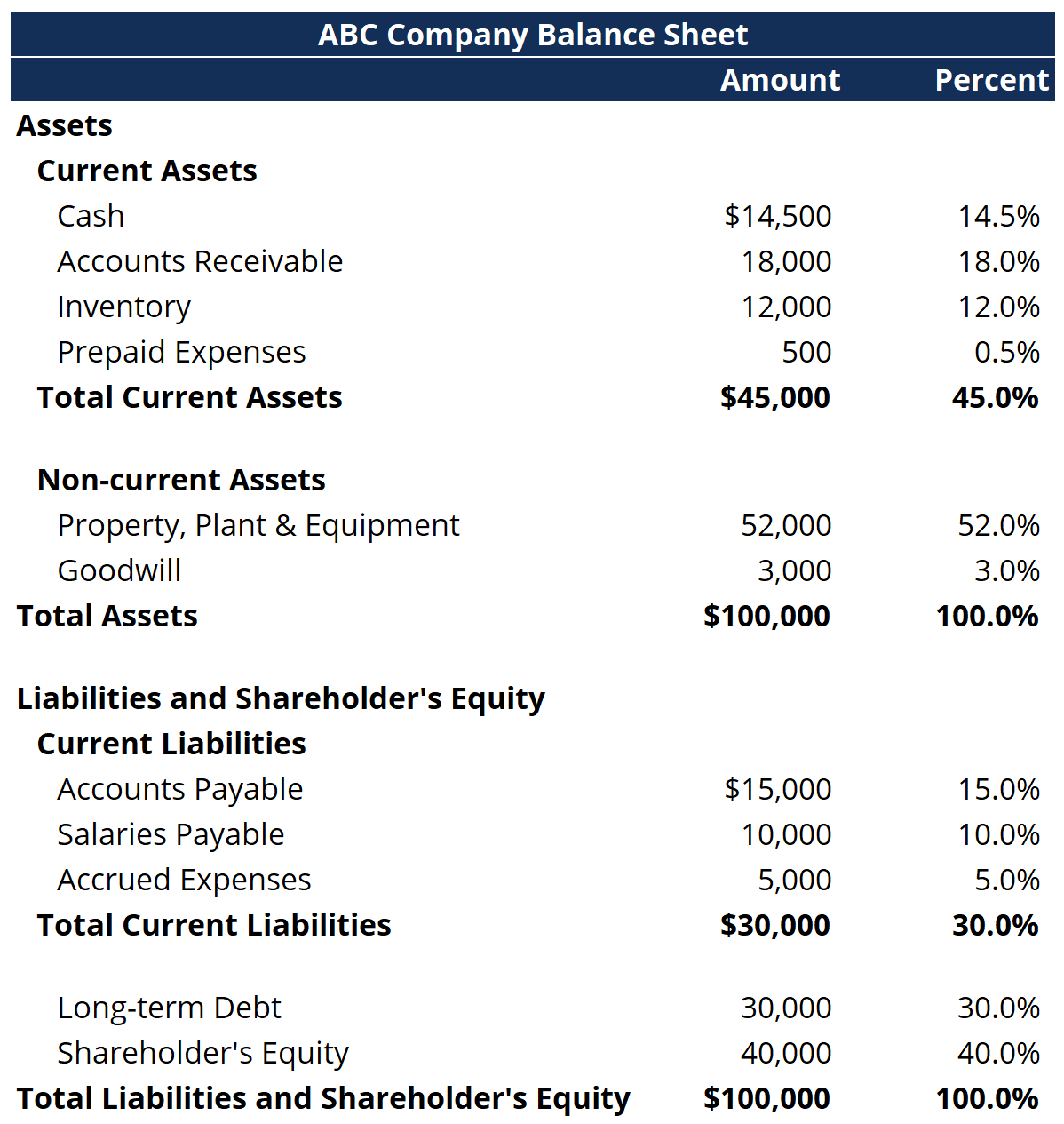

A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be quickly analyzed. What is comparative balance sheet? The common size financials are.

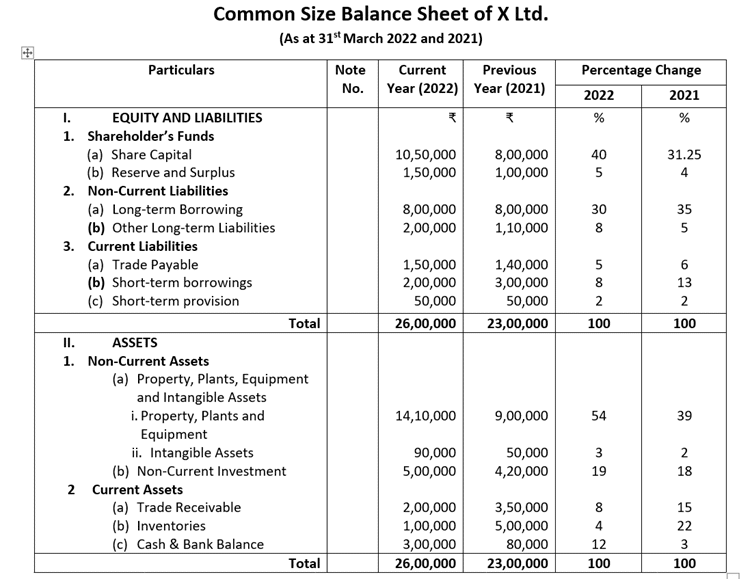

Comparative financial statement is a document that represents the financial performance of the business by comparing them at different time periods. This blog explores the advantages and disadvantages of using a common size balance sheet and provides insights into how to utilize it efficiently for financial. It is helpful for investors to.

Common size balance sheet in this statement the total of balance sheet is taken as 100 & all figures are expressed as percentage of total. Step 1 enter the titles of the two balance sheets, this might be for the same business for different accounting periods, or for different businesses requiring. A technique of comparing financial statements through which the balance sheet of a company is analysed by comparing.

Any single asset line item is compared to. Comparative balance sheet. To common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets.

A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items. Assets and liabilities of business for the previous year as well as the current year;.

:max_bytes(150000):strip_icc()/comparative-statement_final-638912a8e4d7465aacd99e115d561f8f.png)