Perfect Info About Unrestricted Funds On A Balance Sheet

Unrestricted assets on the statement of financial position.

Unrestricted funds on a balance sheet. Restricted fund balance also includes the nonexpendable part of the balance sheet. Unrestricted net assets hold no restriction regarding their usage. As a result of the new standard, the three existing classes of net assets (unrestricted, temporarily restricted, and permanently restricted) will now become two:

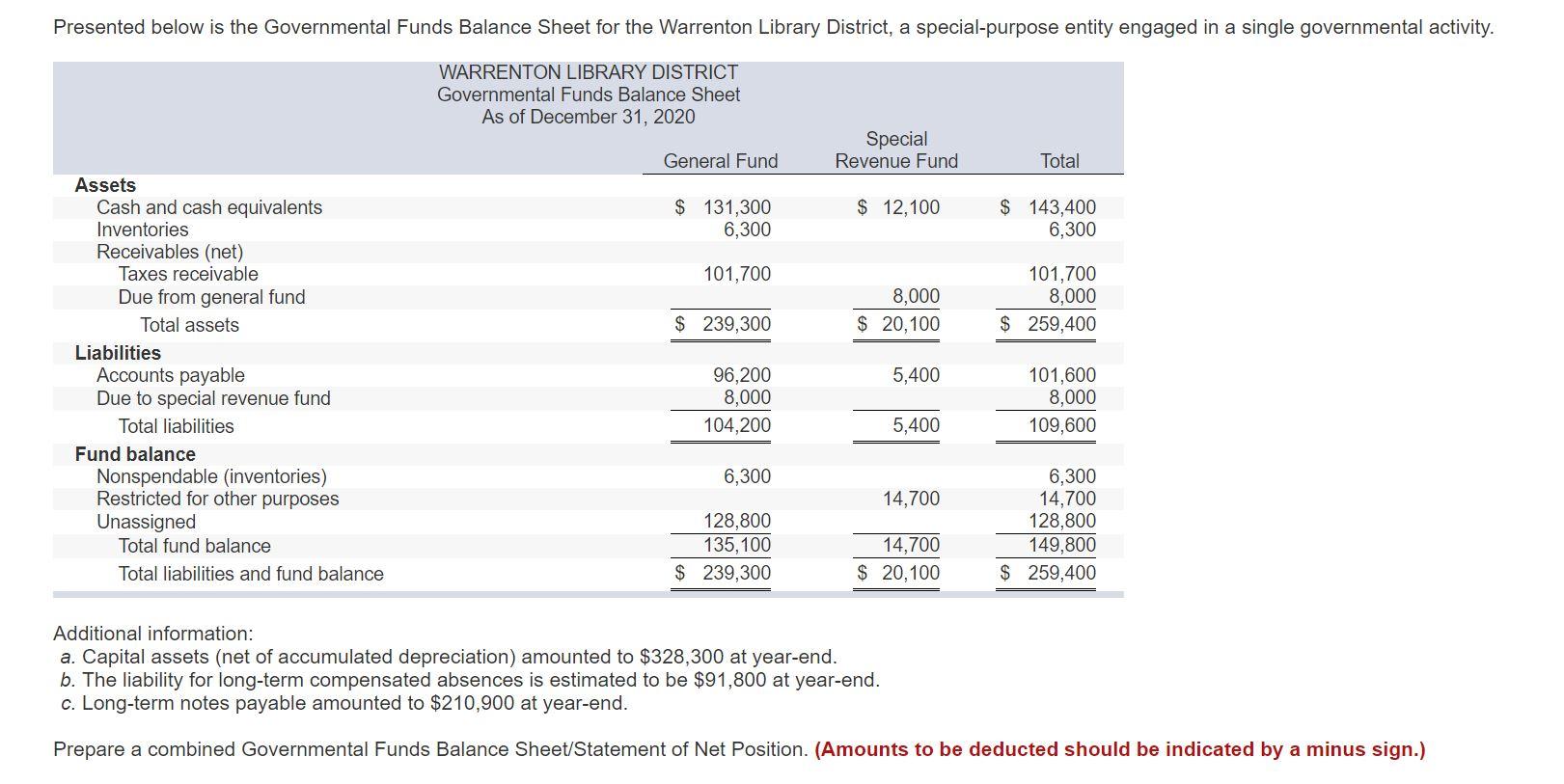

Net assets with donor restrictions is due to the $40,000 in cash, all of which is from a restricted grant, and the $10,000 grant receivable. The restricted balance will increase by $297,320.95, an amount determined by calculating the difference between the existing restricted total and the new balance. Restricted cash refers to money that is held for a specific purpose, meaning it's not available for immediate or general business use.

Restricted cash typically appears on a company’s balance sheet as either “other restricted cash” or “other assets.”. Unrestricted net assets: Unrestricted net assets.

Nonprofits have some unique things about how their financial statements are prepared, which includes. On a company’s balance sheet, unrestricted cash is listed. The agency uses these funds to pay general expenses or to fund.

Total net assets for a not for profit organization is equal to the sum of the above classifications of net assets, i.e.: However, it is commonly referred to as cash and cash equivalents. There may be different kinds of unrestricted, we’ll show a couple of types.

This means that the resources can support the. Funds that are not restricted to a specific purpose by donors and can be used at the organization’s discretion. This includes resources that can be invested, but not spent in the form of a restricted fund.

3rd dec 2021 0 16 5286 accounting for a charity's restricted funds can restricted funds on a charity' balance sheet overstate a charity's overall financial position?