Awe-Inspiring Examples Of Info About Objective Of Consolidated Financial Statements

A holding company prepares consolidated financial statements to present the.

Objective of consolidated financial statements. Mizuho news from around the. A consolidated financial statement is maintained to help parent companies and their subsidiaries to have a ready reference of all the units’ financial status consolidated at one place. The general objective of intercompany income elimination in consolidated financial statements is to exclude from consolidated shareholders’ equity the profit or loss arising from transactions within the consolidated entity and to correspondingly adjust the carrying amount of assets remaining in the consolidated entity.

37) and on the ecb’s website. (a) requires an entity (the. Auscf1 auscf paragraphs included in this standard apply only to:

When the investors buy the shares of the parent, they buy into the group and want to know how the group is performing, which can be very different from the performance of the parent alone. The construction of the aggregate. The objective of this standard is to lay down principles and procedures for preparation and presentation of consolidated financial statements.

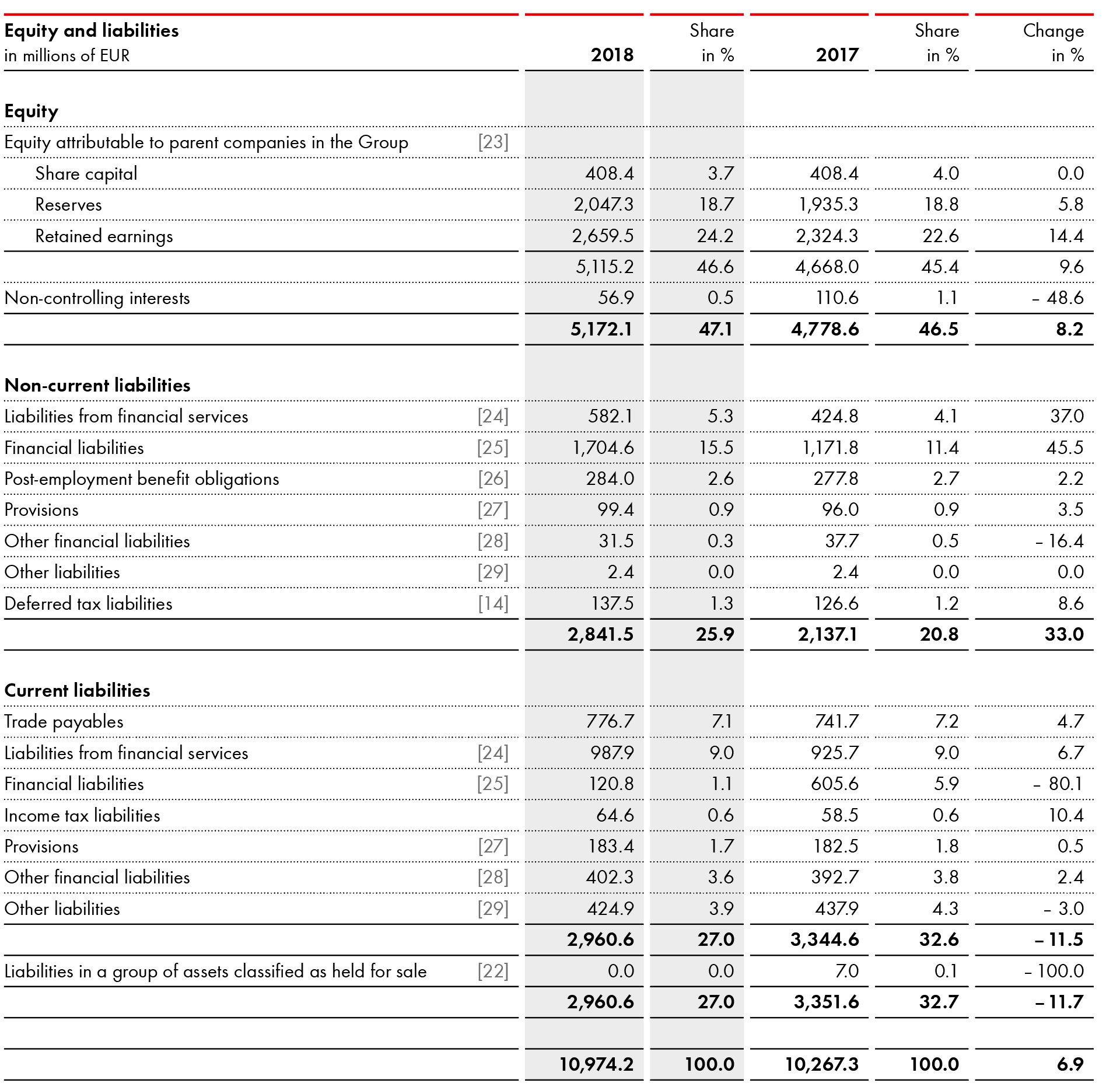

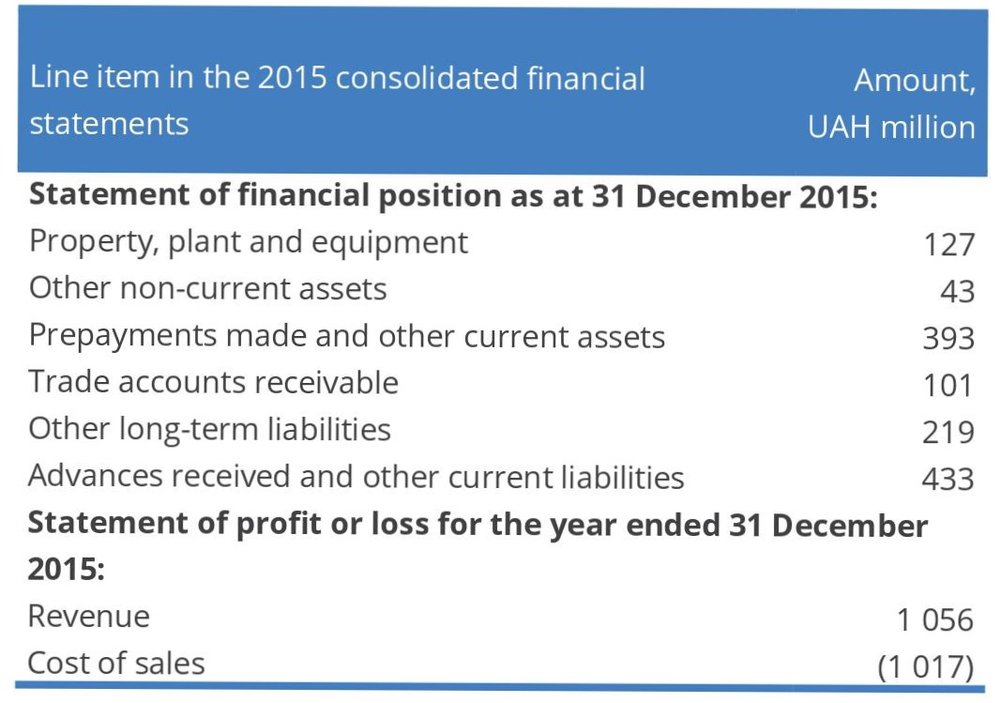

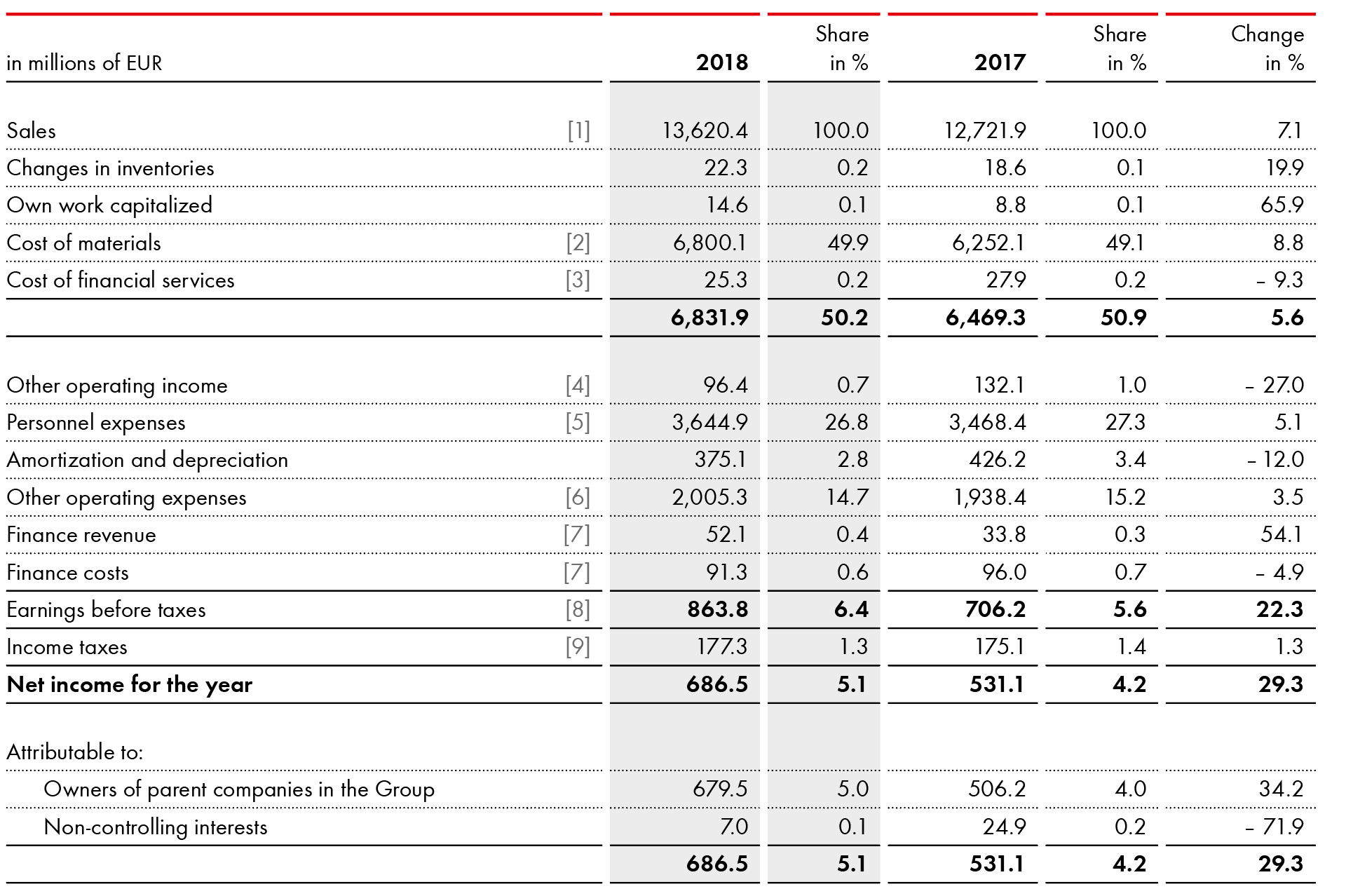

Summary of consolidated financial statements for the six months ended september 30, 2023 under japanese gaap(pdf/951kb) financials; The consolidated financial statements are presented in millions of euros, rounded to the nearest million. The consolidated balance sheet of the eurosystem is based on.

Special dividend of € 1.00 per share. The objective of consolidated financial statements is to present the results of the group in line with its economic substance, which is that of a single reporting entity. Net cash € 10.7 billion.

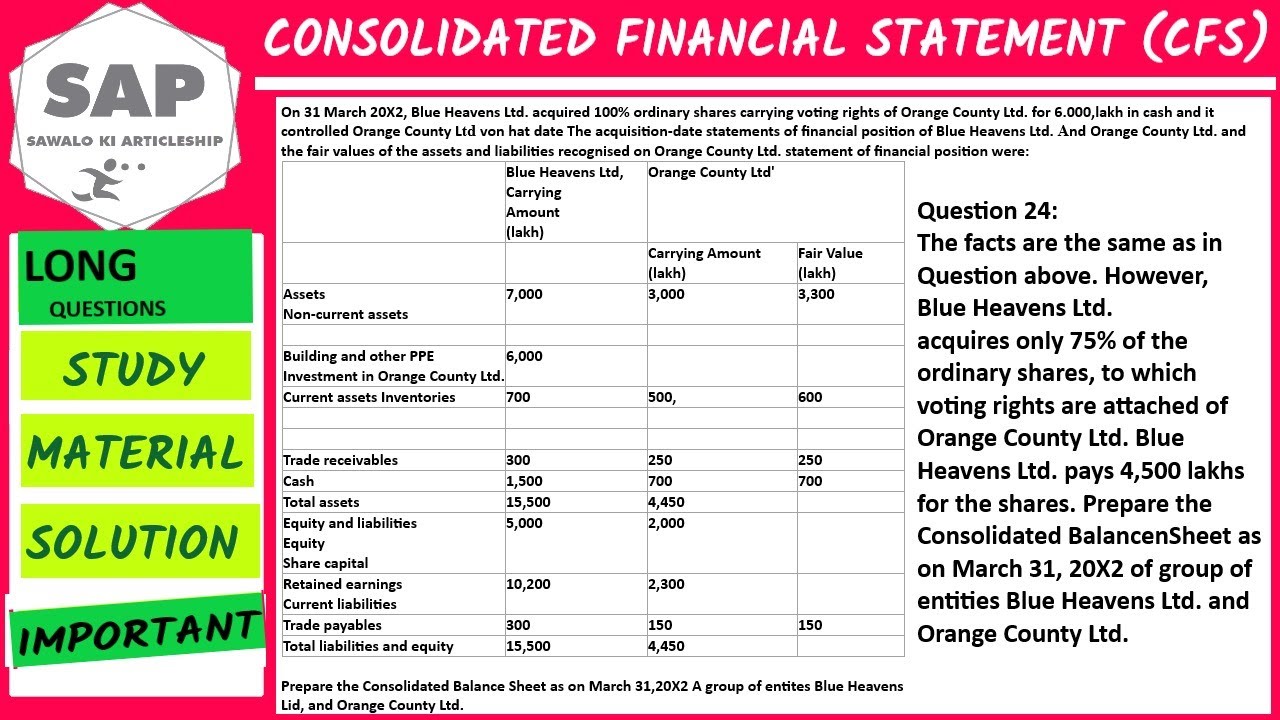

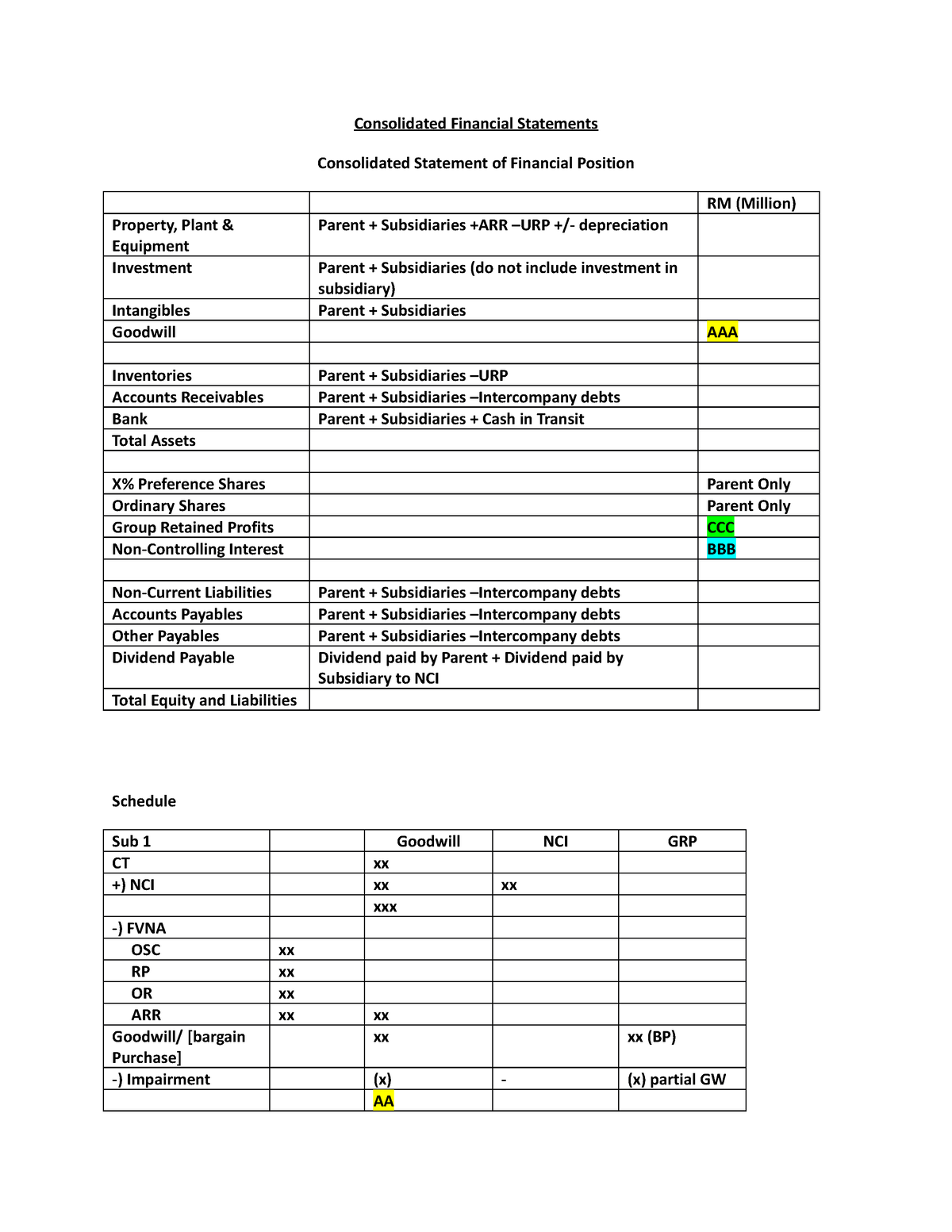

Recognize that consolidated financial statements must be prepared if one company has control over another which is normally assumed as the ownership of any amount over 50 percent of the company’s outstanding stock. A subsidiary carries its assets at historical cost but the parent's assets are carried at revalued amounts. The process of eliminating controlling interests and the accounting treatment of positive and negative cancellation differences.

The objective of this ifrs is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. The information obtained from the consolidated financial statements (cfs) is relevant to investors in the parent entity. Objectives of consolidated financial statements.

Consolidated financial statements objective 1 the objective of this standard is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. The main objective of consolidated statements of financial position is to provide information about the group’s financial position to the equity shareholders of the parent company. Free cash flow before m&a and customer financing € 4.4 billion;

There are a number of prime reasons or purpose of consolidated financial statements as to why they are prepared. A subsidiary has been acquired and its land is to be included in the consolidated financial statements at fair value. The consolidated financial statements provide a.

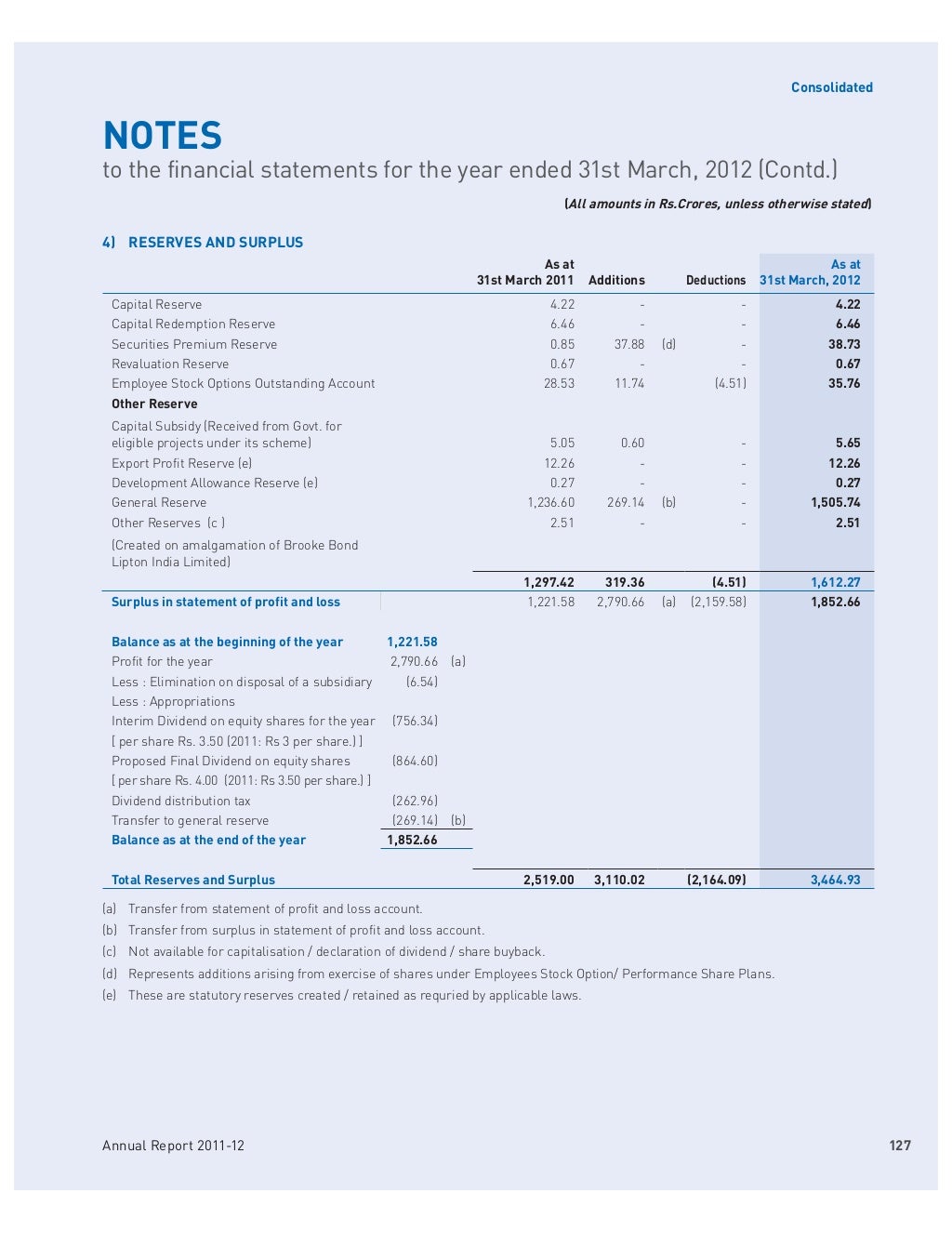

Consolidated financial statements reflect all adjustments necessary for the fair presentation of ifc’s financial position and results Consolidated financial statements are financial statements that present the assets, liabilities, equity, income, expenses and cash flows of a parent and its subsidiaries as those of a single economic entity. The consolidated statement of financial position is prepared by aggregating on

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)