Best Info About Balance Sheet Of A Firm

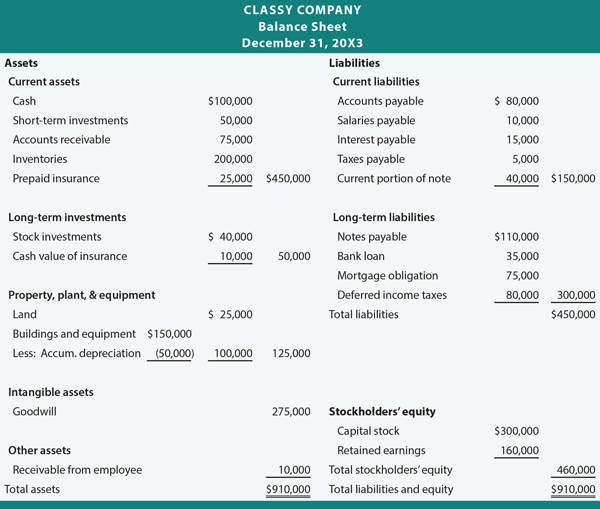

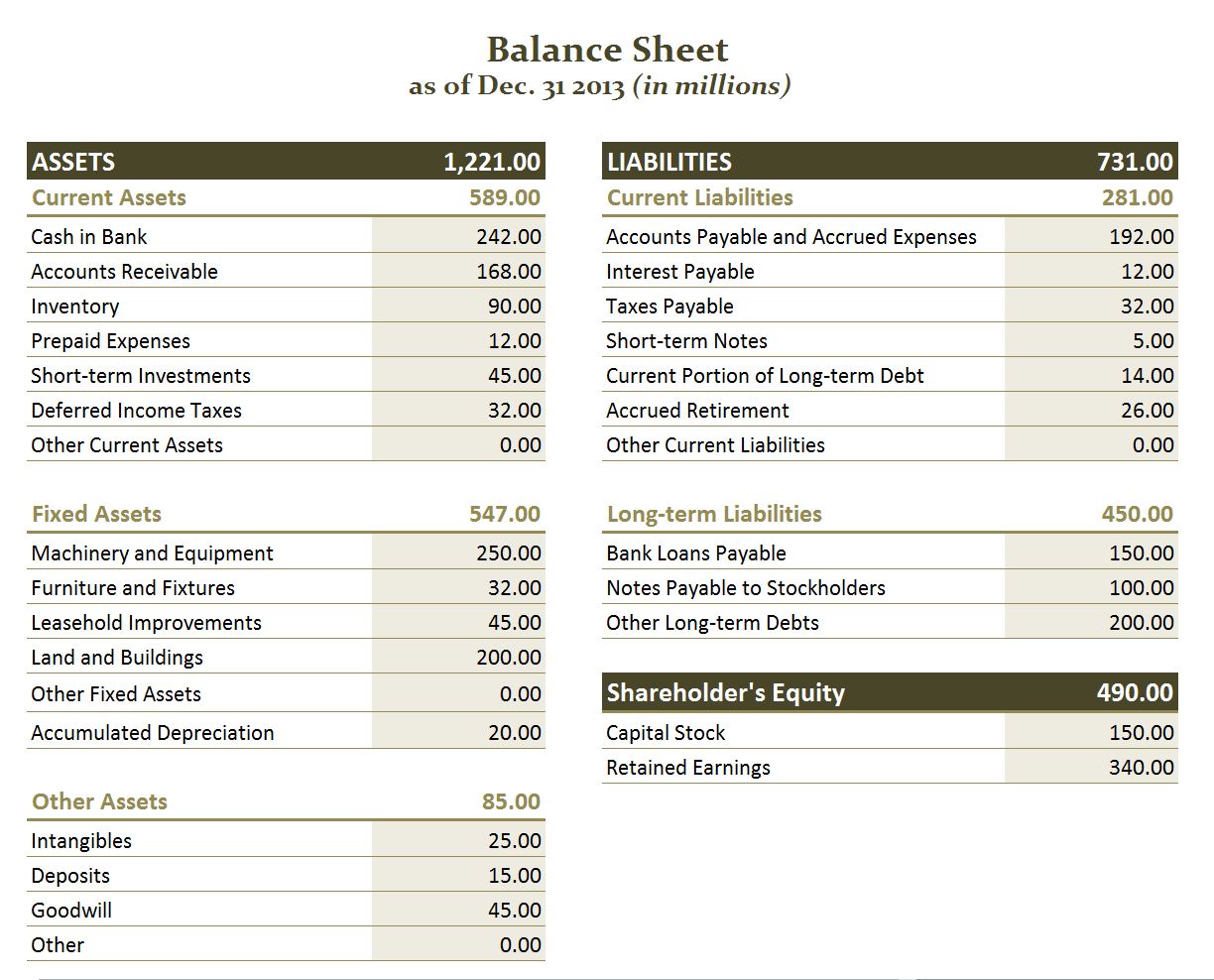

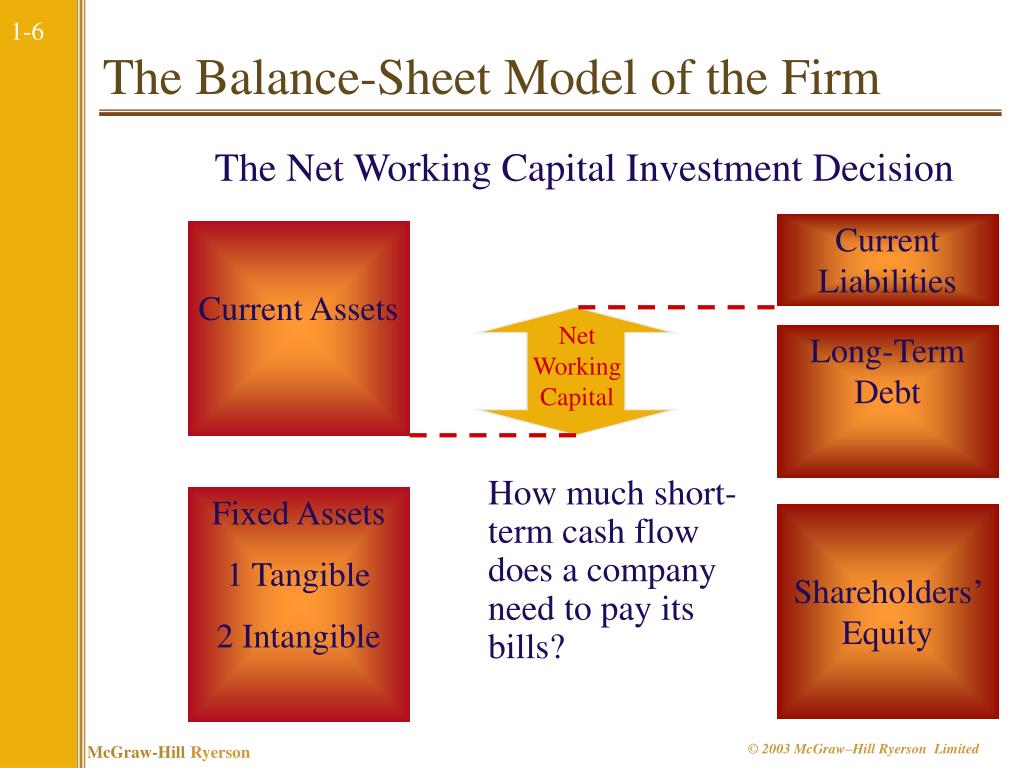

The balance sheet shows us what the firm has (its assets), who owns them (equity), and who the firm owes (its liabilities).

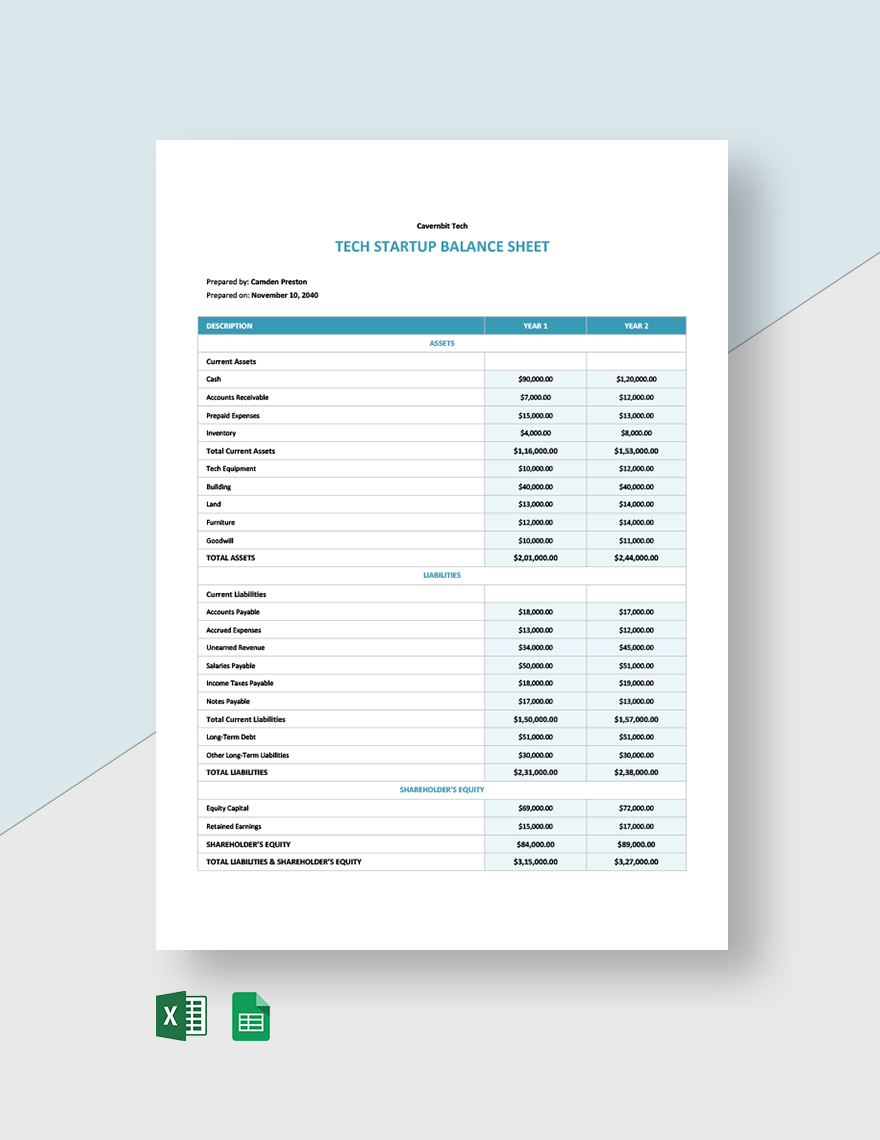

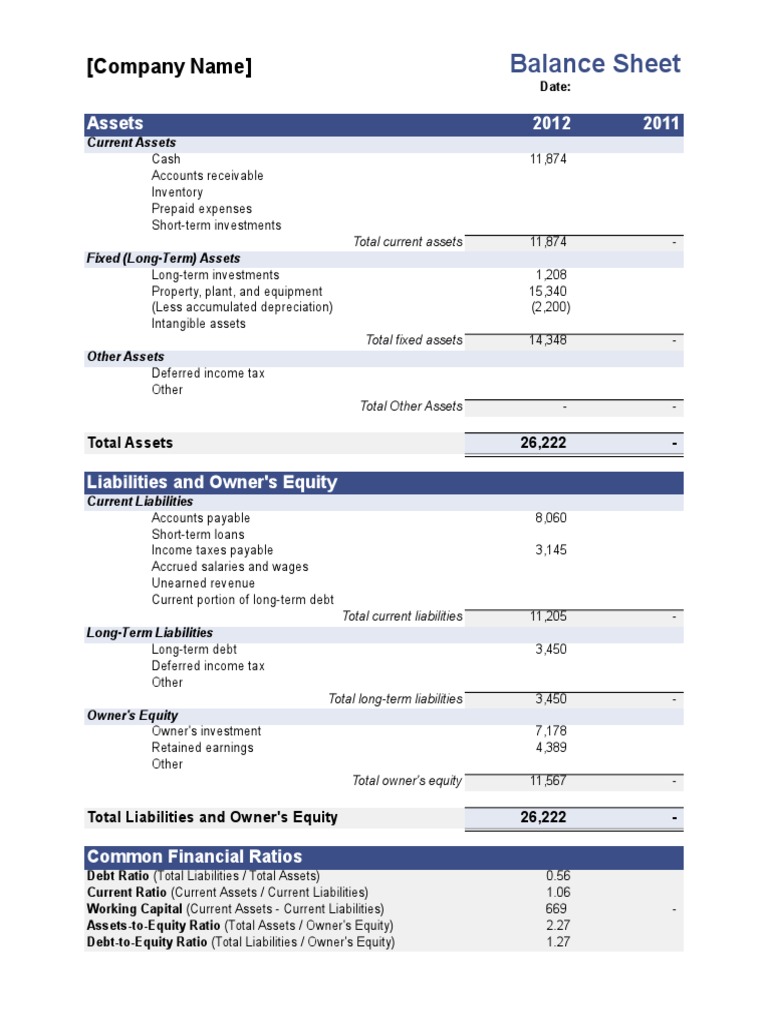

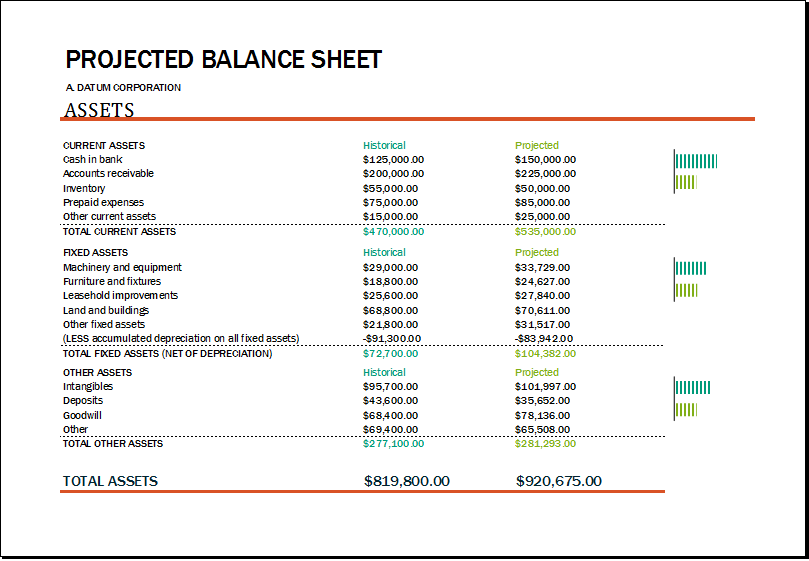

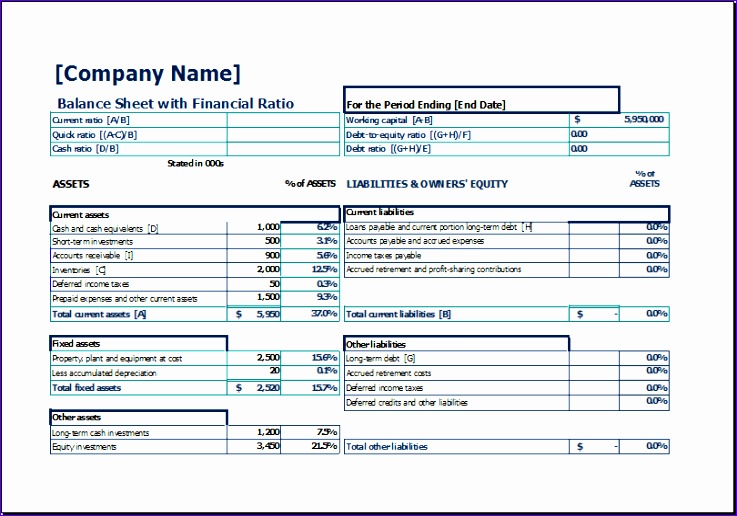

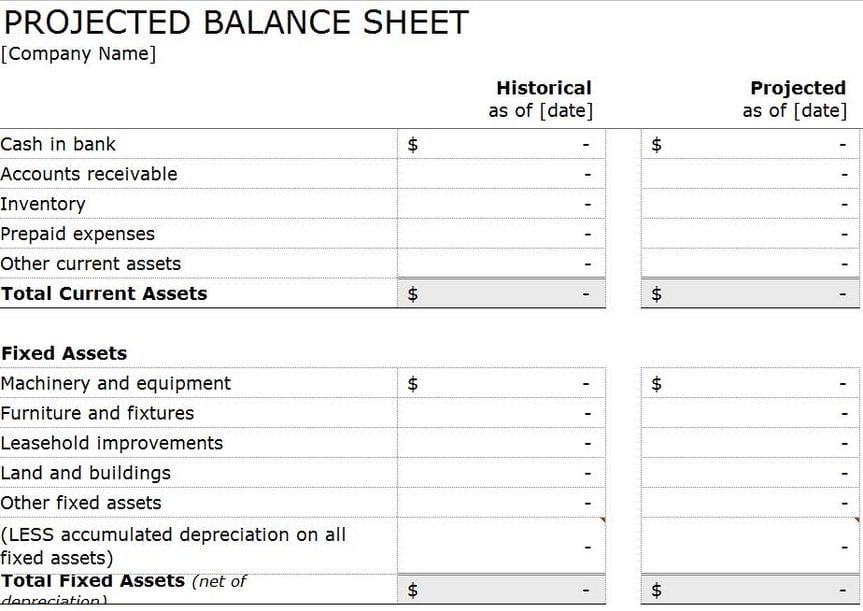

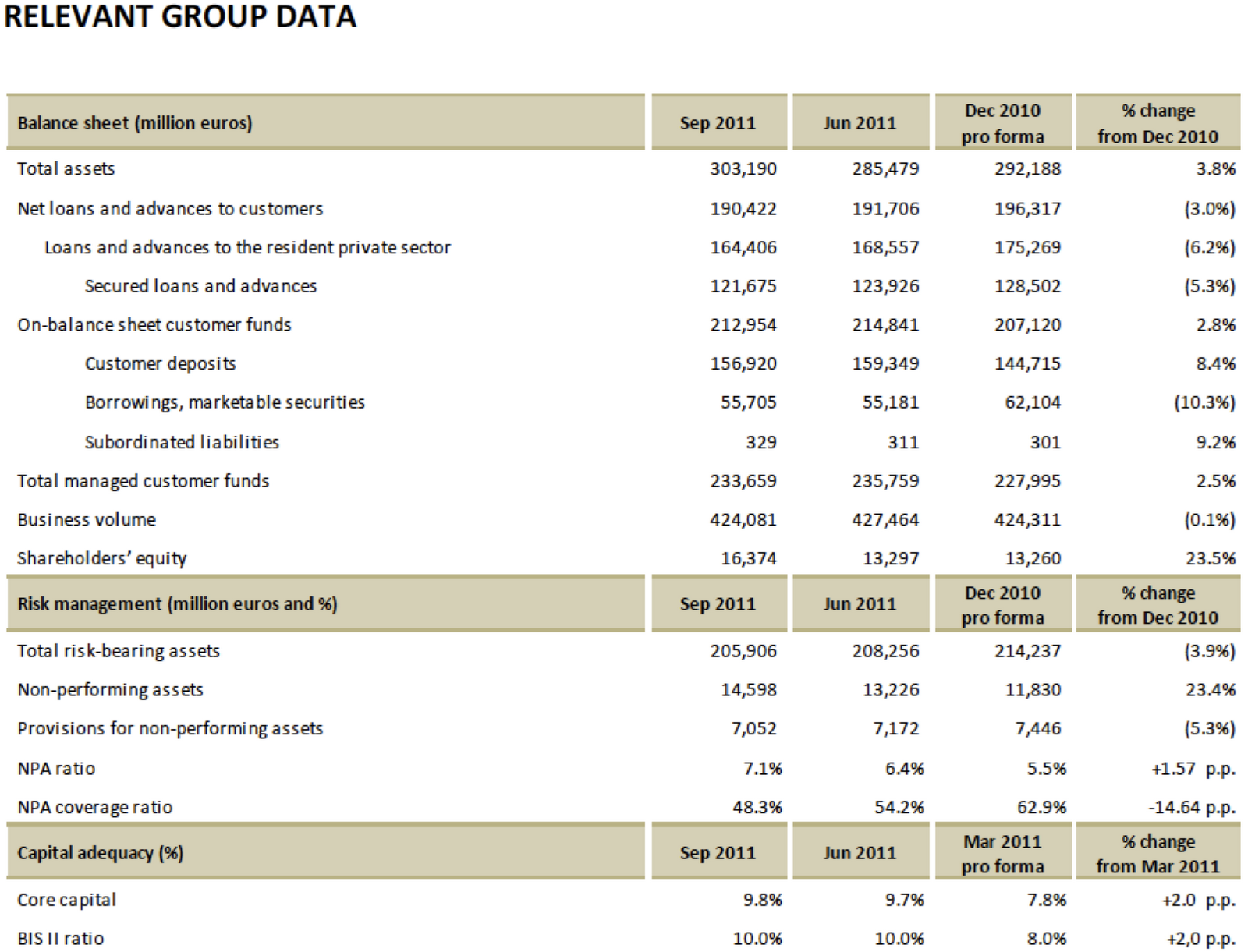

Balance sheet of a firm. The balance sheet includes things owned (assets) and things owed (liabilities). Assets = liabilities + equity. Balance sheet templates, such as this investment property balance sheet, allow you to factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains.

It reports the resources of a company (assets), the company’s obligations (liabilities), and the difference between what is owned (assets) and what is owed (liabilities), or owners’ equity. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year. The formula can also be rearranged like so:

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. Its purpose is to verify that the.

The balance sheet, one of three financial statements generated from the accounting system, summarizes a firm’s financial position at a specific point in time. These three core statements are intricately linked to each other and this guide will explain how they all fit together. Assets assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash.

What is a balance sheet? A balance sheet is often described as a snapshot of a company's financial condition. These can include cash, investments, and tangible objects.

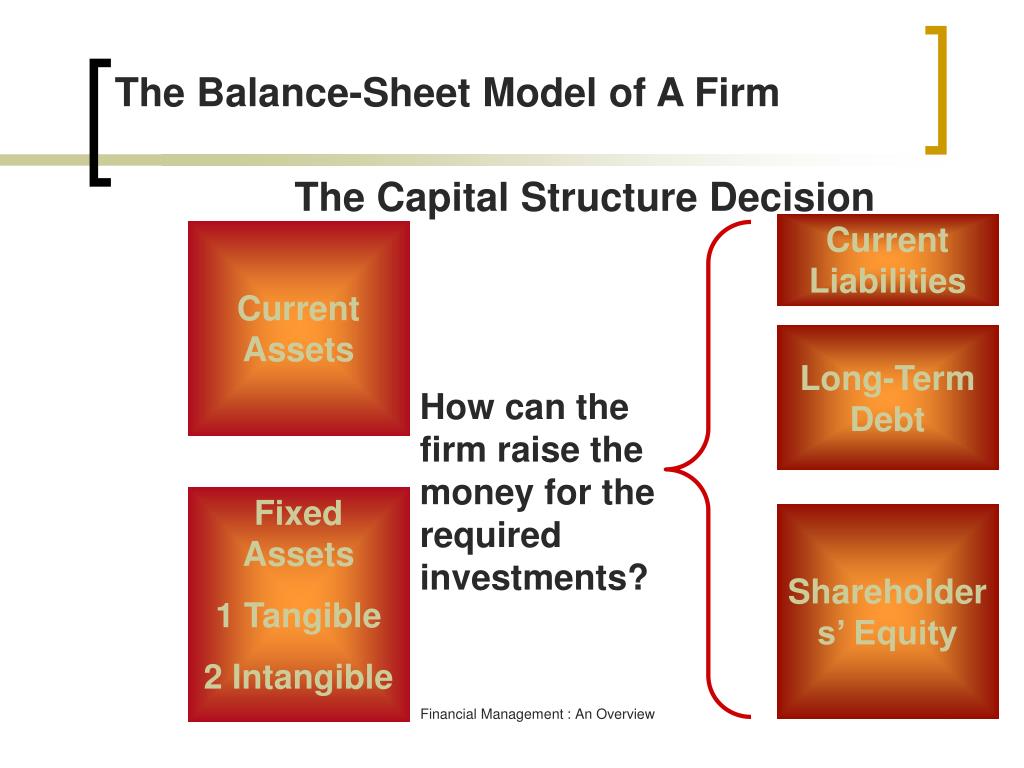

Raising capital via equity offerings allows the firm to increase net assets and thereby potentially avoid balance sheet covenant violations. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. [1] it is the summary of each and every financial statement of an organization.

Assets, liabilities, and shareholders’ equity. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. Assets are things that a company owns.

You can learn about the health of a business by looking at its balance sheet. Situation as at 31 december 2023. This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity offerings.

Preparing this document helps people understand the current capital structure of a firm. Therefore, this equation should always be true. (in million eur) december 2022.

What are some examples of assets? The balance sheet shows us what the firm has (its assets), who owns them (equity), and who the firm owes (its liabilities). Assets = liabilities + owners’ equity.