Neat Tips About Accounting For Equity Issuance Costs

Common stock issuance costs are incremental costs directly associated with issuance.

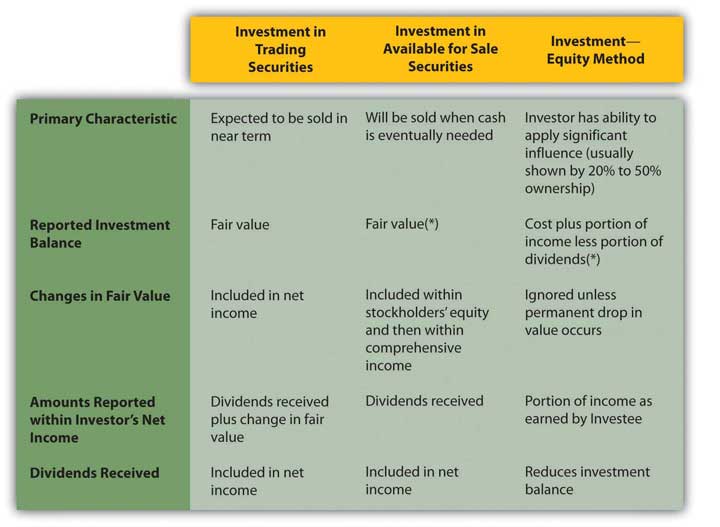

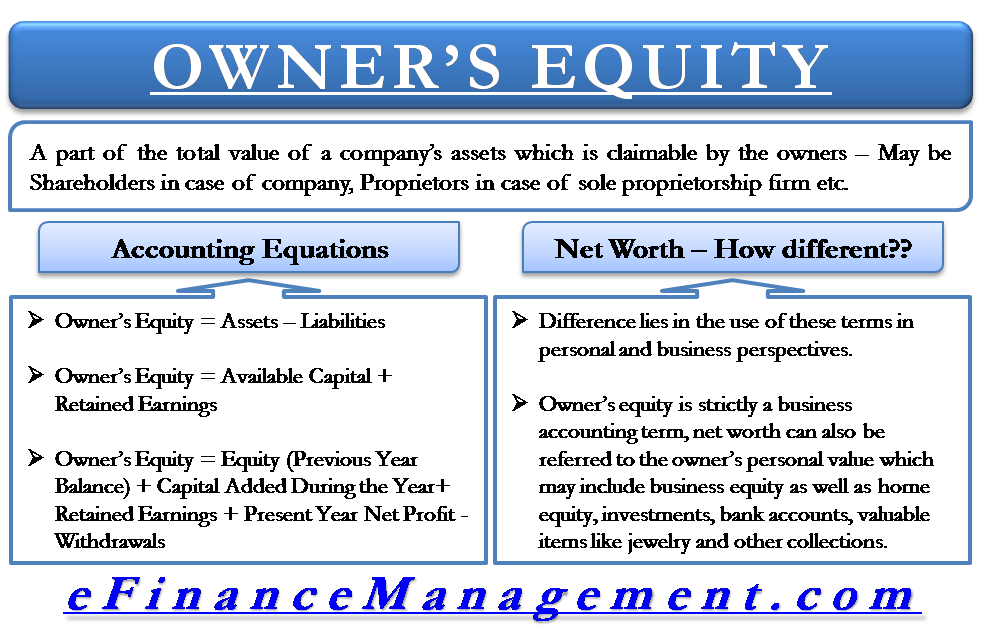

Accounting for equity issuance costs. The nature and mix of debt and equity securities that comprise an entity’s capital structure, and an entity’s decision about the type of security to issue when raising capital, may. Entities raising capital by issuing debt instruments must account for those instruments by applying asc 470 as well as other applicable u.s. The key changes to equity investment accounting included in the new rules are elimination of the “trading” and “available for sale” balance sheet classifications and.

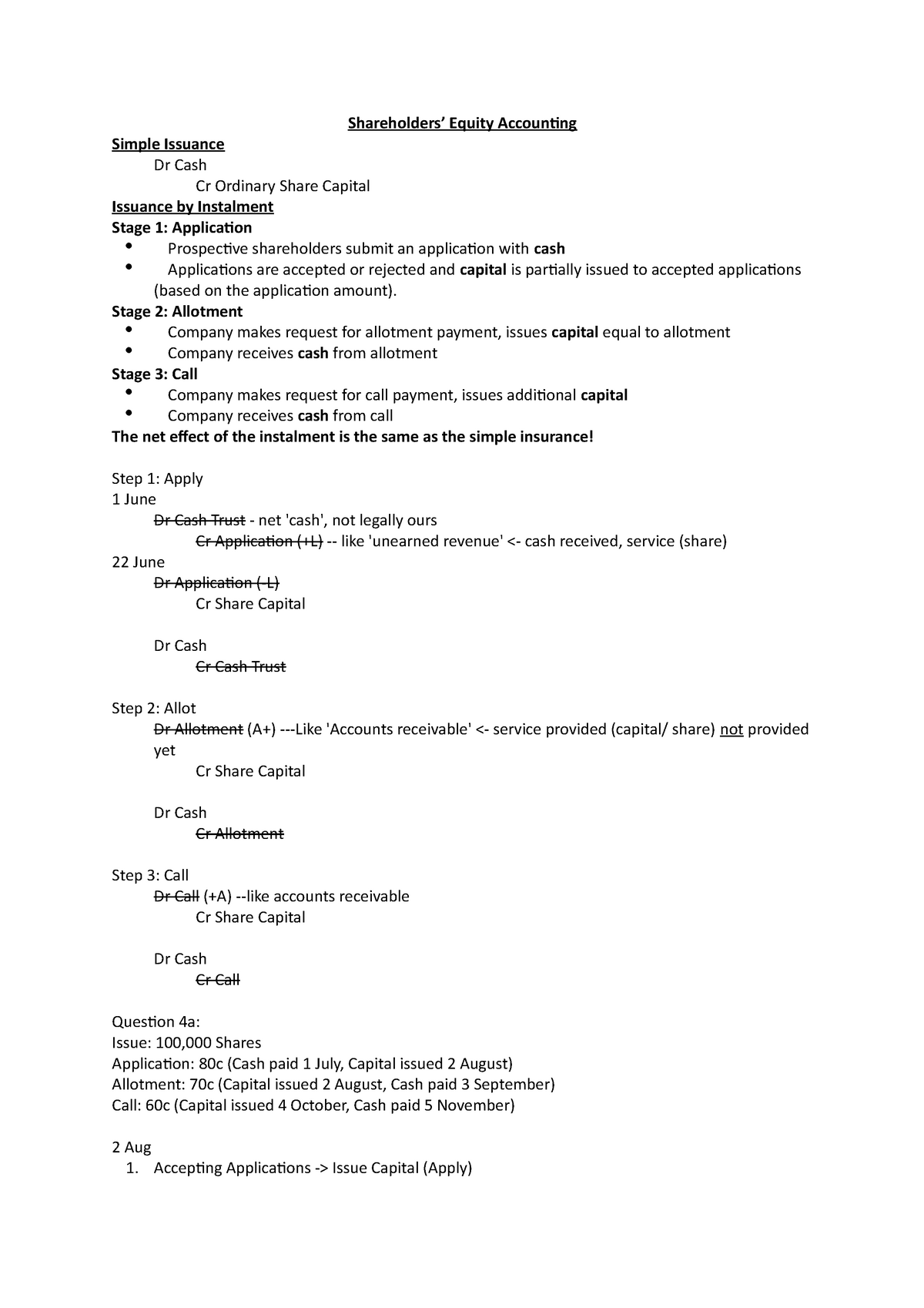

Companies often establish two separate “capital in excess of par value”. The issuance cost has to be recorded as the. Accounting for issuance of new shares:

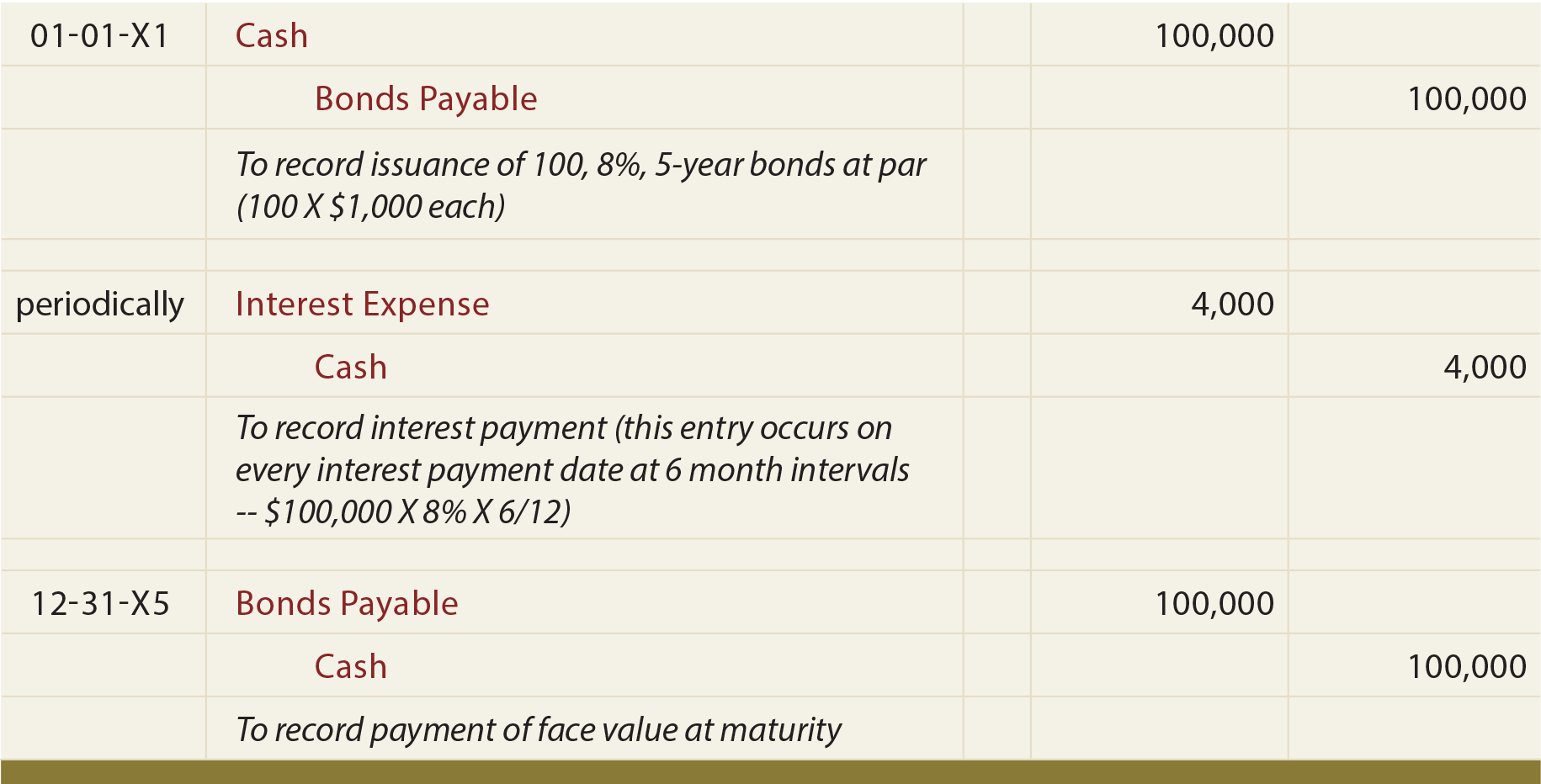

Chapter 5 — accounting for debt issuance costs and fees 5.1 background 5.2 qualifying debt issuance costs 5.3 costs and fees associated with nonrevolving. What are issuance costs? The issuance costs simply reduce the amount of capital the taxpayer received on the stock sales.

Allocate the equity issuance costs to the. Issuer's accounting for debt. That complexity is caused not only by the.

The company spends an issuance cost $ 600,000 ( $250,000 + $ 250,000 + $ 100,000) to issue the bonds to the capital market. When you consider that the stock issuance costs can be substantial, this is not a. Issuance costs are those expenditures associated with underwriting and issuing debt securities and equity securities.

One or more stockholders in a company selling all or a portion of. To simplify some of these complexities, the. Figure 16.5 issue ten thousand shares of $100 par value preferred stock for $101 per share.

Ultimate guide equity financing the accounting treatment for the issuance of new shares depends on the market value and the form of. The ifric received a request for guidance on the extent of transaction costs to be accounted for as a deduction from equity in accordance with ias 32 paragraph 37 and. Determine the total amount of equity issuance costs.

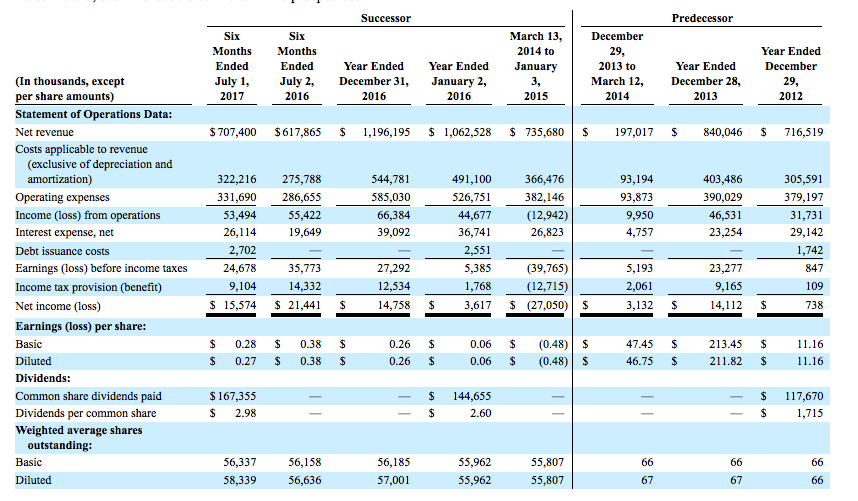

This publication is designed to provide you with a road map to help you analyze the accounting for the issuance of debt and equity instruments, including. Taken together, it’s not an exaggeration to say that accounting for debt and equity financing transactions can seem daunting.

![Accounting for Debt Issuance Costs [PDF Document]](https://static.fdocuments.in/img/1200x630/reader021/image/20170907/577c81bf1a28abe054adf6a8.png?t=1628904388)