Here’s A Quick Way To Solve A Tips About Furniture And Fixtures In Balance Sheet

![[Solved] STANDARD SIZES OF FURNITURE & FIXTURES (Philippines](https://media.cheggcdn.com/media/a56/a56c576d-ca33-41a8-9ae6-f32b3a554431/phpWa4o2e)

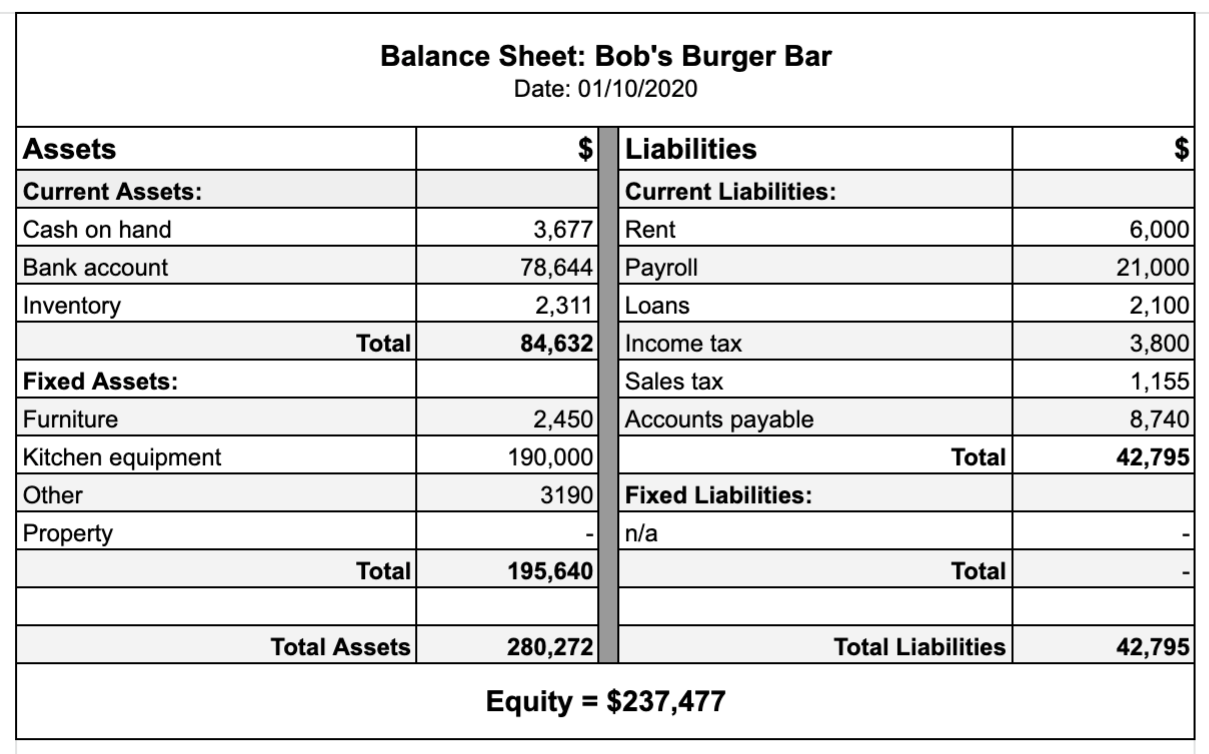

The cost of furniture and.

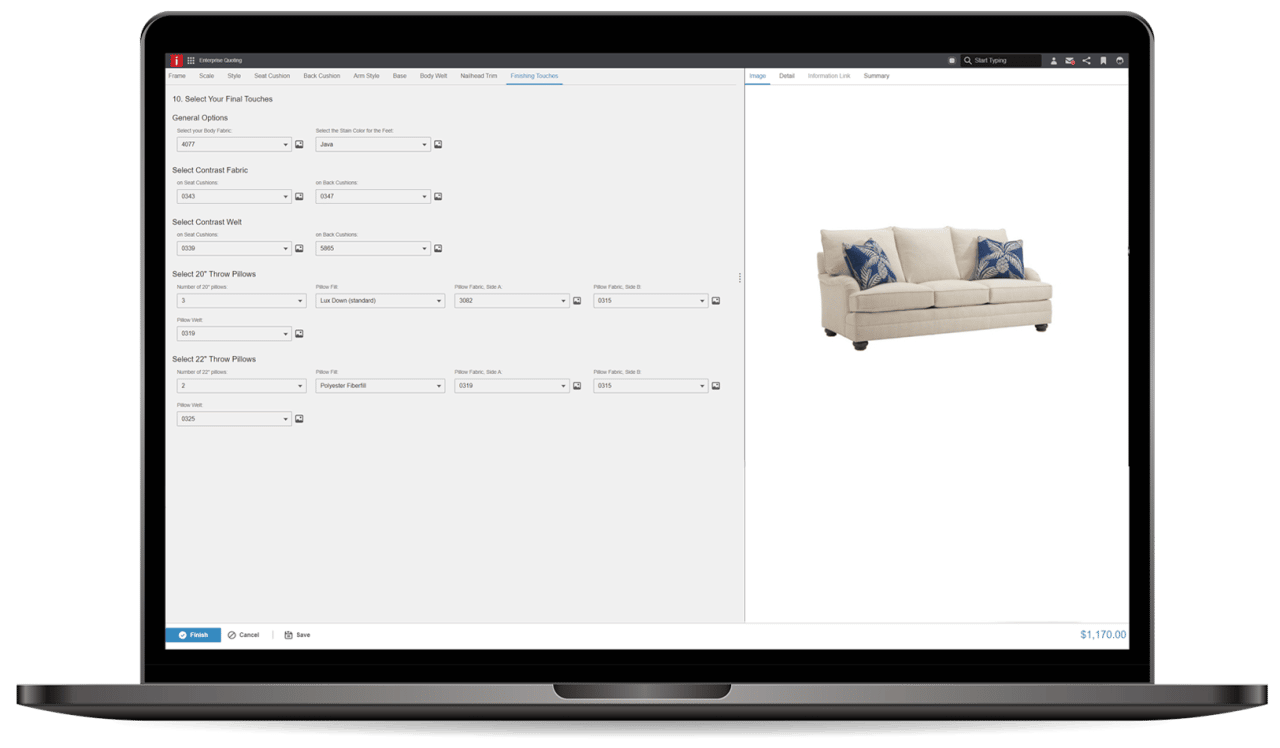

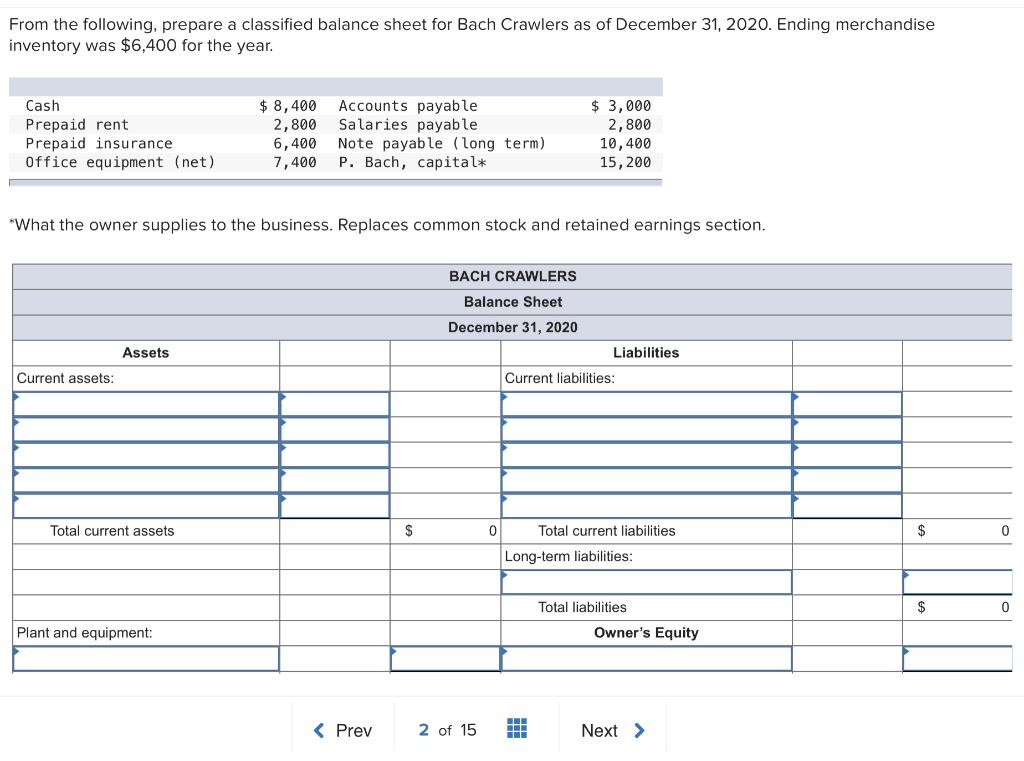

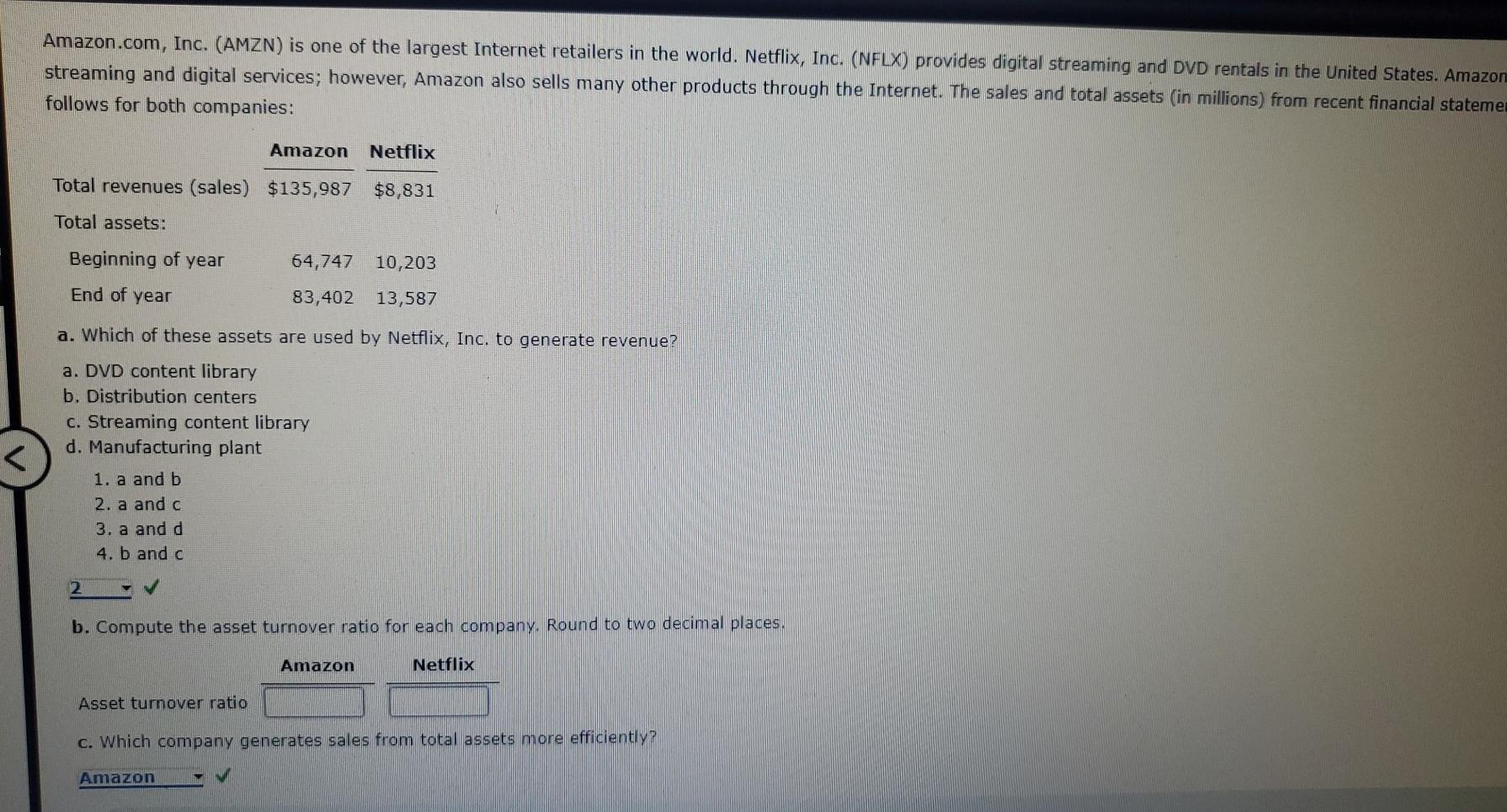

Furniture and fixtures in balance sheet. These furniture items are any movable asset used to make any room, office, factory a convenient workplace with desired working conditions. That is, they are assets that a business uses in its daily operations. The term ff&e is used in different service industries for various purposes but generally talks about the same items.

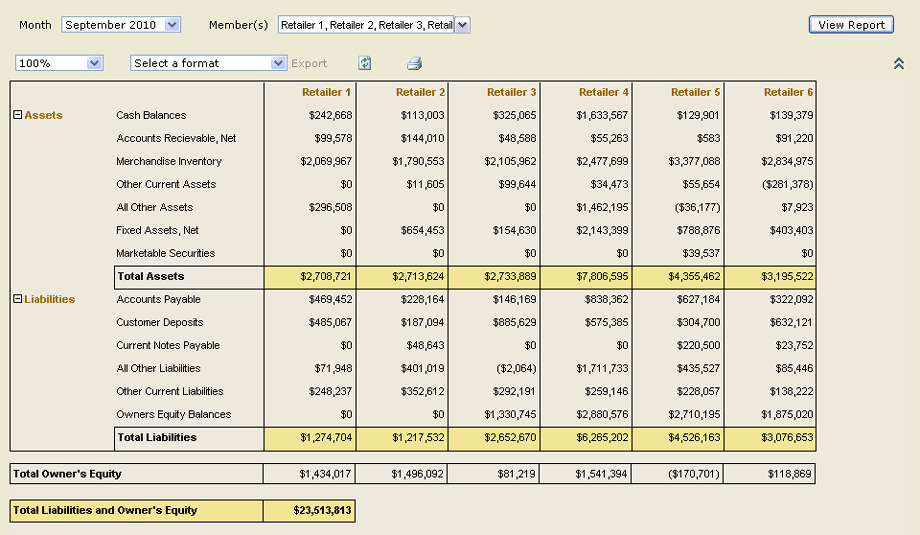

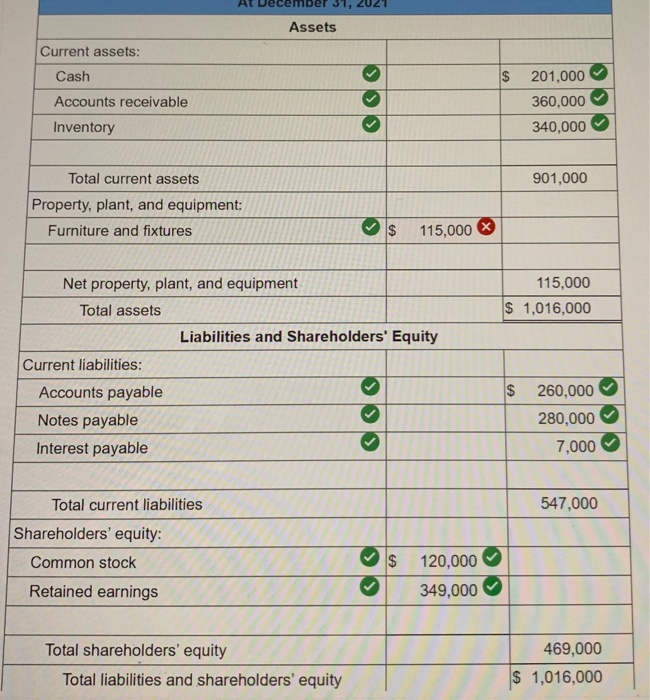

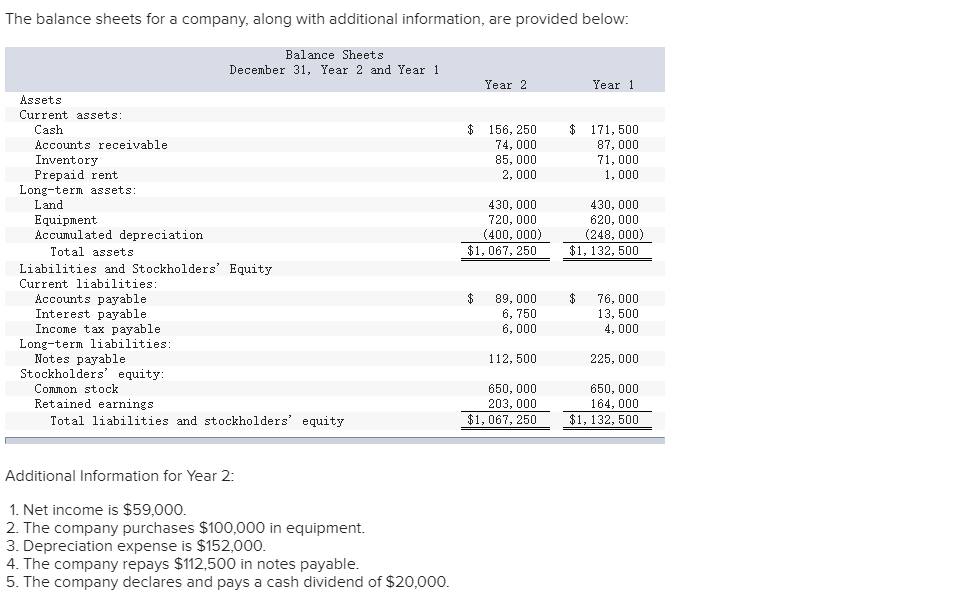

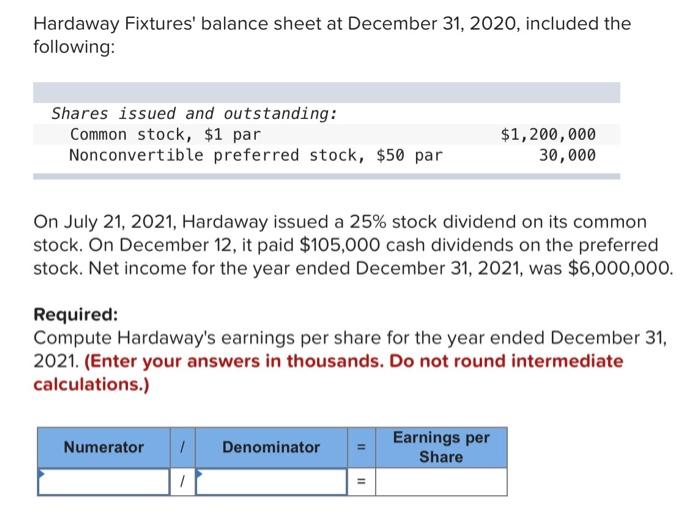

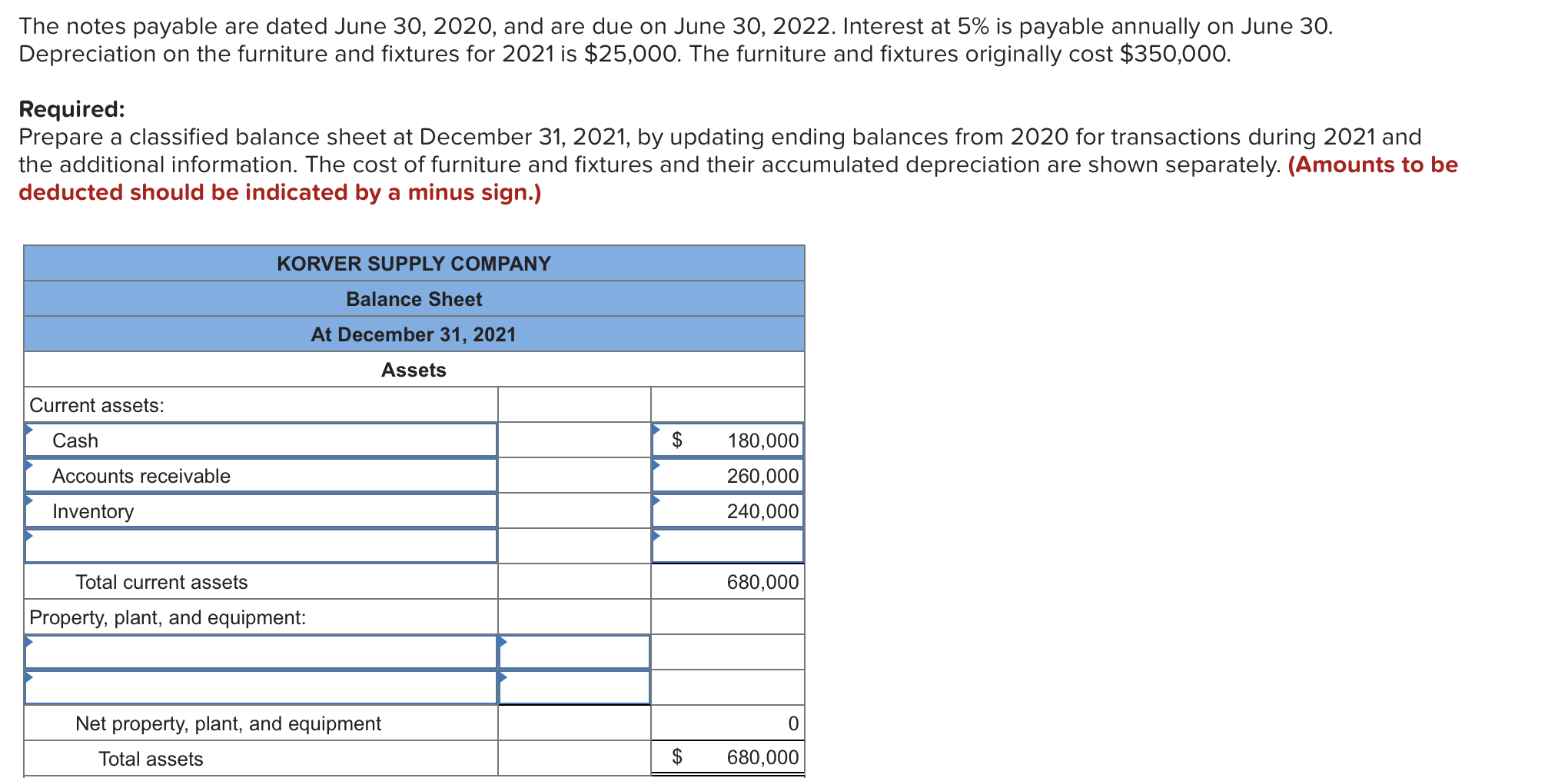

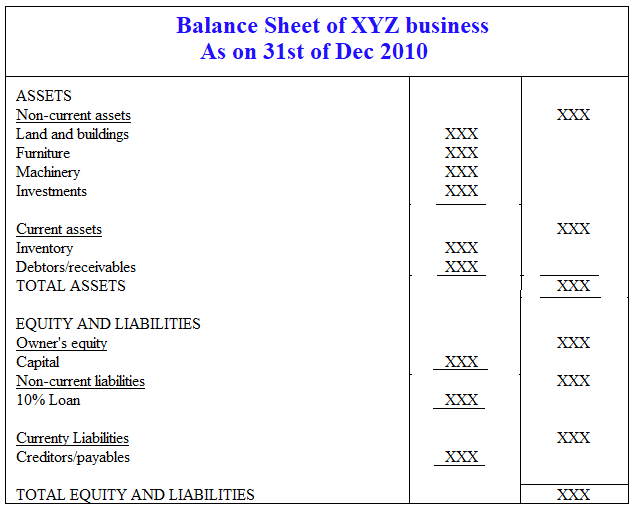

Depreciation is calculated on their useful life and it is deducted from all furniture and fixture's book value for showing written down value in balance. You're more likely to find furniture and fixture line items on the balance sheet of major retail chains that hold significant furniture and fixture assets in their retail outlets than on the balance sheet for manufacturing companies that. Furniture and fixtures are long term assets which are showed in assets side of balance sheet.

These accounts consist of the five accounts listed in the bank premises section of the fr 34 balance sheet, the furniture and equipment account and its related allowance for depreciation account, and the other real estate account listed in the other assets. All buildings include fixtures and fittings. This chapter discusses property and equipment accounts.

6 types of contra asset accounts and what they common | easystclinic.com Fixed assets appear on the company's balance sheet under property, plant, and equipment (pp&e) holdings. What are furniture and fixtures?

Furniture refers to movable equipment (not fixed to the building) that helps in carrying out business activities. Furniture, fixtures, and equipment (ff&e) are tangible assets used by a business to carry out its the core operations and generate profits. In accountancy, the term ff & e is preferred.

Furniture, fixtures, and equipment (ff&e) is shop property not permanently connected to a building such such office furniture, partitions, and business equipment used in the operator of a company. That are used in the business. Land refers to the land used in the business, such as the land on which the production facilities, warehouses, and office buildings were (or will be) constructed.

Accounting treatment of furniture, fixture, and equipment? Fixed assets on the balance sheet. Previously, this depreciation rate of furniture and fixtures was 15%.

Wiring, light fixtures, fans, and sockets are some of the common examples of electrical fittings. These noncurrent assets are recording in the company’s balance sheet at the end of the accounting period. These items also appear in the cash flow statements of.

Furniture, fixtures, and equipment (abbreviated as ff&e or ffe) refers to movable furniture, fixtures, or other equipment that have no permanent connection to the structure of a building. Accounting for ff&e. All of the specific items being depreciated in the other categories—furniture and fixtures, leasehold improvements, and vehicles—have their own account, which shows the initial cost of the item and the amount of depreciation taken each year, with the total amount of depreciation shown as accumulated depreciation.

Balance sheet, income statement, balance sheet and income statement are linked. Furniture and fixtures this account reports the cost of desks, chairs, shelving, etc. Furniture and fixtures are larger items of movable equipment that are used to furnish an office.

![Solved Problem 33 Balance sheet preparation [LO32, 33]](https://media.cheggcdn.com/media/d86/d86f8be5-c04a-4eab-8823-8e9e4c3559fd/php4uud2S.png)

![Problem 33 Balance sheet preparation [LO32, 33] The following is a](https://img.homeworklib.com/questions/ed407e30-435c-11ea-87dd-89e7fcbab79e.png?x-oss-process=image/resize,w_560)